Big Changes to Crypto Tax in 2025 and How To Navigate Them

Level 1 - NGMI

There’s only a few days left to sort your taxes, so as a reminder, we recommend using Summ (same as always).

Welcome Avatar!

With only a few days left till the April 15 tax deadline, we’re taking a focused look at crypto taxes and what’s changed between 2024 and 2025.

Especially because some of you might be thinking that thanks to Trump firing a few people at the IRS you’re off the hook for taxes this year. That’s wishful thinking.

The trend is clear: deadweight employees will be replaced by more automation and AI. Given the pro-tech nature of this admin, we’ll likely see this trend in 3-letter agencies like the IRS as well.

And definitely don’t assume you get a free pass just because you’ve got crypto. With the increasing sophistication of blockchain auditing tools (Chainalysis working with IRS), new data-sharing programs (covered later), KYC’d on-ramps and public blockchains, crypto investors are sitting ducks.

Individual income taxes accounted for roughly half of government revenue in 2024, which makes it the largest single revenue source for the government by a country mile. With Trump aiming to lower the deficit from 7% to 3% by the end of his term, you best believe your tax dollars are key to executing the plan.

This is partly a result of the increasing convergence between crypto and traditional finance, which is pushing the IRS to act and improve compliance and reporting standards in crypto, bringing it more in-line with TradFi. With the current admin looking to accelerate cryptocurrency’s maturity, we expect the trend to continue accordingly.

So what’s actually changing?

This year will see the introduction of 1099-DAs and new reporting requirements for brokers (i.e., US crypto exchanges). This will make it easier for the IRS to link your real-world and on-chain identities. Couple this with the global CARF framework, and there’s nowhe re left to hide.

Then there are new cost-basis accounting rules which are going to give you a major headache if you don’t sort them before you pop the champagne on NYE.

Summary: The IRS has a renewed focus on crypto. If you haven’t been reporting your crypto correctly, the IRS is about to see that clear as day thanks to new data-sharing laws. The IRS can audit you up to six years into the past, which means you're not safe from future administrations either. They could easily back-audit known investors (e.g., anyone who has KYC’d with a US exchange).

Keep reading to get the full alpha on what’s changing, what you need to report, and how to navigate the new rules.

As usual none of this is legal or financial advice. Every situation is different, and you should seek your own professional advice. This is meant to give you an idea of what’s changing and how you might fit it into your own strategy.

Crypto Taxes 101: Quick Refresher

Note: If you know your stuff, scroll down to the 2025 changes section. Otherwise, don't risk getting blindsided by a huge tax bill due to your own lack of understanding.

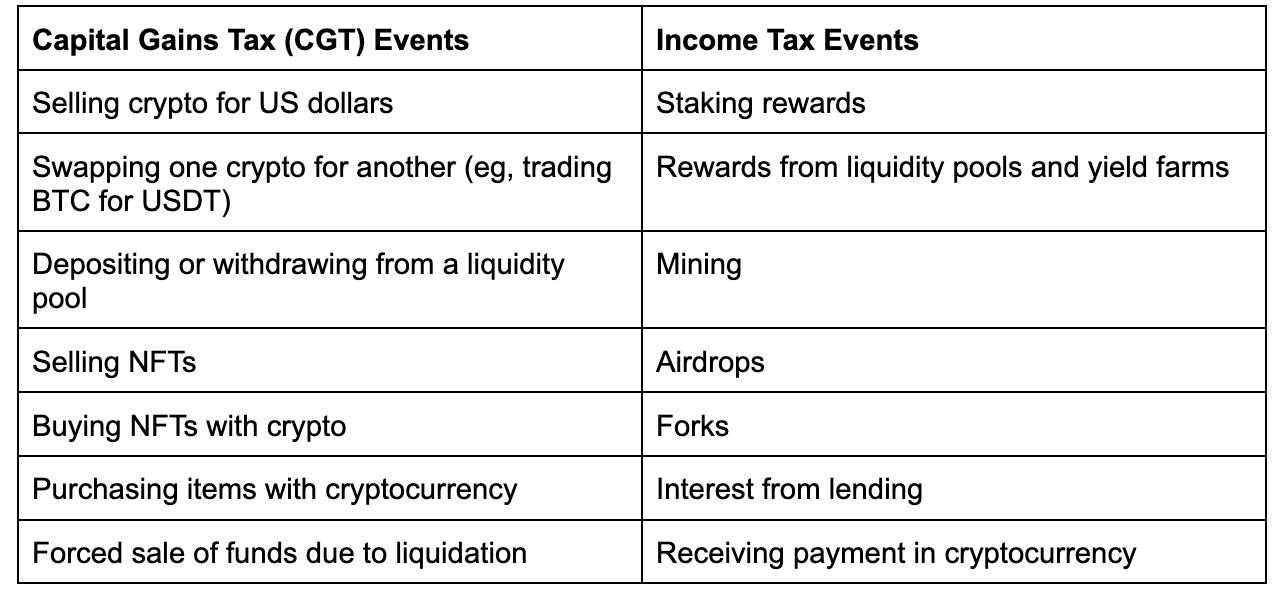

First things first – crypto is taxed as either capital gains or income. Your job is to figure out which of your transactions trigger capital gains events vs. income events.

