No Crypto, No Escape: Why Under-35s Are Finished If Crypto Fails

Level 2 - Value Investor

Welcome Avatar! We’re going to make a compelling case that the doomsday scenario is not related to BTC trading at $1,000,000 and Web 3.0 working. Rather, the real apocalypse would be the complete failure of Web 3.0 and decentralized finance at large.

We’re under the assumption that the vast majority of the readership is under 35 years old or so. Even if we ear marked 40 years, the title would still be relevant. If crypto fails and the youth sees no hope at keeping pace with rising cost of living, home prices and general malaise… what does that look like? Not pretty.

Part 1: Implications of Unaffordable Housing

The mainstream has done a good job instilling fear as it relates to Bitcoin and crypto at large. In fact, Chinese media even came out and said “if Bitcoin succeeds we all die”, a humorous meme’d excerpt that has stood the test of time.

The logic is that the system collapses, death spiral and riots + chaos in the street.

How about the other side of the equation? The new youth is absolutely obsessed with technology. In order to stay on top of things, we do visit college campuses and search for the next trends. Crypto is still there. We’ve even heard middle school/high school kids are involved with crypto (Barron Trump being one of the loudest when a high school senior)

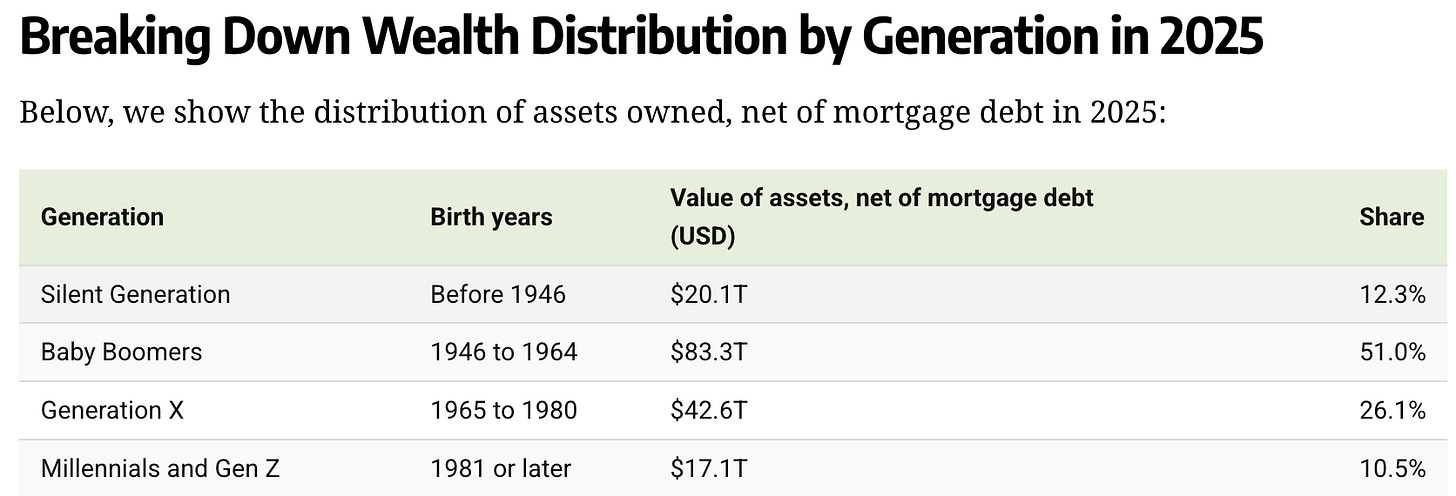

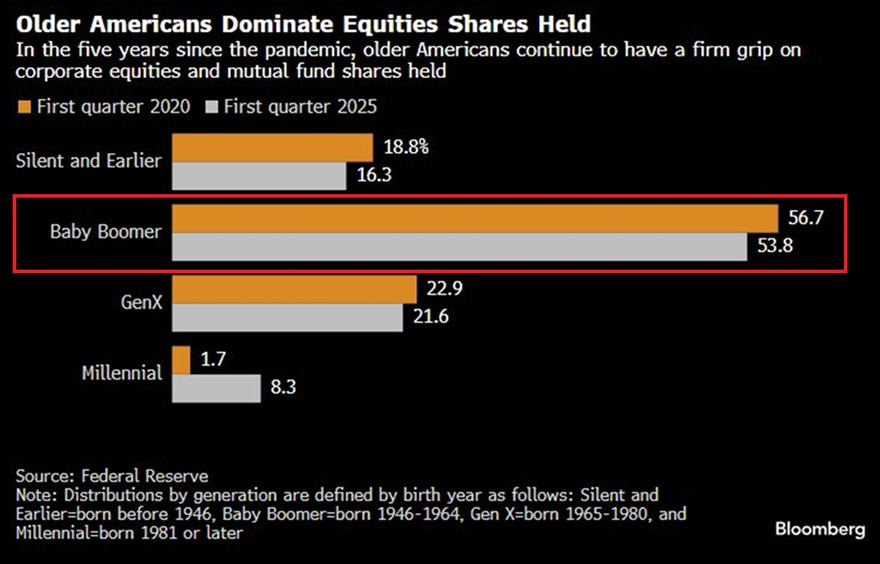

In a situation where crypto fails and everything goes to zero, life would be massively worse across the board. For the next generation this isn’t a speculative asset but a vehicle for outpacing inflation and building a new financial system that doesn’t shove more and more money into the coffers of 50, 60, 70 year olds (hint: they benefit huge from the entire passive bid into the S&P 500, they already own a boatload of shares)

In essence crypto is one of the only ways to dampen the blow of rising prices, stagnant wages and lower opportunity sets. Now onto the maths.

Ladder Pulled Up on Housing?

This is a core problem. If young adults do not see a path towards home ownership it cripples their motivation to work. If you were to talk to the typical American their main goal is home ownership. One house, a nice vacation 1x a year and 2 kids (or dogs in 2025 language). If they think this is no longer attainable… you get the idea.

