How to Be a Better Investor Without Knowing Finance

Level 2 - Value Investor

Welcome Avatar! Now that we’re squarely into the standard downturn, there is a large swath of people who didn’t take anything off the table (despite the historical 4 year cycle). There is a reason for this. We’re going to explain how this happens to new investors and ways to avoid it in the future. Without paying tens of thousands of dollars (per million invested) for some fund that underperforms the S&P 500.

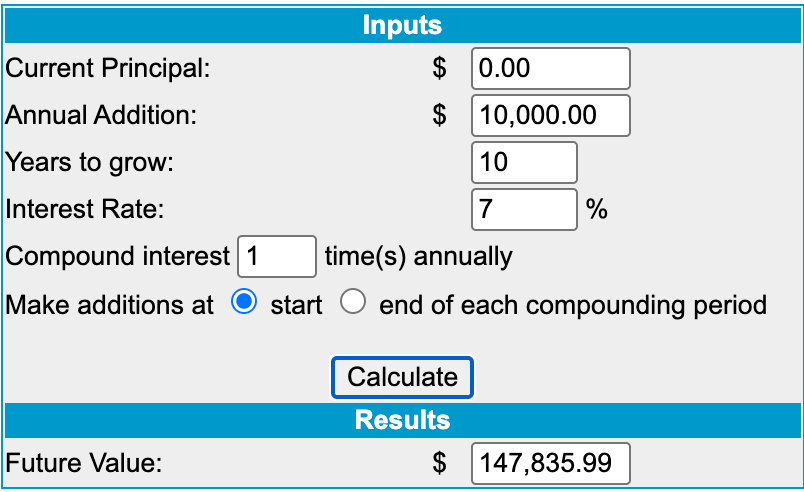

(BTW: if you ever think a 1% fee is small, realize on $1M it is $10,000. Compound that for 10 years at market rates instead? ~$150,000.)

What You Actually Need to Become a Better Investor

As usual, these are just opinions from us based on our own life experience. From what we’ve seen you don’t need a Bloomberg Terminal (wasted too many hours on these). You don’t need magical valuation tools (already automated nowadays). You don’t need a CFA (thinking like the herd). Instead.

You need emotional control and emotional awareness.

In the end, a person is making a decision to buy or sell. Even with algorithms, someone made the algorithm. Think of markets as large night clubs. People come in spending money, bigger spenders come in popping bottles and competition heats up for the attention. Then. It all comes to an end before you wait out for the next Saturday night.

The key to performance is actually reading the room (deciding when it’s peaked out) and more importantly, making sure you call it quits when you’ve maxed out your fun for the night (IYKYK).

What most people do is they wait until it is “time to show up” or they overstay thinking that people are suddenly going to show up the last hour. Unlikely.

In market terms it would be: 1) buying when it is consensus = no returns left, 2) selling when there is low interest = party/venue is empty = unless going to zero likely fills up later and 3) repeating this over and over thinking that investing is about following herds… It is the exact opposite.

The Cheat Code? Your nervous system is giving you the answer every single time. If you find yourself feeling FOMO you should write that down in your one day journal. If you back track the info, you’ll find that your emotions are the exact reverse of what ends up happening. If you’re excited? Usually the peak. If you’re depressed? Usually the bottom. So on and so forth.

Instead of trying to outsmart billionaires and quants, the easier move is to monitor your own feelings and emotions. Get control of your dopamine receptors and you’ll perform much better making a handful of moves per year. This also frees you up to build up that WiFi money = absurd financial gains every 4 years.

How to Evaluate an Asset

Asset price = Fundamentals x (Emotion^3)

Asset price is the market cap of the item you’re looking at. Fundamentals are use cases/new product updates. Emotion? This one goes all over the place like a theme park roller coaster.

Therefore? The price today is more of a reflection of emotion vs. anything else in any particular time.

The equation is not going to be in an economics book. In fact there is no way to prove anything in there. However. If you use that as the framework you’ll recognize when good businesses are selling at panic prices and when terrible businesses are selling at euphoric prices. Does this mean you “pico top and bottom”? No. It means you simply get in at slightly better prices and get out slightly more when you’re feeling like a genius.

If you want a Boomer/old person concept, this is largely what “Mr. Market” represents. Mr. Market is really just mood of the day/week/month/year. Instead of treating Mr. Market as correct, you should evaluate if Mr. Market is depressed or high on a million stimulants.

Correctly recognize when he’s high or low? You’ll do better than 99.9% of people. Good enough.

