How the Rich Avoid Massive Taxes

Level 1 - NGMI

Welcome Avatar! Every single year there is another viral meme about taxing the rich. They focus on the top 1% income earners. The problem is that this is just another failure and will make the rich even richer. If you tax income, the employees who work for the actual rich (business owners) get richer. Hint: employees can’t save enough to escape!

Even Bernie Sanders, the biggest socialist/communist angled person in the USA is playing the same game.

But First… What Is More Logical

Before we start posting all the math, we are going to offer a solution. It is actually quite simple. Structure a sales tax based on consumption.

We go through life and we spend money on various things, Water, Food, Clothing, Cars etc. The problem is that it all has the same tax rate.

Why in the world should a Ferrari get the same Tax Rate as a used Honda Civic. It doesn’t make any sense at all.

Similarly why would the tax rate be the same when you purchase a Dining Table from IKEA vs. a brand new Gold Rolex?

Increasing Tax Rate: Instead of having an increasing tax rate on income. We should have increasing tax rates on goods. The easiest example is sales made for cars (hence why we started with that one). If the car purchase is $100K it would have a different tax rate vs. the $20K car.

You can do this with a VAT/consumption tax. We’re aware that there is fraud risk at the B to C level but the point is still the same. You can go and tax the actual company based on what they are bringing in. This would then drive the cost of the car up. Import a bunch of basic cars? Low Tax. Bring in a bunch of Ferraris, higher tax.

In short, the people insecure enough to post lambos, yachts and Pateks on the internet should be paying double or triple to show everyone they are rich. They are insecure in the first place so we all know they will pay for it to show off. Make em pay. Don’t make John the Plumber pay an extra $2,000 in tax because he had a big year fixing issues in the city.

RE - Another Option: Need to remove the ability to pull forward depreciation and claim zero income on rental properties. Before anyone gets mad (we know a lot of RE people read us), this will never happen. So don’t panic. We’re just writing out the easiest way to make housing more affordable and reduce all the tax games wealthy people play. Here are all the deductions:

You can depreciate the asset - that’s right depreciation on an increasing asset!

All your maintenance is deductible

Property tax is deductible (business expense not SALT)

1031 exchange is possible - swap for another rental no cap gains

Cost Segregation: You can actually pull forward a bunch of the 27.5 years forward. This would allow you to deduct 4-5 years in the first year

Now you understand why the rich don’t really pay tax.

Step 1: You go and buy $5,000,000 of real estate rentals

Step 2: You rent it out and collect say $300,000 in income. You deduct everything you can and suddenly you’re “showing income” of $50,000 (most greedy people show $0).

Step 3: You go to the bank and borrow against the asset.

As you can see none of this is paying any real tax. Some fake low income number. Borrowing isn’t taxable. Ta Da. Good luck auditing every single rental property in the world. Majority of people are deducting things they shouldn’t/can’t but no one cares to check

Easy fix here is to move all the tax benefits to primary residence and remove it from rentals/secondary. Again. Won’t happen so play the game and eventually do some basic borrowing from low risk real estate (after you get rich!).

Make Borrowing Against <5% a Taxable Event: This is really hard to enforce. The jist should be “can’t borrow against meaningless numbers”. This is the only way that Buy, Borrow, Die works. If you’re borrowing only 1% of your assets per year, you never need to pay tax again. Since you’re going to generate better than 1% even if you stuck it all into boring stuff.

This needs to be closed out. No it won’t happen. So plan for this if you do make it into the big leagues (many of you will).

Carried Interest Loophole: This also needs to be closed. Essentially what PE/VC/Hedge funds pay themselves out as if it was a long-term capital gain instead of income. Carried interest is classified as profits from a long-term holding period. This drops them from regular income (taxed at 37% Federal and 10%+ State - all these guys are in top tax brackets) into… 20%.

Summary

We do have real solutions. None of them will be passed since the politicians use the same schemes. That said it would be summarized as: 1) taxing consumption vs. W-2 income earners, 2) Real Estate Deductions, 3) Finding a tax rate on Buy, Borrow, Die and 4) Carried interest loophole removal.

