Figuring Out What Luxury is in Your City

Level 2 - Value Investor

Welcome Avatar! As we head into the first interest rate cut of the year, it’s probably a good time to dust off the books and figure out what luxury means in your specific city. Real estate is always going to be a religion and it’s pretty difficult to lose if you’re willing to stay in a particular house for 10+ years. Assuming a massive 2008 type recession + luxury purchase and you’re still back to entry prices within 5-years or so.

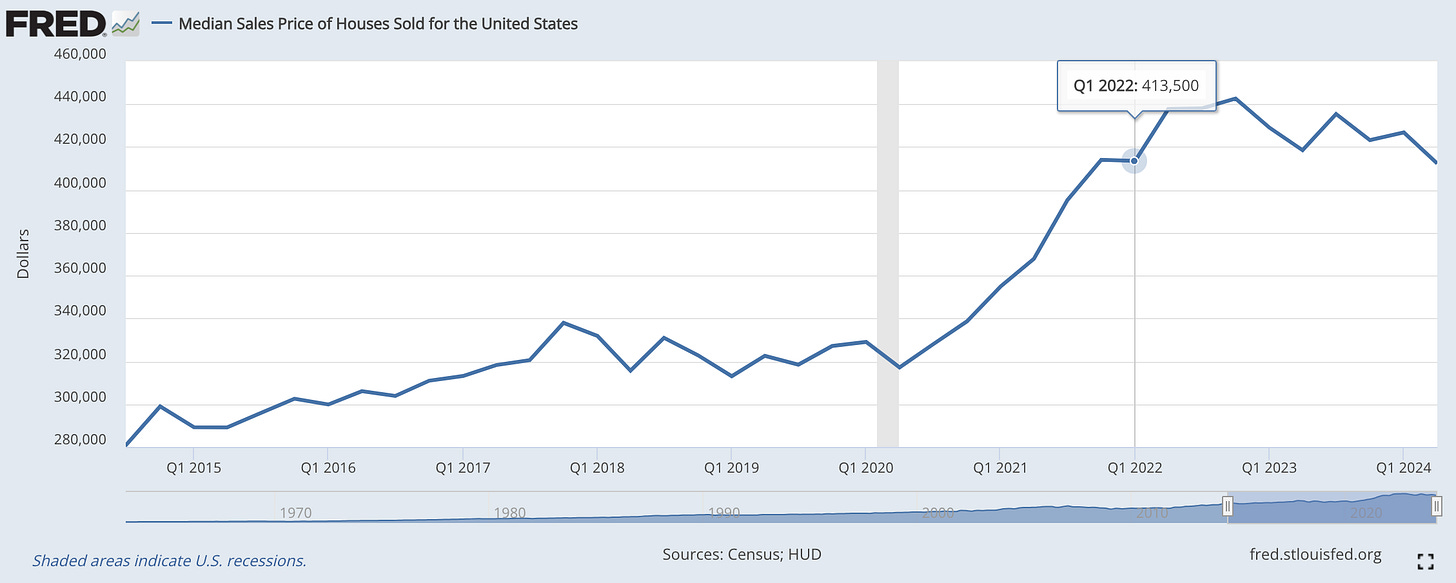

Median prices for average homes (performing worse than luxury) recovered in about 5 years during the 2008 recession

Part 1: Defining Luxury

Luxury good vs. status good is entirely different in our opinion. A Luxury good is both rare and difficult to fake ($10M place in Manhattan). A status good is something that is rare but easy to fake ($100,000 car, designer clothing, etc.).

A status good is something that anyone can afford if they want to go into massive debt.

The way to define a luxury property could be summarized as “displayed wealth”. A wide range of people can lever up to find $100-200K. An exclusively small number would be able to lever up and find $3,000,000 to $5,000,000 due to qualification requirements.

First an Income Filter

Many attempt to cite the standard $787,000 top 1% income (source). The problem with this is that it doesn’t control for your specific location. While $787,000 is the national average, that number is dragged down tremendously by less populated states. In West Virginia the number is $435,302 and in Connecticut it is $1,192,947. Hilariously, someone commented that California can’t be right since it includes everything including the middle of no where. In a way the post is right, San Francisco/Los Angeles will be much higher than $1 million.

Before blindly comparing housing prices to the national average or the national median wage, it’s better to look at your specific city and compare it to the income needed to crack the top 1%. This will at least give you a rough range for what will be considered luxury in that city.