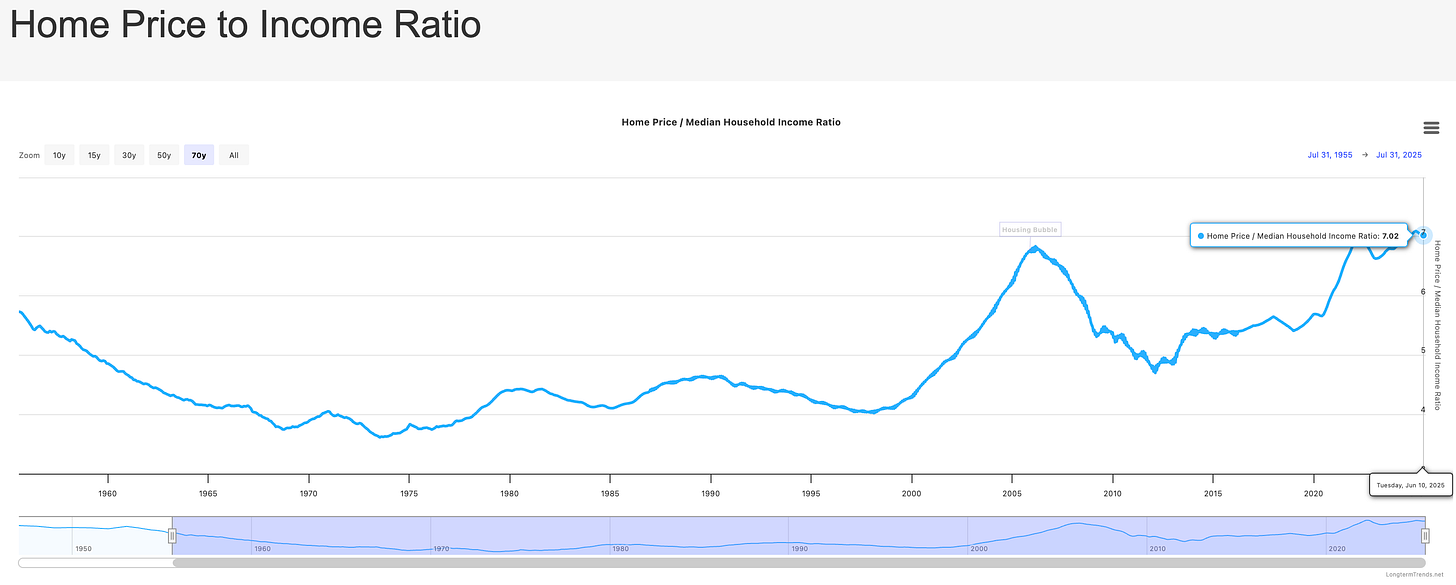

1985 to 2025: Median Income: went from $24K to $83K around +250%. Meanwhile? Median Home: went from $83K to $417K around +400%.

150% is a wide spread. A slow and methodical rug on motivation.

This means the price to income ratio on homes is about 5x.

Compare this to the rule of thumb “3x your income is the home you can buy”

Once again a big spread

This means someone has to earn ~$140,000 per year to afford a typical home at $417,000. Need to come up with a wage increase of 68.6%

Skipping coffee is not going to do it. Sorry frugality guys. The FIRE movement is cooked.

Part 2: Most Realize at 30. Making Decent Money but Treading Water. How?

Take a typical 30 year old. Probably partied a little bit too much. Didn’t go too crazy and still gets promoted looks around and he’s making “six figures” which always means $106,000 or something just over $100,000 so the company can claim he is doing well.

At this point, he’s realizing that partying doesn’t last forever. Having no home base at 40 doesn’t sound appealing. Time to buckle down and aim for that 20% downpayment.

To keep the math simple we’ll just say the home costs slightly more at $450,000. Make $90,000 easier to remember. Add in some closing costs and move in costs/furniture etc. You’re looking at around $95,000 in post tax money.

Traditional Path (No Upside as *you* know, but not the majority)

Since the typical person is not an incredible investor and doesn’t want to risk losing the downpayment, he’ll try to save $10,000 a year. This is doable and 10% is “safe” according to mainstream financial experts. The same experts who think it’s smart to pay off 2.5% mortgage debt (insert chorus of laughter).

