Basic Inheritance Tax Planning and Organization

Level 2 - Value Investor

Welcome Avatar! We wrote a more complicated overview of how the rich avoid taxes and this one is going to be more basic. Don’t really mind doing this on the free side of the web. If you’re like us and grew up with the annoying sound of mice clawing at the walls, showering over buckets to save water to flush toilets and having a whopping 3-4 outfits to wear at some garbage public school… This is for you!

If you’re at rock bottom, there is only one direction for you to go: up!

The problem is that no one will be there to help you plan in advance. If you end up going from the underworld to the middle class, upper middle class or wealthy, it doesn’t make sense to leave anything to chance. You may as well set up your future for the most basic situations.

Man these things printed - IYKYK

Part 1: Who to Trust and Reasonable Expectations

As usual none of this is legal or financial advice. Every situation is different and as you scale up the video game of life you will have your own specific situations. This is meant to be general and simple for the majority to avoid any major issues.

Create a List

We have no idea who you personally trust. Hopefully, you have family members that would never cross you. A best friend who you’ve known for decades. So on and so forth.

If you have about 5 people you trust by the time you’ve reached middle age or so, you are a very very rich person.

We’re going to assume that you have a few people you trust. Some being family members (most common) and maybe a couple of other ultra successful people who would never burn their long-term friendship with you over $XXX value.

Don’t Trust the Government. Also. Don’t Be Extreme.

While everyone is in full panic mode over “unrealized gains taxes”, it is a lot better to make some baseline assumptions related to the future. It’s highly unlikely that the government is going to impose a 50% capital gains tax on a primary residence (example). It is much more likely that a $15,000,000 home in the Hamptons is targeted.

Similarly, it’s unlikely that the government imposes a huge inheritance tax on a few million dollars. While that is significant money, it is still unlikely. In the grand scheme of things even someone with $10,000,000 isn’t a big fish! Seriously.

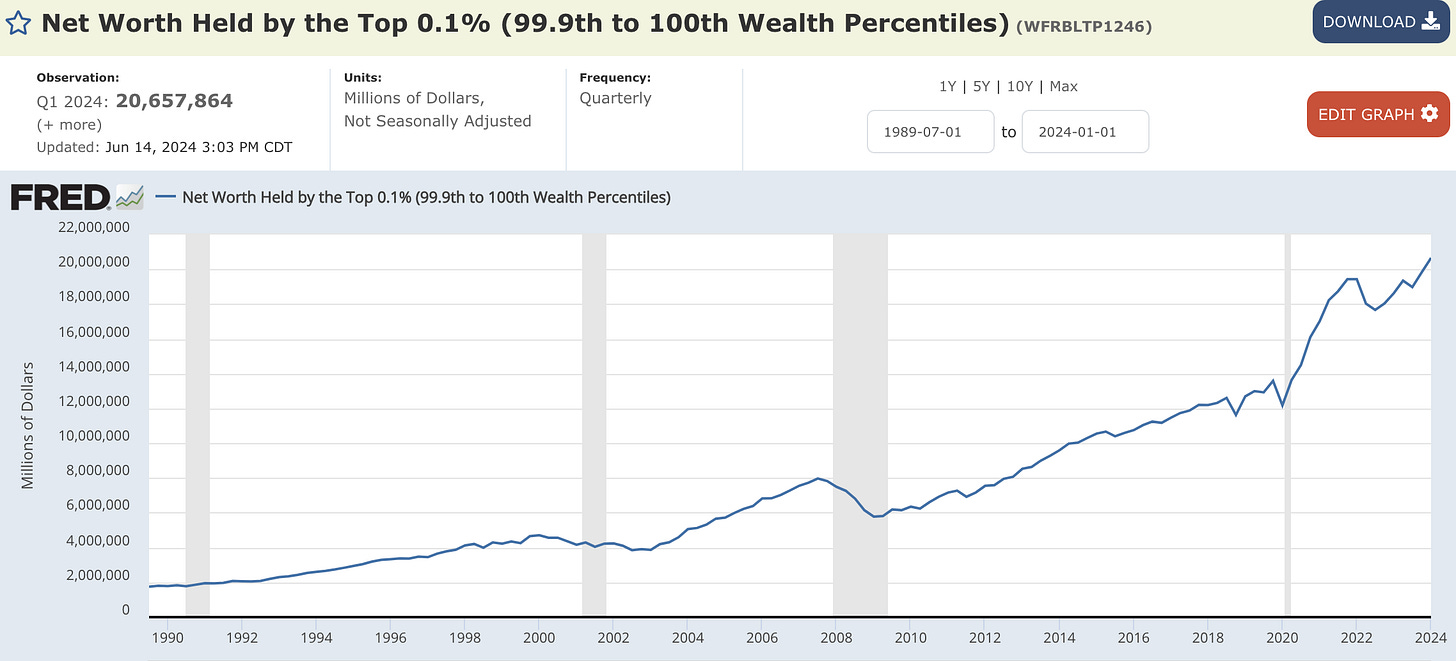

In our humble cartoon opinion, we’ve always used this as the rough metric for “watch out”. The top 0.1% control $20.7 Trillion US tokens in value. Trillions!

