BTC Cycle Update Quick Maths

Level 2 - Value Investor

Welcome Avatar! Crypto is a broad space so we’re fine just putting the BTC data out for free. If you look at prior cycles (2017, 2021) BTC always tops first and then we get an alt season. This is largely due to a wealth effect where crypto natives feel richer, willing to take risk on more volatile alt coins. The vast majority of the gains are typically made in the 4th year for all coins (2013, 2017, 2021 and 2025?)

If you’ve been involved for a long time you already know that the price gains occur in an extremely short time frame. Specifically if you miss the best 10 days on any particular year, you might actually lose money! That’s how important it is to “HODL” during the uptrend.

Who is Buying

Right now there are largely 3 major players in the space:

1) governments

2) Microstrategy and other public companies like Coinbase

3) Wall Street/Institutional Investors via the ETF products

All of this represents a much larger checkbook relative to 2021. Back then it was just rich individuals and a small number of big buyers (MSTR and Tesla at the time). Now? We’ve got all of the institutional money and governments stepping in to use BTC as a reserve asset.

This is important since it gives you some line of sight to the future of purchases. With MicroStrategy attempting to buy $42B of BTC over 3- years (likely completing this faster), it’ll give you a bid for the vast majority of the mining emissions over the next 12-18 months.

Current Emissions: Right now there are about 450 bitcoins minted per day, this is 164,250 BTC a year. That equates to around $41,000,000 worth per day and ~$15,000,000,000 per year. Doing some quick math, since MSTR already used $6.6B or so of their $42B plan, we’ll call it $35B left.

$35 billion/$15 billion = ~2.33 years left. This means that MSTR alone is going to buy all of the emissions until the start of 2027.

Add in Some ETF Flows: Even if things slow down from ~$30B and we assume just $15B from the next couple of years that gets you another 1 year worth of emissions. Now we’re already at the next halving!

This type of money is sticky and will cause a lot of FOMO in 2025. Unlike last cycle or the cycle before that, the buyers are not interested in holding anything for a year or two, they plan out over a decade.

Where Can Price Go

There are hundreds of models out there. Instead of worrying about which one ends up being correct you can go ahead and use an amalgamation of indicators to come up with your own number. Our assumption is (redacated +/- 10%) and as usual when we sell a chunk we’ll tell the paid subs.

Since the goal is to get some proxies here are some examples of models people use.

This was popularized by PlanB a crypto influencer in the last cycle. It has broken down quite a bit and he has constantly revised his model over the years. If you look at the original one (not his modifications) it seems to track a lot better. This gets you to somewhere in the mid-low 6-figure range. He has a standard deviation around $400K.

The main problem is that BTC does not seem to overshoot is model by much. In 2014 it overshot a lot, 2017 less so and 2021 much less. This means you can probably take a haircut to the estimate on the original.

Log Chart

Similar to stock-to-flow you get a rough model for when to buy and sell BTC. The problem similar to stock to flow is that the euphoria phase overshoots less and less. in 2014 it went well beyond the bubble value and in 2021 it only got to “fomo intensifies”

Since the goal is to not ride all this down -50-80% like all leverage blow ups, that gets you to around $240,000 or the “HODL/Is this a bubble” range. It just isn’t possible to get a sudden $100,000 candle on a multi-trillion dollar asset without some financial system breaking or absurdity such as buffet buying it with hundreds of billions (he won’t).

Macro Theory all M2

Another good theory is that instead of bothering with price targets you should just follow global M2 money supply. Besides, BTC isn’t even at all time highs if you were to adjust for inflation.

This would lead you to tracing Fed Minutes and the second they pivot selling your bags. Since they haven’t even started printing money yet, more likely up than down. Once they print and reverse course? Head for exits according to the Macro guys.