Now… Onto the Loopholes

Back to Bernie. He somehow owns three properties. Guys like Michael Moore and Robert Reich also come to mind as “tax the rich” marketers despite being rich themselves. Add AOC on the come up as well.

All of these hooligans are worth at least $10,000,000+. Don’t believe any of the lies related to google numbers. The goal is for them to *seem* relatable. The reality is that they are running up numbers since they are politicians. While Nancy Pelosi is the Queen Bee, all of these politicians play the same games.

General Scheme around $1M+: At this rough marker, everyone knows the mike tyson punch is coming. The second you take that screen shot of crossing $1,000,000 on the dot, the cosmos will hand you a big L. Either your biz will take a hit, get laid off, get screwed on a bonus or your investments fall off. Just how it goes.

The people who grind back end up doing the basic structure related to RE. What they do is buy a duplex or some sort of rental property. They run it at “break even”. Many even pretend they are going to move there to get favorable rates with banks. We don’t really care what you do as long as you don’t break the law.

This ends up leading to a new cash flow item of a few thousand dollars a month. You’ve learned your lesson and want some money coming in just in case things go south again.

General $5M+: At this range it’s quite similar to the $1M+. Usually something happens (again). This time the hit is much smaller in terms of down draw. The people who have a zest for taking massive risk might actually go bust. Go back to general scheme in $1M+ and you’ll find that many do this with huge leverage. Doesn’t work out and some actually do go under.

Instead the game moves into paying yourself in a different structure. Dividends, long-term capital gains, selling part of your biz etc. This prevents you from showing high “standard income” which would be taxed at 35%+ and you now lower your average tax rate to something more flat-lined - around 20%-ish. You talk to accountants decide if S-corp is better, where to have the headquarters etc.

General $10M+: At this point most of your “alpha” is really structuring your life for lower long-term taxes. Rarely do you meet anyone in this range that truly cares about running the numbers up anymore. Again. *Rarely* doesn’t mean all of them.

At this point you’re doing a lot of minority ownership stuff (sell chunks to incur long-term cap gains) then move it into a bunch of different assets to lower your effective tax rate.

For example, instead of trying to get 1099 consulting income, you try to own some small piece of an asset and collect the dividend. You move your entire company (if possible) to lower tax places to avoid State taxes. Or. You are moving entirely to take advantage of more complex items like tax havens (PR Act 60, Singapore, Dubai all the usual culprits).

General $40M+: Unless you’ve got the greed button and want to end up chasing dollars for life, practically everywhere looks like a tax haven. Take it to an extreme and assume you have a $50M book. You can now deploy buy, borrow, die and avoid significant taxes.

You can gift up to $13.6M in your life with the lifetime exemption. Your kids/family/whoever you care about can now grow that and not have to pay tax.

You then set up a GRAT/ Dynasty trust/Generational skipping trust. Another $30M is protected from estate tax rules

Unless you go full crazy mode with off-shore trusts and other set ups like that, maybe you owe some sort of small amount of estate tax

