Decentralized Science (Part 2 of 2) - VitaDAO

Level 2 - Value Investor

Shrike and BowtiedBiotech here again talking about Decentralized Science (DeSci). Previously we provided a general intro to the concept of DeSci and today we aim to go into further detail on the potential of this exciting new area using the first DeSci DAO as an example - VitaDAO.

What is VitaDAO?

VitaDAO is a Decentralized Autonomous Organization (DAO) that represents a new approach to advancing intellectual property (IP) and therapeutic development that is related to aging/longevity.

VitaDAO aims to disrupt the biopharma industry by solving a number of key problems rooted in IP development transitioning from the public to private domain (i.e. the Valley of Death). The current biopharma system does not give the public ownership of IP generated by taxpayer-funded early stage research. Related to this problem, companies use their IP to build moats around their products, which reduces sharing of data and slows research. Many academics lack the training and/or the will to commercialize their discoveries. Since translating science is extremely high risk, there are limited funds for early stage drug development. Many of these funding sources take 6 months to evaluate proposed work, and have low success rates. Between the high risk, and large moats for companies, drugs can pull exorbitant prices. Thus, incentives for patients, researchers and industry do not align.

VitaDAO aims to leverage web3 to align these incentives, which is expected to improve drug discovery—faster decision times for researchers, attract top researchers via open science initiatives, and provide democratic ownership of IP.

Key Value Proposition

VitaDAO is essentially a bet that the tools provided by web3 can better align incentives between the public, researchers and pharma companies, accelerate research commercialization, and democratize IP ownership.

For investors, VitaDAO de-risks early stage research. By focusing on the Valley of Death (initial jump from academia to biotech), VitaDAO can help develop promising early stage technologies to a stage where larger companies are willing to invest.

For researchers, VitaDAO represents a new funding pipeline centered on translational research, with shorter decision times. Additionally, VitaDAO provides biotech and drug development expertise that are not readily available to academics.

For the public, VitaDAO allows a direct say in what research is funded, and a share of ownership in the IP generated by VitaDAO-funded research. VitaDAO has introduced an IP-NFT, which is a non-fungible token representing IP rights in a specific technology.

In contrast to current approaches, VitaDAO aims to be a sustainable funder in early stage research. To do this, profits from the IP held by VitaDAO do NOT accrue to the token holder, but instead are used to fund additional research. This aims to create an “evergreen” model whereby VitaDAO can perpetually fund new science ideas.

Alternatives to VitaDAO

There are other DeSci DAOs launching, including ScienceDAO and BioDAO that intend to do similar things focused in other, partly overlapping, areas of research. However, they are not as developed, and the current energy in the DeSci space is collaborative rather than competitive. Given the extensive space in the area, this is unlikely to change in the near term. See Part 1 for an analysis of the DeSci landscape.

There are traditional systems that VitaDAO is poised to disrupt. For funding, that includes biotech, VCs and Pharma. Purchasing stock in public biotechs is one way for the public to gain exposure to new underlying IP. The National Institutes of Health is the main funder of academic work. University Tech Transfer Offices (TTOs) help academics protect IP and license that IP to companies to further develop.

How Does VitaDAO Work?

Organization

VitaDAO is organized as a permissionless DAO: any individual or organization can join VitaDAO by holding the token. Voting power comes from the governance token $VITA. After ideation, rules and proposals are posted in their governance forum for discussion and revision. Some proposals (eg tech assessments) only need to pass at this stage. if the proposal alters rules or involves >$50k, the proposal then proceeds to Snapshot,. On Snapshot, the proposal is voted on. Anyone can discuss the proposal in the governance forum, while voting on Snapshot is cast by $VITA.

Organizational leadership is provided by VitaCore, which is a group of 4 classes of stakeholders that keep the daily activities running. These stakeholders are the WorkingGroup leads, significantly contributing service providers (e.g., Molecule GmbH), partner DAOs (e.g., LabDAO), and other strategic contributors (none yet).