General Four Market Emotions

The market is in one of the following emotions: 1) Denial, 2) Anger, 3) Depression, 4) Hope, 5) Excitement and 6) Euphoria

This is how we’d characterize how each one feels. You *should* notice this in your own daily emotional check up. A single sentence explaining how you feel

Denial: In this stage, the feeling is “nothing has changed it’ll come back soon”. Historically that leads to the next two waves in short order.

Anger: Typically blaming something else. Could be the fund manager. Could be a boss. Doesn’t matter. Usually leads to lashing out despite the buy/sell being in the hands of the user

Depression: Give up stage. Here is when you’re at peak opportunity. It’s when people *really* give up. Not “I’ll wait it out next cycle”. Instead people need to really believe it is over for good. No future cycle. No reason to invest ever again. Checking out for life type commentary.

Hope: This stage you usually see some outperformance. People laugh and say “but it is down X% the last year”. This means the price has improved but it is still much lower than prior high. Go look at commentary when BTC was at $35-45K in 2023.

Excitement: You’re in a confirmed positive market. New participants are showing up to the club. New products/use cases are coming out. Narrative forms and we’re back at the highs or above.

Euphoria/Greed: Despite being up 2x, 3x, 4x or 5x… people don’t sell anything. They know “someone else” who did a 10x so they “have” to get the same return. This results in fighting every signal. President of USA launches a meme coin? Doesn’t sell a single thing related to Solana. BTC price hits ATH at the exact average of all 4 year cycles in the history of BTC? Doesn’t sell a thing because 4 year cycle is broken. So on and so forth. Once you start backward rationalizing why you own something, it’s usually the end for a period of time.

The Real Enemy? Typically Just Emotions

You. Yes You reading this. We’re nearly certain you have had 5-10 amazing investment ideas. You were probably early to FAANG. Or Crypto. Or some biotech stock. We don’t know. Were you wrong or did you just mis-time it or not wait it out?

Probably a brutal sentence to read. We know the truth. You’re good at figuring stuff out. The problem is the emotional control.

If you believe what we’ve written so far (and it sounds familiar). Then the likely answer is that behavior is the biggest determinant of performance. Not finding interesting companies, assets, etc.

If you’ve already found this strange part of the internet, chances are you’re already sharp enough to find good investments. You can read our stuff and DYOR. You’ll find something and the key is actually behavior.

Can you hold through periods where people are laughing at you? Can you sell when your dad calls to call you an amazing investor? These are serious things because the ego will tell you you’re a genius when mom and dad call in (the worst possible time to buy)

Why This Happens to Everyone

Unless you’re some cyborg genius emotional robot… chances are it will happen to you. No different than how your first couple iterations of WiFi money will likely fail. Again. We’ve failed several times before getting better at anything (WiFi Money, Investing all included). No one goes out bats a thousand on day one.

The issue is actually structural. Humans have evolved to *hate* risk. If you measure brain responses to a $10 reward vs. a $10 loss, the loss is significantly more painful than the $10 dopamine hit. Think that through. This means you are naturally (programmed) to feel more pain when things go down vs up.

This ends up resulting in: 1) getting cautious too early, 2) rage quitting - selling it all at lows, 3) levering up to make it all back and 4) selling the split second you get to break even.

In the end all of this just results in underperformance.

Developing Emotional Operating Systems

Here is a simple way to take emotion out of the equation. If you’re not a full time investor we think this will be “good enough” for the majority. The majority can buy index funds (blah blah we all know that). However. Long-term you do need to learn how to invest by yourself. Carve out a chunk of money and this is your real investing performance. Put it in a separate account and compare to the index account. Simple as that.

Create Percent Allocation

Most damage occurs by selling at panics and buying in mania. To prevent this you can use percentage allocations. For example if you buy a high risk tech stock and it is beating the S&P by 2% this year, probably not wise to sell it. Why? If you took that much risk you better have conviction and it needs to beat the index by a bit more than 2%

Once you decide on this basic framework, you can move onto the emotional checklist.

If you feel like you need to buy? You don’t.

If you feel like you need to sell? You buy 1.5x what you normally buy

If you feel like a genius? You check the percents and sell

If you feel absolutely nothing? You just do your standard buy or sell (depending on where you are at in the emotional rollercoaster)

No Decisions During Life Events

The whole point of an emergency fund is to avoid emotional decisions related to your personal life. If you recently got promoted or recently broke up with a girlfriend, this is not the time to make changes. Instead you need to stop and relax for a few months.

