Rich and Poor Divide Acceleration: Which Side Do *You* Want to Be On

Level 2 - Value Investor

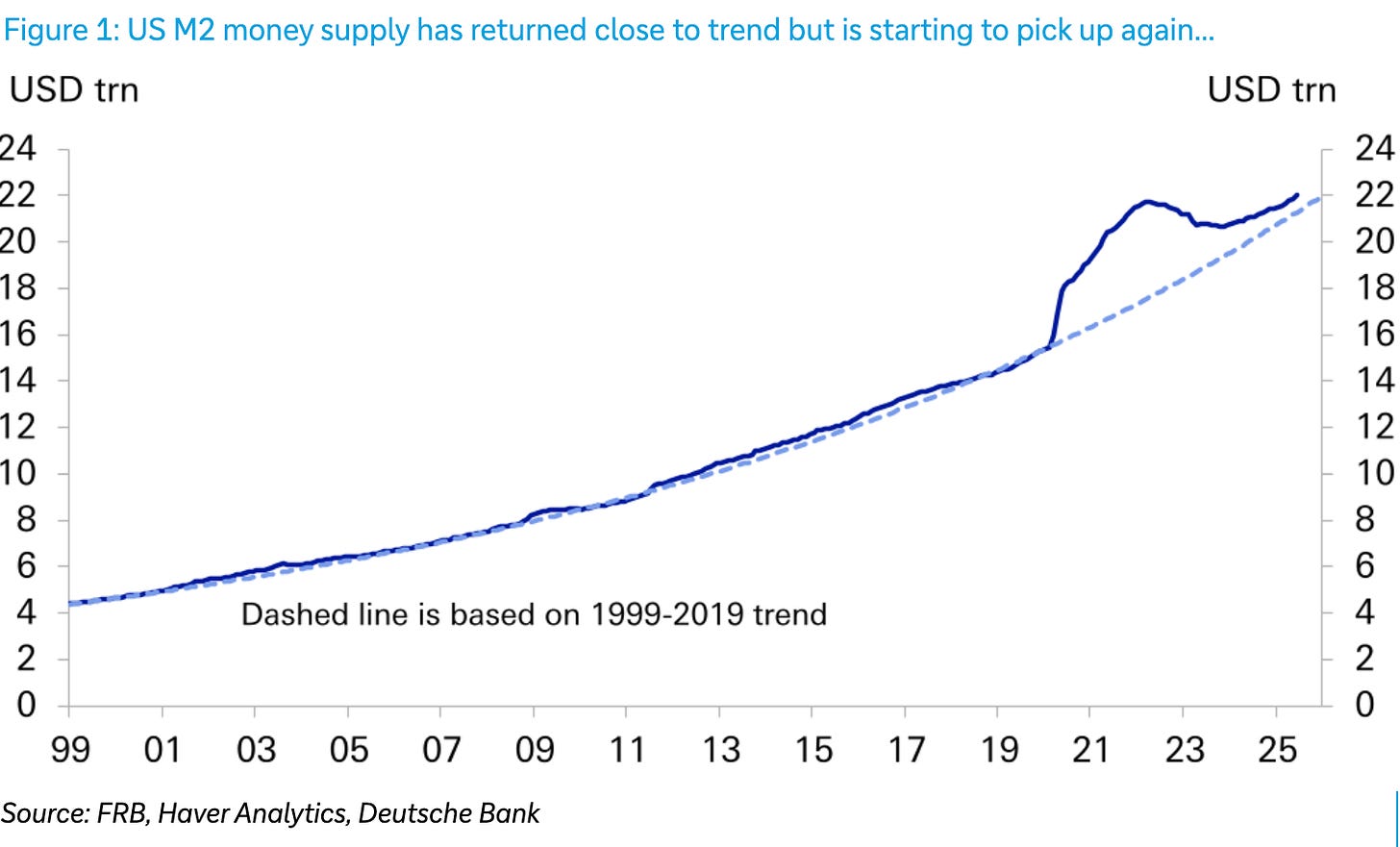

Welcome Avatar! New 50-year loan products are coming. Trump is looking at stimmies again. The Fed is ending Quantitative Tightening. The Fed is lowering rates. All of this means? The goal is to continue inflating the money supply.

