How to End Up Broke Despite Clearing Mid-Six Figures

Level 1 - NGMI

Welcome Avatar! With the latest news, Amazon cutting 30,000 employees, we thought it would be wise to explain how you can end up broke despite making $300,000 and even $700,000 a year. If you think they are over-spending? You’re right. Will the vast majority fall into the spending trap? Also a big yes.

Comment from sigma91.

The important part is within section 2. “wasn’t in a position to sit on a beach for years”.

This post will explain why this is the case and how you should *always* operate assuming you have less time than you think. You can make it at any age. That said, no reason to get in your own way and pretend that time and energy doesn’t exist.

Saving Nothing With Mid-Six Figures

You would think that this income is "set for life”. You think you’re past normal problems. You think you’re in the top 1% and you have won. You haven’t won. You upgraded the treadmill. Life is set up with increasing responsibilities. This means, increasing costs and life costing much more than you think.

How the treadmill traps, bleeds and keeps you obedient until old age: You grind for a decade. Degrees, credentials, brand-name firm on one-page resume. You start making mid-six figures. Maybe you’re a senior associate in big law, a staff engineer at Meta, officially a practicing doctor or VP/director on Wall Street. $350-700K all in depending on how good or bad the year was.

Then something odd happens. You’re find that net worth isn’t scaling as fast as you thought. You quietly know it when you look around. You can feel it. This is not rare. It is actually the most common outcome.

Financial planners working with people earning mid-six figures? Well. They report that their clients live month to month in many cases due to: 1) large mortgage, 2) prive school, 3) nanny/child care, 4) car and 5) renovations/other one time costs. (Source)

Even at $500,000! Recent reports show that many workers making $500,000+ a year are still functionally paycheck to paycheck. Half a million dollars. Still stressed and can’t afford to coast.

The reason given? Lifestyle. They keep upgrading. They lock in fixed costs that require constant cash flows to cover the burn… for 20, 30, 40 years. Two strategies: 1) the guy who rents and has a larger brokerage, 2) the person who is levered with a mortgage and a much smaller brokerage. Neither are free.

The core problem for high earners? Fixed cost escalation: 1) housing, 2) vacations, 3) private schools, 4) country clubs and more. Now the lifestyle owns the person.

Most don’t buy freedom. They buy overhead.

How the Math Works

Going from ~$6,000/month to ~$17,000/month take-home is significant. A rough 3x from what you earned while living in a dingy apartment with roommates.

The first “real” check feels like a bonus.

You feel like you’re printing money. Then? Suddenly the dopamine says to reward yourself. New car? Yep. Better zip code? Yep. Nicer house? No doubt and 500x if the person has a wife/kids. Can’t say no to that.

Next up? Private school, upgraded kitchen/bathroom, and the $5,000 cheap vacation turns into a $40,000 family vacation that everyone “needs”. Within 12 months, the new lifestyle is the norm. Dopamine wears off. Can’t downgrade.

“The attending paycheck does seem quite large until we inflate our lifestyle to the point where we cannot save or pay down debt.” Source

Once lifestyle steps up, it becomes the new baseline. It is easy to go from Toyota → Porsche. It is painfully hard to go from Porsche → Toyota. You’re locking in higher floor level spending.

Social Pressure Lock-in: You’re supposed to look the part before you get the role. This means lifestyle expectations creep in quickly. Saving the bonus is a mantra that begins at the associate level on Wall Street, not even the VP or Director level. Since you’ll get 10-20+ bonus checks, not a big deal since those are “guaranteed”. Spoiler alert! Vast majority do not generate meaningful numbers until they are late 30s/early 40s and the chances of keeping that slot for a decade plus? Slim. It is called up or out for a reason. You get pushed out.

System Designed for Burn Rates: Private school is nearly guaranteed in expensive cities where the majority of high paying W-2 roles exist. Public options are ignored because the districts register as a 5 or below. (out of 10).

Once the private school kicks in, you get Country Clubs for “networking” and a nanny because you need to be at peak performance to retain this new lifestyle. You’ll also eat out frequently since you’re far too tired to cook.

Every single one of these is a significant recurring cost. You’re looking at $10,000+ in after tax income just from a couple of those items. $100 here and there is nothing but $10,000+ hurts. Hurts a lot.

Minimum cash flow required to to survive? Just went up.

Better to be Company D than Company A

Onto Governments Punishing Workers

Taxing high income earners is a psyop. We’re of the belief it is designed to keep the rich entrenched. If you make it nearly impossible for people to save money, they can’t quit and start a competitor. Just forced to pinch pennies and make it work.

Most think “Wow $500,000”. That’s just the printed number though.

What you learn is that two full days of work within a standard 5-day work week goes straight to taxes. ~40%.

You are in copper handcuffs: too rich for empathy, not rich enough to keep up with increasing responsibilities and family obligations. You’re getting smoked at high marginal brackets, you don’t own the firm - can’t sell the job you have, you can’t pass expenses through an entity - minimal deductions and you can’t arbitrage residency or corporate structure without blowing up your career.

