Demographic Destiny - USA and Abroad

Level 2 - Value Investor

Welcome Avatar! We didn’t have time to watch the game on Sunday, however, the SuperBowl is always a huge American culture event. This time we saw a few trends: 1) 90% Spanish language half time show with low quality dance moves, 2) celebrities/ex-athletes promoting injectable weight-loss products and 3) pop culture continues to infiltrate ads with the Pepsi/Coldplay cheating commercial.

We’re going to walk through what this means and how it signals some general bad choices being made by brands. Specifically, going for the largest population is rarely a good move at this point. We’re entering into the world of the sovereign individual which means you only care about the talented few, not the masses.

The day of marketing to the biggest population is on the decline since they will inevitably be on government support as AI eats up low paying positions.

Yes we realize this all sounds pretty brutal. Doesn’t mean it isn’t true. Also. We don’t really fault the advertisers for going after the only growing population. Seems logical if you’re not looking at second derivative impacts.

Part 1: Some General Trends and Theories

As usual this is just viewed from our own lens. We’re max long digital immersion, degeneracy, loneliness and wealth disparity.

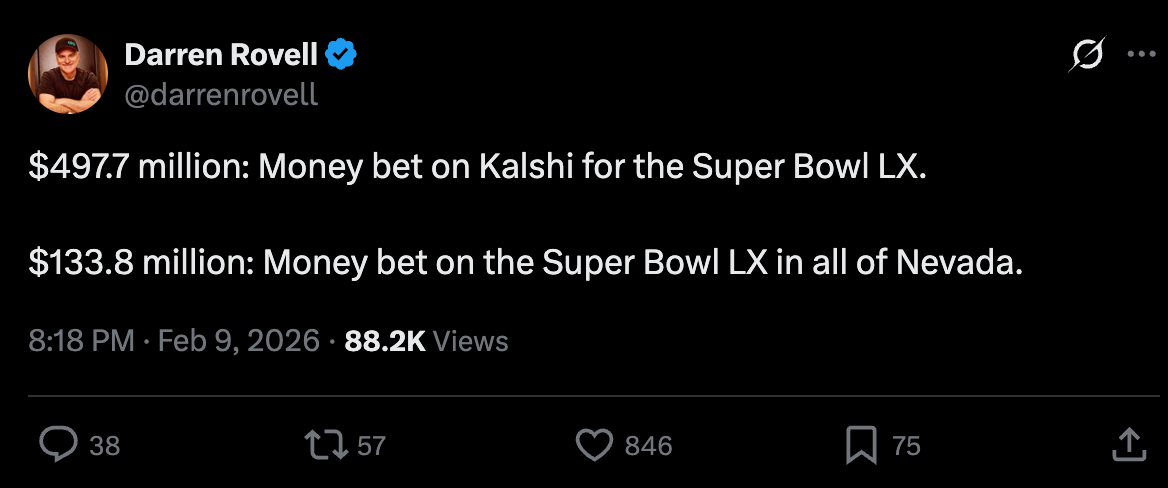

Exhibit A of Glued to Screens and Gambling

30 years ago a talented person could only make money in one industry. Now? A talented person can earn money off 10 different skills and (surprise, surprise) these people are typically in the top 1% of more than one activity! Competition simply rises exponentially.

Where America Is

Big corporate America is still on some of the old operating system. The old operating system was as follows: 1) large headcount means successful company, 2) need to stay relevant to the next major population group and 3) retain brand awareness for the next generation.

The reason why Pepsi and Lays chips still have commercials? Exactly that reason. They know that the typical 30-50 year old has seen their product a billion times. The typical 10 year old has not and is still susceptible to new trends (hence mega influencers launching their own products like Feastibles from Mr Beast). If you lose awareness with the next generation you potentially lose market share forever (a big no no for a company as big as Lays or Pepsi)

Spanish Half-Time Show: We mentioned this briefly on Sunday but it’s pretty much a signal that the NFL needs more viewerships. Since the population of Hispanics in the USA is rising… surprise surprise, they allowed this Spanish Halftime Show to happen. We looked into it and the 2027 SuperBowl is occurring in Southern California. Pretty clear agenda. The plan is to expand by targeting minority groups

Mass WeightLoss Ads: On the same trend of expecting instant gratification, they allowed injectable weight loss products to be marketed to the masses. This isn’t going to surprise anyone. Since the majority of Americans are out of shape, the wide audience was perfect to normalize injectables (insert greedy big pharma meme)

ColdPlay/Pepsi: This was probably the worst ad of the group. They attempted to showcase polar bears cheating on Coke by drinking Pepsi. They reused the ColdPlay cheating scandal as the image.

