How CPI/Inflation Can Be Understated and Financial Literacy/Human Nature

Level 1 - NGMI

Welcome Avatar! Two sections today: 1) calculating out Inflation and how inaccuracy can occur and 2) basic financial literacy and human emotions to be aware of - markets are not efficient! Part one is more mathematical and part 2 is pure comedy.

Part 1 - Getting Real Inflation Completely Wrong!

Unless you don’t pay for your own stuff (parents or living for free somehow - homeless), you will notice that prices are rising much faster than the stated CPI number of 7.9%. Don’t believe there is much debate there and our official estimate is 20-30%. Instead of fighting this reality, we can walk through each line-item and figure out where the errors occur!

#1 CPI from February 2021 (Source)

Pause and Estimate: The main categories listed above are pretty fair. The big question mark is “how much weight for each category”. This is where you can have a wide range of errors. For this article, we will use some basic 2015 data, it’s good enough as the numbers look reasonable. Around 1/3 on home, 1/3 on transportation + food, 10% on healthcare and the remaining 1/4 or so on education, insurance, clothing entertainment etc.

Rough Estimate of American Spending (Source)

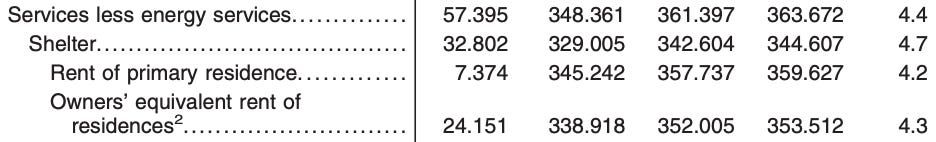

Jumping In With Shelter - Only 4.6%?

From the above we know housing should be about 1/3 of total spending or 33%. According to the first image shelter is only up 4.6% year-over-year! We can safely say that is not accurate. Here are a few reasons why straight from the BLS (source)

“Because rents change rather infrequently, the CPI program collects rent data from each sampled unit every six months” - This is a big issue as rent moratoriums and other COVID-19 related issues created a lot of lag in the system (state by state as well). If a landlord couldn’t evict a person who was not paying, he eventually has to raise prices and evict when he is legally allowed to do so

“The pricing areas are metropolitan areas and smaller urban places” This is a a COVID-19 specific issue. The CPI focuses on major Urban Areas and doesn’t focus much on suburbs. In fact they even call it “All Urban Consumers” in the first sentence! Two big issues here: 1) it does not account for people moving to the suburbs = a HUGE trend in 2020-2022 and 2) it does not account for number of people living in the unit. Note: If you have a 3 bedroom place and five people live there instead of three or four, nothing shows up in terms of quality of life changes for the rent change.

Owner Equivalent Rent Likely understates they ask the following: “If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?” For people who have owned their homes for a long time, they have become disconnected with regular rentals. This means the pricing will trend downward in a big way. For Proof of this check out the official number from the CPI (page 8 of 37).

Now compare these numbers to a more frequently updated website such as rent.com . What you find is that the numbers are a lot closer to reality at approximately 20-23%. Since the methodology (covered at the end of the article in the link) is more broad, it provides a better overview of the rental trends vs. Urban standard.

Shelter Conclusion: Real number is closer to 21%. This means 33% times 21% = 6.93% inflation on housing *alone*. Remember. If your rent goes up, the price of the property goes up by even more since value of home divided by annual rental income is practically always a double digit multiple. IE. a home with $25K in rental income is certainly worth more than $250,000 and if the rental income goes up to $30K, the value of the home goes up by $50K not $5K.

The main reasons CPI/Inflation for housing is wrong: 1) rent moratoriums/rent control/Urban population focus when people were fleeing major cities, 2) data is not collected frequently and 3) owners equivalent rent is frankly a made up number since there is no way to tell if the survey is accurate.

#2 Moving Onto Food - 8.6% at home and 6.8% for food away from home

This seems a bit more reasonable, while we think it is still understated a bit, the problem with food is that people can move spending around. Buying more Chicken versus Beef, buying more beans and rice versus fruits and vegetables etc. We’ll keep it simple and look at the data as is.

If you’re on Twitter, you know our following is a lot intense guys with a focus on fitness and money. You can see this from BowTiedOx who is helping thousands of people get into shape. This means we’re *biased* to see higher prices. If you look at the line items, meats, poultry, fish and eggs is up the *most*. This means it is the most obvious to anyone who is into physical fitness (protein is a massive part of diets).

We’ll go ahead and believe these stats for fun except for one issue, why are the prices of “food away from home” below “food at home”. Well you could say more demand for people eating at home, however, we’d say it is likely *shrinkflation*.

It is not possible to track portion sizes across the United States and people who live in major cities have already seen the impact (10-20% decrease in portion sizes). More and more companies will go down this path of reducing packaging sizes to avoid sticker shock.