In addition to VitaCore, six Working Groups maintain VitaDAO’s operations, and are broken down into Operations, Tokenomics, Governance, Technical, Awareness, and Longevity.

To keep incentives aligned, researchers funded by VitaDAO are given $VITA, as are contributors to VitaDAO, other major stakeholders, and other strategic partners.

In addition to the DAO, there are off-chain legal entities. A Canadian non-profit Vitality Healthspan Foundation that received $1.15M from VitaDAO. VitaDAO is not able to make investment recommendations in early stage companies, but they are able to use their expertise to review proposals from said companies, and those assessments are available. There is a holding company to hold IP that cannot be held in IP-NFTs, and to defend IP as needed. There is a Swiss Special Purpose Vehicle (SPV) that allows institutions to participate in DAO governance. The SPV holds $VITA and votes with that $VITA as directed by the SPV investors on a pro rata basis.

Funding Research

VitaDAO uses an iterative, three-tiered system for funding research. Proposals are initially handled by the Longevity Dealflow working group. This group provides a scientific and business evaluation, and has a team member guide the process along (listed for each proposal). Outside reviewers are sometimes solicited. When necessary to protect the IP, the scientific and business evaluation is done under an NDA. If the initial evaluation is positive, the proposal is posted for initial feedback from the community.

In contrast to traditional funding agencies, the reviewers of the proposal may ask the researchers questions if there are concerns about the data or the approach. They may also host the researchers for a community Q&A. Based on responses, the initial proposal may be revised to address key issues. If the revised proposal passes the informal vote on the governance forum (which is 1 vote/person, no $VITA needed), it proceeds to Snapshot for formal voting in proportion to the $VITA held.

To date, VitaDAO has awarded $2.5M in funding for research projects. Intellectual property is held on-chain in the form of IP-NFTs, which may be fractionalized in the future. VitaDAO considers early stage research, both from academics and from companies. Having a university or company amenable to the IP-NFT and licensing terms is required.

Tokenomics

When launched (June 2021), 64,298,880 VITA were minted. This is approximately the number of minutes lived by the longest-lived person on earth (Jeanne Louise Calment, at 122 years, 164 days). Since longevity is the mission of VitaDAO, the supply is capped until someone exceeds Calment’s lifespan (the closest living contender is Lucile Randon, at 118 years).

The initial token offering (~10%) was auctioned using Gnosis auction, and is currently available via Uniswap and balancers VITA/ETH pools. On launch, 10% was allocated to service providers, 10% to fund working groups, and 70% retained by the treasury.

Allocations to Working Groups and key contributors are detailed in their tokenomics proposal. Note that Molecule GmbH holds 7.75%, with the ability to distribute 1.5% across its team. These tokens are locked in an on-chain multi-sig.

Token allocation on Genesis Launch

Like most tokens today, the price is likely driven by liquidity and holder sentiment. VitaDAO emphasizes $VITA is a ‘valueless governance token’, and consequently the team makes no attempt to drive revenue to the token, or worries about the price. Notably, revenue from IP is NOT allocated to the token, but instead directed to an evergreen funding strategy. The evergreen funding strategy for VitaDAO is key from a crypto regulatory perspective. Wednesday's paid post on BowTiedBull dissected the recent, leaked, draft crypto regulatory framework coming from Congress. Since $VITA is not designed to “create profits, liquidation preferences, or other financial interests'', it may be the final regulations do not impact VitaDAO. They have very intelligently positioned themselves for incoming regulation.