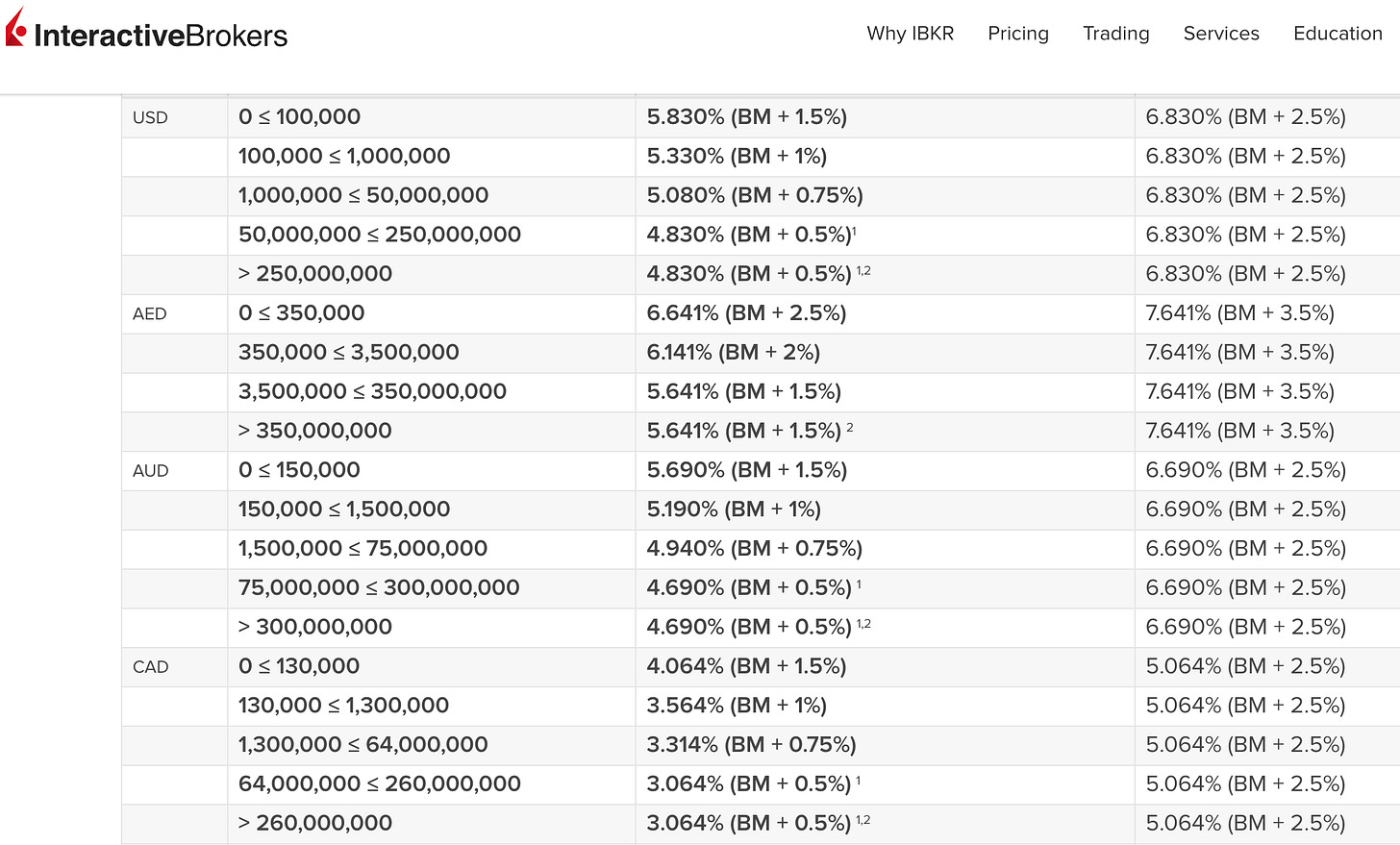

Ends up looking something like this

Even a Basic Interactive Brokers account would get you 5% today so please don’t say any of these numbers here are insane. Getting to $50M is entirely insane and takes psychopathic dedication + some lady luck. The math is not insane.

Sounds Daunting But Possible From Zero

Getting to $1M Literally Anyone

Most prefer to doom post. They won’t even bother trying anything. 90% of businesses fail blah blah. Reality is that $1M is attainable by simply putting in effort. Anyone who disagrees, just do yourself a favor and delete their contact info.

You don’t even need good timing.

