Is Any Industry Keeping Up With Inflation?

Level 2 - Value Investor

Welcome Avatar! As a thought experiment, we wondered out loud if any industry is actually keeping up with inflation. Generally speaking, it doesn’t look good but always depends on how you measure everything.

We’re going to ignore the classic exception to the rule. If you were the first 20 employees at META/Facebook that doesn’t count. If you were one of the first employees at FAANG in general, we can hopefully agree that it is not relevant.

What is Actual Inflation

Here is the starting point. You have to decide what you believe. Do you believe the same government that told you July 4th cookouts were down “16 cents” in 2021? Do you think that the total cost of everything is up 25% since the pandemic? Do you feel like wages are growing in-line with overall cost of living?

If so then you use the government inflation numbers. If not? Maybe look at the items you need to survive (food/cars, housing etc).

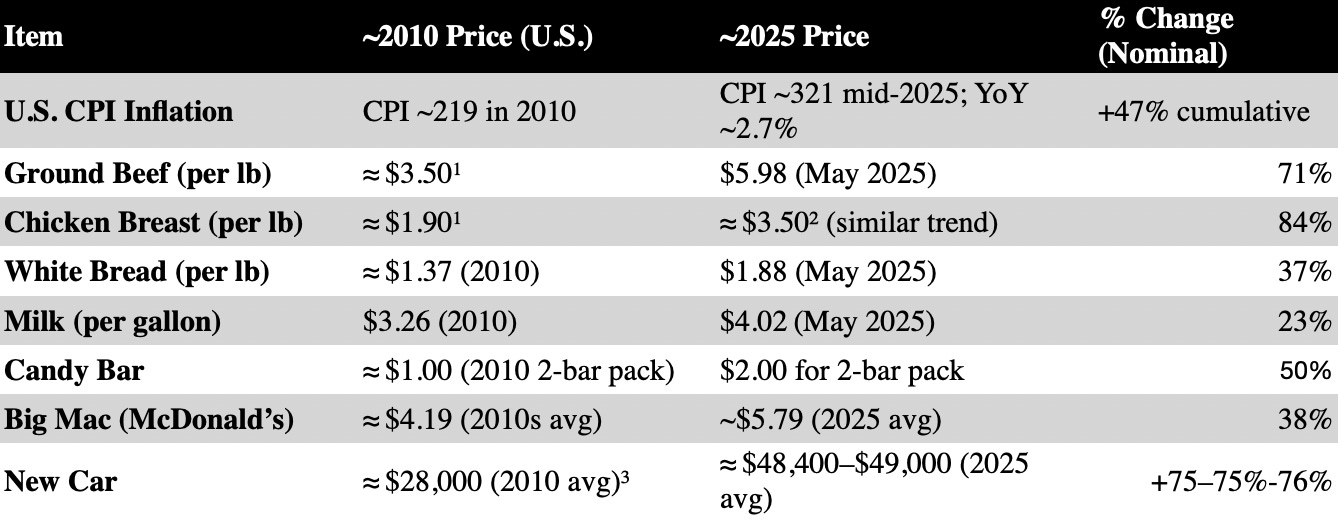

Helpful Starting Point

As you can see from this over the past 15 years or so, stated cumulative inflation is about 47%. Just to make a number that is easy to remember, etch 50% into your brain. In 15 years the cost of everything went up by about 50%.

Now if you really look under the hood, you can see a lot of important items went up much more than 50%. The typical new car is up 75%. Beef and Chicken is up 70-80%. While you might be able to substitute for more bread and milk, this isn’t really a good comparison since quality of life is what matters. If you can keep your costs flat by never eating steak and becoming a bean eating vegan, that’s an entirely different lifestyle.

Come Up With Your Number: If you believe in government numbers, that’s 50%. If you look under the hood and come up with fair lifestyle comparisons, you’re probably landing closer to 60-70%. Remember. All of this is post tax money. Remember that comment for later. All inflation numbers are based on sticker prices which are paid with post tax money not with pre-tax W-2 income.

