Crypto vs. Global Money Supply and The 2001 Tech Bubble

Level 1 - Definitely NGMI

Welcome Avatar! It is time to zoom out. After numerous interactions on Twitter, we get the sense that people are not thinking big enough. Most are still emotionally attached to US Tokens. On the other side of the fence, we find that the younger generation is concerned that they “missed it”. They didn’t miss anything.

Crypto and Advanced Tech are in *Inning One* of the great transition. We will admit, you will unlikely catch the OGs who HODL’d since 2012 or earlier (the first “alt-cycle” where everyone made a “faster Bitcoin”. However. It doesn’t matter in the long-run. There is still a ton of upside left and no one seems to understand the importance of tectonic shifts.

Brief History of Trash

The guys who called Bitcoin “Tulips” are done. They have no chance of saying that publicly without being laughed at. However, the people who suggest prices are high can say this and maintain “face”.

Remember the Tesla Bears over the past five years? They still exist. And. Somehow get followers after being wrong by a magnitude of 15x over the past five years (yes it has gone up 15x since just five years ago and people still listen to them for “tech investing”).

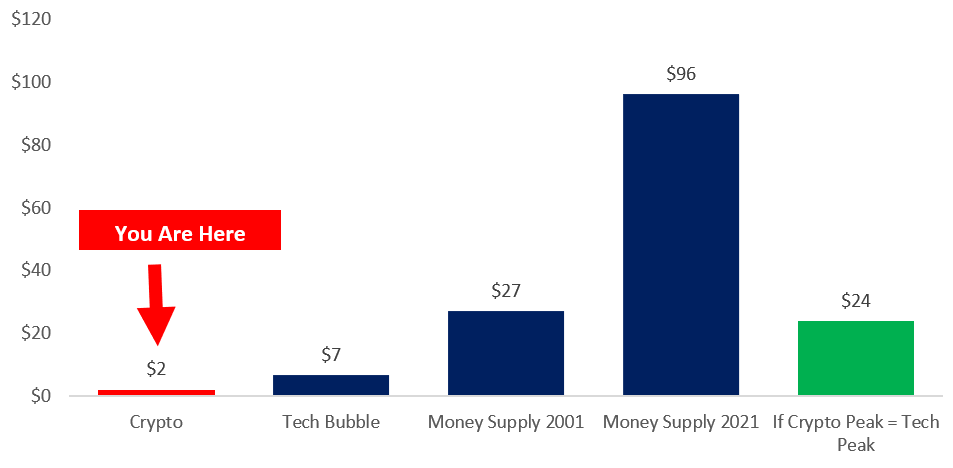

Therefore, we have to address these pessimists who try to compare it to the “Tech Bubble” of 2001. In short, this is *nowhere* near overheated compared to the 2001 Tech Bubble. Since most reading this are future Turbo Autists who will see the light soon, we can use *basic* maths to prove this out. Generally speaking, basic maths usually result in the best understanding of where we are.

Money Supply: As you know, money has been printed for years and years. The United States is no different from a wide range of Countries. Back in 2001 the *Global* money supply was around ~$27T US Tokens. Since then it only escalated to $60 Trillion by the time we got to the Housing bust. The key number here is ~$27 Trillion in 2001.

Why This Matters: If fiat currencies are printed it means that the prices of goods must go up. This is simple maths. Think about it like this. If everyone in the world got 2x their net worth (today), then the prices of goods go up 2x. This way no one is “punished” since the purchasing power is the same. (this is overly simplistic but gets the point across). Over 20 years, if the money supply doubles, the cost of the *assets* will double as well.