Food Conclusion: The food prices don’t account for shrinkflation and since profit margins on restaurants are razor thin the better estimates for food prices is 8.6% as people were forced to eat a home. We’ll use the 12.5% estimate times 8.6% which means food inflation accounts for 1.075% of the inflation. Add this to shelter and we’re already at 8% or so.

#3 Transportation/Energy - Tougher

Here it gets a lot harder. There are a ton of ways to reduce transportation costs (once again we attempt to hide our own biases). If you live in a central part of a major city you can walk (Manhattan). That said around 90% of American Households own a car!

What gives? Well, when we look at the two numbers disclosed it simply doesn’t add up as of February 2022. The claim is that Transportation services are up 6.6% and gasoline is only up “38%” over the past year?????

This goes directly against the cost of crude oil which is up from $66 in February of 2021 and now sits at $110 (a 66% increase!). Chart from Macrotrends (Source)

Once again, you’re looking at a lagging impact. Just like restaurants slowly raising prices after goods go up, airlines and other gas based transportation will lag a few months behind. Don’t want to get too technical but large organizations like airlines have contracts to hedge out sudden spikes up and down in oil prices.

Estimating the Real Number: We know that energy is going to lag and 38% is understated. That said, we do think transportation services will remain low due to government backing (public transportation - just print money).

For this we’ll go ahead and take energy services as a whole to estimate the true cost of transportation. The gas price is not everything (66%) and the number of people who use public transportation daily has been quite low due to COVID. Energy services is probably in the middle as they have contracts to hedge prices and they don’t have a lot of ways to “substitute”. 12.3% is the stated number multiply this by 17% of typical spending and you’re looking at 2% to your total spending. We’re already at double digit inflation and we’ve only gone through 62.5% of your spending!

#4 The Rest of Your Costs

We’ll go ahead and use the stated 7.9% for the rest of it. We could poke holes in a lot of it (medical in particular if you’re forced to take tests to go to a concert or board a flight) however, it’s a pretty fair number for “random expenses”. If you hit a rough patch like 2020-2022, you can always cut down on certain expenses. You can reduce spending on clothing, you can avoid upgrading your computers and you could start changing your own oil to save a few bucks here and there.

#5 Putting It All Together

This is the BowTiedBull bare minimum real inflation number. The reality is that job loss, automation and being forced to move around due to COVID makes the number understated. That said, you can get to 13.1% without *any* crazy assumptions

Explaining why the numbers don’t match with reality is quite simple: 1) housing is off by a big number due to how they gather data, how often and where; 2) food prices have lagging indicators particularly for takeout and don’t include shrinkflation; 3) transportation numbers simply don’t line up especially since more people will be back to commuting now that people are returning to the office and 4) we’ll go ahead and use the stated inflation numbers for the rest since people can adapt based on what they buy and use for entertainment.

In short, 13% inflation means you lost 0.131*365 days of the year (a month and a half minimum has disappeared).

Note: we’re sticking by our 20-30% real estimate due to the lag effect. The above is a bare minimum number and we’ve given you the tools to look at how easily the data can become stale.

Part 2 - Some Basic Finance and Human Emotions

For those on the paid substack you can slowly move your mouse to the top right corner and click the X button. If you wish to see some of these comments, be warned that you may suffer a brain aneurism. For your own mental health be sure to close it when you’ve “seen enough”.

#1 Stock Price Means Nothing: For some reason, people believe that a stock price tells you how valuable a company is. This information tells you nothing without the *share count*. If a stock is worth $10 or $1,000 you have no information on the valuation of the publicly traded company. A stock or share is just partial ownership of the Company.

This means two things: 1) when you buy the stock you are not “giving the Company money”. They get zero dollars on their balance sheet and 2) without a share count number you have no idea if the Company has a high or low valuation.

The Problem: In economics you learn to think as if market participants are rational. This means the entire base/foundation assumption is wrong.

In the real world if you do a stock split retail (people who don’t understand finance) will be more likely to buy the stock! Yes. This is true. They believe owning 8 slices of pizza is “better” than owning a whole Pizza with exactly 8 slices (exactly equal in size and weight).

Rational Stock Splits: In a world where people are educated a stock split should not impact the valuation of the firm at all. If you have a $100 stock with 10 shares outstanding and go to a $1 stock with 1,000 shares outstanding… the valuation of the company hasn’t changed.

Unfortunately, there is something called “unit bias”. This means the prices of stocks that go through a split can go up if the market cap is low.

In short: 1) when you buy a stock you’re not giving the Company money. The would need to sell the stock or offer a secondary offering to get cash on the balance sheet and 2) stock splits do not create any economic value for large companies. However. Since people are financially illiterate, if you do a stock split for a popular company with a small market cap, the price likely goes up “joe would rather own 10 shares of Amazon at $10 instead of 1 share of Amazon at $100”… even though it is exactly the same.