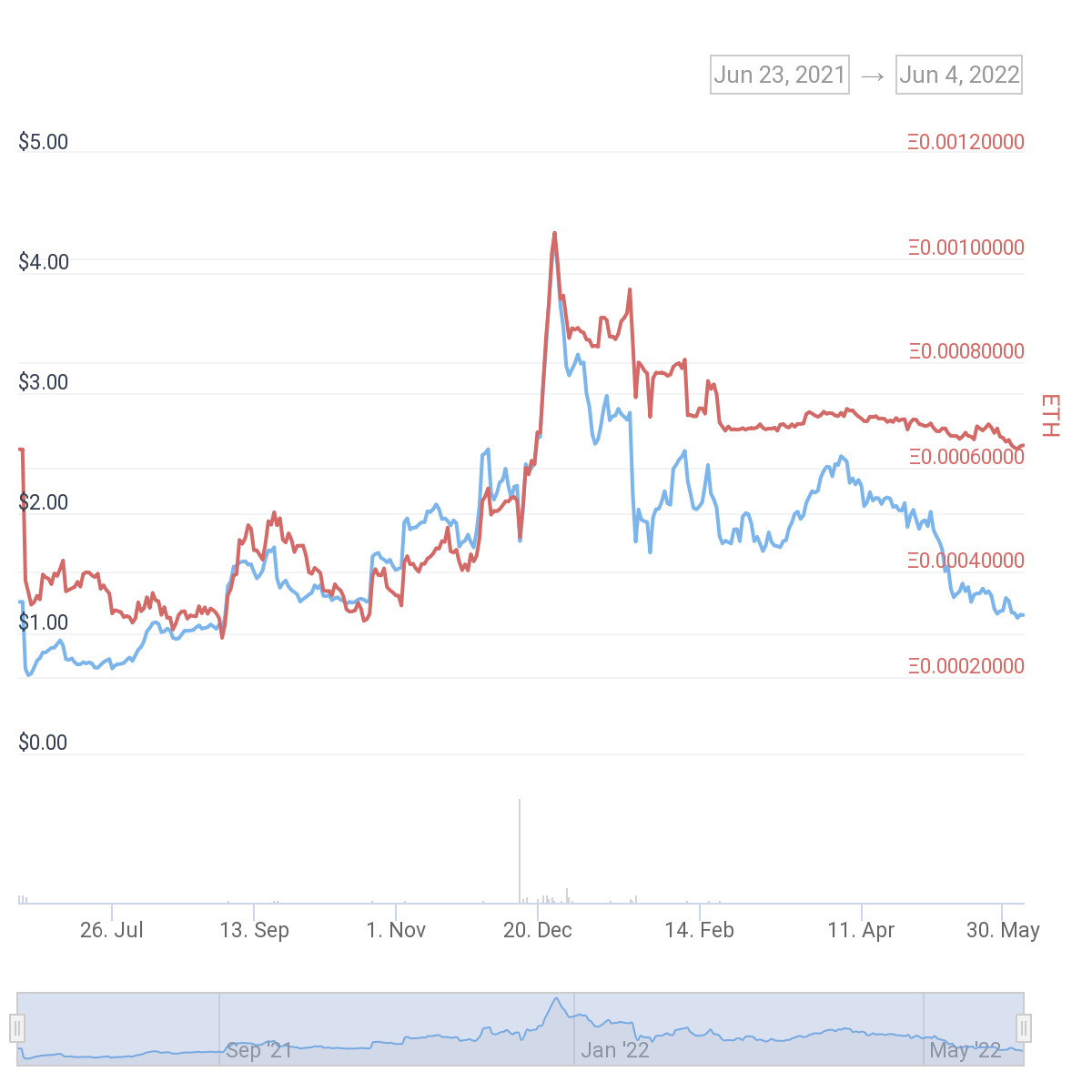

One long-term speculation (NOT made by VitaDAO) is that token price would reflect the value of the underlying assets of the DAO. As of June 4, 1 $VITA is $1.15/0.00064218Ξ . At this price, the Market Cap is $18M and FDV is $74M. For price comparisons, $VITA launched at $1.26/0.00063445Ξ.