Gross income sounds enormous. However, your after-tax is significantly lower than you like to admit. Privately, when talking with financial advisors, they will explain that making $200,000 a year is required to save $100,000. After taxes and lifestyle overhead, the rest is already gone

That’s why high earners feel broke. Optically they are not broke. They are living a good quality of life. What you don’t see? The minimal change in net worth.

It’s math. There’s a big difference between wealth and income.

The top 1% wealth in the USA is $13,700,000. At a basic 5% return, this is $685,000. More than the top 1% *income* generates despite working 60+ hours a week.

Where It Gets Dark and Depressing

The majority fall into the above trap and now they are in a chokehold. Living well according to an outsider. True. You’re also skating on thin-ice. If the income breaks (the ice), you’re in a world of hurt.

You need to perform flawlessly. Otherwise it is maximum pain. Bad bonus? Pain. Skipped for promo? Pain. Get pushed out in early 40s? minus 50%+ on compensation: catastrophe.

You literally cannot leave. That’s the exact opposite of what being rich is supposed to feel like. Instead of having more options, you actually have less options. Forced to work.

This is why you see people in their 40s (top 1-2% income quietly panicking). Can’t quit. Can’t take foot off gas. Can’t reduce burn rate - newly locked in cost structure. And. The wort of the bunch. Can’t start a biz without performing worse on the job - Gulp.

The income didn’t build wealth. It built obligations. A high salary can actually reduce your freedom.

Seven Deadly Financial Sins

Want to see how fast this money goes away? It is gone in seven quick steps.

1. Bigger House ($1.5M–$2M mortgage - 6.5% rate): ~$8,000/month after tax = $96,000/year

Pre-tax cost: $160,000

2. Private School (2 kids @ $36K each): ~$6,000/month after tax = $72,000/year

Pre-tax cost: $120,000

3. Nanny / Childcare: ~$4,000/month after tax = $48,000/year

Pre-tax cost: $80,000

4. Two “Nice” Cars (leases + insurance): ~$3,000/month after tax = $36,000/year

Pre-tax cost: $60,000

5. Vacations / Travel: ~$2,500/month after tax = $30,000/year

Pre-tax cost: $50,000

6. Dining / Entertainment / Social Life: ~$2,000/month after tax = $24,000/year

Pre-tax cost: $40,000

7. Household Help (cleaner, gardener, maintenance): ~$1,000/month after tax = $12,000/year

Pre-tax cost: $20,000

Pre-tax Total: $530,000.

You can nitpick if you like. One time events always come up (health issue, car issue, insurance cost, country clubs, bad bonus year etc.

In the end, the fixed costs can eat you alive. Fast.

How to Avoid This Slow Moving Train Wreck

Pick a target lifestyle number that you can comfortably live on. Call it $100-200K a year after tax all-in spend for your family. That’s housing, food, childcare, insurance, travel, everything. Then you lock that number. Tattoo it.

That number is now your “max lifestyle.” You do not let it scale linearly with income.

When your income jumps from $300K to $450K? You do not *deserve* to scale lifestyle 1:1. You siphon the marginal(~$80K-$90K post tax) straight into buying time and leverage: taxable brokerage, second cash-flowing asset, equity in something you own, principal paydown on a mortgage, or building/purchasing a side income stream that is not tied to a boss. Again. You use it to invest in things that earn or you control. Until the number is hit, you haven’t *earned* the right to increase lifestyle spending.

Instead of spending first and saving what’s left, you invert it. Set the savings and wealth-building targets first and then force the lifestyle to fill the difference. Lock in a savings rate immediately and live like you’re still waiting for a promotion for at least 12 months. Don’t let lifestyle creep eat the raise.

You front-load freedom. You pay yourself first, not your boss. You’re here to build your dreams not theirs.

If you are still in a W-2 and high income, your only real edge is how fast you can convert active income (salary/bonus) into assets and systems that survive if the salary dies.