The rough cut off as of this writing is $40 - $60 million. If you find yourself blessed enough to reach this level in your lifetime, more complex stuff will come up and you can read between the lines in our paid stuff on how to avoid it.

In short we now have a rough range. If your assets will hit around $1-9 million this post is for you!

Part 2: Setting Yourself Up In Advance

In the good ole’ United States of America here are some basic facts as of 2024.

You can gift anyone you want $18,000 tax free. If you are married you can gift $36,000 to anyone you like. Again. Tax Free

As of 2024, if you want to go over these individual limits, you have a lifetime gift tax exemption of $13,610,000

If you only have a Will set up, you will likely go through lengthy probate processes which will cost time and money

If you inherit an asset worth say $500,000 it does not matter if it was purchased for $100,000. This is stepped up and upon receipt the value is $500,000. If sold instantly for $500,000 there is no capital gain or loss

This is pretty much good enough for the majority in the $1-9M net worth range. If you forecast your future and expect to be in this arena, better get your ducks in a row!

Majority, Get a *Revokable* Living Trust First

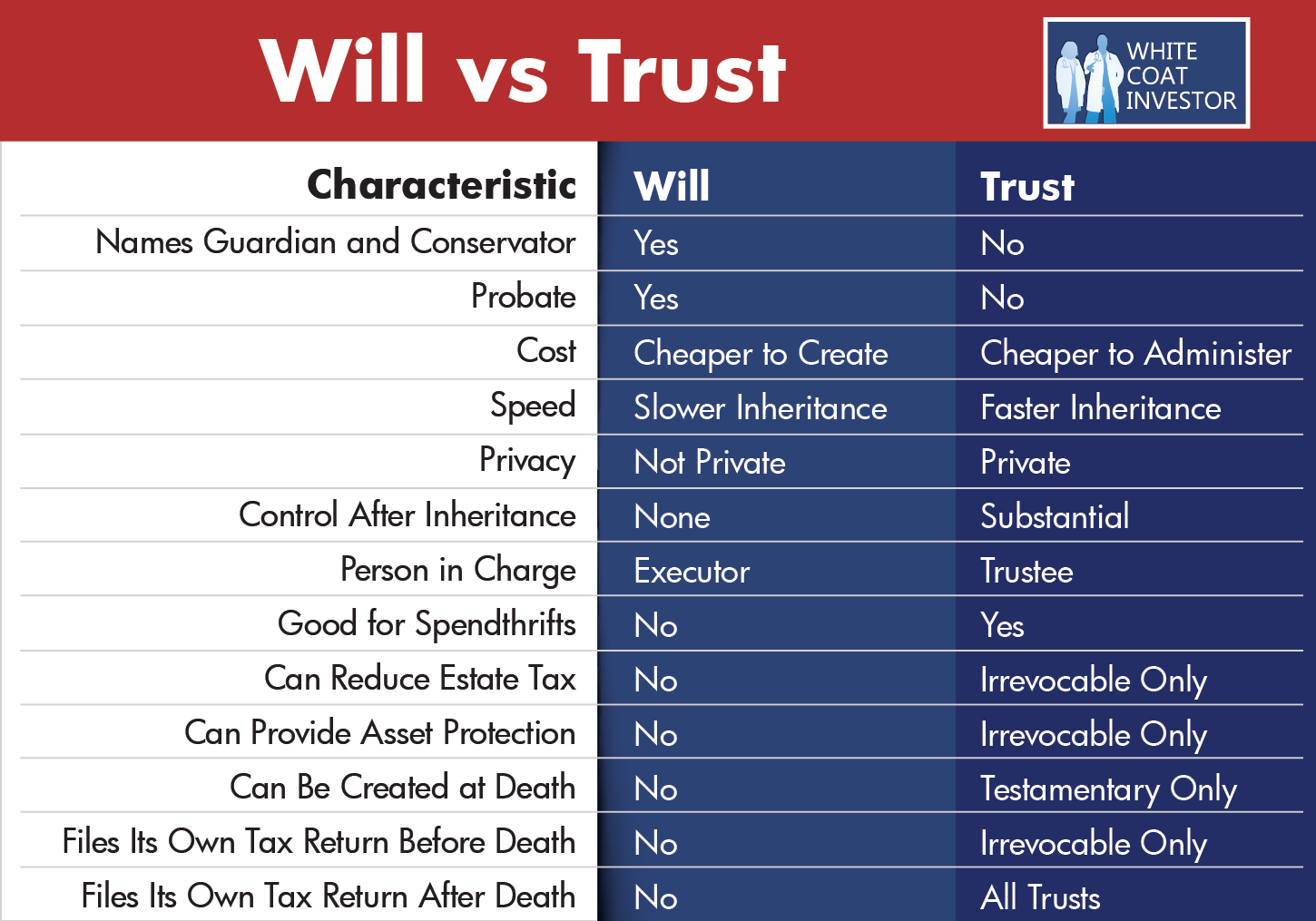

This is a good basic image (ignore that it was made by someone with pink hair - source)

What you can see is that: 1) the trust is more expensive to set up first and 2) the transfer of all the assets is much faster and the information is private.

That alone should tell you enough. Since you won’t be alive it’s probably better to have all your assets go to the right people vs having them fight to the death over everything you own.

General Cost: We’re sure an elite trust lawyer somehow reads this side of the web. That said as a general rule of thumb it will cost you around $5,000 to set up a standard living trust. Could be a few thousand, could be ultra cheap “do it yourself online”, but the point is the same. If you’re planning on being a 7-figure person, you will need a way to transfer everything and better to spend the $3,000 to $5,000 to have an expert draw it all up.

If you don’t do this, you will likely end up spending 4x that on probate. If you only have a Will set up it will run you $20,000 from drawing it up, going through probate and finalizing everything. That is based on *todays* costs. Unless you think we’re going into massive deflation for 30+ years… more likely it will cost even more in the end

