ETHEREALIZE THE WORLD

Level 2 - Value Investor

Welcome Avatar! This is a guest post by Vivek Raman (X handle HERE). We’re not involved in the project in any way, the post is written entirely by Vivek. This is an educational/informational overview of the product and plans. Hope you enjoy it!

Introduction

We believe blockchain technology is on the cusp of its ChatGPT moment.

Smart contract blockchains, which allow money and digital assets to be programmable on globally accessible platforms, have been around for 10 years. Over that time, we’ve seen countless iterations of internal blockchains at banks, permissioned blockchains at enterprises, and pilot consortium blockchains.

However, just as private corporate intranets were ultimately replaced by the public Internet to achieve the full potential of global scale and interoperability, we’re now at the public Internet moment for blockchains.

And this will happen on Ethereum: the most secure, most decentralized, most battle-tested public smart contract blockchain.

Ethereum will be the backbone of the new global financial system. And ETH, its native token, will achieve store of value status alongside BTC and gold.

Blockchain has the potential to be as big and impactful as AI and the Internet. Just as the Internet transmits data and information globally, Ethereum transmits value globally.

Public blockchains will unlock a Renaissance for the global financial system as we modernize assets for the digital age.

The future of finance is on Ethereum. And we’re building Etherealize to accelerate this.

Ethereum

Ethereum and ETH is currently a tale of two cities. If we look at the trajectory of underlying adoption, the Ethereum ecosystem is already winning - by far.

Ethereum has existed, without any downtime, for 10 years - earning its place as the safest, most secure blockchain for institutional adoption - where all high value assets will live.

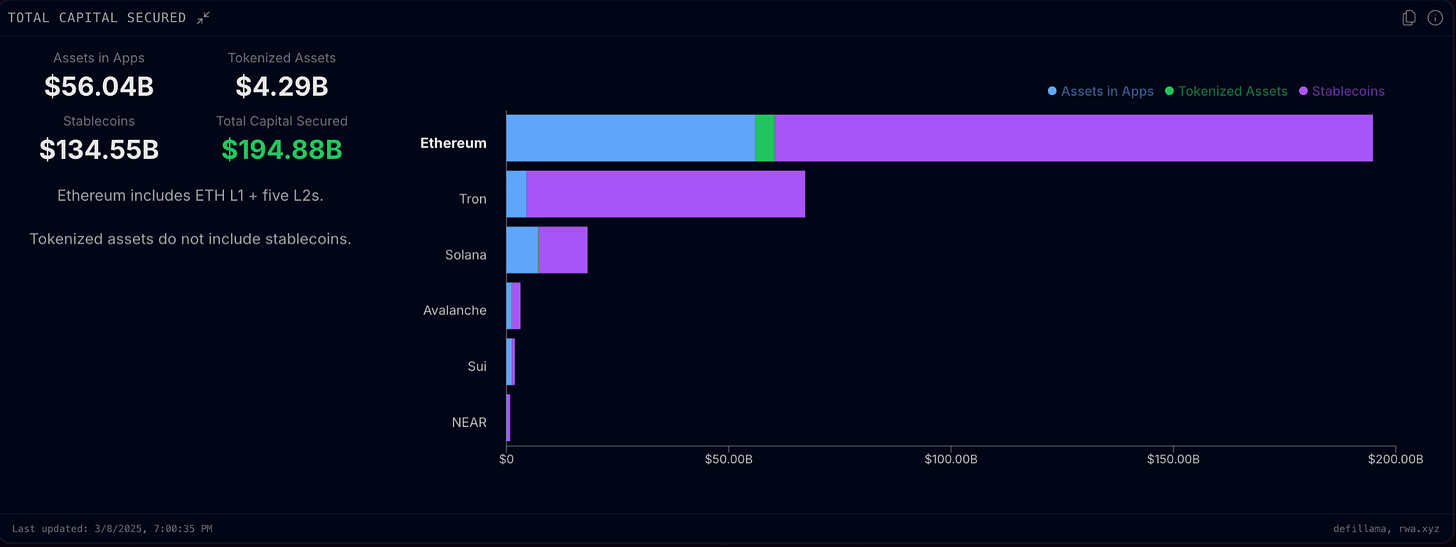

The Ethereum economy (consisting of Ethereum plus its Layer Two blockchain ecosystem) secures the most stablecoins, the most tokenized assets, and the most high-value financial applications of all blockchain ecosystems.

