Bank Branch vs. Smart Contract: Why Wall Street Is Cooked and Even Vanguard Caved

Level 1 - NGMI

Welcome Avatar! Yes sentiment is down as it always is 4 years into the standard crypto cycle. Anyone new is in full panic mode. Anyone who has been around reading us for a decade is sitting back laughing. If Vanguard caved, everyone is going to cave.

This is actually massive news as they are going down the rabbit hole. The realization that legacy bank systems are under extreme pressure. Outside of M&A and some niche parts within the conglomerate banking system, the industry is cooked.

The traditional system is hardware, headcount and regulatory red tape.

The crypto system is software. Ask Uber and Taxi companies how that ended.

Part 1: Skyscrapers vs GitHub Data Uploads

The traditional banking system comes with enormous overhead. Bank branches, compliance people, IT staff to fix aging computers/servers/ATM machines, land costs, air conditioning, floors and more. Due to the high cost structure, there is a ceiling to how much they can compete on price.

For the non-finance people this means operating costs/income. In even simpler terms: the banks spend 63 cents for every dollar of income generated.

Any Major Bank: 1) multiple floor HQ in a Tier-1 city, 2) hundreds of branches, 3) 10,000+ employees, 4) immense regulatory red tape not just to avoid fines but to pay every single month and 5) servers, computers and software systems that are a decade old

Web 3: 1) no branches, no headquarters to report to, 2) $185B+ stable coin issuer Tether has employees measured in the hundreds. Last check close to 200 with global distribution, 3) no managers or paper pushers for reviewing eery transaction, 4) 24/7/365 operational hours and 5) near instant *global* settlement

For the older crypto folks, people forget that Uniswap alone has done $2,000,000,000,000+ in total trading volume (source - 2024!). Employee count in the hundreds.

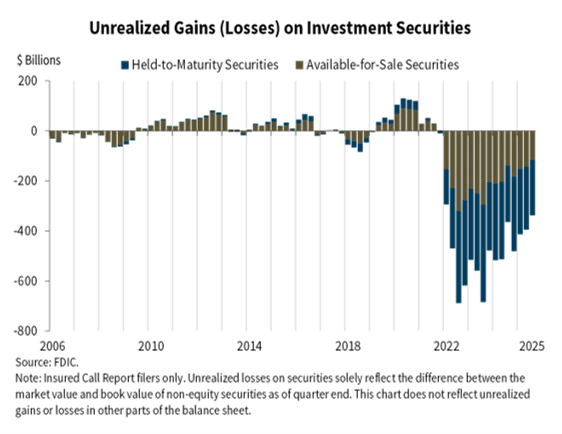

Compare that to your average large bank where they are sitting on hundreds of billions of unrealized losses.

Banks are surviving due to regulatory moats, government bailouts and making the consumer load up on debt. Over a long time horizon, the cheaper software takes more and more market share. Every bailout and blow up due to debt that is plugged via money printing? Well more of that will flow into the new financial system as people give up on the legacy system. .

The cost structure with less overhead wins. Now you understand why we’ve been pounding the drums on e-com. Structurally better in every way versus brick and mortar. This is even more pronounced as it is digital money vs physical products that need to be made + returned.

Part 2: Break Down the Costs to See the Magnitude

Bank Branches

This was the first Market Maker or User Interface for money. Go into the branch to submit money for interest (yield farming) or borrow money (debt). The bank would find the right way to play the spreads.

Now? Just a cost center.