You can make the following simple assumptions: 1) if it requires top 1% income to get into the zipcode/neighborhood its highly likely to be luxury, 2) if you want to be on the edge of luxury it would likely require 70% of top 1% income and 3) if you want to “guarantee” luxury, the area should be populated primarily by business owners since the income there is much higher (especially post tax) when compared to a high W-2 earner.

The most telling sign is when you pull the property records and the vast majority are cash purchases or high-equity set ups north of 70% (meaningless mortgage balance).

Plug in a Range: Now that you’ve done your quick research, you can filter out your area for the prime locations. We don’t know where you live but you can make some basic assumptions on what the typical buyer will do: 1) since it is higher end, the majority will have the 20% down, 2) they will likely stretch a bit beyond the normal 25% post tax income to mortgage - call it 30% and 3) you should see some cash offers flowing through since wealthy foreign investors need a place to park money.

Large City Example - Assumes $600K as requirement for Luxury - $2.6M Home

This won’t apply to places like Park Avenue in New York but is probably a good starting point for the majority of homes near major cities. If you were to pencil in $3,000,000 and near major city, it’ll likely land you straight into a luxury/high-demand zip code.

Part 2: Why It Matters

After the COVID boom, the median home price in the USA hasn’t budged much. It’s roughly flat over the past couple of years if you were to compare Q1 of 2022 to today. This is due to rising interest rates, increasing inventory after the big construction boom and the flow through of inflation (price of all materials up, leads to forced increases in prices to maintain profit margins)

Under the hood, the real estate market on the luxury side has been in full mania mode. Cash buyers flooded in since the COVID boom meant high stock prices, significant wealth creation for the top 1% and large stock based payouts for the high-performers at mega companies (Magnificent Seven).