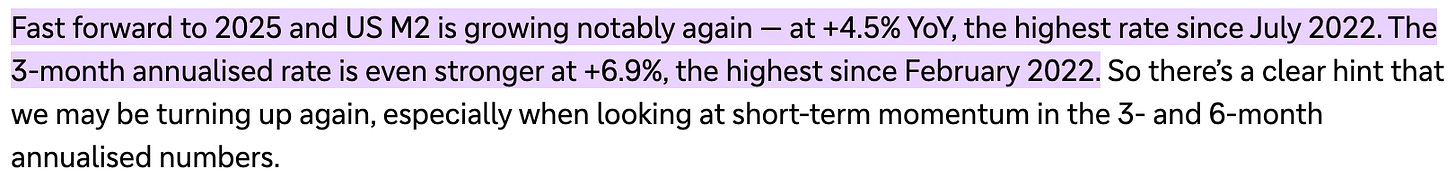

If you want more proof of the wealth divide, just check out the appreciation of luxury real estate vs. a standard home. They are going up roughly 2x as fast. If a standard home is $400K and a Luxury home is $1.26M this means the difference is $24K vs. $138.6K. The middle is significantly further away from the wealthy in home equity.

The divide between asset owners and everyone else is getting wider. Here we’ll highlight new data proving this out (opinions are worthless without data), explain why betting on ourself is the only logical conclusion in 2025 and how inflation is no longer becomes a concern as a business owner.

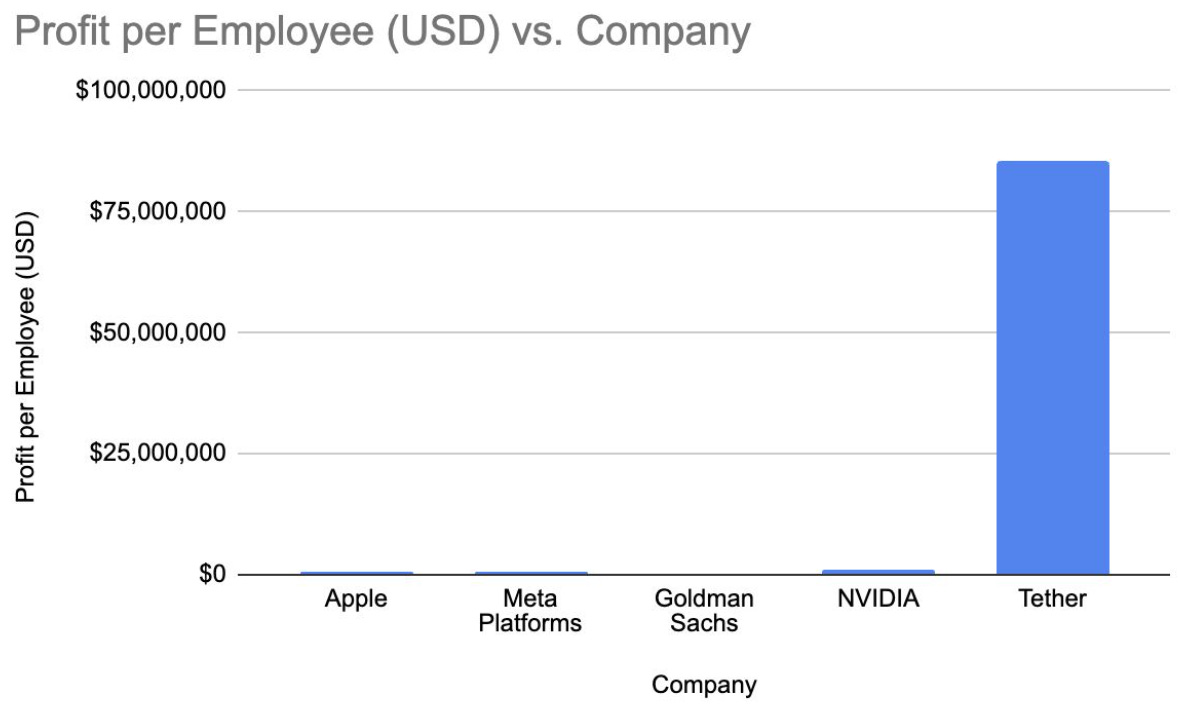

If you feel like the life path you were sold doesn’t work anymore… you’re right. It is a relic of the past. Much like headcount being a flex during the industrial revolution. The real flex is different in 2025. It is profit/person, ownership percent of a niche business and how much of your time is in your control.

Proof: America’s Wealth Is Concentrating At The Top

The top 1% is driving practically everything. They are buying more stuff, investing in everything and generating too much income to spend (and they spend a lot!).