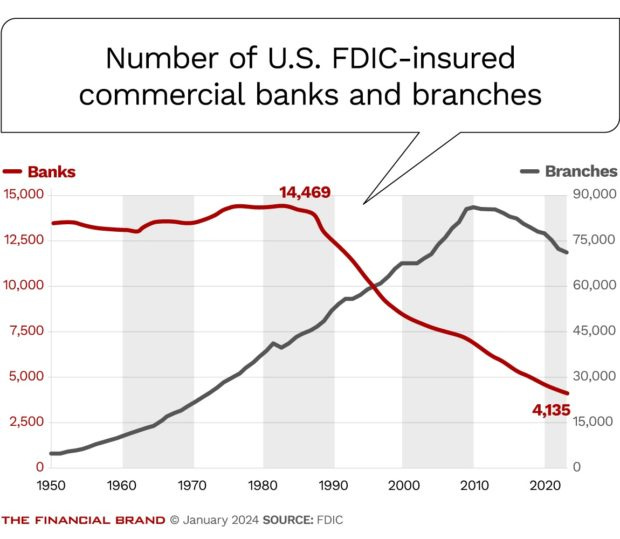

Both Banks and Branches have been on the decline since the Global Financial Crisis. You don’t see expansion efforts and we could argue they won’t even exist in your lifetime (yes yours!)

This is an industry that is being forced to rely on more technology to remain profitable. 1) rent/tax/insurance for real estate, 2) bank tellers, managers, IT people, security, 3) physical cash handling/delivery and 4) regulatory/security compliance

You can use technology to slowly modernize, but it doesn’t help when the public wants change (~70%).

Compliance and Regulation Overhead

Every 5-10 years or so there is a new scandal. From penny stocks being sold to retired people to toxic mortgage backed securities… more regulations come in.

Other rules include: capital ratios, stress testing, Anti-money laundering, Know Your Customer and internal risk committees *on top* of the external rules!

Have you heard of less banking regulation? Neither have we.

All of this just means more costs: lawyers, accountants, auditors, risk committees, IT spending etc.

The conclusion? You guessed it. More bank consolidation is a safe bet. The cost of running a bank goes up leaving you with just a small number of options over the long-term.

Old Hardware

This adds up fast. Everything from air conditioning to servers. Many are forced to run excel on computers from the 2000s.

This means more IT people, more patches, more code adjustments, more vendors, more, more more.

Think of it like a car. Instead of finally updating, it’s just constant repairs and solutions to keep the engine running. Barely. Focus on margins not on growth. Exact opposite of innovation.

Part 3: Crypto and DeFi: Simple Solution

Crypto is messy. You have scammers, hackers, geniuses, autists, celebs, politicians etc. You know what this sounds like? The internet in the early days.

It’s easy to focus on the bull case or the bear case depending on what the market has been doing for a month. Instead we suggest zooming out.

Look at the system functions. Software > Hardware.

DeFi vs. Bank Trading Desk

Currently on DeFi transactions alone you’re looking at about $10,000,000,000 of trading volume per day. Roughly $3.4 trillion processed per day. To do this type of volume the traditional way you would need: 1) human capital - traders/sales etc, 2) huge amount of compliance, 3) all the volume to be compressed during market hours and 4) massive wave of documentation.

Compare that to DeFi: 1) click button, 2) logged into the chain, 3) everything confirmed and accounted for in seconds.

The compliance cost is really at the chokepoint (going to/from a centralized exchange) if someone wants to cash out.

Much Thicker Margins: All of this means the process is faster, more secure and cheaper. The long-term ability for crypto to offer better yields is structural. Due to a software layer, they can offer better yields and better loan rates as more and more people are onboarded to Web 3.

In simple words for readers here: crypto is e-com, tradfi is brick and mortar. Crypto is software, tradfi is hardware.

We can see which model wins over time.

Part 4: Fees in decline

Wall Street is being commoditized. As more assets are trade on-chain (like stocks, commodities etc). There is no real reason to trade in the traditional system. Does anyone want to wait for market open to buy or sell if they learn of new information outside of market hours? Exactly.

Add to this the general loss of trust in institutions: 1) paying 1-2% to underperform a basic index fund that tracks the S&P or NASDAQ, 2) loan generation fees and 3) hot IPOs but at the cost of paying points for years, negating the benefit long-term.

Every layer is being commoditized and we still haven’t suggested that fund raising move on-chain to remove the IPO argument.

