Getting Rich is a Game of Attrition: Even Geniuses Get Hit By Greed

Level 1 - NGMI

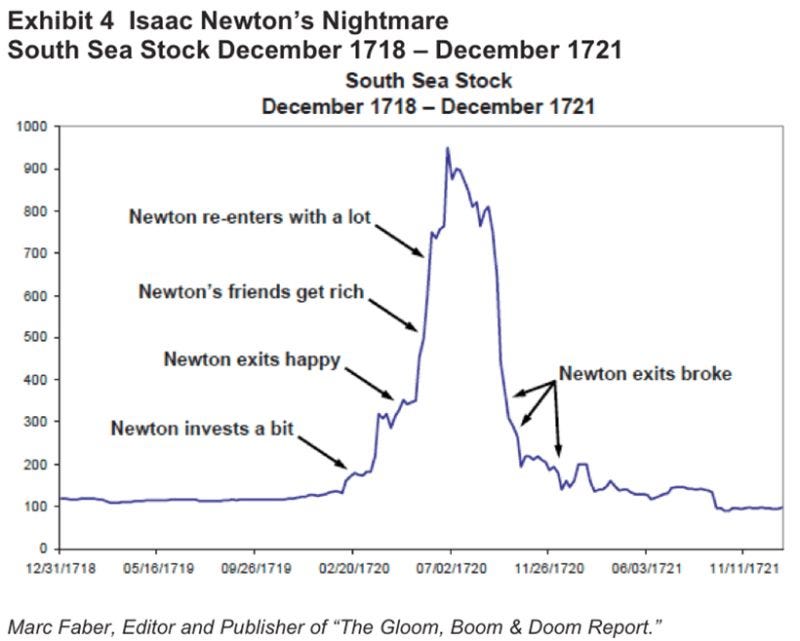

Welcome Avatar! On the paid side we already provided our market opinion but this post is more directed at people on the come up. If you look through history, these high profile booms and busts are nothing new. The only difference is that we have the internet so they are found and highlighted within seconds. People with $30,000,000+ went to zero. You know who else got smoked? Isaac Newton - famous south sea bubble.

The Game Of Attrition - Avoid Going to Zero

We could apply this to everything. People hit age 25 and start to give up. Falling victim to cheap alcohol and shots at the bar. Maximum of 3 months of effort spinning up a biz, happily getting their annual raise that barely keeps up with inflation instead. Even works for dating. Most guys let themselves go or refuse to travel internationally to find their type (typically an attractive rich foreigner)

Anyway. Life isn’t a sprint. While you’ll get large step functions, the groundwork was made when things seemed stable for months or even a few years. It’s a long, punishing tournament of attrition (think of those boring games on the TV show Survivor where all you have to do is not move off the post). A test of who can stay standing when everyone else burns out, quits, or self-destructs.

The difference between those games and this? You never have to go to zero. You might have a bad year, month or quarter. Doesn’t matter. If you never go to zero, there is no financial reset.

An unspoken rule of every game worth playing (business, investing, fitness, relationships, etc). The winner isn’t the fastest or strongest for a single year, it’s the one who survives across a decade of changing environments.

Recent Blow Ups

The above was trending this weekend. The problem is that this is one of many. How many of you guys already forgot the following: 1) Sam Bankman-Fried - a thirty year old billionaire running one of the most profitable exchanges at the time. Got greedy and took customer funds leading to bankruptcy and prison, 2) Do Kwon - hilariously stating “Steady Lads, deploying more capital”. Doubling down on his own ponzi. A zero and 3) Long-Term Capital Management a fund *literally* built by Nobel Prize winners. One over-leveraged bet at the wrong time? Farewell.

Even Isaac Newton lost his mind in the South Sea Bubble. After selling early for a profit, he re-entered out of envy (at the top). “I can calculate the motion of heavenly bodies… but not the madness of men.”