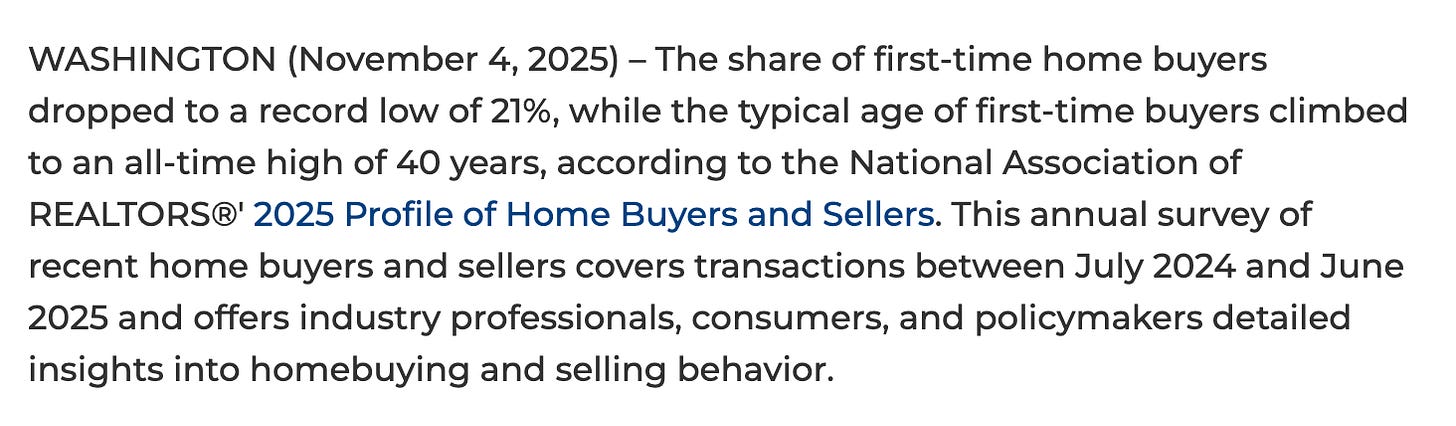

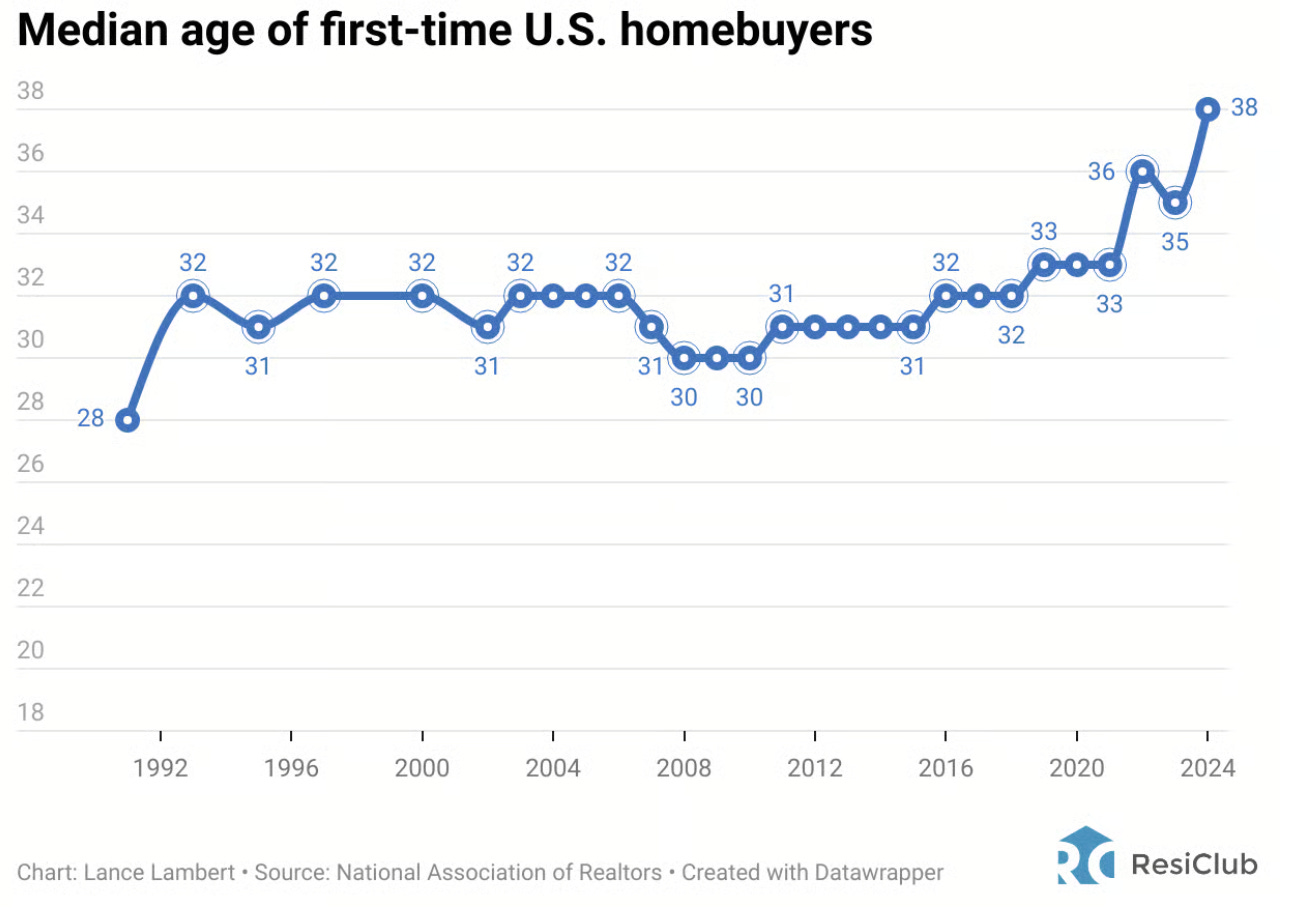

After diligently saving, you’re looking at 7-10 years to get there. Again. 7-10 years. This means the person is about 37-40 years old (median is at 39

What do You Know This Lines Up!