ETFs Spiral

To make matters worse for the active manager attempting to charge you 1-2%… the expense ratio for index funds is declining in general. So. It will be even harder to outperform an index.

Before you go full frugal W-2 penny pincher… ask if this sounds familiar.

An ETF is simply a piece of software traded electronically.

Crypto is the next logical step in this. Tokenize the assets for 24/7 trading and then allow the user to create their own basket. In fact, you could even implement fractional shares with crypto!

Now you have 24/7/365 infrastructure at a fraction of the cost.

Trading Commissions?

Yeah this isn’t Wolf of Wall Street. When is the last time you called your broker to place a trade. That’s right… Never.

Inevitable Fee Compression

A decent argument for traditional systems is a lower payout structure. Unless you’re incredibly talented, charging 1-2% is expensive. As ETF fees decline, asset management fees need to decline as well. To justify charging 1-2% the performance needs to be in excess of 1-2% to justify the value.

Note: For the wealthy that are privy to the other benefits, we do agree there is value in talking to someone about Trust funds, generational skipping trusts, anonymous trusts and more. The point is still the same. Fee compression and more of an “a la carte” model where you just pay for a specific service of use for your situation. Blindly handing a guy your assets isn’t wise.

Part 5: But They Are Still Making Money!

Of course they are. So did news paper companies after the internet was out for 5-10 years. Just because an industry is still doing fine today, does not mean it will be doing the same thing in the future.

Most people (with limited conviction) expect to wake up one day and see everything happen at once. Life doesn’t work like that. You’re not going to wake up tomorrow and see “all banks are closed now”.

Instead you’ll see a consistent decline in workforce (check), lower commercial presence (check), consistent bailouts of bad loans (check), consolidation of the industry (check) and more people moving dollars on-chain (check)

Secular decline is not a sudden drop. It is a slow and steady bleed.

Compensation for banks? On the decline. Inflation adjusted it is horrific. A Vice President in 2010 would be making the same or *less* as someone in 2025. Despite 15 years of inflation.

Banks are trying to show profits by slowly paying less and cutting costs (until there are no costs to cut). Also helps that they can magically erase bad debt if the government says they can mark it all as good.

Part 6: How To Optimize

Again. This is not about waking up tomorrow and seeing that JP Morgan doesn’t exist. That’s not how this stuff works. The goal is to transition more and more of your presence to where the assets will be.

If you’re currently spending most of your time interacting with the traditional system, you want to move more and more of your time away from that.

No different from starting your own biz. While you can interact with your W-2 it is not going to make you rich and you have to move your income source to the digital world.

Quiet Quitting

A good term, you are slowly quitting the traditional system. Slowly minimize your interaction:

Use banks for: 1) auto transferring money into your brokerage/crypto CEX, 2) a separate bank for the mortgage since banks love W-2 income and 3) emergency money you might need.

Use Crypto for: Testing new products such as assets on chain. Getting slightly better yield. Moving your day to day transactions into the digital realm.

Once you find yourself clicking buttons instead of heading into branches for transactions, you’ll realize how much time and effort you are saving.

Become a Builder

By constantly looking and optimizing for the digital future, you will ironically become more valuable at your W-2. You’ll know exactly what new tools/products work and you won’t be the 1,000th guy in line picking up pennies in front of a steam roller.

You’ll know which tools need to be built, are being built and can be integrated or not (where you currently work).

No other solution. Build niche skills and information or become commoditized.

Part 7: What If They Just Kill The Industry

At this point there is too much money at stake for the big time finance companies. Blackrock is making more money off their Bitcoin ETF than they are off their other products. Vanguard is giving up because too many of their customers demanded access. Seeing the price fall and wanting at least some of the action to buy the dip or get exposure.

Those days are largely behind us (again opinion)

Once this type of money is involved (tens of billions and soon hundreds of billions), the industry is going to be protected by the wealthiest people in the world.

On That Note…

Are you convinced in the digital future or praying for a return to the past.

We all know how hope as a strategy ends…

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

How ETH is Staked: Covered (here)

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money