This makes Ethereum core strategic infrastructure for the global financial economy:

Stablecoins have become a global distribution network for the US dollar, and the Ethereum ecosystem is their primary home. And stablecoins not only facilitate transactions, but also hold substantial amounts of U.S. Treasuries, thereby contributing directly to the U.S. government’s financing needs. Stablecoin legislation is a priority for the new crypto-friendly U.S. administration, and this will unlock a wave of new capital into the Ethereum ecosystem.

Tokenization is the endgame for blockchain adoption. The future of all assets is digital, and tokenizing onto blockchain unlocks utility, programmability, and distribution at the scale of the Internet. Tokenized assets are still quite nascent today, but as the world moves onto crypto rails, they will become a multi-trillion dollar asset class. Ethereum currently has the lion’s share of institutional tokenized assets, including:

Blackrock’s BUIDL money market fund

Franklin’s BENJI money market fund

Guggenheim’s commercial paper tokenization

Apollo’s ACRED private credit fund

Numerous others - comprehensive list at: Ethereum Adoption Source

Layer Two (L2) blockchains built on Ethereum enable institutional players to have their own customizable environments while plugging into Ethereum’s liquidity. L2s are the best way to scale the Ethereum network while having customizable zones and preserving security and decentralization. The financial world is too large and too complex for all economic activity to happen on one blockchain layer.

And this has been proven via prolific L2 adoption. Some examples of institutional L2s built on top of Ethereum:

Coinbase’s Base L2

Deutsche Bank’s L2 buildout

UBS’s L2 asset deployment

Sony’s Soneium L2

Kraken’s Ink L2

Tether’s L2 stablecoin deployment

And many more in progress!

Many criticize Ethereum’s modular L2 architecture, claiming that (1) L2s extract too much value from ETH and (2) L2s fragment the blockchain experience.

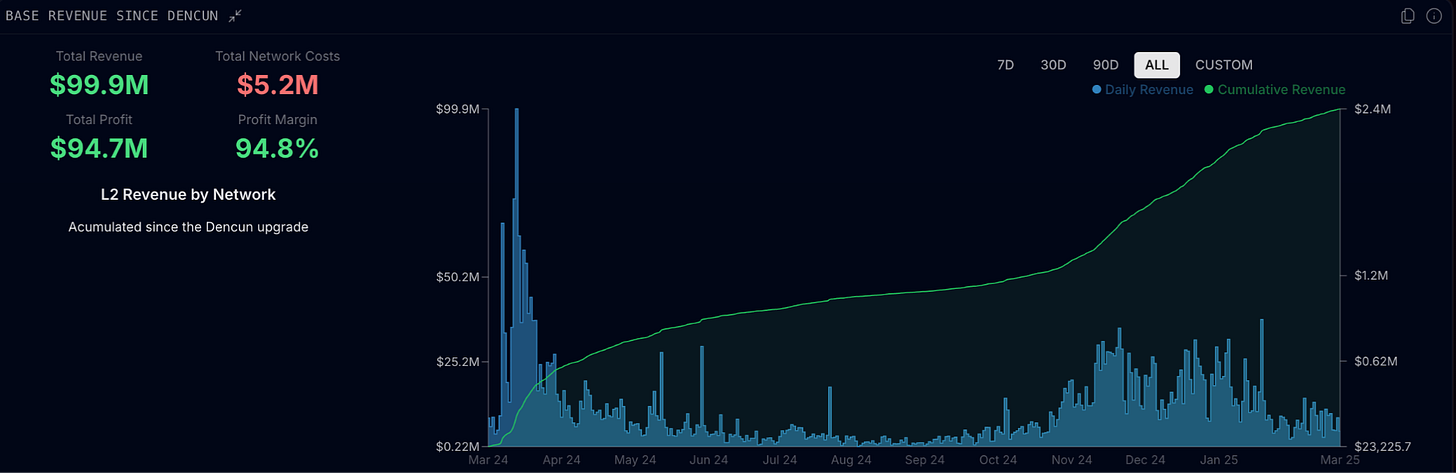

Point (1) is short-sighted. Ethereum scaled itself so that corporations, institutions, governments can deploy L2s on Ethereum in a very profitable way. And this is a good thing - L2s should make a lot of money! Base’s annualized revenue and profit margins are highlighted below.