Now you have a good feeling for why most are stagnant. After 15-20 years of doing well, they just now got enough to buy. The average time to afford a house gets elongated. Buying a home at 25, then 30, then 35 and now we’re at 40.

In an Ideal world, the Rough Age Should be 32-33. This rough range is where people still feel motivation to work a W-2 and grind it out. (historical norm below)

Autist Note: This assumes that the prices are not higher in 10 years which is a likely scenario (chasing a moving target that is rising)

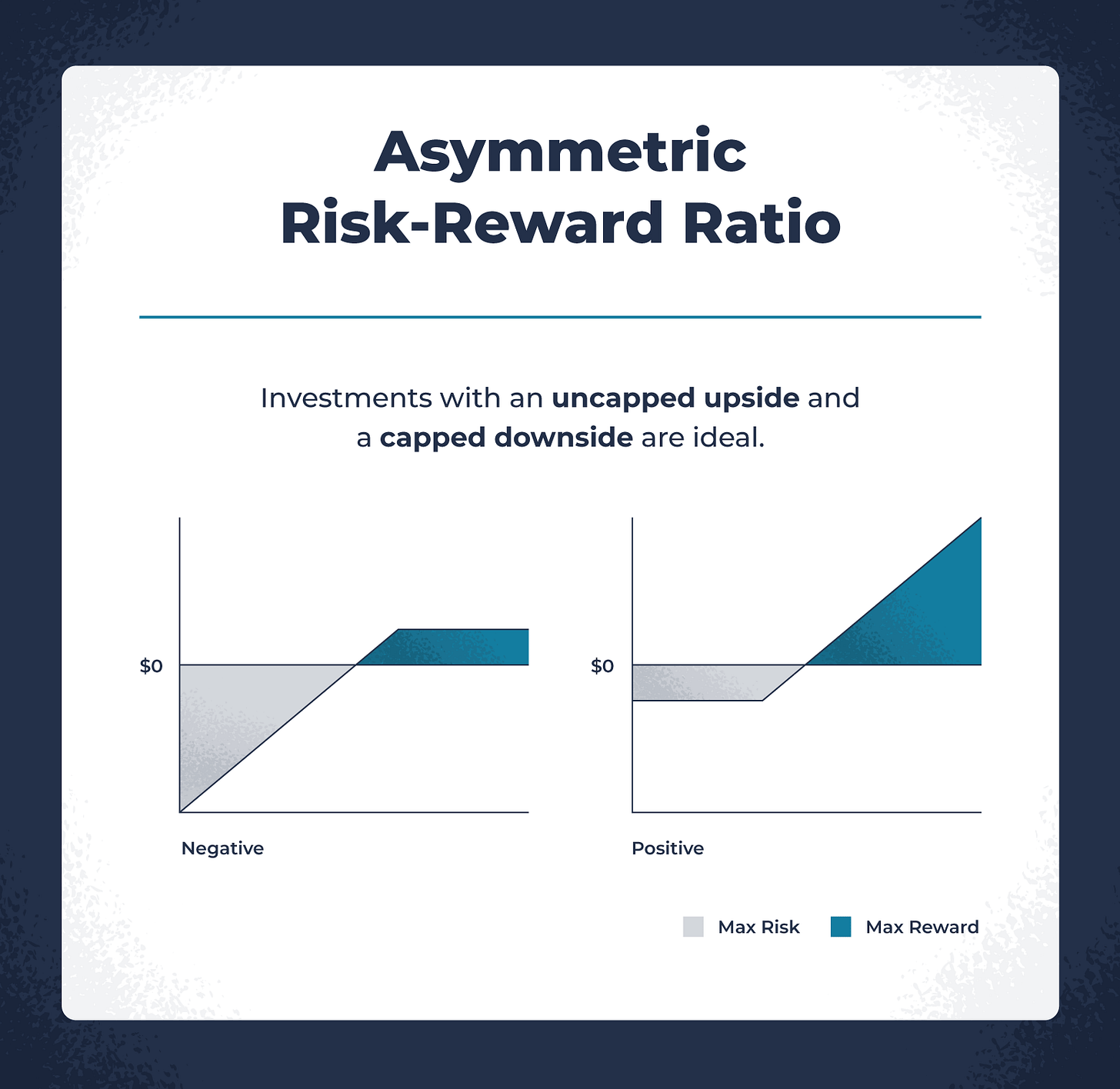

Part 3: Crypto Asymmetry: Bridges the Gap

We’re not going to assume full mania every year. We know a lot of people got burned chasing memes and things like that (no one here we hope). Ignoring those times, if we just look at crypto market cap of large caps and assume 20%, that’s going to be better than stable stocks.

We’ll do the same exercise now. Instead of $10,000 just going into cash/safe stuff, the person utilizes a barbell does $5,000 crypto, $5,000 safe yield at 3-5%.

Rough math over 7 years

Conservative bucket (~5%): ends around $41k (5% with same $417 contribution compound annually)

Crypto bucket (at 20% CAGR): ends around $65K (we did $417 monthly, compound annually)

Total: ~$106k after seven years.

With this small amount, you’re now shaving 3-4 years off of the time to home ownership. In fact, with a couple basic promotions in there and little bit of side hustle income you’re easily going to cut the time in half (5 years instead of 10).

Time is Valuable:

How does buying a house at 35 sound vs. 40? How about 30 instead of 35?

The extra years also allow you wiggle room for life events (deciding to have kids, random medical expense etc.). Majority just give up on the idea of home ownership if their excel sheet spits out 40+ years old.

This isn’t even an extreme example. Saving $417 a month in crypto is not an unbearable number.

There is no guarantee here of course. It is max pain to hold crypto/tech stocks with conviction. Part of the game. No volatility means no upside.