It’s a lesson repeated for centuries. The same plot. The technology changes, but the outcome is identical: greed, leverage and the inability to stay *in the game*.

The smartest people in the world fell for their own complex models, forgetting that emotional humans determine the market, not numbers.

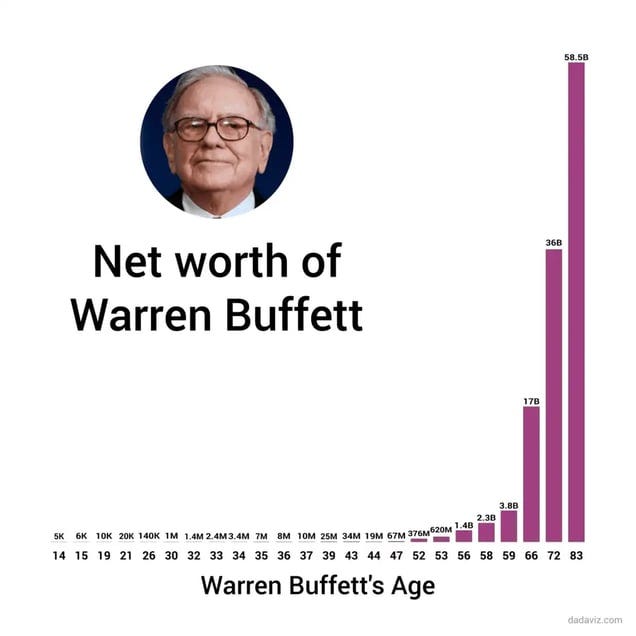

Attrition as the HQ: The game rewards those who can survive their own psychology. Buffett has been mocked for decades as boring. He underperforms in manias and buys things no one wants. Yet he’s still here. His empire compounds because he has one rule: don’t lose money. While we would never look to him for anything tech oriented, conceptually his strategy is sound. You want to stay in the game and simply refuse to sell at losses (requires deep research, diamond hands and no leverage - interest alone can cause you to lose money)

Jeff Bezos did the same thing, he raised $1 million by selling <20% of the company. He could have sold more. But he wanted to stay in control — to remain in the game. This proved the be the smartest decision he made. Through the dot-com crash, through years of spicy board meetings, he was able to hang onto the horns. By trading greed for endurance it resulted in over a trillion-dollars (AMZN market cap).

Elon Musk has lived through this as well. He isn’t the greatest example since he *could* have gone under. However, still a great example of survival. After PayPal, he poured nearly everything into Tesla and SpaceX and nearly went to zero. He borrowed rent money from friends. Never quit. He played to survive, not to look successful.

Apple is another example (surprisingly) in the 1990s it had bankruptcy risk. Most firms fall apart. Apple didn’t. They cut, rebuilt and waited. A few years later, the iPod hit, then the iPhone and the compounding phase began. Another trillion dollar lesson in resilience

In short, think of all these examples before you decide to mess with leverage. Can you survive a true downturn? -50-60%? Combined with losing your job? Combined with an emergency expense? Much easier to model with rose tinted glasses on

Never Invest With Regret

This is something we’ve already done. Long-term readers know our relationship with RingTones and Netflix stock and a couple others. Luckily we stopped making this mistake and hope that none of you are forced to live it.

The quick summary is that any investment you thoroughly research and believe in should be held forever. As in 20-30 years. It does not mean you should hold *all* of it. But you should hold some of it forever. If you bought Bitcoin at $100 and sold everything at $200, you would never be able to look at yourself in the mirror again. We know tons of people like this. People who bought ETH at $80 and sold everything at $200. Only to see it go into the $4,000+ range as their S&P 500 underperforms that by 1,000%+

Anyway. You can sell *some* of any well researched investment. Just be sure to keep some of it in case you sell too early.

Going to Zero on Purpose Makes Little Sense.

Most people don’t even get crushed by leverage. Instead they crush themselves.