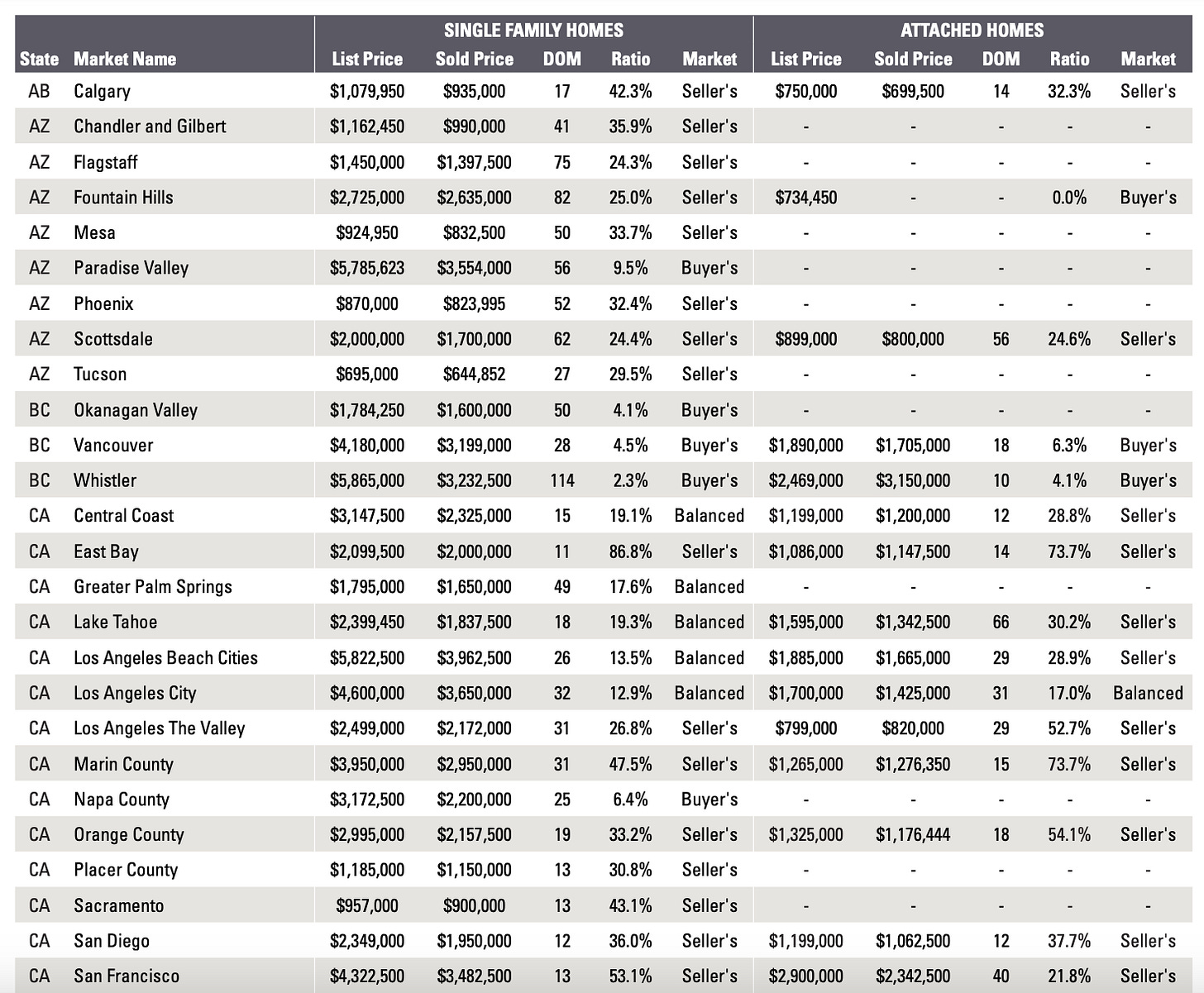

Luxury has done well and you can get an idea by tracking the major cities

This explains the big disparity between the national average and “Money Twitter”. The people on X have a point since the majority of high-earning individuals are living in the cities that are in high demand - hence continuous buying pressure.

Careful on the Zip Codes

Over the past decade or so (pre-covid boom), one of the major moves was to try and predict/forecast up-and-coming neighborhoods going through a process of gentrification. Despite what the media says, gentrification is good. It just means that richer people and more business activity is moving to the region.

The problem is that the COVID boom caused every region to act as if the same dynamics were occurring in that city. You saw this with Austin, Texas (already crashed) and Boise, Idaho as well (already crashed). The influx of high-earning people and business activity was temporary.

Part 3: Top Down Funnel

No different than your sales funnel, here is a list of steps to take before you consider the area to be luxury. This will also insulate you (somewhat) if there is a housing downturn in the future.

Assuming you already did the rough top 1% income (times 70%) as a starting point, you can move onto the zip code details.

Step 1 - Cash Buyers: Go through the neighborhood you’re considering and pull the last 6 months of transactions. After they close you can look up the address and see if it was a cash purchase. If you see a bunch of low down payment transactions, that is not a good thing.

Step 2 - High Equity: Anything above 50% should be considered high-equity. While prices can crash in any city, the high-equity areas are typically a sign of luxury. If everyone in the neighborhood is in high-equity position, they are not in a position of weakness if they try to sell in the future.

Step 3 - Low Inventory: This should be self explanatory, the inventory level of highly sought after areas is always going to be low. You can look at the months supply for the general area and use that as the proxy (compare it to the 5-7 zip codes in the surrounding area).

Step 4 - School Ratings: If this is constantly cited as the reason to live in the area, that is also a significant green flag. In 2024, kids are practically displays of wealth. The majority of people are steering towards pets and people building families have large sums of money. There is a lot of truth in the over-analysis that high-income families do when they decide to become parents (calculating every penny, worried about the stock market etc.)

Step 5 - Relative Appreciation: A real luxury area should *practically* always do better than the surrounding area. If you were to take the entire county size and sort it by appreciation, the top neighborhood will always do better than the average. If prices were up 5% it should be up more than 5%. If prices went down 2% the prices should stable. So on and so forth. Since real estate is local, comparing places like Manhattan to Los Angeles makes little sense (despite both being highly competitive).

Now you’ve got a decent filter for what we refer to as “luxury”. There is no way for us to know every region but these general filters should work out across the United States. Cash buyers is our preferred initial filter because it’s a signal of stability. Ultra wealthy business owners/foreigners are not looking to rapidly grow their huge sums of money. The cash buyers in luxury markets are largely looking to hide money, protect their capital and get some appreciation along the way.

This is likely a good enough summary of what Luxury really is.

If you’re looking to buy, best of luck in the battle for prime real estate. It’s never fun. It does improve your negotiating ability and patience though!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money

What are your thoughts on gentrification areas still currently underway?

Example:

(I am in a boom city that went up just as much as Austin, but didn’t crash)

They put a Soho House in a otherwise shitty industrial, near ghetto area a few years ago. Because of the proximity to the ghetto it’s still cheaper than other - already gentrified - areas in the city.

Now they’re opening a Hermes store there in 2025, instead of putting it somewhere downtown, or in a mall next to Gucci etc. All the realtors are screaming from the rooftops this is the area to buy. The area still objectively sucks to live in though.

General rule of thumb for me has always been, If every house looks the same / a CB2 catalog it’s not the luxury neighborhood.