Downturn? Recovers Faster Than You May Think

Level 2 - Value Investor

Welcome Avatar! Now that everyone is in full blown panic mode, it’s probably a good idea to review some numbers. Unless you think the USA is really on the way out (insert laughter since no other country has any real innovation), we can surmise that in 10, 20 and 30 years markets will be higher across the board. Sure some major companies are replaced in the S&P 500, a few needle in haystack international companies do well… And. In the end, the US market returns to new highs.

Part 1: The 2001 Tech Crash

Back in the Tech Bubble internet valuations got way out of hand. Trading at 50x or even 200x sales for companies that had practically no profits or revenue. This was an insane time where the metric was “eyeballs per page” the equivalent of what we would call pageviews today. Multiples/valuations were derived on that vanity metric which (of course) was littered with fraud due to botting activity.

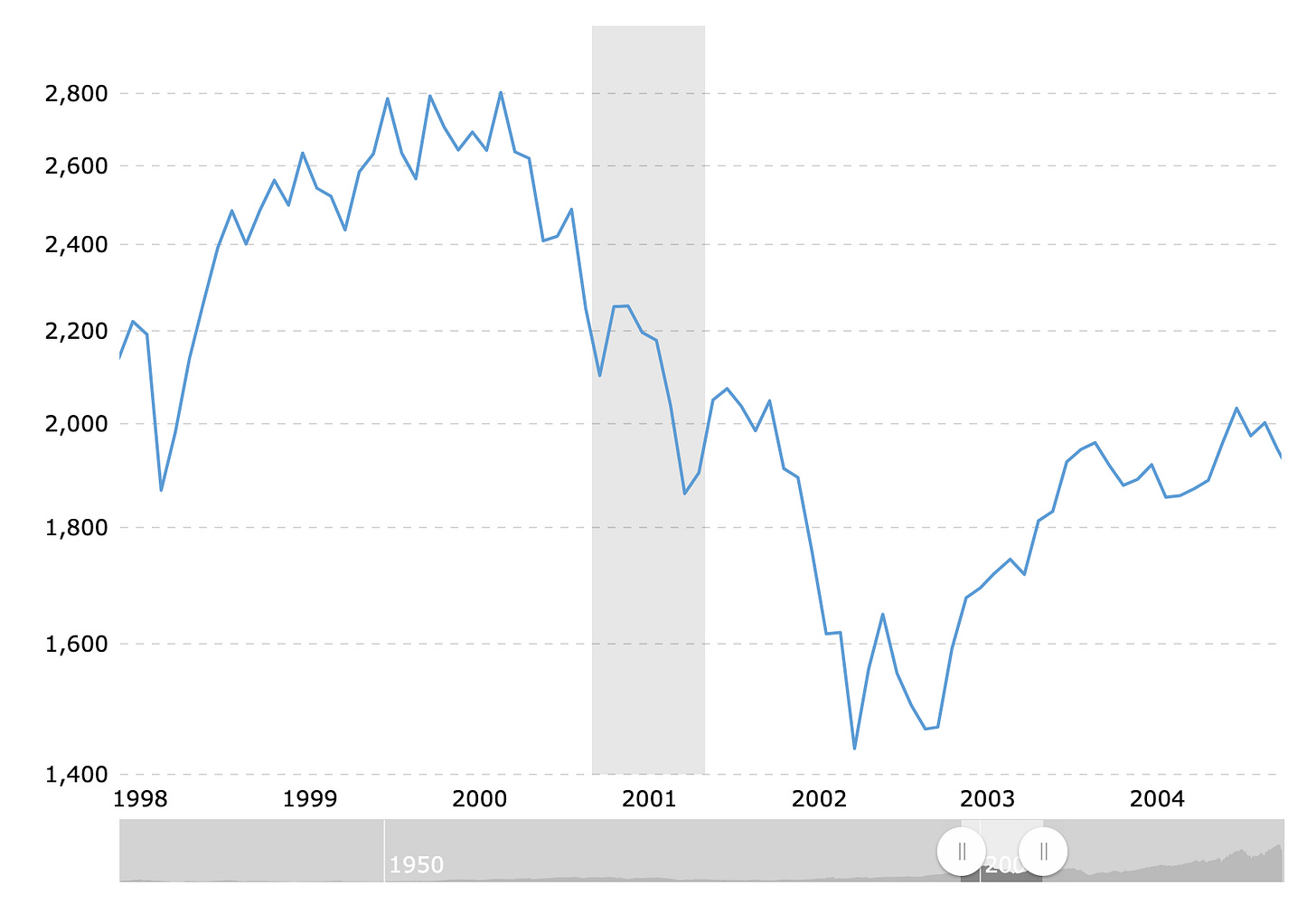

Quick History: We’ll always refer to the S&P 500 for this post. Easier since the NASDAQ or Dow are too concentrated in a single industry. The S&P peaked at around 1,500 in March of 2000. Exact decimals or numbers do not matter since no one buys or sells the pico tick.