The failed marketing is pretty obvious. What was the result? They got fired. Psychologically this is a miss in our opinion (again just us). The commercial actually made you think of Coke not Pepsi. And. Cheating on coke just got you fired and embarrassed in the end.

Add These Up

As you can see the marketing play for the SuperBowl is anything wide-net. Its one of the only times you can really just market to “Average American”. The problem? It’s a terrible way to scale at this point.

There is no need for constant pandering to the next demographic class. The only “class” you need to care about is social class.

In addition to that, being a high headcount company just means you are wasting money. Nothing to be proud of anymore.

Summary

The SuperBowl basically said the majority are still operating on an older system. Demographics do matter, just not the sheer numbers. There is a reason why Emerging Markets have failed pretty dramatically. Human capital is real. And. That’s the next frontier.

Part 2: What Companies Should Optimize For

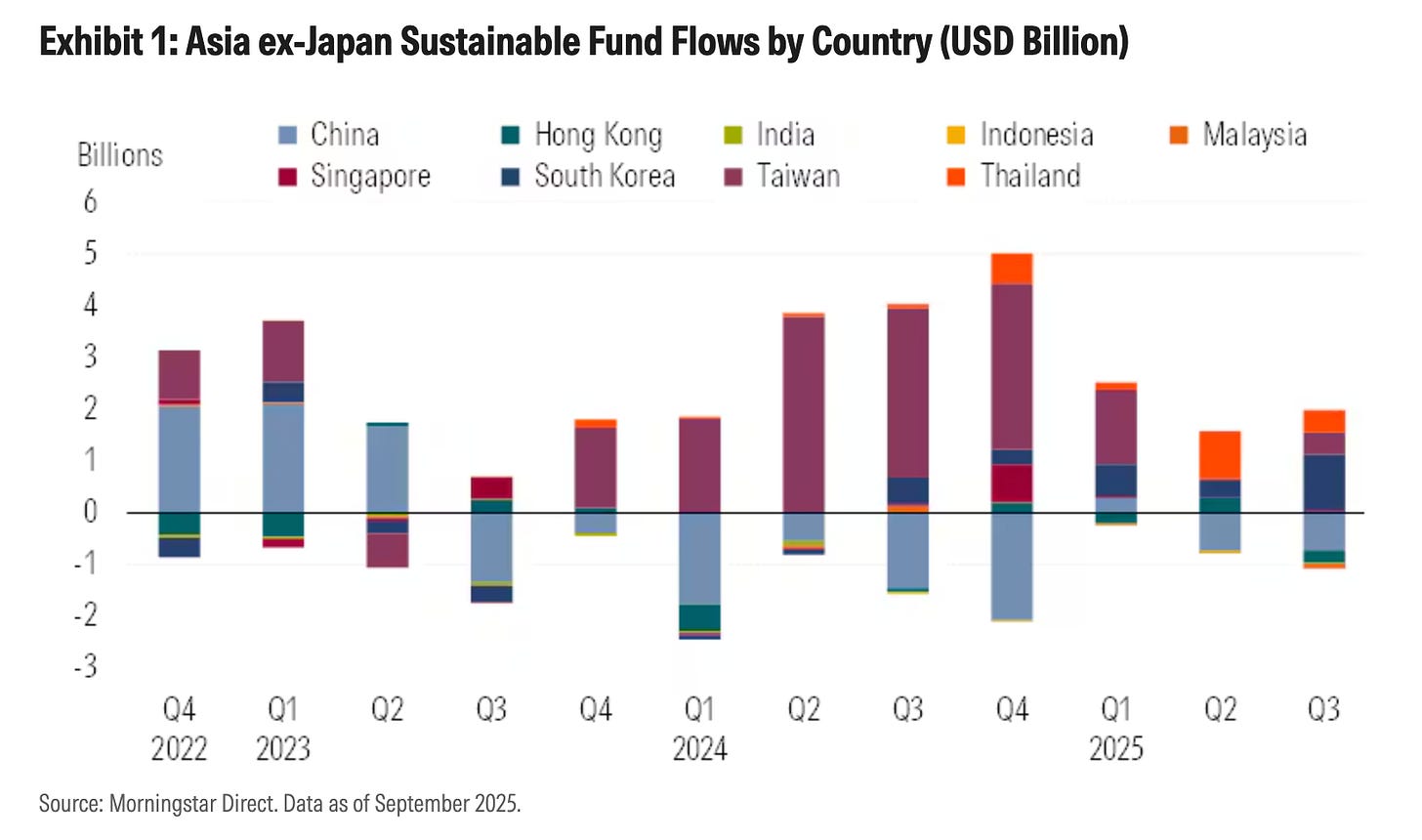

From 1980 to 2020 or so the world had a huge tailwind. A population that was actually getting younger as workforce expanded much faster than retirees.

Fast forward to today? That trade is dead. Kaput. Zilch. Nada. Zero.

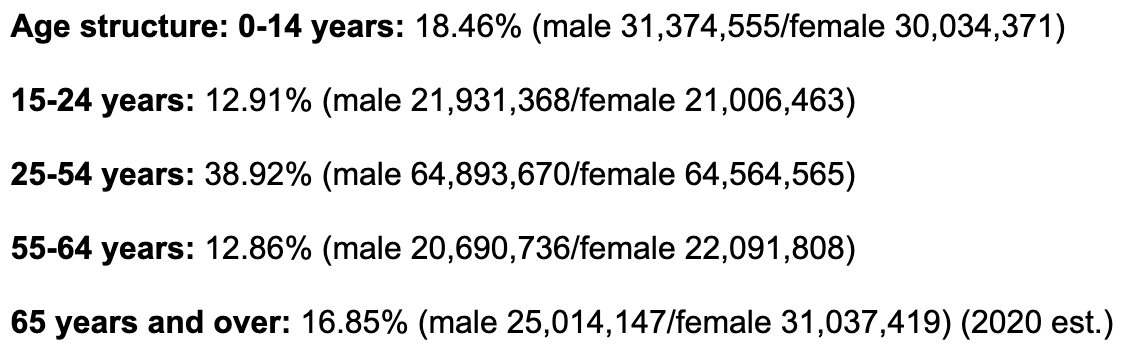

It isn’t “slowing” it has actually reversed at this point. Inclusive of natural deaths/attrition, you have the same number of people in age 55-64 vs. 15-24. Not great!

When this happens the “normal” systems designed on an expanding work force no longer make sense.

Things like social security get ugly since its harder to pay them, faces math problems quickly

Housing markets become more localized since outward expansion is no longer a guarantee

Inflating the debt away is no longer a strategy but the only viable solution

As jurisdictions compete for the high performers, money becomes more concentrated into pockets

The USA still matters. The difference is that this is less about who has the most people. Who has the best people.

Structural Demographic Regime change.

If your population is down 5% but the people who are leaving are unproductive and talentless, you actually won. The cost of basic goods will flatten out a bit and the winners stay longer and longer (creating more value and making the area more competitive). Quite the pickle!

Companies and Governments Are Bargaining Instead

Since they don’t know what to do, they are doing all of the bad ideas at the same time: 1) trying to cut benefits, 2) trying to raise taxes, 3) trying to inflate away debt, 4) more immigration which drives up more competition + social problems and 5) going back to borrowing

As you can see none of these address the core issue. How do you retain the best of the best? Trying to just increase headcount is a relic of the past. You want to attract the best of the best. Now you understand why tax havens have become the biggest talking point of the truly rich.

