Patrick Stanley (ex-Head of Growth STX) and Wealth Calculations

Level 2 - Value Investor

Welcome Avatar! Many of you have asked about developments related to STX so we’re happy to have Patrick Stanley (who is the Community Lead for City Coins - LINK). Before jumping in, we’re putting this disclosure up front.

Yes, we’re involved with STX and no we’re not involved with MiamiCoin/CityCoin. Paid Subscribers see our buys and sells (in real time) with time stamps of both the winners *and* the losers. Unlike Griptoe Tweeter, we do get things wrong and are happy to leave them up there since it is fair (LINK).

There are two sections here: 1) entirely written by Patrick and 2) a section on wealth/net worth calculations to remove a lot of the negativity we’ve seen since the prices of crypto assets have gone up.

How Crypto Can Accelerate Cities

Cities can prosper in new ways using technology to activate a citizenry with no borders

By Patrick Stanley (LINK), CityCoins Community Lead

TLDR on MiamiCoin (MIA) for context: All Startup Cities are going to have their own city-based token. MiamiCoin (MIA) is a new programmable governance token for a real city. It has raised almost $4M for Miami in just 31 days (no pre-mine, or ICO). The more it’s used, the more STX and BTC it generates for the City of Miami and those who Stack MIA in a 30/70 split respectively. I’m mining it because I’m bullish on Miami leadership. Holders of MIA are committed to their city. Buyers are bullish on city leaders (Suarez). Sellers are bearish on city leadership. Developers are now creating apps for their city.

Overview: “Think globally, act locally” urges us to consider the bigger picture, and to take actions within our communities to affect it. But with the way our world works today, the former feels much easier than the latter. There’s a disconnect between cities and the citizens they serve, and it’s growing wider every day.

The way residents and local officials communicate is antiquated and utterly removed from how we actually live our lives. People mostly orchestrate their day-to-day lives on their devices––it’s how we get our food and supplies, get around, communicate, entertain ourselves, and work. So how can it be that the best way to get involved in your city is to attend interminable, ineffectual local government meetings? With work, family, and other responsibilities, who has the time? This complete lack of modern, tech-based feedback loops between residents and officials means decisions are made with almost zero input from the communities they're meant to serve.

If we use technology in nearly every aspect of our lives, why shouldn’t we use tech as the primary means for civic engagement? How do you use technology to promote civic engagement that’s driven not by obligation, but by opportunity?

The Rise of Startup Cities

Just like companies, modern cities are competing for talent––the “talent” here being people who move to the city and create value and jobs, or new employees who move to the city to fill those jobs. Together they help build a robust economy.

The past 18 months made remote work the default, and workers certainly aren’t going back. No longer pinned to geography by a job, people can live anywhere. The adoption of remote-first gave people the chance to try out new cities and reconsider how well their local government worked, and decide whether they should try to fix it or not.

Savvy mayors will take advantage of this transition by treating their cities like startups and doubling down on recruiting the best talent––the newly mobile legions of smart, prosperous information workers. Some, like Mayor Francis Suarez of Miami, already are.

If you’re an innovator, Mayor Suarez wants you. He’s been incredibly successful at “recruiting” new talent to his city— in Q2 of 2021, Miami ranked #1 for growth in tech jobs in the US. Through enticing tax rates and other business-friendly policies––not to mention the beaches and palm trees––Suarez is welcoming companies and talents to Miami, a Silicon Beach to rival the Valley.

Startup cities like Miami are reimagining the role of municipal governments. Officials become allocators of capital, accountable to a market for good decision-making.

Today people can choose their city just like any other product. And the rise of startup cities empowers other innovations, too.

The emergence of the “CEO of the City”

Suarez is pioneering a new model for mayor: “CEO of the City,” a term coined by Balaji Srinivasan.

In the Twitter era, Miami’s Mayor Suarez has given us a masterclass on how to get the most out of this model. First, he’s being active and transparent on Twitter, championing his city directly to hundreds of thousands of followers worldwide every day. Mayors used to have to look within city lines for support. Today they can look beyond borders and garner support from any corner of the globe.

Second, he’s competing aggressively to draw talent to his city, making it an irresistible place for companies and innovators to set up shop.

Third, he’s leveraging emerging technologies like crypto on his city’s behalf.

Every Startup City will have a City-based Token

By building new decentralized systems for civic engagement, startup cities can introduce a more equitable dynamic where citizens can be both the customers—beneficiaries of the city’s services and resources—and stakeholders who can benefit from a city’s growth and success.