Top 1% vs. Bottom 50%

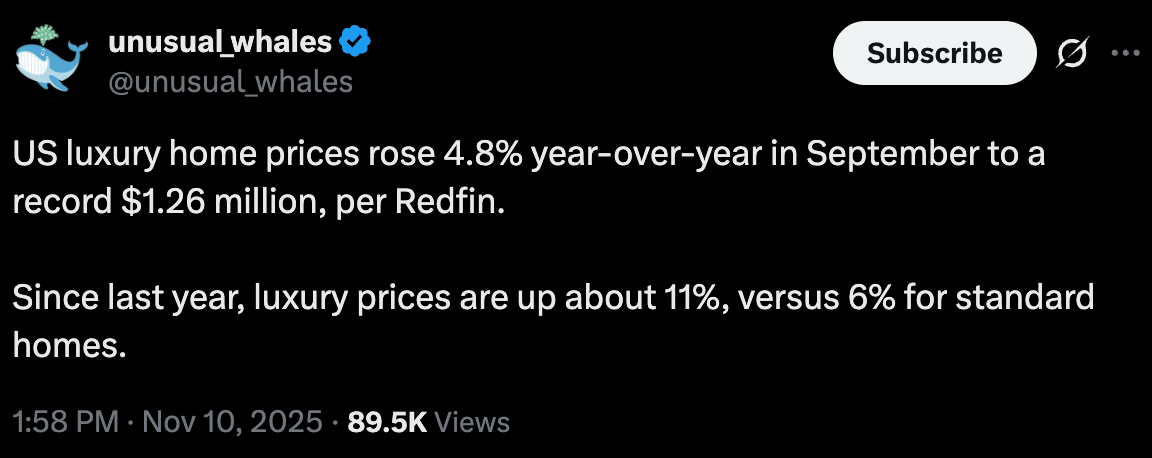

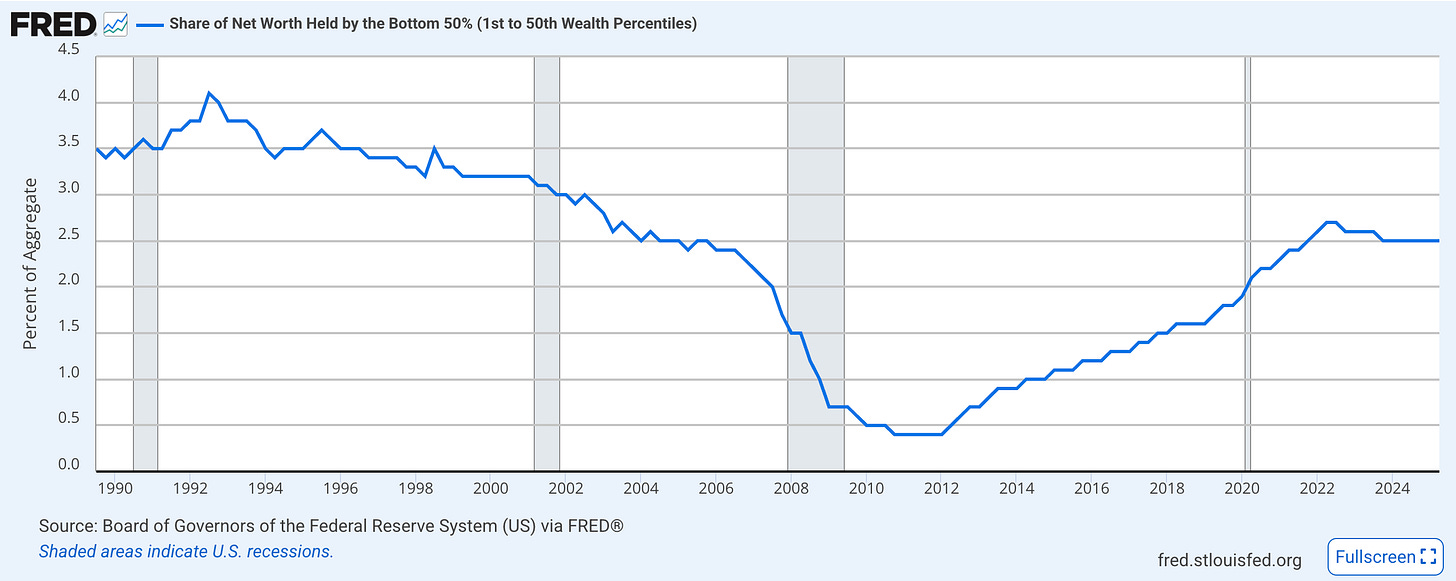

The Fed shows that the Top 1% now control ~31% of all household net worth (up significantly since 1989). Doesn’t matter who is the face of the USA (President), it’s a mathematical calculation

You see those recessions? Yep, paper losses. It just goes right back up when the market recovers since rich people never have to sell.