$VITA performance in USTT (blue) and ETH (red) terms from Coingecko

For the period April 30-May 30, $VITA dropped -34%/-4.6% in USTT/ETH terms. This out-performed a large chunk of DeFi, including Yearn and L1 tokens like AVAX and Matic. Compared to the all-time high of $4.34/0.00104781Ξ, $VITA is down 74%/39% from all-time highs in USTT and Eth, respectively. Thus, $VITA has held its value better than most of DeFi through the bear market, including Maker.

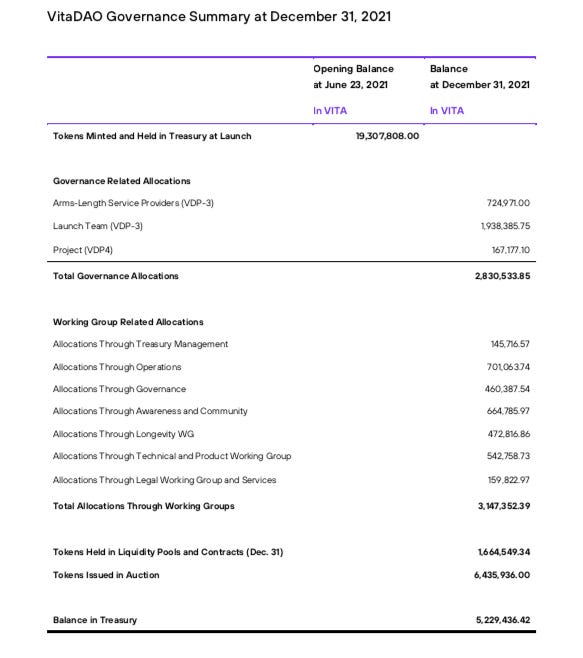

VitaDAO makes available regular Treasury reports. The most recent is December 2021. Treasury and Governance summaries are included below. Readers so interested may practice their finance skills to evaluate DAO health and runway.

Team

VitaCore

The 13 members of VitaCore are all active in the project and doxxed. They bring a diverse range of experiences to managing operations of VitaDAO. The team includes the founders of Molecule, who authored the IP-NFT whitepaper, a co-founder of LabDAO, an Assistant Professor at Wash U (#4 in the US for research by NIH funding), biotech VC, operations, legal and software expertise.

60% of the VitaCore allocation vests linearly for 12 months post launch.

Various team members are also active in spinning up other parts of DeSci like LabDAO, and involved with key Service Providers like Molecule GmbH. Note that Molecule is based in Switzerland/Germany.

Service providers

The DAO tasks service providers with a project or an ongoing role, such as lab work or software development. They provide support through their expertise and are in close collaboration with working groups. Contracted as legal entities, service providers contribute valuable resources to the DAO, such as their teams’ competencies, networks, reputation and legal status. Initial service providers include:

Molecule GmbH: architecture, operations, awareness, business dev, genesis IP, IP NFT workflow, legal

Decentralized Matter: communications, community management, marketing and DevOps

Linum Labs AG: smart contract development and deployment support

Keyko AG: tokenomics and system audit

Curve Labs: governance and system audit

Arctoris Ltd: contract research automation and R&D

Software & Security

Currently, <2M $VITA vote regularly, so voting is susceptible to 51% attacks. However, the low volume on the exchanges enables large holders to manipulate the price. For example, in response to a social engineering attack on a community member, the team drained liquidity from the pools to cut the attacker’s profits.

Governance moved from a smart contract modeled on MolochDAO to Snapshot to provide gasless voting. However, the governance contract seems to retain a self-destruct option that would provide all assets to the admins. This would make migrating to new versions easier, but also requires trust in the admins. Since the team is doxxed, there is more accountability than with an anon team.

Bug Bounty: Up to $50,000 for high threats, $10,000 for medium threats, $1000 for low threats. They follow the Ethereum Foundation and Gnosis Protocol v2 guidelines.

