History of Black Out Drunk Nonsense Alt Seasons

Level 2 - Value Investor

Welcome Avatar! As we head into 2025 it’s fun to do a quick trip down memory lane. Every four years there is typically an “alt season” where everything is going up. Your racist uncle with alcohol addiction invested in animal meme. It is printing 100% gains. Meanwhile, he is downing a Coors Light at 7am Sunday morning before church.

While no one knows how crazy a proper alt-season will be, this is to serve as a reminder. It can get out of control quickly and it can also end quickly. When it cracks it won’t even be down -99.99% but rather -99.99999999999% and down another -99.999999999% for a full -999.99999999% drawdown.

It in fact does go lower than this

Until then? It’s entertainment mode.

2012-2013 Alt Season: The OG Degens ~$15 Billion Peak

We’re aware that the glue sniffers are likely coming. This happened in 2013 as well and it can get hilarious fast.

At the time of the 2013 “alt season”, BTC was still a baby, total market cap was around $1 billion or so and a whale would be a purchase of $100,000 or so. At this time, Mt. Gox was still around and the “investors” were the same ones you’d see going to Magic the Gathering trading card events (hence Mt. Gox).

People came up with the idea to make a “faster” Bitcoin. The theory was that by reducing block times you could speed up the transactions and this (at the time) was considered a serious innovation.

Litecoin: This one is still around and the entire idea (by Charlie Lee) was to increase the blcok time from 2.5 minutes (vs. BTC at 10 minutes).

The price rose from around 10 cents to $48. This represented a rough 47,900% gain. The coin actually had a second massive run in 2017 (as you’ll see later) before Charlie Lee dumped all his coins at the top and claimed it was “better” for the network without him (everyone knows what it means when a founder sells 100% of his holdings).