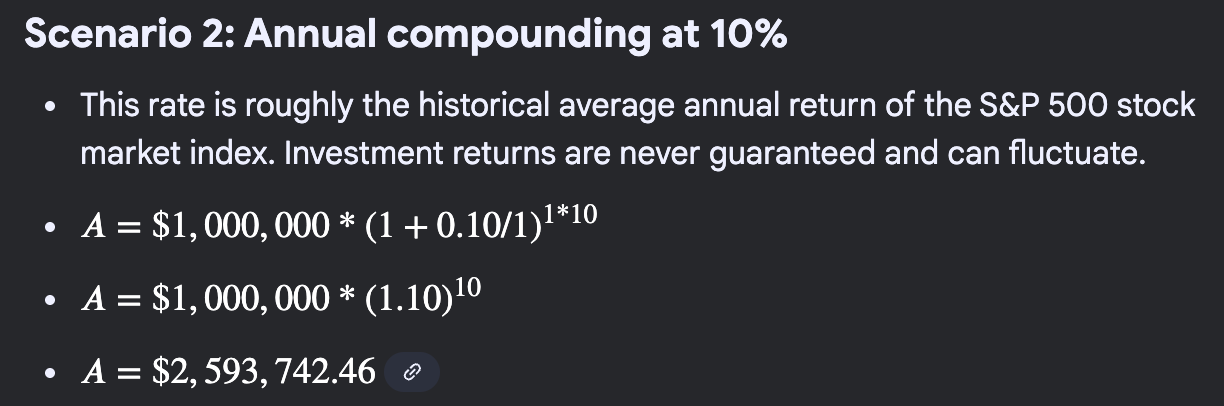

Generally most people have 10 big earning years. If you put away $1,000,000 fast (all you need to do is sell one ultra small business at 4x earnings with $250K net income) and you’re looking at $2.6M by the time your career hits a snag. $2.6M is enough to cover all your bare bones expenses for life (practically anywhere).

If you can lock in wealth first you never have to painfully downgrade. If you create a single event (sell a company/big payout) and slam into investments, the assets produce income to fund your lifestyle in 2-3 years (not long at all). You buy time, you buy compounding, and you permanently lower “how much lifestyle you think you’re entitled to.”

That’s your only way out. You don’t control tax code. You don’t control Fed policy. You don’t control your firm’s promotion ladder. You don’t control whether AI automates half your strategic work.

You control one thing: how much am i shoving into assets. WiFi biz? An Asset. Stocks? An asset. Crypto? An asset. Primary home? Not an asset. Rental home? An asset (produces positive cash flow).

Only Way to Invest More is With Owned Equity

Most will stop there and go onto FIRE/Frugality websites. They don’t work. The FIRE movement got destroyed during the pandemic due to rampant inflation. They also live extremely boring lives having no parties, no wild stories, nothing, zilch, nada until they are 40+ and unable to go to nightclubs at all

Only “Frugal Move”: You can spend money, just make sure your *burn* rate is low. For example, going into a nice school district or home schooling is a lot better than private school. $40,000 is a lot. We can pretty much guarantee if you saved $40,000 * 13 years and put that into stocks? It would be more valuable for the child than whatever slop they are teaching at the local private school.

Once you have frozen the fixed costs, you can now control the operating expense line item.

Second, automate the system. You need to have an automatic sweep of cash flows into accounts. This is going to be lumpy. The IRS knows that entrepreneurs go from $2M years all the way down to $200K years frequently. The nature of people building businesses? Low income and event. Low income and event. Low income and event… over and over again.

When the event comes, instead of booking a flight to dubai or (insert degenerate eastern europe party location), you have a system that already buys you *more* assets before you blow a bunch of money on stuff you will take with you to the grave.

Reinvest in… you guessed it… buying/building outside your job. Could be a small stake in a boring local business. Could be a short-term rental you run professionally, not emotionally. Could be starting a side LLC that spins $5K/month. Could be an online product. Could be a consulting slice. Don’t care what it is, it’s not dependent on one boss continuing to like you. And. In an ideal world it is scalable and sellable within a few years (consulting largely reserved for people who still think WiFi money is “fake”).

The minute you have a non-employer income stream that covers a meaningful chunk of your fixed life cost, the power dynamic changes.

That last one is the whole thesis. The BowTied universe bangs this drum every day: you cannot save your way to freedom on salary alone if every dollar you save is still dependent on continued W-2 health. You have to start diverting active income into assets and systems that survive you getting fired, demoted, replaced by AI, medically sidelined, or simply bored.

The real endgame nobody tells you in HR onboarding? The firm will use you until you’re tired and then replace you with a younger, cheaper, more energetic version of you. Law does it. Medicine does it. Tech does it. Finance definitely does it. And. They’ll do it right around the time you finally start to enjoy the lifestyle you built.

The firm knows they have leverage. Hard to replace your current income. You’re getting tired. Interviewing, restarting at a new place, grinding hard all day… is not exciting anymore. Sounds like punishment actually.

Same person who has a WiFi business generating enough to cover their living costs? Now you are incredibly dangerous. You can reinvest practically everything you make. You can even let the firm pay you a bit less than you are worth, elongating the tenure without worries. Now you can also invest heavily in asymmetric investments. You are cash flow positive even if you get laid off. That is real status. Material status is just something the average person cannot afford.

Self Inflicted Trap

You are trapped due to societal pressures. Converting raises into lifestyle. Should be converted into assets.

High income is not your moat. High savings rate plus disciplined lifestyle plus asset ownership is your moat. That’s your escape hatch from being 45-55, resentful, sleep-deprived, still on call, still chained to a desk because you “can’t” step down.

You already did the hard part. You broke into the top fraction of earners in the country. You’re in the rare zone where a few disciplined years of building can change your life for the next 30-50 years

But if you keep scaling burn with comp, you’re not “living well.” You’re just an expensive hostage.

Lock the lifestyle. Capture the delta. Buy your way out.

If you want the actual playbooks, growing markets and where asymmetric upside exists? Need to join the jungle. The ones who get it, get it. The rest will keep financing the G-Wagon and Lambo truck.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

How ETH is Staked: Covered (here)

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money