If blockchains are the future of the financial system, blockchains need to be capitalistic. L2s don’t “extract value;” L2s are the most profitable and symbiotic way for institutions to build on Ethereum. As the number of users, L2s and apps increases, value will flow back to ETH.

Point (2) is naive. The world is built on modular systems in order to scale. The United States “scaled” with individual states operating together as one nation, and with a hierarchical banking system with individual banks tailoring their custom offerings to their customers . The technology sector is comprised of individual profit-maximizing companies that plug into the Internet, which is itself built in layers. Ethereum is a base infrastructure layer upon which a variety of innovative L2s, apps, and users will flourish.

At the end of the day, decentralization matters. For high value assets, security and stability matter. Institutions are choosing the safest, most battle-tested, most resilient blockchain architecture for stablecoins, tokenizations, and L2s.

That’s Ethereum.

ETH

While the Ethereum economy is winning, ETH as an asset has been (temporarily) lagging. This is partially because the value proposition for ETH is more complex to explain than BTC’s “digital gold” narrative.

Ethereum’s complexity is a feature - not a bug - since an entire global digital economy runs on Ethereum. So let’s simplify the thesis. While the potential for the Ethereum economy is vast, the value proposition for ETH needs to be clear.

What is the best way to capture upside in:

The growth of tokenization? ETH.

The growth of stablecoins? ETH.

Institutional blockchain adoption? ETH.

The potential for a new digital economy? ETH.

A new source of yield in the digital economy? ETH.

An upgrade of the financial system to the Internet era? ETH.

Owning ETH is like owning a piece of the new financial Internet. And the value accrual is clear - more users, more assets, more applications, more L2s, and more transactions - all flow value to ETH.

In short, all roads will flow through ETH.

As the Ethereum economy matures, ETH can become a reserve asset that complements BTC as a digital store of value. One could even argue that the upside for ETH as a technology platform and a digital store of value should far exceed BTC.

In the end, as Ethereum keeps on winning, ETH will win too.

Etherealize

So what is Etherealize?

Etherealize’s mission is to connect the world to Ethereum.

Blockchain technology is indeed ready for its ChatGPT moment. A large part of this is due to a new political regime in the U.S. that embraces crypto and encourages institutional adoption - which is the best structural tailwind the sector could ask for.

However, with the regime change, the game also changed. Ethereum has forged its decentralized foundation in the fires of regulatory adversity, designing a global and secure network for the long run. We’re now in a temporary era where centralized companies that operate less secure and less decentralized blockchains have been aggressively campaigning for market share. This could result in a suboptimal end state for blockchains - where high value assets move onto centralized databases effectively controlled by one company rather than on a global blockchain.

How should Ethereum compete in this new paradigm? The answer is not to centralize Ethereum, or to ask the Ethereum Foundation to expand its scope.

The best path forward is to create new, independent organizations that push for adoption of the most secure, most decentralized, most battle-tested blockchain: Ethereum. The Internet did not have a Foundation with a business development and product arm, and neither should Ethereum.

This is where Etherealize comes in. Our origin story is here, and our mission is clear.

So how will we connect the world to Ethereum? We’ll start with institutions - who have the highest standards for security and decentralization for their high value assets.

Etherealize started its mission of institutional adoption via marketing and business development. However, Ethereum is not just about “shilling ETH” - there are plenty of other blockchains where the sole product is the token.

Ethereum is about blockchain technology. Etherealize is building products for institutions to use Ethereum. We’re bringing tokenized assets onto Ethereum - both on L1 and on L2s - and creating immediate utility.

Etherealize is here to show: Ethereum is open for business.

Crypto began with Bitcoin, but crypto’s full potential is far beyond digital gold. The endgame for blockchain technology is to create the digital economy that will spark the future of finance. And this will be on Ethereum.

In the end, all assets will be tokenized on, and secured by, the Ethereum economy.

Let’s Etherealize the World together.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money

"As the number of users, L2s and apps increases, value will flow back to ETH."

Thanks Vivek, and how wil this happen? How does value flow back.

1.As an entity trying to promote ethereum to institutions, where would your funds come from? Donations or others?

2.Considering it’s not a Nonprofit organization, where or how you think the profits will come from?