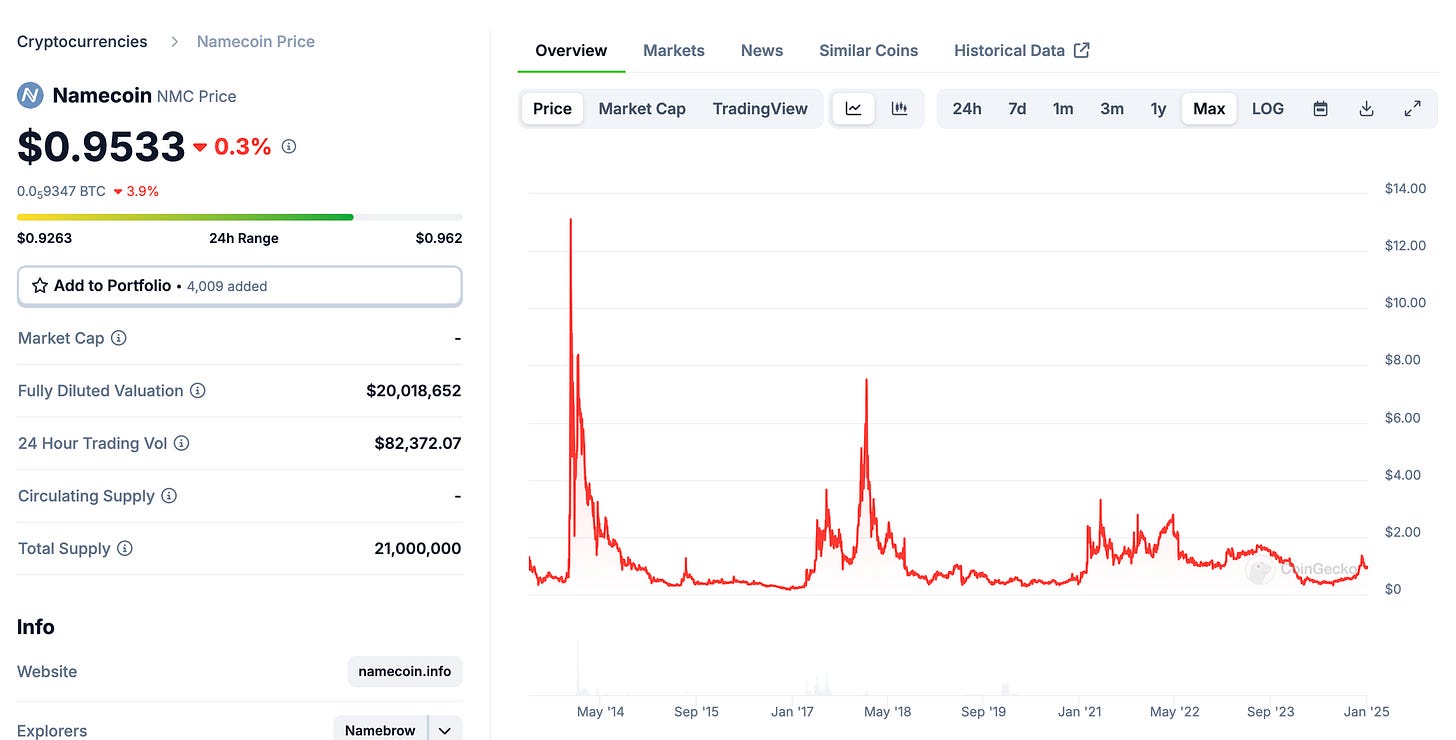

Namecoin: This was a BTC fork and the plan was to create decentralized web domains (kind of similar to what ENS ended up doing with the dot eth move). It ended up going to $13 or so and got sent to the hades shortly after. It’s actually still around today trading at just under a Dollar. From bottom to peak it was around a ~30x gain return.

Peercoin ($PPC): This was one of the first proof-of-stake tokens (the mechanism used to secure ETH today) and had a double pump. One in 2013 and later in 2017 when the ETH ICO mania hit. It ended up going all the way to $7 or so representing a 60-70x gain. Naturally, it never got real adoption (no activity) and has since died out to $0.42. (one of the interesting takeaways is that nothing actually goes to zero except pure ponzi’s like Bitconnect or LUNA).

The Mania: Bitcoin ended up hitting $1,200 and all of these coins were flying because of the interest in crypto. Anything that got a post on BitcoinTalk would moon instantly just on speculation alone. The closest we have to that today is a celebrity pumping some new meme coin or celebcoin (HawkTuah).

Mt Gox Collapses: At this point the party ended when Mt. Gox collapsed. This was due to a major hack and we saw a massive -85-90% correction in BTC (depending on how you look at the bottom) and a -99%+ decline in the alt-coins.

2017 Alt Season: ICO Mania and the Ethereum Boom ~$800 Billion Peak

During the bear market a lot of interesting stuff happened. Ethereum was launched as a smart contract platform to make programmable money. This was a real innovation because instead of simply sending digital tokens around, you could create a contract as well. It changed the game.

Like everything in crypto, this came with the standard crime issues as well. The ETH DAO was hacked for over $100M and the chain was forked into ETH and ETC. Today there are still people who suggest that this was the wrong move. We’re not here to debate that topic, just to explain the history.

Once we got into about 2016 or so people realized they could launch new tokens on the ETH blockchain. There were called Initial Coin Offerings (ICOs), where projects sold tokens directly to investors. The mania kicked off in 2017 with people launching every possible scam project you could fathom.

Ethereum: Since you needed ETH to launch all these coins, it led to a parabolic move from around $8 to $1,400 by January of 2018. This was an unfathomable return (at the time). As of today, trading at $3,650.

Ripple (Bank Coin): This is still the “bankers coin” and the theory was that it would displace SWIFT overnight and become the defacto standard. Despite being centralized (no one cared) and dumped millions into the token. It went from about 1 cent to $3.80 and trades at $2.41 today.

In a strange way, the investor base continues to be retail. You saw much of the same in the latest pump as it was dominating TikTok with calls for Quadrillion Dollar market caps “what if it gets to the same price as BTC”.

Litecoin: As mentioned it had yet another run going all the way to $360. Despite Charlie Lee selling every single coin, it would later run to $384 in 2021 as well!

EOS: This token somehow raised $4 billion via an initial coin offering, hyping itself as an “Ethereum killer.” It hit $22 and has not seen an all time high since.

NEO: This was yet another ETH killer except it was marketed as “the Chinese Ethereum”. Looking back this should have been an instant avoid since who would trust the Chinese communist party with a crypto innovation. Either way. It went from $0.20 to $200 for a full 1,000x gain.

Bitcoin Cash: RogerVer was the biggest Bitcoin celebrity at the time. He was part of the big block war debate and took the side of Bitcoin cash. In August of 2017, at block 478,559 everyone got one Bitcoin Cash for Each Bitcoin held on their wallet. The price soared to around $3,800 on the back of Roger’s stance. It has since fallen off into general obscurity.

Other ETH Killers: During this time other coins many of you recognize were also marketed as an ETH Killer (ADA, Tron etc.). If the token had a “whitepaper” this somehow justified 10x, 100x pumps. Other fun coins launched at this time include Filecoin and Tezos.

BTC - Yield Scam: If you thought BlockFi, LUNA, Celsisus and Voyager were the first yield scams, think again! The first massive yield ponzi was actually Bitconnect where they were giving this guy millions and millions of dollars.

Regulators Stepped In: Much like the 2021 cycle, regulators and ponzis blowing up brought down the industry once again. The SEC went after projects like EOS and we went through a solid 85% drawdown to $3,500 or so in March of 2020 (where many of you likely found us! If that’s you congrats IYKYK).