The bottom 50% is max pain. You’re better off taking absurd risk at this level since it’s not going to make a difference if you have $10K to your name or $15K. The bottom half is stuck at <3% of all wealth. The top 1% owns more than the entire bottom 50%. By a factor of over 10x

Important thing to learn here? See that massive drop during the housing crisis? Now you understand why the government will find any possible way to keep it propped up: 1) they know the majority of people hold their wealth in a home and 2) need that property tax money to fund the government. Property prices dropping means less tax revenue for them, a big no.

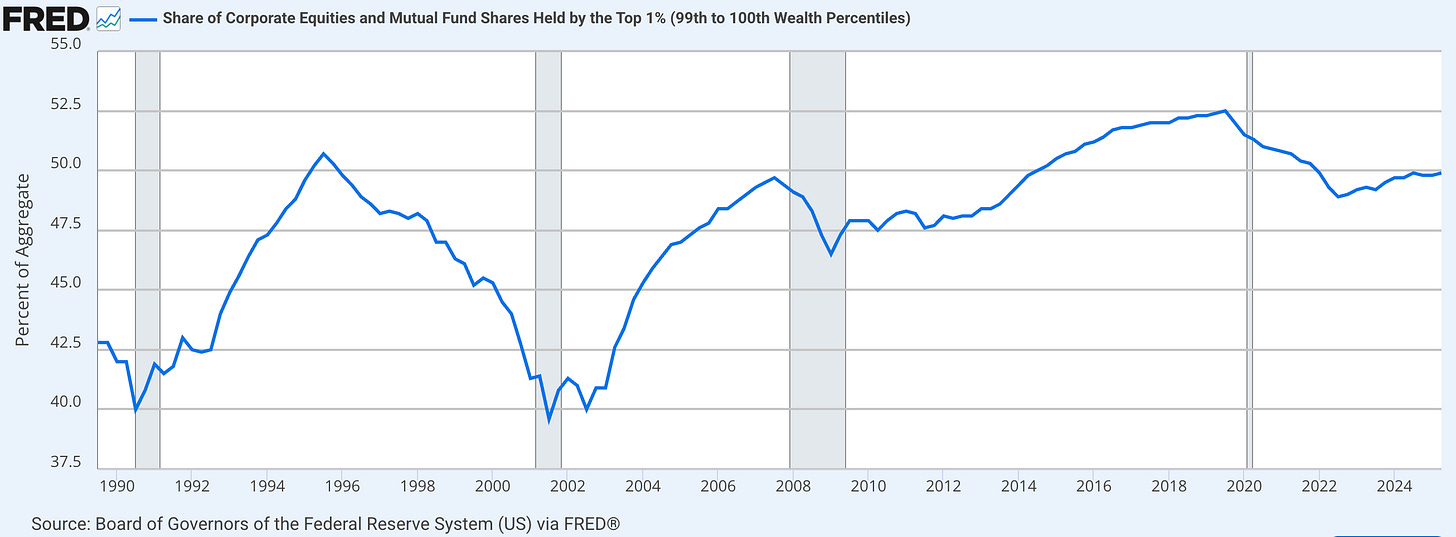

How About Stocks?

Now we can look at the stock market. We see the same picture again. About half of all stock ownership is held by the top 1%. Read that again. The top 1% owns half the market.

If you wonder why NPCs don’t care about stocks, now you know why. From the above graph you can deduce they only own some real estate and that’s about it. No stocks.