#2 Shooting Messengers: As a rule of thumb never deliver bad messages if you don’t have to. This is actually serious. If you’re in a company or run your own company one of the only real “value adds” of human resources is the firing aspect. No matter what happens, humans will blame the bearer of bad news.

If you want to look at how delusional it gets, look up the death threat rate for weathermen and sports ball referees. People blame the weather and will actually spend time tracking down a referee for a sports game (and harass their families).

If you believed people were rational before, this hopefully converts you immediately.

#3 Copying a Billionaire Investor - Not a Great Idea: This one is almost unbearable. If a billionaire gives you a “tip” on television he is not interested in making *you* money. To become a billionaire you had to take enormous risk while simultaneous juggling a personality disorder.

We see a lot of this in crypto. People simply follow one rich VC and are surprised by the sudden pain/suffering as they exit their positions without telling anyone. This is the same concept for Wall Street. While a fund manager *might* tell you what they are doing, you never know for sure if they are telling the truth. There is no law preventing you from saying you are short or long XYZ stock. This is the benefit of being ultra wealthy. People just copy you and you can move the market without any justification. Example: while we’ve always been bullish on Tesla, don’t be foolish enough to believe that Elon isn’t making money off his Twitter account. (No we don’t have “proof” just hoping the typical person can think for themselves! Similar to pro athletes using PEDs)

#4 Status Goods Only a Flex If Private: If you’re wealthy, you *typically* do not want anyone to know you’re wealthy. We still see people falling for the same old Lambo Rolex shenanigans and we don’t expect it to slow down any time soon. People who are paid subs to this stack are 100x less likely to fall for cheap marketing. Instead of arguing about it, here are some simple ways to explain why a rich person doesn’t disclose everything publicly (unless forced to do so like a celebrity/pro-athlete who is likely getting the stuff for free anyway)

Do You want Attention? When you make it (we’ve already estimated that everyone who sticks around here for ~3 years will make it), you will realize that all you get is people asking for stuff. They ask you for “a $100K job because it’s nothing to you” they expect *you* to pay for stuff any time you hang out (still don’t understand that concept) and they do everything they can to drain value out of your contacts and financial resources.

If you’re attracting attention all the time, what you really end up doing is painting a target on your back as we’re seeing time and time again as the wealth divide gets larger. As usual it only takes one bad experience and you put everything you worked for at risk (look up crime statistics such as Miami for robbery). Also. Some cities like San Francisco are paying people $300 a month not to shoot!

Privacy and Gated Communities: If you are ultra rich, you know that one of the biggest concerns is both safety and privacy. Gated communities exist for a reason: rich people prefer them. If rich people prefer privacy does it make logical sense for them to blast off on social media?

Status Goods Only Impress People Who Can’t Afford Them: If you’re worth $10M are you impressed by a Ferrari? Not really, it’s 2.5% of your net worth. If you see someone with a $20M home you’re probably impressed! Notice, you’re poorer in this case than the guy with $20M. Once you see this trend you can’t unsee it. People who post nothing are usually ones to be feared especially if they fly private and yet have zero photos on social media.

#5 Wealth and Income: If you want to understand human nature it can be summed up as follows “how much you spend” is what a typical person views as rich while a future wealthy individual believe “how much you can spend forever” determines who is rich.

A person who makes $240,000 after taxes and spends it all is “rich” to the typical person as they can see the use of the money.

A person who makes $240,000 after taxes generated from his *assets* is rich according to an actual rich person.

They are not the same and yet you will see these two same people at the same bars, clubs, restaurants etc. Once you understand this you’ll understand why wealth and income cannot be confused. The guy making $1M a year is actually not rich if he spends all of it and the guy making $1M off of just dividends is rich (his assets are closer to $20M based a 4% payout ratio).

As a rule of thumb avoid people who say “you can’t take it with you when you die” as they are unlikely ever going to understand the difference.

Conclusion

You now have a easy step by step way of seeing how inflation is understated by a minimum of 65% and is likely understated by over 100% due to a lag effect. In addition, if you made it through part two without clicking the X, you can sleep better knowing that this all human nature. For more info on the last part, wealth versus income, you can click here. The wealth gap is the primary reason for the existence of this financial community as we look to fund more and more talented people (around 30 people are already making side hustles with 8+ making a living wage - not bad for 11 months!)

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

Daily Reminder: You ARE EARLY. Too much negativity/cope. Everyone reading this is extremely early. If you stay on top of technology, there is always a new opportunity.

most airlines/cruise lines no longer hedge fuel since this typically ended up a net negative after bank fees (not including SW airlines god tier hedge in the past)

Really great read! Super informative, but also funny and entertaining which are factors often overlooked by other crypto writers