By leveraging decentralized technology to create city-based tokens, cities can introduce new ways their citizens— both new and old— and supporters everywhere to combine efforts, accelerate local growth, and create a more positive-sum dynamic between local governments and those they govern.

How? City-based tokens are programmable, decentralized, and applicable to a wide range of use cases. One use case we’re particularly excited about is using city-based tokens to unlock novel ways that a community can organize to better itself.

While this might strike some as a far-off idea, some cities are already laying the foundation for how city-based currencies could accelerate their local economies.

Let’s look again at Miami. A city mid-renaissance, driven by a freshly untethered workforce and a leader who’s rewriting the playbook for leading government in the Internet age.

Miami is exploring different ways to leverage crypto markets, mostly notably with its recent support for MiamiCoin, a programmable token built on Bitcoin via Stacks that generates earnings in both for its holders. MiamiCoin fuels additional revenue for the city and accelerates open-source development of apps and utilities that directly benefit Miami.

Just as every tech company has a tech stack and cap table, every “Startup City” will have a city-based token.

Using Crypto to Evolve Civic Engagement

Historically, citizens have had two levers to influence municipal policy. The first is to vote with your ballot, hopefully placing the people you want in power. The second is to vote with your feet — If you don’t like how your city is being run, move somewhere else.

City-based tokens open up a third: voting with your crypto.

Below are just a handful of ways a community could leverage city-based currencies. As with any emerging technology, we know these principles can and will be applied in ways we can’t anticipate right now.

Financial Incentives: There are many reasons local organizations might offer benefits and incentives tied to city-based currencies, such as rewarding citizens––both new and lifelong residents––for participating in the local economy and injecting more capital to build a better community.

Some possibilities:

- Grants or collateralized loans to attract new businesses and founders, stimulating

the growth of new industries.

- Crowdfunding for local services such as maintenance needs (imagine payments

that are made in city-based tokens that will be locked in an app until the job is done, then distributed to the service provider).

Community Governance: City-based tokens can be used for capital voting, enabling token holders to vote on proposals. For instance:

o Users could delegate their tokens (without losing them) to help modernize their communities by funding new initiatives, such as free WiFi or new solar panel installations.

o Communities from different cities can pool their tokens to propose and vote on regional initiatives and projects.

Access Controls: City-based tokens could grant and control access rights to certain digital or physical spaces and services. Communities can design apps for token holders to use. They can also create new services that replace or enhance existing services offered by third-party businesses or funded by local governments. Some examples include:

o Establish a “Proof of HODL”—login credential for certain physical and digital spaces and events. One could imagine accessing wifi at select cafes by signing in with keys that hold a balance.

o Create a decentralized global network of WeWork-style co-working/living spaces that requires city-based tokens to access.

o Integrate tipping into local transportation apps (i.e. Uber or CitiBikes, or even creating a community-run Uber-like application with its own transparent and inalterable reputation and dispatch system).

Crypto can empower community

These ideas are just the tip of the iceberg. City-based currencies can give communities a voice by allowing them to vote on new initiatives and signal their support or disapproval on how their cities are being run. At the same time, creators are empowered to modernize their cities in a

way that prioritizes residents. It’s these kinds of exciting ideas that brought me to the Bitcoin community.

It can often feel futile for ordinary citizens to make a tangible difference in their cities, but everyone should have the opportunity to make an impact. The idea for city-based currencies is highly ambitious, altruistic, and is nothing short of revolutionizing the possibilities for civic engagement.

Quick Note from BTB: While there are no guarantees in life we think Countries/Cities begin competing for citizens. This lines up with our long-term belief in the Sovereign Individual. Governments compete for citizens.

This is an inverted world view and is likely the future (multi-year time frame). If we look at something like CityCoins it is effectively a “step in that direction”.

The Mayor of Miami has done a tremendous job when it comes to attracting talent (that is visibly evident from 2020). That said, this is a brand new concept/idea and we’ll have to see how it plays out over the next couple of years.

Calculating Net Worth and Staying Focused

One of the big issues in Crypto and Technology investing? Getting sucked into “comparisons” with other people. In the end, you were lucky enough to be born. If you were born in a First World Country you were given the best possible result in “Country Roulette”. If you were born in a war entangled country, you never got a fair shot.

Mental Damage in Crypto/Tech: This is a normal part of being early in an innovation cycle. The “crypto market” is essentially real-time pricing of brand new companies with no roadmap or revenue. In a sentence, you’re witnessing VC/seed investments trade as public 24/7 assets. Queue Molotov Cocktail for volatility.