Wage vs. Owner Math

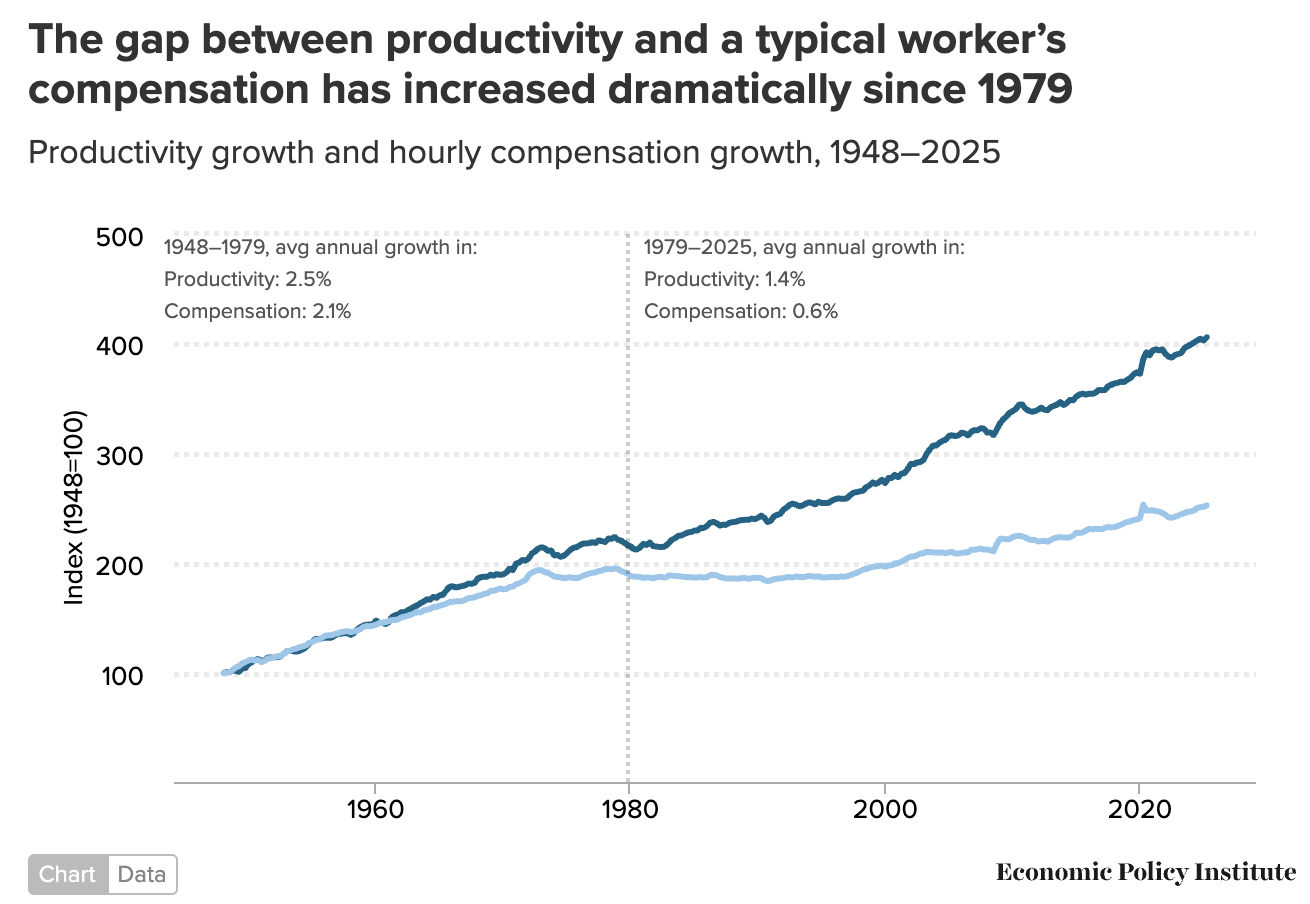

Pay and productivity decoupled decades ago. In the industrial revolution, there was immense demand for labor allowing people to job hop rapidly for big increases in pay. No different from the big money years on Wall St. where it was normal to jump ship every 1-2 years. All of that has changed. Productivity is rising while typical worker pay is not.

We’ll give out the easiest explainer: technology makes it easier to replace the person. Productivity was rising because you simply handed the same tech tools to someone else. That someone else generated the same performance. Guess what that means? No reason to give the person a raise.

In our opinion the gap is only going to widen. Doomers and life’s losers will see this as a negative. It is a huge positive for *YOU*. It means advanced technology will make you as capable as someone with 15-20+ years of experience.

We won’t be surprised to see a larger and larger gap develop over time. Productivity will boom because people like yourself can build 8-figure businesses without a massive head count. Tether is a prime example of leveraging new technology to maximize profit per employee.

(source)

Simple Conclusion: If we know that compensation is increasing slower than productivity, who is getting the spread? The answer is owners, share holders, equity, insert any word for “asset holders”. As companies become more productive and labor becomes cheaper due to AI, robots etc. It means the owners of the assets (capital allocators) are the winners. Capital is beating labor by a wide margin.