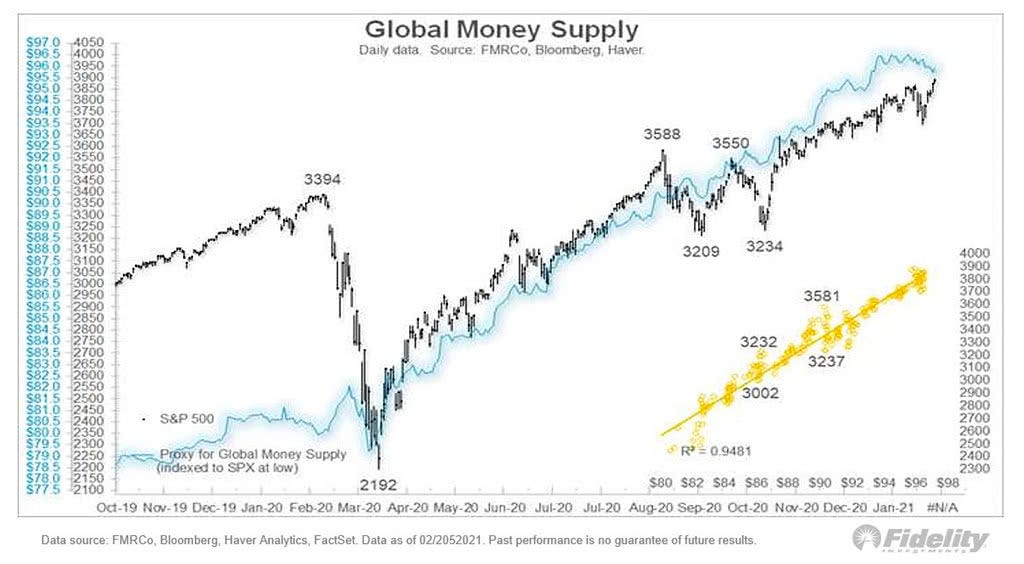

Autist Note: Notice. We used the Fidelity example up front since people trust TradFi more than a Cartoon Bull… Even though you can see a clear #N/A error in the bottom right of the slide along with incorrect date format in the footnotes “02/2052021”. The game is the game.

See Correlation Above: Before the nit pickers jump in again, we know that “correlation does not mean causation”. Everyone took basic statistic classes and the people who say things like this would fail an advanced statistics exam.

With that out of the way, you can see that the massive money printing (starting in March of 2020) correlated pretty cleanly with a large recovery in the S&P 500. Roughly speaking, we’re sitting at a global money supply of $96T which is up from $78T (in just over a year! +23%).

Pause. This is up roughly 3.55x from the $27T in 2001 (use $96T/$27T = 3.55x) . *Coincidentally*, the S&P 500 is up roughly 3.33x from 2001 (4,441.67/1,335.63 = 3.33x) (LINK - for exact numbers)

Roughly, speaking this is a 20 year correlation. It means that the “stock market” *depreciated* by ((3.33/3.55)-1) = -6% for the past twenty years. All price “increase” was tied to money printer go brrr.

Note: For the ultra intense, we realize the NASDAQ has significantly outperformed the S&P 500 for the past five years (Technology eating the physical realm). We *could* make an argument that the NASDAQ should be the Bellwether of growth. That said, the S&P 500 is still a better cross sector indicator as it includes major technology companies within the index already (LINK).

Hit Fast Forward to Present Tokens

You guys are with us so far. We have no doubt. In steps: 1) money printer go BRR drove the stock price returns, 2) Money printer recently went BRRRR crazy with a $20T move and 3) there is an argument that “crypto” is a bubble. Time to go through the third point.

Technology Bubble: The tech bubble was in the early 2000s and we saw peak market capitalization of around $6.7 Trillion. “…late-1990s bubble that began to implode in 2000, wiping out within two years $5 trillion in paper wealth on Nasdaq, the stock market on which the shares of many tech companies are traded. The market value of Nasdaq companies peaked at $6.7 trillion in March 2000 and bottomed out at $1.6 trillion in October 2002.” - Emphasis BTB (LINK to Source from LA Times)

Time to Put This Here Maths All Together: Now we have the data: 1) Crypto Market Cap - Total around $2.1 Trillion, 2) Tech Bubble was $6.7T at peak and 3) Money Supply was $27T and is currently at $96T (we will ignore the barriers to invest in some tech stocks on a global scale to keep it simple). This results in the following maths.