This applies to building businesses as well. We’ve long stated that if you sell a business you’re not allowed to upgrade your lifestyle for a full 12 months. You can throw a party take a 1-2 week vacation, but you need to reset the dopamine receptors.

When it comes to investing your own money, you should never do it when you’re going through a large life event. Life events typically coincide with terrible sleep and high stress levels (good and bad types - adrenaline vs. cortisol)

Less is More

For those that have been on our paid stack for a while, you know we don’t try to buy pico bottoms or sell pico tops. We’re upfront about this. We don’t have some thousand dollar widget to sell or some $10K+ management fee to collect.

Instead we try to make 2-3 big changes per year and the rest of the time is largely spent buying new assets. That’s it.

Therefore, you should write out what you’re going to buy (write it into an excel sheet) stick to that. Then reference your percent allocation. Then as a last item, write down that you only get 2-3 big moves per year.

Warren Buffet had a punch card analogy that is fitting. He stated that if people could only make 20 investments in their life they would do better. One punch per investment.

This is the same concept and more realistic. You have your basic blind buy allocation. Then you got a punch card every year with 2-3 real punches in it. You don’t need to use them every year either.

Write Down Your Emotional State When You Hit the Punch Card

The majority of your money is going to look like this. Get money, reinvest into WiFi money, buy some boring index funds. This is not what we’re referring to.

That’s your basic Standard Operating Procedures (SOP)

When you make a more significant change (larger investment in something you believe in) or (larger sale of something you own a lot of). You have to take out the checklist.

Am I selling because i am down and scared?

Am I buying because of FOMO?

What are the masses doing, am I with them or against?

Did something change my investment thesis or is this based on price?

How am I personally feeling in my life in general, if extremely negative or positive the action needs to be the opposite

If you’re unwilling to audit your emotional state before you make a bigger decision, then you’re not taking this seriously. While this isn’t life or death, it can certainly save you years of headaches.

Simple Metric to Decide Where We Are At

If you’re closer to the top you’ll see: 1) This time is Different, 2) New Paradigm, 3) “I coulda just invested in this instead and been rich!”, 4) It’s the least risky investment out there and 5) All over CNBC/mainstream in a positive light

If you’re closer to the bottom you’ll see: 1) “It will never come back again”, 2) “Everything is un-investable only cash works”, 3) Good news has no impact on price, 4) it is on CNBC/mainstream media with obituary type commentary and 5) omg i can’t believe people still own that garbage [asset]

The good news in all this? The highs and lows are actually a bit easier to spot once you get the hang of it. You’ll never hit the pico top or bottom consistently, but these signs are pretty universal.

Typically we’re somewhere in between, either working toward Euphoria or toward Depression

The Classic Inverse Yourself Seinfeld Strategy

There is an episode in Seinfeld where George does the exact opposite of what he would normally do. This results in everything working out.

We don’t like this strategy as we think you can learn it (as outlined above). However, if you have a history of underperforming the market (IE. unable to beat S&P), then you should give it a whirl one year.

Feel great about something? Sell it.

Feeling terrible about something? Buy it.

Add a Tracker: If you want to try the inverse of your own emotions, then you should 100% have a journal. Do not try to pretend or manufacture emotions. Wait for news to hit (asset is up or down a ton) and see how you feel. When you actually feel something, you reverse it and move on.

Chances are high your brain will still be swayed by what is hot/not

Good Enough as Baseline

If you are serious about making it, you know that the vast majority of your time is going to be spent scaling a business. You won’t have time to sit in front of a computer screen all day long. In addition, the vast majority of traders lose boatloads of money.

If you adopt the good enough mantra, you are only looking for signs of Euphoria and signs of Depression.

This will also limit your big moves by default! 99% of the time an asset is neither in depression or euphoria. Needs to be in the news big for a good/bad reason. Then invert it unless the headline is obvious (company going bankrupt for example)

That’s it.

Learn to manage your own emotions and recognize them in the market. Instead of losing tens of thousands of dollars, you’ll invest in the emotional control fee. If you’re doing better than the typical fund manager, you’ve already won.

Summary

We’re going to stick to our singles/doubles framework. We’ve become accustomed to both the euphoria and depression emails/comments. In fact, they have actually made us significantly better! Has been an incredible run and we hope that all of you are able to learn the basics of emotional reading as well.

On that note, stay toon’d and on Wednesday we’ll outline the typical rollercoaster for Crypto during a down year.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

How ETH is Staked: Covered (here)

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money