They sell the stock or coin after a 10x run, proud to have “locked in profits.” They sell their startup for a few million to buy peace of mind, then watch it go public later for millions/billions (Victoria Secret a popular example of this one). They abandon careers, relationships, or ideas right before the exponential curve bends upward. The knee in the curve is where all the gains are! (Reminder improvement is non-linear and this applies to stocks, coins and any small business as well)

To avoid this, structure your life so you can absorb losses and retain some risky positions that have run. Keep burn low. Stay liquid enough to take big swings without desperation. Hold on to skills and equity. These two assets compound until the knee is visible.

Endure the boredom that comes before breakthroughs. Accept looking wrong for years. The people who make it aren’t the ones with the best strategy… They’re the ones who last long enough for the strategy to start working.

Every major success story is a case study in pain tolerance and conviction. Compounding only works for the few who stay solvent long enough to experience it. It’s the price of admission to the 1%.

Most people can’t tolerate being underestimated or delayed. They need recognition and attention. So they cash out to scratch the ego.

They need comfort, so they give up options. They mistake motion for progress and validation for security. They exit the game voluntarily, right before it turns unfair in their favor.

The irony is that singular focus on survival/adaptability creates inevitability.

If you stay in the arena long enough, the odds eventually tilt toward you. The longer you can withstand pain, boredom and obscurity, the more tail events you’re exposed to. Life runs out of ways to stop the man who refuses to leave.

If you’re in that grinding phase where nothing seems to click, that is entirely mental., If you’re making the right choices the momentum piles up silently. You’re not supposed to feel rewarded. You’re supposed to survive.

Every month you stay solvent, every year you hold your ground, your probability of breakthrough rises. That’s the math of attrition.