Technical Analysis Guys

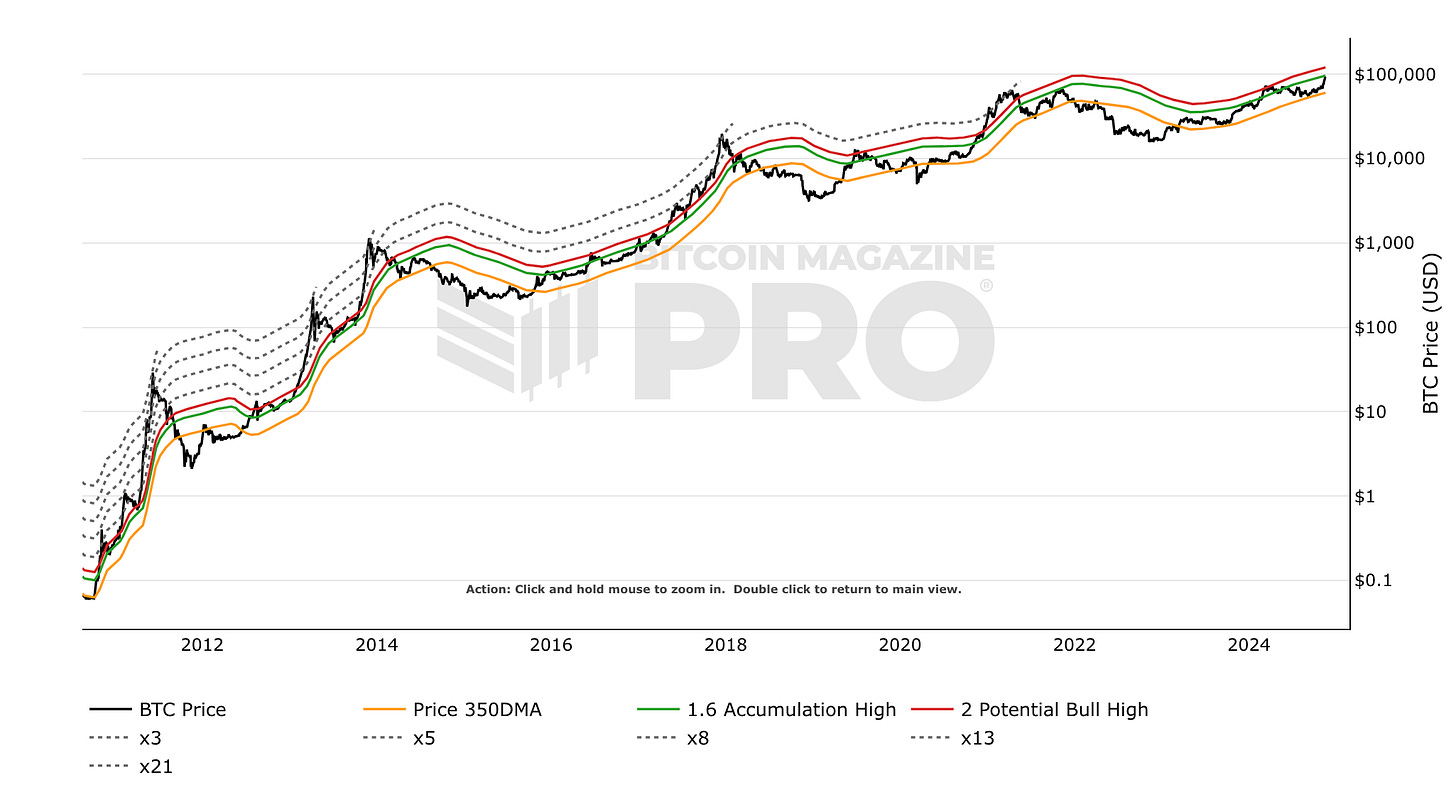

“The Golden Ratio Multiplier is a bitcoin chart that explores Bitcoin's adoption curve and market cycles to understand how price may behave on medium to long term time frames. To do this it uses multiples of the 350 day moving average (350DMA) of Bitcoin's price to identify areas of potential resistance to price movements. Note: multiples are of the 350DMA's price values rather than its number of days.

The multiples reference the Golden Ratio (1.6) and the Fibonacci sequence (0, 1, 1, 2, 3, 5, 8, 13, 21). These are important mathematical numbers.” - Source

We’ll go ahead and do the quick math for the dotted line peak, and it gets you to somewhere around $210,000. Once again none of these models are going to be perfect they are just used to determine when hype/euphoria is really entering into the space.

What’s This Mean for Everything Else

Much, much, much crazier. In 2017 people made millions off of worthless ICOs. There is still folklore around the creator of Litecoin selling all his bags at the top then claiming he was “doing good for the coin”. It never recovered and he’s out being a degenerate risk free.

In 2021 we saw huge sums of money made in both DeFi and in NFTs. It wasn’t hard to find a few people who minted 100+ ETH on a few NFT flips or farming at 10%+ daily yield when money was being given away like sand on the beach.

In 2025? Looks like there will be multiple options: 1) Memes, 2) NFTs, 3) DeFi and 4) AI/gaming. Not clear which one ends up being the most popular. We’re aware the majority will just say “memes already won”, the problem with that comment is that if everyone already agrees then it’s already got the majority mind share (no more entrants).

We’re betting that every single one of those will be opportunistic over the next 12 months. Just don’t blow it by hanging out with the EuroPoors.

As a quick “guesstimate”. Since everyone is on the $10T market cap band wagon, it unlikely hits that outside of a single day spike. More likely lands somewhere in the $8-9T range. This would represent a 3x on prior of high of $3T and similar to the $1T high in 2017 that moved to $3T peak in 2021.

Summary

For those new to crypto, this is a good short read to keep expectations in check

No basically no shot we see $1M bitcoin this cycle

No we’re not going to sell any coins at the end of this year since this is a 4-year cycle (2017, 2021, 2025)

Yes we’re going to cut positions when we think things have gotten frothy

Yes we’re pretty confident that everyone who has been around for a few years will make it - as long as they don’t get greedy with leverage or go all in on small alts

If you don’t remember anything, just sell when your mom is asking you if she should buy. Or. If your dry cleaner is pitching you meme coins

On That note Stay toon’d! Paid subs can ask questions monthly and we have a short Q&A currently live on the Sunday post. Good Luck and Enjoy the Ride.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money