This means new information is suddenly priced in (good or bad). It means that tons of worthless projects are funded and you get to watch them live. It also means that people will suddenly become rich as they invested in the “first round” of a project that goes vertical within a short period of time.

Pause and Look at the Big Picture: Life is a big Video Game. If you take it too seriously you stress out and underperform. If you continue to practice and “level up” you’re going to get better over time (by definition). Do your best to compare yourself to your prior self every ~3-5 years (1 year is too short and 10-years is too long).

Once you get into this habit, instead of worrying about what other people are “worth” focus inward on the bigger picture as it relates to finances. “How much do *you need* to feel comfortable”. It does not matter if people disagree with your level of wealth. It does not matter if your city is “prestigious” (we all saw how that ended for prestigious expensive cities in 2020). Instead, take a long hard look at what would make you feel comfortable.

Once you have that in mind, move onto step two. Step two is where you begin calculating your “worth” in terms of years spent. Notice. This *does not* have any financial metrics. It is based on your own personal interests.

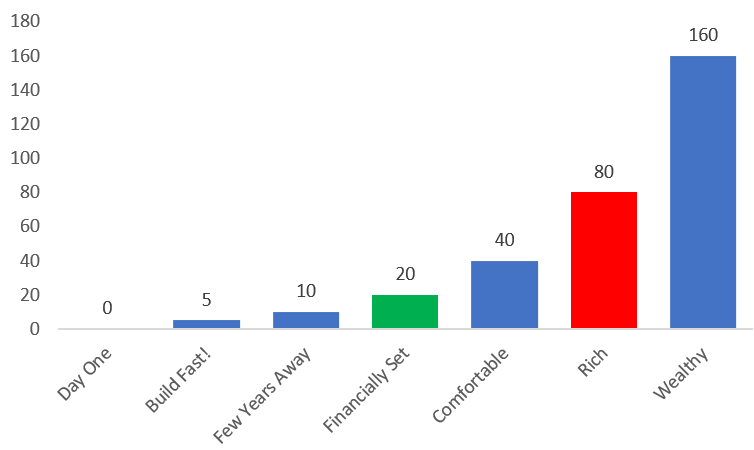

Rough way to think about how *close* you are (Years of Living Expense Saved)

This is probably he easiest way to think about your future. As soon as you have around 20x your annual spending, it is impossible to go broke. Why? If you’re reading this you’re already an intense person with a background in tech, finance or sales based on our readership.

This means you’re blessed and cursed with a need to “do something”. You will always earn enough money to cover living expenses. If you take a year off you’re still set since you have 20x annual spending which is practically impossible to deplete.

The second thing that should stand out from this concept is the lack of $ signs. It just doesn’t matter. If you’re truly happy with say 1.2 BTC or 2.4 BTC spending ability per year, you’re good to go at ~24 or ~48 BTC. The amount you want to spend per year is none of our business. Autist note: people force us to put numbers out there and we’d say that there is limited “utility” past 0.2 BTC per month. If you get to a point where you can spend a whole BTC per month you’re way beyond wealthy/rich and the only thing “left” is really a private jet (which no one needs to be happy). Fortunately, we’re unemployed and homeless which helps this ratio quite a bit!

Continue to Focus on the Future: The past doesn’t exist and the present is just a snapshot in time (like a balance sheet, it doesn’t show you the future growth of the income statement). If you look at where the innovation is going it is going into Tech! Surprise surprise! Anyone who has used a DEX is probably in the top 1% in terms of technology understanding. That is how early we are.

Take a minute and look at what you really enjoy doing (none of our business) and we’d wager that your comfort level will be achieved a lot faster than you think. In 2021, most people are miserable and unhappy (living lives of quiet desperation). By simply being happy with your life you’re once again in the top 1%. Congrats!

Now we can all get back to collecting computer coins.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are opinions written by an anonymous group of Ex-Wall Street Tech Bankers who moved into affiliate marketing and e-commerce.

Daily Reminder: You ARE EARLY. Too much negativity/cope. Everyone reading this is extremely early. We’ll probably include this every post for the next 12 months or so!

Hackathon for Miami Coin Occurring.

https://www.eventbrite.com/e/miamicoin-makers-month-tickets-166707341145

Using a DEX puts you in top 1% technology understanding stuck out the most to me.

If the average person knew the power of this (simply staking Sushi for xSushi and earning 5-10% on an appreciating asset) then prices would be exponentially higher than they are.

Putting it into that perspective definitely helps the people who feel “they are late”.

It’s quite literally is simple and when people realize they can beat the S&P 500 with a couple clicks, anyone will any type of crypto bag will accelerate NW in ways never seen before.