It wasn’t until the market fell 20%+ for the US to enter into a recession. Roughly speaking the S&P was in the 1,150-1,190 range when this happened.

People tried to catch a falling knife. Markets kept falling, 9/11 happened and the next thing you know we’re all the way down to 775 or so (high 700s) in October of 2002.

How Long to Recover? Using the bottom as October of 2002 it took about four and a half years to recover back to March of 2000 levels. The only problem with looking at this recession in isolation? The 9/11 attacks. It’s hard to know if the bottom would have occurred earlier without it. No one will know.

What we do know is that it takes about 4.5 years from the bottom to get back to the top using 2001.

S&P 2001 Crash

Part 2: The 2008 Real Estate Crash

This has radicalized a large number of millennials and Gen X. If you find someone deep into crypto, many will cite this as a radicalization point. Printing $700 billion to bail out banks because they wrote loans to strippers for their 7th investment property in Vegas.

That number was an absurd amount (at the time) and now represents a drop in the bucket compared to the $10,000,000,000,000 printed during the COVID-19 lockdowns.

Quick History: After a recovery from the Tech Crash the stock market essentially went slightly above the 2000 peak to just over 1,550. This marked the top around October of 2007.

After this we went down only and according to the NBER a recession lasted abotu 18 months starting around the beginning of 2008/End of 2007. In March of 2009 the market bottomed in the high 600 range (around 670 or so). This represented a 55%+ drawdown compared to the 50% drawdown in the 2000 crash (leverage is a killer, thanks Real Estate!)

Time To Recover: From a lower starting point it took about four years for the market to recover going back to prior highs in March of 2013 or so. The major difference here is that the market bottomed before the recession ended. This is an important distinction because the internet allowed for faster information flow. Once people realized we were at the end of GDP declines the market bottomed before the official end of of the recession.

Back in 2000 and 2001 while the internet was around, it was no where near as prolific as it was in 2008 (everyone in the white collar world had a smartphone by that point - RIP BlackBerry)

S&P 2008 Crash

Simple main thing to remember, it only took 4 years to get back to the prior high.

Part 3: Doing Some Quick Math

Okay now everyone should be relaxed. It takes about four years (nothing) to get back to S&P all time highs based on the last 2 significant recessions. We also know that the market typically bottoms just before the recession ends because of access to more accurate and real time information.

Unless the new admin drags along all this volatility for 4+ years, you got nothing to worry about. Much more likely that 2025 has a bottom in it and we’re back to all time highs in *under* 4 years since there have been: 1) no major layoffs so far, 2) no major bankruptcies and 3) no leveraged blow ups that will take years to clean up.