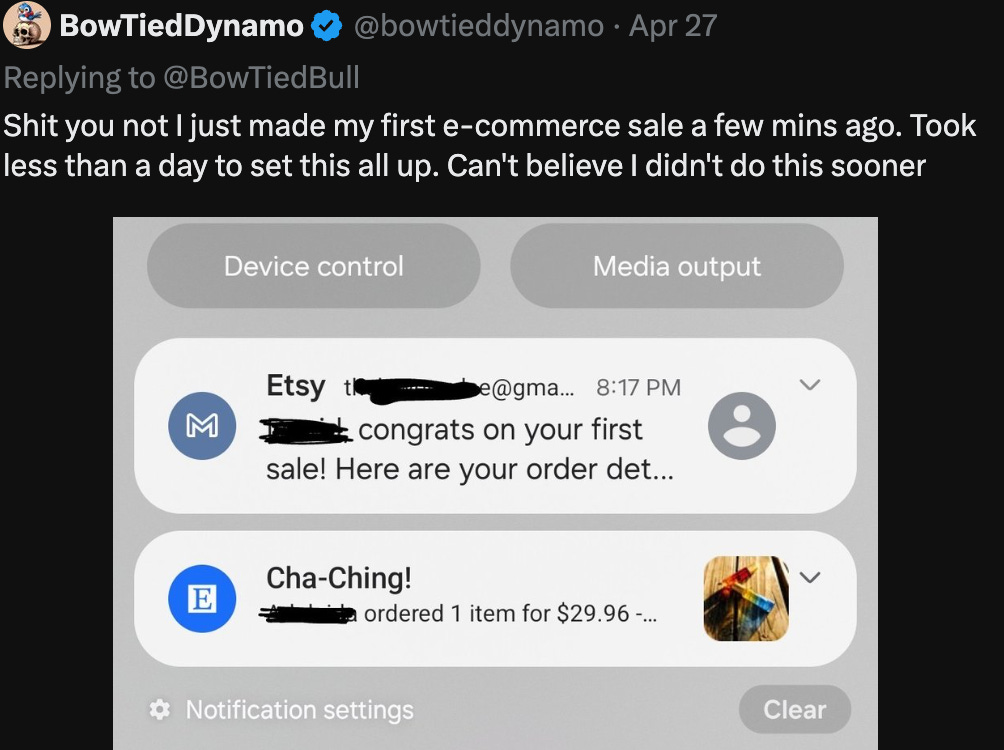

People *choose* to be millionaires. Or they choose not to. It’s lack of priorities that set them back. Go into Tech sales, Tech or worst case scenario Wall St (secular decline). Immediately (not later) start a boring side biz that can be a product or consulting. The second you get your first $1 we promise you will already see it.

You’ll be so busy the $150-200K you’re being paid will just go into the biz or into your bank accounts. Ship that back into the biz 99% of the time or invest in the future which is basically: crypto, tech, healthcare and degeneracy. Any of those are going to work since people will spend more time online now and in the future. We’re never going back to the past.

Dynamo is not going to be rich tomorrow. He will be rich faster than the guy sucking up for that extra $10K bonus though. All the BowTied success stories are built in public.

Scaling to $5M – Systems, Not Sacrifice

Selling lipstick? Selling shoe laces? Selling dog treats?

Legit don’t care. After you’ve learned to sell something you focus on systemizing it. Once its repeatable you no longer have to worry about it “working or not”

They teach you that 90% of businesses fail and ignore the fact that you’ll learn every single time and by attempt number three or so you will become unemployable.

At this stage, you are no longer shipping all your money back into the business. We’d wager majority end up making $150-200K online. This has been the rough average in the jungle from our glance in the background.

Everyone has a different belief system but the same concept is this, ship into appreciating assets: 1) other e-com/biz flips, 2) Real estate, 3) SaaS or 4) the aforementioned secular trends.

Create that Money Making Machine = Put in $1 get more than $1 back. Keep spending until it is no longer green

$10M+, Luck, Effort, Exits

The ideal situation is luck. Luck is when you wake up and the Kardashians are promoting your stuff for no reason. Or some ad you made goes viral like the morning routine Saratoga guy. Who knows.

If you don’t get lucky, it’s most likely an exit. This means you would need to sell the system from part 2 at a multiple. If you can get to around $1M in net income, probably looking at $3-5M exit value. That plus all your savings from work/grinding gets you close enough.

Majority around here will say it was relationships that made it work for them. Right guy/girl right place. Fawn and Gator probably Exhibit A for this one (we’ve got zero doubt they’ll be in the 8-digit wealth camp).

Buy Borrow Die Level?

Honestly got no idea, if you take life seriously though we can assure you it won’t be attainable. Lady luck hates serious people. Diseased individuals.

Anyway. Now you know how the rich actually operate. You can either copy paste them “success leaves clues”. Or you can go and hang out with blue haired complainers at the AOC/Bernie rally.

The Rest is up to you - MPM

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money