Capital Gains Events

A capital gain (or loss) occurs any time you dispose of crypto. “Dispose” is a word you need to get very familiar with when it comes to tax. Erase the idea that you are only taxed when you “sell”.

Disposals include things you probably expected, like selling crypto for fiat, swapping one coin for another, and spending crypto on real-world items.

But disposals also include things like depositing/withdrawing from liquidity pools and yield farms, wrapping tokens, bridging, liquidations, and paying gas fees.

It’s these complex DeFi activities that trip many people up and tracking in excel is next to impossible once you get beyond a wallet or two. Automation is the answer – use Summ (code: BTB25) to sort it out for you.

Long-Term vs. Short-Term Capital Gains

Capital gains are taxed at different rates, depending on how long you hold the crypto before selling it.

This is key to mitigating your tax and maximising your profits – especially once we start thinking about the new cost-basis rules and how they come into play.

Short-Term: Gains on assets held for one year or less get taxed as ordinary income rates, meaning they’re typically taxed at a higher rate than long-term gains.

Long-Term: Gains on assets held for more than a year are often taxed at a lower rate than short-term gains (0%, 15%, or 20%), depending on your total income.

This difference can be huge, depending on how much you’ve traded over the year. If you can HODL your winners for 366 days, you might save a chunk in taxes.

Income Tax Events

When you receive crypto, that’s usually income. This might come from token rewards (e.g., airdrops, yield farming, staking), liquidity pool and lending revenue, or payment for work you’ve done.

All of the above is taxed at your ordinary income rate (10% to 37%).

If you're raking in token rewards from something like airdrop farming or staking, then you need to keep in mind that you’ll pay tax in two stages. First when you receive the tokens (as income) and then again when you sell them (capital gains).

Long-Term vs. Short-Term Capital Gains

Not all gains are created equal:

Short-Term: Gains on assets you held for one year or less get taxed as ordinary income, meaning they can push you into a higher bracket.

Long-Term: Gains on assets you hold for more than a year often get taxed at a lower rate (0%, 15%, or 20%, depending on your total income).

This difference can be huge for active traders. If you can HODL your winners for 366 days, you might save a chunk in taxes.

How to Establish Your Cost-basis

Your cost-basis is essentially what you paid (in USD) for your crypto, including fees.

When you sell or swap, you compare the sales proceeds to your cost-basis to figure your gain/loss.

Example:

You buy $1,000 of BTC and pay $30 in trading fees

Your cost basis for the BTC is $1,030

You sell the BTC for $2,000

Your gain is $970 ($2,000 – $1,030)

Pretty simple.

Where it begins to get complicated is allocating which asset you actually sold. E.g, was it the BTC you bought for $15,000 in 2017, or was it the BTC you bought for $50,000 in 2022?

As you can imagine, the allocation has a massive effect on your overall profit/loss. One of the most straightforward ways to approach this is by following the First-In, First-Out (FIFO) accounting rules, which the IRS typically prefers.

As the name suggests, under FIFO, the first asset you purchased is the first one you sell, as far as cost-basis is concerned.

Now, where it actually gets complicated is whether you use universal or per-wallet accounting to establish that cost basis. But by the end of this year, you won’t have a choice.

The Big Changes in 2025 and How To Navigate Them

Changes to cost-basis accounting rules

New rules come into effect this year, requiring everyone to use per-wallet accounting to establish their cost basis. Anyone still using universal accounting must switch by the end of the year.

If you want the details, read on. Otherwise, just use the software (CTC); we’ve confirmed they are handling this automatically for new accounts. If you’re an existing user, go to settings and lock your previous financial years, then flick the toggle to per-wallet cost basis.

Why it’s important: Depending on exactly what assets you sell, per-wallet accounting can substantially impact your reported PnL. So if you were using universal accounting previously, you need to get your head around the “new” per-wallet system.

Universal accounting

Under the universal system you could merge all of your assets across multiple wallets into a single pool for the purpose of cost-basis tracking.