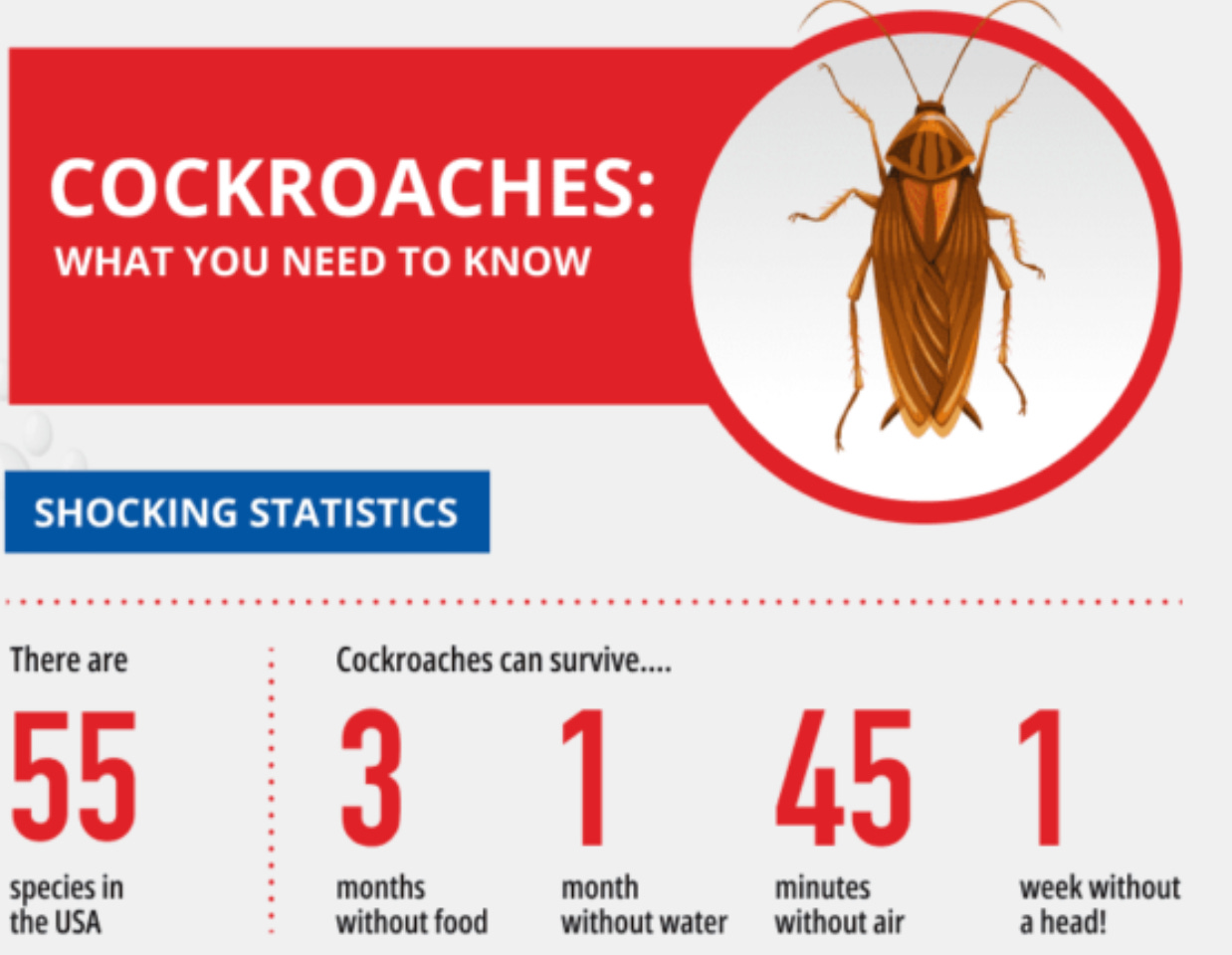

People Hate Cockroaches and Yet They Teach a Valuable Lesson, Find a Way to survive

The more you want results today, the less you’ll get. This is how lady luck works. The real skill you want is staying power. Stay at the table long enough and Lady Luck decides “huh this guy really doesn’t care guess i’ll give him this pot of gold”

Don’t blow yourself up. Don’t cash out of asymmetry too early. Don’t sell your future for comfort. Keep your burn low, your ego smaller, and your runway long. Because life doesn’t reward the smartest player — it rewards the one who makes it to the final table.

Think of it like poker. You simply want to make it to the final table instead of being a highlight on day one.

Survive long enough, and statistics will do the rest.

Final Note on Survival - Even If You Mess up

If you need some real world examples of come backs, here are a few to keep in mind that you’ll recognize today:

Disney: In 1923, Disney’s Laugh-O-Gram Films, went bankrupt after his distributor didn’t make payment. Moved to Hollywood, created Mickey Mouse and Snow White, and built an empire

Ford: Went bankrupt two times before founding the Ford Motor Company. His first company (Detroit Automobile Company) collapsed because they were too expensive an inefficient. Created mass production and changed manufacturing

Jobs: Fired from Apple in 1985 and went all in with NeXT and Pixar, coming close to financial ruin. Apple eventually bought NeXT in 1997, bringing Jobs back… resulting in the iMac, iPod and iPhone.

George Foreman: Popular boxer went broke in the late 1970s but came back to fight at age 38. Collected enough money and created the Foreman Grill which earned Hundreds of Millions

Milton Hershey: Had two failed candy businesses before creating Hershey Chocolate. Even the most recognizable name brands? They too failed the first few times and simply kept trying.

There are thousands of other stories and millions that we don’t even know about. The point is the same. You want to learn from the mistakes of others. Don’t go to zero, don’t sell 100% of an investment you believe in and don’t use leverage.

In the rare case you do, well… people have come back from worse. There is just no point in putting yourself into that situation given the excess returns from tech/crypto and niche internet businesses in 2025.

That’s just a cartoon opinion though.

Stay Toon’d!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

How ETH is Staked: Covered (here)

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money