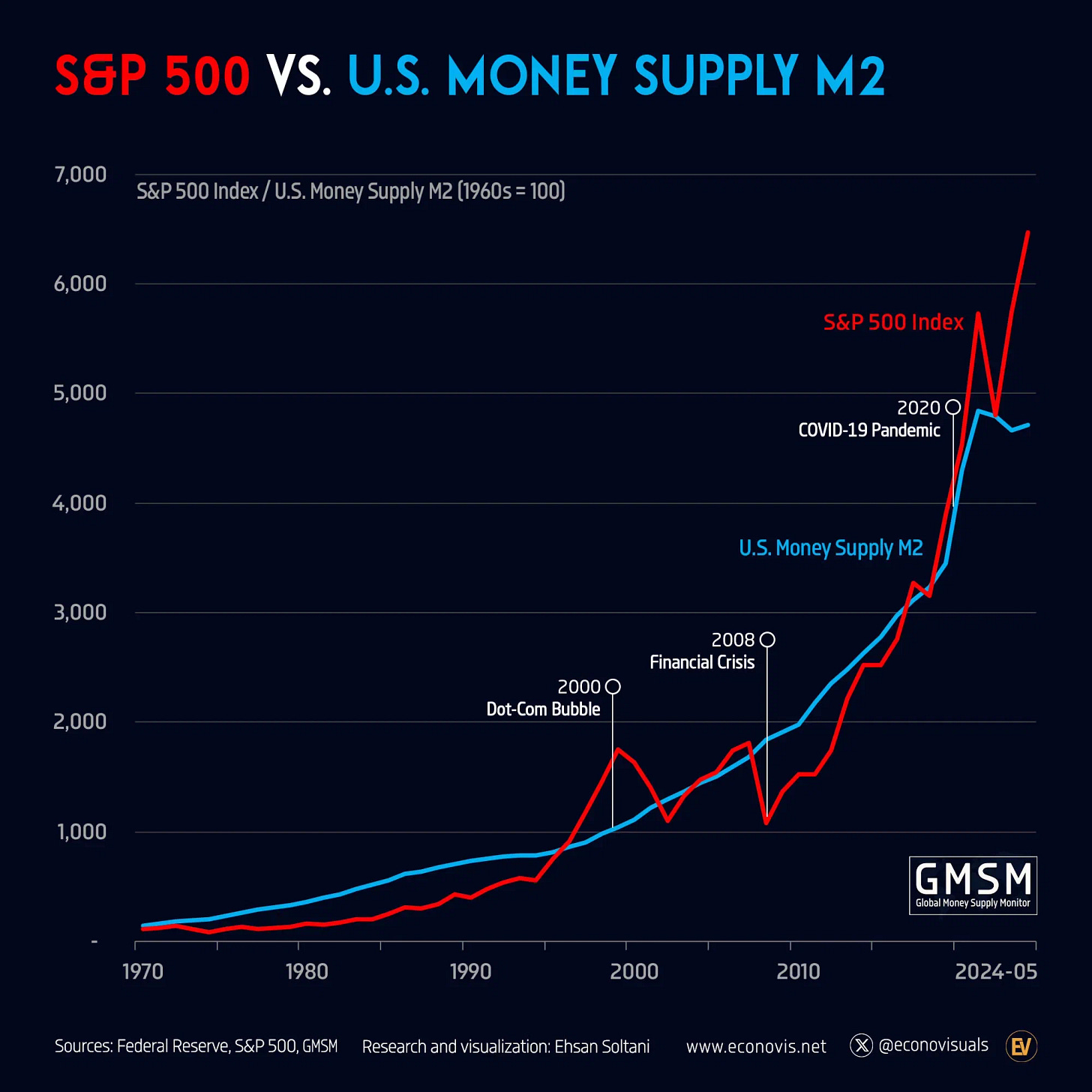

Can Argue Would Happen With or Without Tariffs

Even before all of this, you could argue that fair value was closer to 5,000 anyway. In fact slightly below. The S&P is just a conduit for money printing since the mid 1990s anyway.

Quick Math: It took about 4 to 4.5 years to erase 50-55% in losses. This means the market went up 100% in about 4 years (going from 1500 to 750 and 750 back to 1500 is a 100% gain).

Plug that into excel… you learn that a 19% compound return is available by buying the S&P 500 when the down turn is complete. You don’t even need to tag the exact bottom. If you’re even within 10-15% of it, you’re looking at 15%+ returns for the next 4 years.

Summary

If you’re under 45 or so you should be celebrating the declines. There is no way you are down a significant amount of money relative to your annual income. The only people who should be upset are retired because they rely on the market to live. Far too many people were sitting back hoping for double digit returns while they build no valuable skills at all (no biz, no nothing just ticker price go up).

Wealth Is Relative: This comment always makes people mad but wealth is relative. If you own $100K of a stock and it goes up 10% but all the rich people own $10M of it, you’re not gaining ground on the elite (not even close).

You’re actually better off if that stock goes down 50% (you have $50K, they have $5M each) and you can buy $50K more of it. Now as a ratio you own more on a weighted basis.

Why This Matters? This is important because its actually how the USA continues to retain global dominance. If US markets go down 10% but all other markets go down 30% who is the winner? The USA is. Don’t leave us any messages saying you’re going to invest in the Mexican Stock Market or the European Stock Market. We know you’re lying.

After all is said and done, the US market will be the best performer. Down less than everyone. Or up more than everyone. Been this way for a century now and be careful when someone says “the US is done”. What they are really saying? They are personally done.

They couldn’t even make it in the USA. The easiest place in the world to get rich.

The projection never changes.

On that note, don’t panic and enjoy the fireworks!

When people think the tariff war is never going to end. You will know what to do.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money