The Altcoin market saw the -99.999999% drawdown as the majority of coins were just scams. Back then, if you put your coin on the superbowl it would shoot up some 5x instantly, for an example check out VIBE coin.

From $0.04 to $2.00+ back down to a… $262 total market cap!

2021 Alt Season: DeFi, NFTs, and Meme Coins - $3 Trillion

In 2021, everyone was working from home glued to their computers/smartphones with nothing to do. The Government printed $10,000,000,000,000 out of thin air and that only represents the US Government.

DeFi projects enabled farming, NFTs made JPEGs mainstream (selling for millions of dollars) and meme coins reached absurd valuations. Bitcoin hit $69,000, ETH hit $4,800 and the total crypto market cap hit $3 trillion in November of 2021.

Dogecoin: Started as a joke but went parabolic on the back of Elon Musk becoming interested in the coin. It also became a Reddit favorite. Today, it is essentially an Elon Meme coin at this point with Department of Government Efficiency. The price went from around half a cent to 74 cents representing a ~15,000% gain.

Solana: Became the next "Ethereum killer" with fast transactions and low fees. This was largely touted by SBF (who is now in jail). The price went from $1 to $260 or so, 26,000%.

Shiba Inu: A meme coin clone of $DOGE that minted a metric ton of millionaires. If you measure it from its near $0 valuation, it would represent a 500,000% gain,

DeFi tokens: $AAVE, $UNI, $SUSHI, and $YFI saw 10x to 50x gains, as decentralized finance locked up hundreds of billions in TVL. Today TVL on DeFi is actually *higher* on many projects!

NFTs:

CryptoPunks: Sold for millions, with the cheapest punk hitting 100+ ETH.

Bored Ape Yacht Club (BAYC): Became a cultural phenomenon, with floor prices reaching similar insane levels

AirDrop Insanity: For those around here you got $40,000 for simply have a $100 .eth domain. There was $40,000 in airdrops for words on a screen. You could cross a bridge for a 2% gain in a day or week. NFTs like BAYC airdropped tons of other NFTs at high valuations. There were billions of dollars of airdrops.

Even Crazier…: Anything and everything was going up things like SAFEMOON were touted by guys like Dave Portnoy. Celebrities like Snoop Dogg and Paris Hilton were pressing on various projects. Tom Brady and Steph Curry were pushing crypto exchanges. FTX (now defunct) actually bought the naming rights to the Miami Heat stadium.

Ponzis: Tons of ponzis were born. Our haters claim we were involved in this stuff but were not. (source). Many people avoided 5-6 figure losses. Never a good reason to go into these products and lose custody of your coins.

Death Spiral: When liquidity began to dry up (free money checks to all these projects) we saw the decline of the aforementioned ponzis. In addition, FTX went under from stealing user funds and on top of that we had the SEC step in once again to regulate. Too many large scale scams and rugs led to a clamp down on the on-off ramps in crypto.

Key Lessons

Take profits. The market moves quickly and you will likely get the feeling of greed. If you find yourself saying “i wish i coulda bought 2x more of XYZ token” it is more likely you should sell half your position and be happy. Selling into BTC/ETH or Stables. Don’t really care. Just don’t chase the greed.

Hype cycles repeat. Every alt season has a narrative: Bitcoin forks, ICOs, DeFi, NFTs, or memes. If you find a narrative you should probably stick to it since the niche knowledge you developed will evaporate by the end of the cycle. Instead of juggling just niche and live with the results.

Risk management is everything. Gains are insane. Every personal situation is different. We’re different from you. You’re different from your neighbor. Have a plan that works for you and stick to it. Don’t continuously move the goal post because some guy with $100,000 to his name says “$10M isn’t enough to retire”

Survivors thrive. Alts come and go, but Bitcoin and Ethereum have dominated every cycle. If it has been around for this long, the risk profile of going to zero is lower. Solana is probably approaching this level assuming it finds a use case beyond pump dot fun in 2025.

Did we learn anything on ponzis? No. Not really. From what we’ve seen people still don’t understand the concept of “Not Your Keys, Not Your Coins”. You are free to buy crypto stocks and other levered crypto plays in your brokerage. Just know that you own $0 of crypto if you hold those stocks or hold a crypto ETF. You never know what they intend on doing with them as evidenced by MARA.

During the bull market we get blasted for not shilling the latest meme coin. However. Look around and you’ll see the jungle people who stuck to the plan are millionaires and doing pretty well. If you have a long-term perspective and focus on that WiFi money success is incredibly high. The degen looking for 10x gains will get the likes. However. He can’t keep up with the anon market buying 6 figures a month. Statistics catch up.

Good luck anon! “We are Coming”

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money