Insurance: currently not directly offered to our knowledge. Although $VITA LPs on Uniswap or Balancer might be able to buy qualifying coverage (please drop us a comment if you have more detail on this)

Key Strengths

Market Fit: The Valley of Death is called that in part due to lack of funding - VitaDAO serves an unmet need in this respect. In addition, the concept of a decentralized accelerator is highly appealing, with potential to support self-assembly of large, diverse expert networks.

Large addressable market: Longevity is a very broad field that spurs a high degree of interest from people wanting to extend their functional life-span. This gives VitaDAO a large range of projects to consider for funding, and multiple areas in which it can invest.

Alternative TTO: VitaDAO effectively serves as an alternative TTO with funding. Most university TTOs do not provide any money to academics seeking to commercialize their products. Instead they shop the IP to companies, and expect the companies to pay patent costs and support continued development. This could help academics dealing with cash-strapped TTOs, and provide additional networks for an eventual exit

Assessment-as-a-Service: VitaDAO has access to the expertise needed to evaluate early stage proposals. The DAO may formalize the assessment provided by the Working Group by voting on it. This could be very helpful to smaller non-profits and other organizations that would have challenges assembling and vetting the expertise. The ability to comment anon on the assessment allows further consideration of any delicate aspects of the proposal.

Geographic Reach: VitaDAO can fund projects world-wide. Location currently matters a lot for biotech (In the US, there are ~10 cities for biotech). This means more remote locations can access the funding and expertise from the DAO that may not be present in their local community. It also enables VitaDAO the ability to pivot outside of the US/Europe as needed.

IP-NFT: The concept of on-chain NFTs that can be fractionalized opens up an entirely new use-case for intellectual property. It will be interesting to monitor adoption and how this will actually work in practice.

Funding model: VitaDAO is structured to drive revenue generated from successfully commercialized IP back into future ventures. This allows sustainability, provided VitaDAO funds enough successful projects.

Key Risks, Weaknesses & Mitigants

DAO organization: All the issues we cited in Pt1 that pertain to scientific DAOs in general remain here - attracting key talent, voting, quality of scientific and entrepreneurial review

Centralization risk: Current control of VitaDAO is effectively centralized. Voting in proportion to $VITA in circulation could allow an outside individual to accumulate control. Admin rights to the governance contract have NOT been revoked. Centralization risks are addressed in part by Conflict of Interest Policies (which were used when funding Dr. Peterson’s proposal). It should be noted that on-chain governance is used via Snapshot, and many governance proposals aim to steadily improve the governance of VitaDAO. This project is also ~1 year old.

Key man/company risk: Currently VitaCore and many key service providers have large degrees of overlap. Molecule serves as a ‘backup company’ to facilitate some of the DAO projects/ ventures that are not as easily done in web3. At this stage, it is unclear how VitaDAO would weather the loss of key VitaCore members or a fracture with a key service provider like Molecule. At this stage in development, this type of risk is hard to avoid. However, as the DAO matures, it will be important to build clear distinctions between the company and the DAO.

Regulatory risk: Like all of DeFi, there is the risk that the SEC deems them a security and tries to shut them down. Key mitigants to this include designing $VITA to fail the Howey test, non-US location for Molecule (Switzerland/Germany), and the social good provided by the DAO (increasing human lifespan). Additionally, VitaDAO can (and currently does) fund research outside of the US.

Business model: Even without DAO structuring, this is a high-risk venture. Most compelling early-stage research does not pan out. “Good” VCs in the biotech space bat ~10%. VitaDAO needs the IP it holds to successfully translate, which will take several years in the best case scenario. Careful evaluation of the proposed research it funds is necessary. One mitigant, in addition to the usual early-stage biotech hedges, is that there is the potential for more eyes on any given proposal. More eyes = more chances to find a potentially lethal flaw prior to funding.