Part 3: The USA Needs to Be a Capital Magnet

Read that closely. The USA has always had the correct marketing “The land of opportunity”. It just needs a tweak. “The land of opportunity for the talented only”

Human Capital: If we know that AI/tech is going to make rudimentary work irrelevant, you just need to retain the people who are in the top 1% of their category. You also need to recruit these people. Don’t get psyopped by people on X. If you can recruit a top 1% performer from any country that would dominate in the USA, you want them in the USA. Money and economics is not zero sum. It is a positive sum game.

Regular Capital: Despite all the hate Trump Gold/Platinum cards are getting, it is actually a decent idea. It makes the problem of rich vs poor divide bigger but that isn’t solvable anyway.

To be clear, we’ve stated many times it will make rich/poor divide worse. The distinction is if you think that’s good or bad for your situation (hint: you want the divide to continue if you have that WiFi money going)

Why do you even need regular capital? Investing is one of the only things left in terms of viable human work. AI cannot predict the future because it simply scrapes headlines and consensus which has absolutely no signal in it. Just noise.

If you have a lot of capital, you can invest in all the new tech. Also. If that new tech is built in the USA, you want that tech to win! (seems obvious but spelled it out anyway)

Action Point

Instead of wasting time pandering to the masses, the USA should find ways to bring in the top 1%, 0.1%, 0.01% over and over again. Tax incentives, R&D deductions etc. Whatever it takes.

Once capital has found a home, it rarely leaves and that’ll sustain a basic services economy for the masses to earn a living. If you haven’t seen the huge increase in luxury services we’re not sure what to say. Rich people aren’t even taking their laundry to the cleaners at this point. Bonus, they aren’t even shopping for themselves. An assistant goes out and buys everything!

Simple Summary

People misinterpret the Sovereign Individual for “USA is doomed”. It really doesn’t say that. In fact it suggests that it will be extremely polarizing and expensive. Sounds oddly familiar to today no?

The US is the best house in the bad neighborhood and strength + chaos can coexist for a long time. You can have huge amounts of debt and socio-economic dispersion before anything breaks. As long as NPCs have their chips + VR girlfriends + Sportsball, they won’t be rioting any time soon.

Part 4: How About Abroad?

Big picture, the only defacto winners are going to be tax havens. We’re not going to walk through every single one but many of you already know them. Puerto Rico for US people, Cayman Islands, Dubai, etc. The reason? A lot of people earn their money via the internet and that allows portability. If taxes are zero or near zero, incentives push everything in that direction. Simple as that.

Europe: You already guessed it. Cooked. BBQ chicken. They don’t have any real innovation. Just living with a couple stellar companies (ASML, Airbus, LVMH and… that’s about all we can really thing of). The fact that it’s best known for museums tells you the current state. It is old and dated. Living in the past

Asia: Despite every doomer saying they will crush the USA, the reality is that it is mixed. Asia certainly has a lot of talent and is much more advanced that a lot of your typical Americans would believe.

China, Japan, Korea, parts of developed East Asia: Same age related problems which leads to smaller workforces, ballooning retiree costs and a state incentive structure that tilts toward Control & Stability > Growth. They need to find ways to keep capital at home and on top of that pray that the top talent is good enough since there is no need for bloated organizations anymore. Margin for error is thinner but probability of success is still there

