Fiat Long-term Value is Zero

Level 1 - NGMI

Welcome Avatar! The gold bugs, the early crypto OGs and anyone paying attention during the COVID 2021 printing cycle already know this. The problem is that new people find us every day. This post will help explain the logic behind “up only” in terms of government money printing.

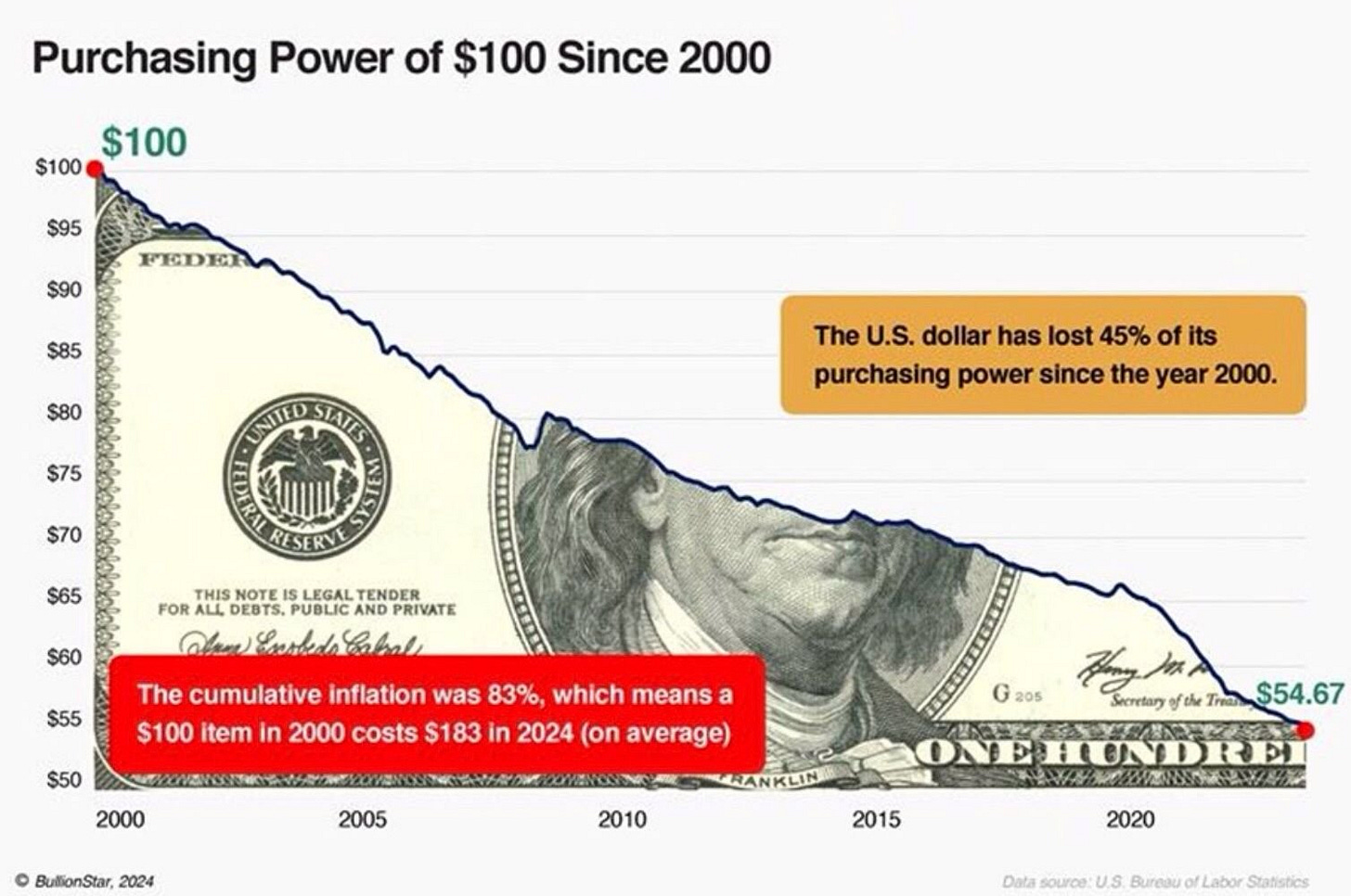

Since the year 2000 or so, the purchasing power has been cut in half. We’re not going to nit pick and triple check the exact number in the photo above. It’s a rough approximation. This is particularly true since housing, college degrees and other things you need to survive went up in price significantly more than stated inflation.