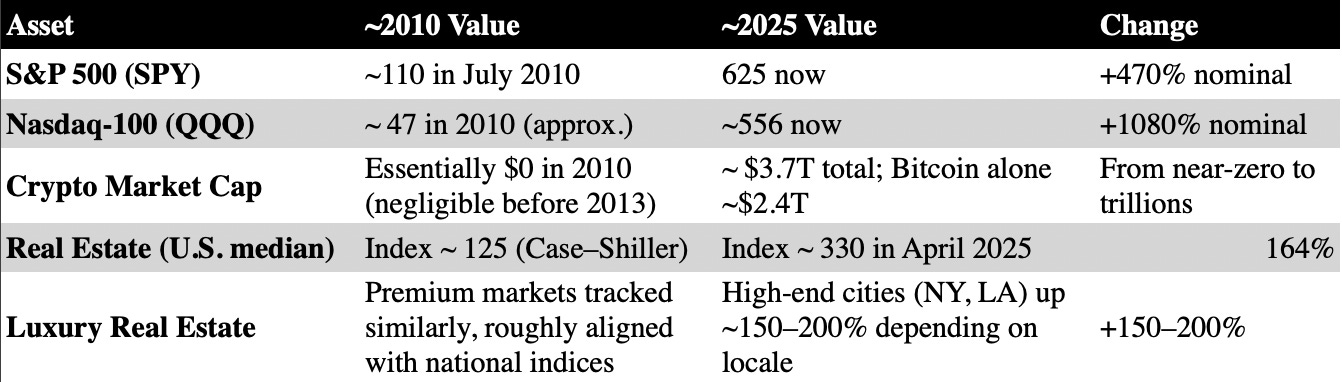

What is Asset Inflation

Not hard to look around the nicest areas of the USA and recognize prices went up much more than 50%. While real estate goes up slower since it is an expensive item with tons of leverage embedded into it, luxury areas are not growing below stated inflation.

You can come up with your own way to measure asset inflation. Using Crypto probably isn’t fair since the returns were in the 10,000%+ range. Using only real estate is probably too low. Using a mix of stocks, real estate, regular cost of living and general inflation? Probably much closer to real numbers.

Pretty Wild! Luckily, you don’t need any advanced tracking to solve this one yourself. While you can debate the luxury real estate one, just use a index based on where you personally live. We can assure you that the chances of finding numbers below 100%+ are low (unless you live in Detroit or something)

Betting Against Tech? Not sure if people enjoy pain. Why would someone invest in brick and mortar retail, banks, plastics, etc. when they can invest in technology? No clue. A basic long of the QQQ would return 1,000% and a basic long of the S&P would net 470%.

We get that people have life events (buying a home, starting a family, random emergencies - health issue etc.). That said, over the long-term, it doesn’t make a ton of sense to hold money in checking accounts

Summary

Come up with your own number. If you’ve got your head in the sand you’ll use CPI which is 50%. If you think a little bit out of the box you’ll be closer to 100%+. If you’re someone with limited emotions, you’ll get to much higher number than 150%. Probably closer to 200% since holding the S&P 500 isn’t particularly difficult.

Industries Keeping Up With Inflation

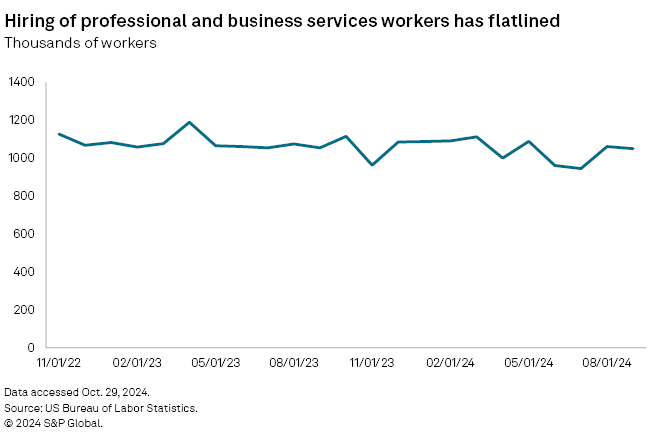

Now for the fun part. Is anything up 50%, 100%, 200%? Not really.

The way that corporate America traps people? They give them higher than inflation wage increases until about age 30-35. At this point they know that the vast majority will get married, buy a home/condo and lock themselves into a particular lifestyle.