It didn’t matter if you had the same asset on three exchanges and in two hardware wallets; you just allocated the cost basis based on your chosen method (e.g., FIFO), as they were all part of one big universal pool.

This made applying rules like FIFO nice and simple, as you didn’t need to think about where you bought or sold an asset, only when.

Universal accounting is simpler than per-wallet accounting, so you may have used it without knowing. For instance, if someone else does your tax like an accountant, or if you use crypto tax software, it might be the default option.

However, starting this year, anyone still using universal accounting will need to make the switch to per-wallet accounting – so make sure to check what you’ve been using so far.

Per-wallet accounting

If you haven’t already, you will need to adopt per-wallet cost-basis accounting by the end of the year.

Here’s how it works:

Under per-wallet accounting, you’ll need to establish the cost basis of each asset in each wallet.

If you have the same assets in several wallets, you will need to establish the cost basis for each asset, for each wallet they are in.

So let’s say you have five wallets. You’ll need to maintain five separate pools of cost-basis calculations.

When you sell assets, you will need to calculate the gain or loss based on the specific cost-basis that was established for that wallet.

So that means that you will also need to think about which pool of assets you are selling from, before you sell.

This means: when using FIFO, per-wallet accounting gives you greater control over your PnL and subsequent tax calculations than using a universal pool.

For instance, you anticipate a dip and want to swap a portion of your BTC for stablecoins. Using FIFO and universal, you would have to sell the BTC with the oldest cost-basis, which could be quite low and lead to quite a high reported gain.

Under per-wallet, you can be more selective and sell BTC from a wallet with a lower cost-basis. The difference in tax could be substantial, especially when you remember that your tax rate is also moderated by whether you held the assets long-term or short-term.

While it might require much tighter bookkeeping and careful trade planning, the new rules can definitely be leveraged in your favour.

Making The Switch

Despite any benefits the new system might have, making the switch is likely to be a real headache for anyone with a diverse portfolio that’s spread across dozens of exchanges, wallets and blockchains.

You’ll need to determine the cost basis for all your assets and then divide them into individual pools for each wallet or exchange account you own. That’s the sort of work we’d normally hire an accountant for.

Again, CTC will handle all of this automatically. New accounts will be good from the get-go. Existing accounts from last year just need to go to settings and lock previous FY years before flicking the toggle. Ref: BTB25 for 25% off first year.

Safe Harbor

The good news is that under “safe harbor” rules, the IRS has given you a bit of a grace period to sort out your new cost-basis pools. The bad news is you were meant to do this before your first trade of 2025.

Safe harbor essentially allows you to continue using existing cost-basis methods until the end of 2025. Provided that you keep detailed records of how cost has been allocated throughout the year between your various asset pools (eg, exchanges, wallets).

So they expect you to be keeping detailed records any time you make a sale this year, and that you will complete the switch to per-wallet accounting by the end of the year for your 2025 tax return.

1099-DA: New data-sharing between brokers and the IRS

The other major change that began this year is that brokers (i.e., centralized exchanges based in the U.S.) will start reporting your transactions to the IRS.

Starting in 2026, you will receive a Form 1099-DA from your broker containing a summary of your from the 2025 tax year. This is like a 1099-B for stocks and will be shared with the IRS.

Something important to note here is that you will need to report your cost-basis to your exchange or the IRS. Otherwise, you risk paying tax on all proceeds rather than just the gain (i.e., the IRS may allocate your assets a cost-basis of $0 if you fail to report them yourself).

The form includes transaction details, cost-basis, deposit history (date and amount), and gain/loss.

Earlier versions of the form included on-chain data like your deposit and withdrawal addresses and transaction IDs. This was removed after pressure from lawmakers who cited privacy concerns and technical hurdles.

Nevertheless, it shows that the IRS wants this information and is getting serious about large-scale data collection, both on and off-chain.

The changes to cost-basis reporting and the introduction of 1099-DA will help force more accurate reporting from crypto investors and increase tax revenue. That’s why 2025 is really the year that everything changes – regardless of which administration is in power.

Couple this with their existing contracts with analytics firms like Chainalysis, and the IRS will have no trouble determining whether you’ve been honest with your taxes – now or in the past.

This is why being less than honest with your taxes only sets you up for failure. Saving a few thousand dollars just isn’t worth them back-auditing your entire operation.

But with the right planning you can make the new laws work for you, and software like CTC is your lifeline for getting your ducks in a row this year.

TL;DR: Ignore the noise; the signal is the truth. Don’t get blindsided by an audit you didn’t see coming.

Sort your crypto taxes out with Summ using this code (BTB25). As a BTB subscriber, you'll get 25% off your first year. Yes, this also operates as a ref link.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money