Printing Money is a Silent Tax

Take a simple example. If someone earns $100,000 and pays $30,000 in taxes that is $70,000 in net income. If that changed to $35,000 in taxes, the person would go on the internet and post a 5,000 word essay on why it’s a massive scam. The amount is 5% of his total earnings.

Instead? The people pulling the strings do it a different way. Instead of taking it out of the check, they make the cost of living go up 5-10% in a few years. The same person is seeing $70,000 in net income but instead of spending $50,000 a year to survive he is now spending $55,000. End result? Exactly the same for the person.

The difference? Ignorance. Since figuring out the entire monetary system takes effort and education, practically no one will know. They just accept it as part of life.

Said differently, the government doesn’t need votes to reduce the savings rate. They just need to print more paper and call it something else (stimulus, freedom bonds etc.)

This Leads to the End of Every Fiat Currency: Over the long-term fiat currencies go to zero. They change the name, they start over and this has happened many times in history: Roman denarius, French assignats, German marks, Argentine peso (practically every 5-10 years), Venezuela, Zimbabwe… the list goes on and on.

Currencies have failed so many times that they created a sub-prime currency called the “Euro”. Since every country continues to fail we can just all band together and extend the eventual failure.

Despite all this, governments continue to redo the same process and the US dollar is the current king.

The King of fiat? Since the creation of the Federal reserve in 1913… the dollar is down ~96%.

While the word inflation is thrown around, the real way to think about this is far more intense: permanent debasement. It’s not going to stop since governments are in massive debt.

Will people become responsible adults in the future? Doubtful.

Why They Can’t Stop

Politicians have one goal. Win votes. Win, win, win. The incentive is to win no matter what the cost is. If you look at what the left and the right *agree* on, you now understand what won’t change. The main ones are: 1) anti-china, 2) pro-free speech, 3) constantly raising the debt ceiling and 4) “middle class” is getting crushed we’ll help save them.

Now you have a short list of things they will constantly preach. They will claim that they will help the middle class, get more money to you via printing - which actually makes the long-term problem worse and your jobs will not go to china.

Politicians have one goal: buying votes with money that doesn’t exist until they dial up President Powell.

They can’t raise taxes. It is a failure at the ballot box. The only one that *might* work is a wealth tax but we all know what they would do (go to tax havens, hide it all in crypto, sudden boom in “Fine Art/Charities” so on and so forth.

Printing on the other hand… it is invisible to 90%+ of the population. It works just long enough to get reelected.