At this point wages begin to flat line. Getting moved up is rare.

Unless you are a superstar? You’re knee capped at around $200-250K. While this is a lot of money in the general USA, the majority of these positions are all in high cost of living areas (Bay Area, SoCal, NYC, Boston, Miami etc.)

Here Are Some General Wage Changes

Woof. As you can see, it is tough to get ahead with W-2 earnings. All of this is *pre-tax* income. As you move up from $150K to $300K, the tax man is going to take more of it as a percentage (not less!). Either way, just left it as pre-tax since some exception to the rule guy will claim that taxes are going to plummet.

Check Your Own Industry: While we explained the classic corporate trick of high raises in 20s only to flat line, you should look at people who are around 30-35 in your industry. Figure out how much they are making (everyone talks) and then go back and see what the same position paid around 10-15 years ago.

That’s how you should actually look at it.

Don’t get tricked into seeing that the next promotion is +20%. This is because it takes 3-4 years to get that promotion where they increased wages by 2-3% (or something meaningless like that).

Turn This Around

Now that you see the writing on the wall. Blood Red Clear. It’s time to ask yourself if you’re really only worth $20K a month. Is that really the ceiling? Break it down a bit.

Say someone stumbles upon this at age 25-26 or so. Great. Now you’ve got 5 years to make your own income increase.

If you start today with affiliate marketing, e-commerce or even the extreme risk averse consulting time-for-money exchange, you can plug that into excel.

$12K a Year: This is practically a layup. Even if you can only earn $33 a day online, that is roughly $1,000. To put this in perspective, you’d only need to sell 3 units of something with a $10 profit margin. Or. You could sell 1 unit at $33 in profits. Or even 100 units at $0.33.

$60K a year: This is probably the goal for the majority. Once you’re making about $5,000 a month online that’s when you quite literally cannot quit. You’re addicted to the game and feel immense freedom. If you get laid off? Just go to Thailand. You want to take a vacation? Paid for in a single month. Want to reinvest into crypto, tech etc? Well you’ve likely gotten rid of your *entire* rent payment or more.

$5,000 a month is only $166 a day. If you’re ultra lazy you could do consulting work for $83 an hour and just do 2 hours a day.

Dream a Little

For anyone who made it to a high paying profession, chances are you’re not average. Unless your parents just hooked you up with the seat, the most likely scenario is that you’re above average. This means the following:

You’ll actually learn from your mistakes

You will find patterns that work in successful businesses

You’ll realize the true nature of consumers - selling to women

You probably have high pain tolerance and perseverance, so failing at the first couple tries is not going to deter you

Three years is nothing compared to 40 years of work life to “maybe” retire in some low cost of living place like Vermont

What Does This Mean: It means that once you can replace your own income with your e-com/SaaS/insert any business, you’re actually 2-10x richer.

You can sell a company you can never sell your job.

While people get glossy eyed over the latest instagram famous person, that isn’t a sellable business. They also have a short shelf life for being popular.

Awesome if you can be the it person for a bit and save every penny. That said, always better to build something with no name, just a brand name and go from there. Even if it’s just called “Organic’s Makeup” that’s a lot better than “First Name, Last Name - Makeup”.

By replacing your income, say $250K, you now have a sellable asset

$250K in income at 2x earnings is a $500K asset at 4x it is $1M and at 8x it is $2M

These are *life changing* numbers for practically everyone reading this. It compounds for the next 20-30 years if you were to simply dump it into assets

Finally, once you succeed once, you will *likely* succeed again. They don’t teach you that because they don’t want you doing something “risky” and losing $4,000 testing ads on META (big whoop)

Summary

Outside of being early to a major winner in FAANG or another huge company we’re unaware of today (such as Tesla), nothing really keeps pace with inflation. You can run the numbers backward and forward into excel.

You spend practically 40 years in spreadsheets, go and calculate the one that matters. Your personal net worth growth with reasonable assumptions. Don’t assume you’ll be the star (you already know if it’s true) and just do the classic up until 33-34 followed by a flat line.

Let us know how it goes.

Oh. And do the same assuming you started a small biz that did $50K and you sold for $150K. Sure beats trying to save $5 by skipping coffee at Starbucks…

The rest is up to you

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money