Big Picture: Before crypto all the high risk items were gate-kept. Have to be an accredited investor. Need the right contacts to get on that hot IPO. So on and so forth. It is one of the rare assets that can compound *faster* than stocks/real estate and is *available* to anyone in the world.

Outside of crypto and technology there is a big chasm to asymmetric upside.

Other options with asymmetric upside require intellectual effort and equity building: start a E-com biz, start a scalable SaaS, house flipping etc. None of them are liquid set and forget investments.

A lot of people do not have the guts to start something (not the people who read us but the median/average person). Without crypto? They are just praying for someone to show up. Just explained the explosion of political divide!

Hope and prayer is not a viable strategy.

Part 4. What if BTC Hits $1M and Crypto Wins

You’ve heard it parroted all over the place. If BTC hits $1M and crypto succeeds then society must collapse.

Unlikely.

Gold is an alternative money valued at $28 trillion. Crypto as a whole is $3 trillion. This means we’ve got a 9.33x before it is even considered a major space.

Also. The system has already collapsed for the middle in terms of affordability.

In a world where crypto succeeds and is a $28T+ market cap asset class, it would probably represent an uprooted monetary system.

If you look at it from that perspective you’d get two options:

Crypto at $28 Trillion: Fiat currency constantly printed, debased and asset prices beating wage growth. Hard asset holders (real estate, businesses, crypto) make it to the other side. Younger people would have *outsized* exposure to crypto versus the general population (they are in RE and stocks) which allows them to gain ground.

Crypto fails: The same story plays out. Massive printing (no we’re not paying down $40,000,000,000,000 in debt). However. There is no asymmetric upside vehicle for the people under 40.

All of the gains concentrate in the old-world which pushes the time to ownership out further, another 5, 10 or 15 years.

Which one of these realities do you want to live in? A situation where the entire youth feels disenfranchised or one where there is still a path/hope to get ahead?