Note: a will is good to have as well. This is more for “other” items though. Other items would be a car, jewelry, collectables etc. The trust is for the big items such as a house.

Initial Living Trust Move: The vast majority just name the trust “First Name Last Name Living Trust”. This is honestly good enough. Now if you want to take it a step further we would *recommend* using a basic and simple name instead *not your name*.

For example “JYM Living Trust”. You are still in charge of the trust but when people look it up, it isn’t as obvious. Only complete psychopaths will look up every single trust and try to see what you have/don’t have. Unless you’re a famous rapper/athlete the chances of anyone really looking into it is slim to none.

In short, make a living trust. Spend the $5,000 or so and we suggest *not* using your exact name. Use something easily identifiable and easy for everyone to remember instead.

What Goes In It: Generally speaking the main items that get transferred in are: 1) a house, 2) certain financial accounts and 3) depending on your personal situation - life insurance.

If you were to force us to make a call on this it should be home + some investment accounts. This is better for transfer of assets and protects you against some absurd lawsuit - a person breaks an ankle on your property and sues.

Important Warning: when you set all of this up, the names must match perfectly. You should review everything extremely closely any time you set it up and make any edits (you want to add someone, change the distribution of an asset etc.). This is one of the other major reasons to use a firm that specializes in trusts. If anything is wrong it can cause problems later on.

Part 3: Now Some Basic Planning Ahead

At this point, you likely have well north of $1,000,000 if you’re still reading. The majority at the $1M marker are going to be perfectly fine with this in most cases. If you’re earning significant money and your net worth is accelerating, you can then look into the previous bullet points. Specifically: “any asset you inherit is stepped up”

You Don’t Need The Money

Lets take an example of you being financially independent. You already have enough money to live forever. However, you’re still earning income because you enjoy working. This income is largely “funny money” and will never be touched in any situation. You have an emergency fund, you have a couple income streams and you already have some paid off assets in a living trust.

You realize wait a minute, i’m going to live another 30, 40, 50 years.