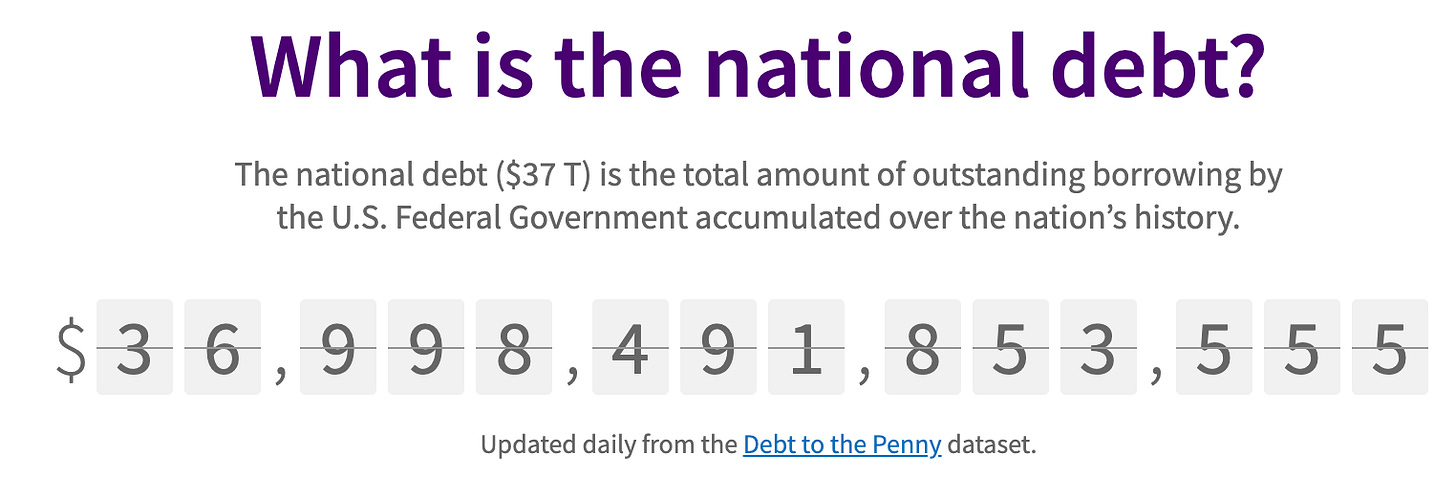

2008, they print to “bailout the banks and avoid systemic collapse”; 2020, printed to “save the economy from the plague”; 2024–25, we’re now printing to “save the government from its own debt.”

Different year, different excuse. Once you realize that the debt can never be paid back without printing, you realize the endgame is already locked in: Endless money creation until the currency breaks.

Autist Note: As the general population gets more frustrated you’ll likely see rumblings of a wealth tax. Going after “Evil BlackRock Landlords” and the “filthy billionaires” will become popular. If the wealth gap gets big enough (it seems to be getting worse) then you’re looking at some risk there. As you get richer from your wifi biz, crypto/tech investments… keep this in mind. Crypto isn’t just an escape valve from massive money printing, it is one the rare assets that cannot be confiscated if you self custody.

What Are the Implications for You

If you are storing the majority of your wealth in Fiat, you will lose long-term. While everyone needs money to spend, the goal is to be an asset accumulator. This means: stocks, real estate, crypto, wifi businesses, etc. Anything that goes up in value of the long-term. Assets, assets, assets!

The second step is the *most* important and the hardest to get through mentally. You must become a business owner or at least an equity builder. If you try to make it with a W-2… those days are long-gone. $400,000 for a doctor in 2000 was real money, in 2025… it is not real money in major cities with a family. Times have changed. Things don’t go back to the past.

The winners front-run money printing by owning scarce assets before the next wave of liquidity hits. This is why ultra-wealthy families don’t keep cash for the long-term. They keep productive assets (businesses, real estate, commodities, equities). They also teach their kids to do the same. Build or die.

Where People Mess Up

The older readers already know the drill. Basic premise is to: 1) get a career that pays the most for least amount of time, 2) build a wifi biz or any business for that matter, 3) quit when the business is making 2x what you make at the W-2 and 4) ship all savings into stocks/crypto/real estate/commodities and other assets you believe in.

The problem? People can’t keep their chips on the table. They get greedy and emotional. As you gain experience you will be able to recognize when you’re “on tilt”. If you own too much of something and are looking at ferraris, probably not a great sign… probably should be selling. If you feel depressed because you refresh your portfolio everyday and it gets worse and worse… probably should be buying.

We’ve failed at several businesses. We’ve made some terrible investments. Expecting to go out and bat 100% doesn’t make sense. Just keep your chips on the table for years and years.

Final note: In case people are confused, having your chips on the table doesn’t need to be a single asset. While you need to concentrate to get rich initially, the next step is solidifying your seat at the table. You could buy a luxury home in Miami, you could change your portfolio to more S&P 500 vs. individual stocks. So on and so forth. The goal is to ask yourself “should i expect a Tyson punch soon”. If you haven’t had any Ls for several years… the likely answer is yes.

The Blunt Reality

90% of people will never get it. They can read this post. You can burn an hour and explain everything to them at dinner. Instead they will just blame corporations, blame the current politician and blame anyone of influence around them.

The system works because the average person can’t do basic the math. They dont understand compounding or secondary effects. If a bad decision was made 4 years ago, they will blame the person currently in charge for the decision he never even made.

If you’re reading this? You can understand it.

Once you see it, you can position yourself to survive the ups and downs of market cycles. You know that the long-term is “money printer go brr”. The only tough part is managing the standard market cycles and personal life events. You won’t be living in that shared 2 bedroom apartment in SoHo forever. The mother of your kids will not be okay sending their kid to a 2/10 school district. So on and so forth.

The good news? You know the game is rigged. And. You are well equipped to play it better than them.

You’ll collect your annual performance review that says “You are on track to promotion but these two people are our star performers getting a whopping $5,000 extra as a bonus this year! Work harder bro!!!”

Smile, nod and agree. Then go back to clawing outta Shawshank in off hours.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money