Part 5: Spelling Out a World Where Crypto Fails

We’ll go ahead and say it collapses. We really doubt it (we’ll be around the next decade and longer supporting this industry). However. We’ll play the game.

Full-blown collapse of the asset class.

Quick Review

Most young people do not have real estate (check see the average purchase age). They don’t have legacy business equity (stock options at GOOGL are great but 99% of people will likely work for a legacy company with modest stock price changes of 5%).

They have outsized exposure to some tech stocks and crypto. That’s it. Again. *outsized exposure* If someone has $10,000 in crypto and a net worth of $50,000 that is 20%. We can assure you the typical rich boomer with $5-10M does not have $1-2M of crypto.

Buying the Same Stuff that silent/boomers already own $100 Trillion of… isn’t going to close a gap

Assume It is Gone? Now you’re left with stagnant wage growth, buying stocks that the boomers already own millions/billions of and housing continues to outpace the wage increases. No bridge.

This would lead to: 1) less stable society, 2) more apathy/nihilism, 3) political divide and 4) resentment of the older generation. You see a ton of all four during the typical bear markets in crypto.

People Take on Even More Risk

If you think it is dangerous to invest in crypto, imagine what they would be doing without that potential. Isn’t hard to see. People would go into grey market arenas, take excess risk in black markets and others would simply give up entirely and spend every penny (“what’s the point” as the new mantra)

None of these lead to long-term social stability.

You’d be in a world where everyone under 40 is: 1) sick of the system, 2) sees no point in working and 3) resentful of everyone in power. Anyone rich better pony up for private security at that point.

Part 6: Crypto as a Public Good

Its the only asset without gatekeepers. Instead it offers optionality. A new system that doesn’t care where you are, who you know or what your name is.

This type of system isn’t even a sci-fi utopia. It is a *need* in todays socio-economic climate.

If someone is nearing retirement with two houses, a large retirement portfolio and a 6-figure bank balance… they don’t *believe* they need crypto. This is why they don’t invest in it (once again, allowing for asymmetric upside). Crypto is just a new fad that has no relevance to you in the twilight years.

If someone is grinding up the corporate ladder, living as cheap as possible, send 30% of income to rent… They need a realistic asymmetric vehicle. It’s one of the only ways to keep motivation up as prices go up and up and up (even Chipotle is expensive now!)

For those that are still on the fence, it doesn’t mean lever up. It doesn’t mean go all in. It means that an asymmetric upside vehicle is a public good when the current system won’t change (the elite love how the system works currently)

You Need This to Keep Society in Order

Part 7: What Can You Do

Anyone under 40 who finds this website is going to understand the concept here. You know that index funds are not going to make a dent (treading water) and you know that salaries are not going to miraculously spike up (especially with AI/automation).

Instead you create convexity and help tech/crypto succeed.

Crypto as a Skill: Every year there is something new. It isn’t on a daily basis and if it was that’s a sign of mania (2017/2021 etc.) Instead view crypto as a skillset. Remain educated on what new items are coming out, how launches work etc. This prevents you from playing catch up asking dated things like “what’s a bridge”.

If you’re in your 20s, definitely would set a basic forced monthly buy as well. Older people have to worry more about portoflio/risk management in cycles. Younger people should be too busy building…

Building Up Cash Flows: That W-2 will never pay you what your worth. You know it since you can read a basic P&L. Instead keep building cash flows up and slice off a chunk for crypto/tech with each profitable month. Instead of lifestyle inflation, you’re going to play the game of portfolio inflation. The buys for crypto and tech just go up.

Secure the Castle: The goal is to bring forward the time it takes to buy your home base. The vast majority see a huge lift in stress if they own 1/2 of their home. If you want proof of this look at all the upper middle and wealthier areas. New buyers do the classic 50/50 approach of cash/debt. (True luxury is cash as well but the newer entrants do 50/50). That’s your initial goal. You’re not trying to catch a 1,000x runner on $1,000 to “make it in one trade”. The only people who made it like that were celebrities and political scammers.