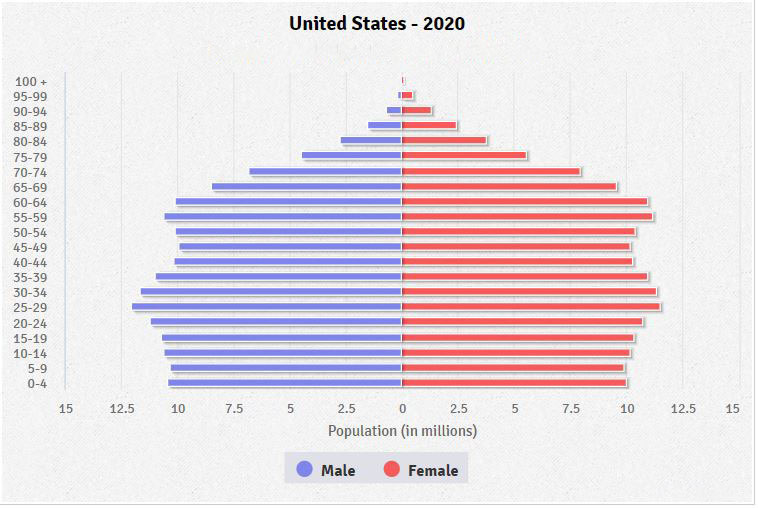

Young Asia (Largely Southeast Asia): Tons of young people actually flock here from all over the world. Cost of living is low and capital markets are being formed. Ideal scenario is tax haven/financial capital creation which could lead to a multi-decade compounding set up. A bunch of small wifi business owners + tax haven + new youth is not a bad situation relative to the current state

Big Picture: Attract Capital is SouthEast Asia and Retain/Control it is First World Asia. There is no broadbased answer here. Some will solve their problems and some won’t. The trick? Instead of watching for manufactured GDP numbers, look at capital flows. The ones that create the most positive fund flows will win since capital and talent are a near 1:1 ratio over the long-term.

Africa/South America: Largely stuck due to things out of their control. Governments view their countries as resources to extract from. You can look at some outliers like El Salvador but this is directionally how it works.

Value is pulled out as fast as possible to defend the interests of insiders/politicians. While there is opportunity there, the question is if you’ll be able to keep the gains as they inevitably destroy the currency. Outside tax havens within this continents, security is too big of an issue to consider making it a home base.

Part 5 — The Public Market for People

If the goal is to attract productive people the value system starts to invert. Instead of operating as a large resource or land based nation, the new resource is: 1) highly skilled workers, 2) entrepreneurs, 3) capital allocators and 4) new job producers.

You’ll find that this is an extremely slim list.

Since that list is thin, the things they care about are also thin: 1) safety/security, 2) better future for their kids, 3) low taxes or good tax incentives, 4) digital innovation and 5) high trust.

If you really zoom out, keeping more money and feeling safe largely comes down to high trust. If you are rich and look around feeling safe, this means that it is likely a high trust society. No one is on high alert walking in a gated community with a private beach. Low Stress, Low Tax, Quality Healthcare and High Trust environment. Good cocktail.

Hint: There is huge upside by becoming a person that governments are competing for. Just imagine a bidding war for your W-2 job hop but with countries that can print their own currency. You get the idea!

Part 6 - Apply it to Yourself

If you agree with this premise the goal in the interim is: 1) become hard to control and 2) hard to trap.

This is done with all the stuff we preach on here. Liquid investments, cold storage, WiFi Money and ownership (that is ideally all linked to digital revenue). E-com absolutely destroys brick and mortar on portability alone. We’d say location independent income is worth at least 1.5x location dependent income.

Income should travel with you

You should remain liquid

Do your best to understate all your value in every situation

slowly and surely eliminate single points of failure by having a plan B (second passport)

As each country increases or decreases the price of staying, you want to have the ability to up and move at any time.

Note: This is yet another reason why we recommend people in their 20s to always rent. Even if you are ready to buy, you don’t want to lock down your location until you’re certain of where you want to be.

Conclusions

If you look big picture at how the USA is operating, it hasn’t caught up to the future operating system. Instead of having anxiety, look at it as opportunity. There are people out there who haven’t heard of the Sovereign Individual and… there are still billions who will never bother to read or look it up.

Focus on the big picture that matters. We’re going to a digital immersion future where competition will only pick up as the top 1% can spin up various business lines at once. If you’re interested in goign down this path you should be following along the Jungle journey as more and more people become Sovereign. (Note, we have an updated post coming from a Jungle individual who escaped in ~2024 and how scaling has occurred over the last year or so)

Stay Toon’d and don’t fret over the SuperBowl ads. The masses will be pushed into government programs over the long-term. Just a matter of time (in our humble cartoon opinion)

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

How ETH is Staked: Covered (here)

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money