US Tokens in Trillions

Two Steps: Step 1: In 2001 the Tech bubble hit $6.7T and the global money supply was $27T. This means it reached peak mania of ~25% of total global money supply. Step 2: Take this 25% and multiply by the current total global money supply of $96T. This gets you to a crypto market cap of $24T.

Per usual, you are free to decide if we’re early or late (our biased and autistic opinion is that we’re quite early). We didn’t include the following: 1) interest rates are at near 0% so borrowing money is easy - in the late 1990s to early 2000s rates were at 5-6%! (LINK) and 2) this market is much more global when compared to the stock market. Essentially, it is a lot easier to invest in this industry and you can lever up on the cheap (dangerous, however, we know that humans are greedy and irrational).

In short, we think we’re still early. Even if you believe it doesn’t reach similar mania as the Tech bubble… comparing a $2T market cap (smaller than a single tech stock like Apple) to 2001 is simply not fair.

Note: While it is *unlikely* that someone suddenly catches up to the “OGs” - ie. people who have been in crypto since 2012 or earlier, there is still a boat load of evidence that suggests we’re in early innings. Per usual, we call it straight. Someone with 5,000+ BTC is beyond set for life even if a genius is able to make smart investments in DeFi/NFTs/Layer 2 etc.

Turning Back to You

Maybe you’re new, maybe you’re aware of our long-term strategy. Either way it does not matter. Our view is that the world has changed forever. Remote work is here to stay and you have an *opportunity* to participate in the great transition (from Web 2.0 of centralized 1984 style scale to Web 3.0 which represents Ready Player one type interactions with niche self sustaining internet communities).

Since we’re in inning one of this transition we focus primarily on the main tools to help you maximize your chances of being a player in the metaverse (instead of a NPC). That strategy? 1) high paying career or work from home at minimum, 2) build a side business asap based on your niche knowledge online and 3) invest in secular growth technology stocks and a little bit of trad fi to remain sane during the volatile ride!

In fact, we believe quite a bit in this thesis. We’re slowly funding anons (likely beginning October) and you can see that here on BowTiedIsland (LINK). Like anything in its infancy, we’re encouraging everyone to move fast and get started today as the future is bright for Web 3.0. Brighter than we could have ever imagined, even three years ago.

BowTiedJungle: For those that are new, you’re welcome to join us for Troll Tuesdays (free US Token giveaways) and watch the group evolve. As a big highlight, a Rat and a Poker Card somehow made its way to a major Reddit community (LINK). 36,000+ Upvotes and counting!

If you prefer video content we’re also taking these free posts and converting them to video along with other educational content as well (LINK)

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

Q&A: We’ve got a busy day Monday, so please limit Q&A questions on this post for the macro picture we posted here (Tech bubble vs. Crypto today). Our Monthly open ended Q&A is coming up in just a week!

Your friendly neighborhood bank regulator here: I asked the CEO of a $500 million bank last week if he had any plans to develop policies or product offerings for allowing customers to have the bank custody bitcoin (basically bitcoin 101 for a community bank). His response was angry tulip mumbling.

I had to stop myself from telling him that MSTR's unrealized gains alone are 4x his bank's total assets. We early, jungle.

Seems unlikely anyone starting in last couple years will catch up with 2012-2013 HODLers. If starting today seems like you could catch up with 2018-2019 bear market ppl pretty quickly. ASSUMES YOU'VE BUILT A DECENT STACK OF MAJOR PROTOCOLS + GOOD CASH FLOW.

So many opps for insane returns. Last summer was defi summer (100x) on top projects. This summer, jpeg summer - same thing.

DeFi fall should be decent. Arbitrum + derivatives. Won't 100X (I don't think?!?)

What comes after that? Idk - gaming, maybe?

Point is if you build a decent stack of major protocols and then willing to be a degen. Some will go to 0. Others will 30X in Y months.