Ignore Crypto Doomers: Similar to TSLAQ the bears always get loud when prices go down. If you zoom out, they just end up in a graveyard. The old guard simply doesn’t want a path for excess gains as they view the up and coming people as competition.

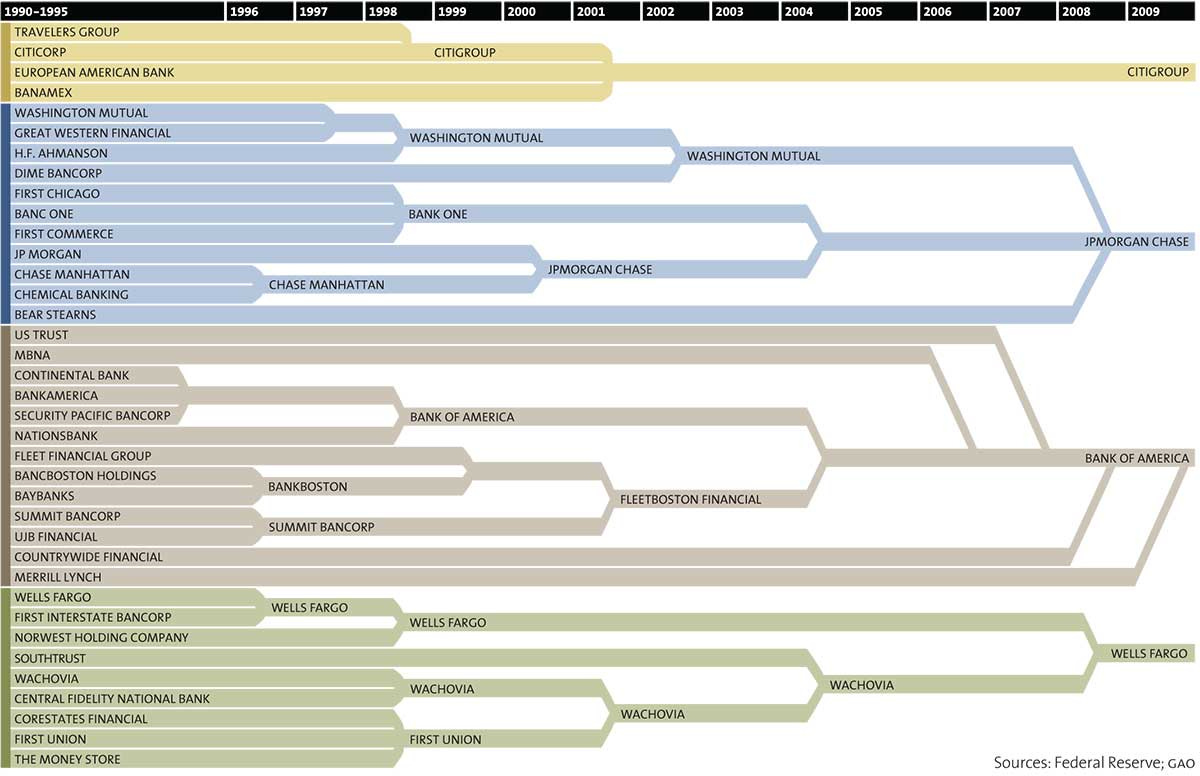

Less Risky Than You Think? The real risk (for society) is that crypto fails and we have a monopoly of banking cartels and 5-7 tech companies who know your keystrokes in real time. A dystopian controlled Truman Show.

If you think this is farfetched, just look at how fast the banks are consolidating and revisit what happened during the 2022 leveraged blow ups (first republic etc.)

Summary

Over the past decade assets have outpaced inflation while wages were stagnant. This is structural due to AI/software and continued global competition. Without a asymmetric upside asset, there are limited ways to keep the youth motivated.

If the industry fails the current socioeconomic division is locked in. The owners of all the value today will be the owners of all the value 10, 20 and 40 years from now. The old guard will say “work harder, make coffee at home” but the math will tell you the truth.

The disaster social scenario is crypto failing. Despite what the media is attempting to tell you.

Sounds much more dystopian to us.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

How ETH is Staked: Covered (here)

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money