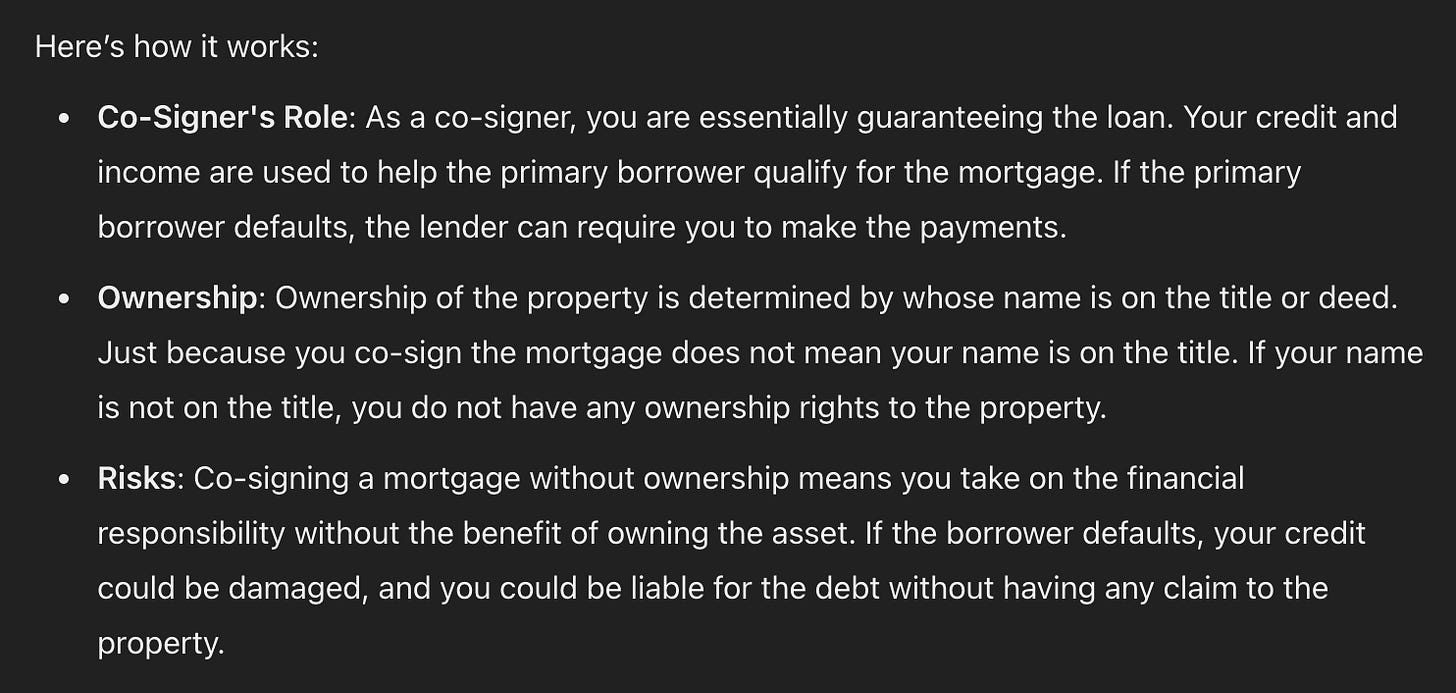

Co-Sign a Mortgage: Since you are a savvy person, you realize that if your dad buys a home for say $400,000 and you co-sign the mortgage, you can legally pay off the note over time. As that house appreciates in value to say $600,000 when it is inherited by you in the future… There is no capital gains tax.

Remember. If you inherit something the cost basis is stepped up. The key is that you need to make sure that the asset is entirely owned by your dad, mother, grandmother, grandfather, uncle, aunt etc.

The risk here is pretty clear: 1) the person somehow removes you from being the inheritor and 2) somehow you’re unable to pay the note. This is only going to work if you are *certain* that there will be no issues.

Another way to do it is by having the person buy it. You don’t co-sign. You send them $18,000 a year every year to cover the cost (this would work on a low-value property).

If someone needs some extra hand holding, you could pay for all of their food/water/daily expenses and they turn around and pay off the house faster. Not hard to get creative!

Speaking of $18,000: If you’re not trying to buy expensive items, you could gift money to relatives. That money is then sent to *their* brokerage account and buys something like the S&P 500, T-bills or whatever. You tell them to use the interest/dividends to pay any taxes generated from the account and upon their death the account is transferred to you, your kids etc.

Once again, this is following everything to the T. You have gifted money, they invested it and that’s that. Following the law. $18,000 is invested into a brokerage account for a decade, it grows, it’s worth say $400,000, you inherit, cost basis is $400,000 - no tax owed.

Conclusion

We’ve given enough out at this point. This is all based on current US rules and even so, this is just a cartoon newsletter. You should always speak to your own lawyers/accountants.

What you learn later on is that the richer you get? The more options you have! Irrevocable trusts, tax havens and more.

We hope you get there and we’re sure many of you will. That said, this should give you enough firepower to come up with your own structure.

Probably shouldn’t have written this all out for free but we’ll be on-top of all changes in the future and have monthly Q&As where you can get our *opinion* on any topic you like.

Stay Toon’d.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money

Man i wish you guys lived in my country so these things applied to me. Then again, we don’t have any capital gains taxes here (for now) so things are good.

What’s your opinion on infinite banking (using whole life insurance and irrevocable trusts) as a generational tool?