IP lawsuit risk: There are three challenges mixed together here. The first risk is inherent to biotech, which includes patent trolls, and rival patent holders attacking issued patents. There is also a risk that the IP-NFT structure itself could fail when attacked. Finally, there are challenges tapping into academic IP. Many universities have draconian IP policies (they own every idea you create relevant to your job function while employed), which makes transferring IP more challenging. This leaves the decision to license or give the IP up to the university TTO. The TTO may not like the competition, because VitaDAO serves as a second-layer TTO. Since money talks, TTOs may be more reasonable, especially at smaller universities. However, this would limit the researchers who could participate in VitaDAO. The team is aware of these risks, which is why off-chain entities are needed and used. Proposals are assessed for ability to agree to terms and conditions, and research proposals come from doxxed teams. VitaDAO also provides assessments for early stage companies, some of which are capable of agreeing to their terms.

Concluding Thoughts

VitaDAO represents the most mature science DAO and is using web3 to attempt new things in the biotech space. As one of the first movers in the DeSci space, VitaDAO is creating the groundwork and best practices for DeSci, and working to bridge on- and off-chain IP assets at scale. Early successes include the successful launch, demonstrated process for deploying capital in a disciplined way, and continued improvements in operations. Win or lose, this experiment will add to the way science is currently sourced and funded. Since this is a new innovation in a high risk area, VitaDAO is extremely high risk.

Token disclosure

Shrike – From a portfolio aspect, I view $VITA as a degen bet on web3 biotech. Even without revenue accruing to the token, the incidental value of governance over IP assets may grow with those assets. I currently do not hold any tokens, but might hold some in the future, e.g. purchase or I may receive some for my participation in the discussions prior to Snapshot. My experience with “decentralized” organizations is that most of the decisions are swayed/made by informal discussion before voting, which is why my primary interest is in the pre-Snapshot discussions. For a science-focused DAO, this is a very good thing because it balances involving non-scientists in funding areas of science they are passionate about, while the pre-discussion improves the quality of the science that goes before the DAO. As the leading experiment in DeSci, they have the most momentum so far. To succeed, the IP-NFT has to generate money. This is both the most exciting part, and the highest risk.

BowTiedBiotech - We currently do not own any tokens. This project comes with high risk and we view the current community/token holders as those truly involved for the governance token in the short term. Drug development is a long process (10+ years) so VITA coin holders should not expect a quick flip. Although important to note, significant value could be realized in a 1-2 year time period as value is unlocked from IP advancement at many different stage gates ahead of an actual product approval. For example, if the DAO is successful with one of its academic investments and the new IP is licensed to a pharma company for a significant upfront payment that would represent likely millions of dollars coming back to the DAO. VitaDAO also invests in standard venture capital equity financings. If one of their equity investments was to exit within the next 1-2 years again, that could represent multiple millions of dollars coming back to the DAO. Also important to note, the current setup is NOT to distribute these proceeds to token holders, but to use the financial gains evergreen to finance additional science. However, one would expect the value of the token to rise alongside the value of the underlying treasury and IP portfolio. This has yet to really be seen in any crypto project, and mostly for that reason we have chosen not to invest. We do periodically pop into discord as this is more than DAO but truly a movement that is revolutionizing the way science is conducted and financed in the future. If interested to learn more we encourage you to also check out the BowTiedBiotech write up on Decentralized Science from April.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We may or may not be homeless. We’re an advisor for Synapse Protocol and on the JPEG team.

For those with additional interest in this topic we have put together a collection of links to written material, podcasts, youtube, etc.

bowtiedbiotech.substack.com/p/decentralized-science

Thank you team BTB for helping us spread the word about this exciting area. Happy to come give an update in 6-12mon - in the meantime pls hit us or Shrike on twitter with questions.

Excellent part 2 article and even more exciting than the first. I’m highly interested in this IP-NFT concept. Admittedly, any degen bet I had set aside for Vegas may very well go into here in coming weeks. Biotech is certainly playing the long game, but what if they’ve figured this out? How many science autists in remote areas of the world might actually find a vehicle for their IP and discoveries? Lots of upside potential here wrapped in the flag of ‘common good’