Houses

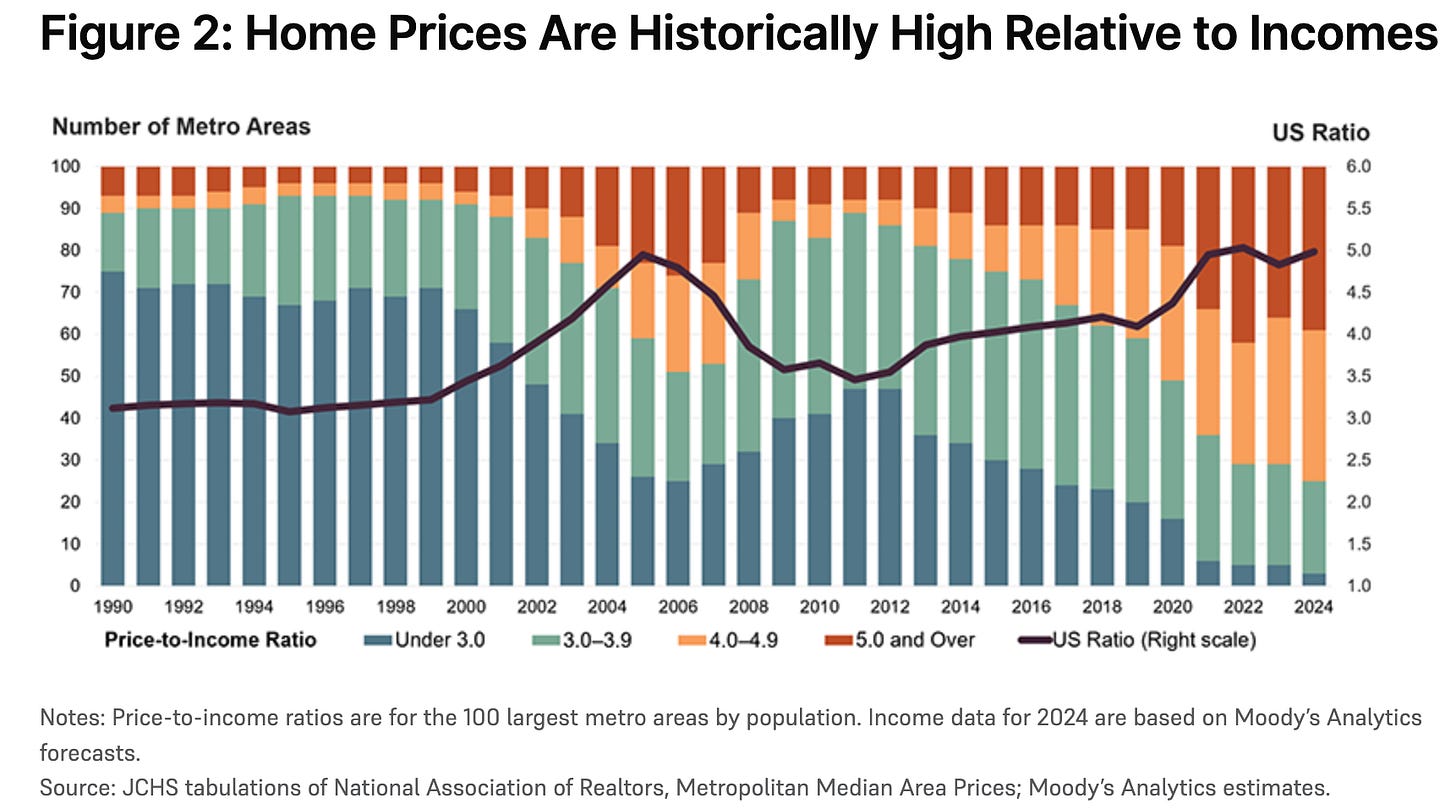

Instead of belaboring the same point related to luxury properties, we’re going to look at the median. The crazy part? Even the median home (despite underperforming luxury by a wide margin) is outpacing income.

(source)

This is the new scoreboard.

If you’re calculating net worth based on dollars/US Tokens instead of actual assets? You’re cooked. You should view your net worth in: 1) total homes you could buy, 2) total shares of S&P/QQQ, 3) BTC/ETH and 4) anything else that goes up with inflation - even Spiderman Comic books would be a better proxy.

Don’t fall into the trap of net worth in dollars, track your net worth based on assets you own and could buy. “I am worth 2 houses” is better than “I am worth $820,000”.

Self-Ownership Is The Durable Edge

School does a great job of making W-2 income feel safe. It isn’t but we’ll go ahead and use that as the framework. We were young and naive at one point as well. Thinking hard work, effort and results would lead to swift promotions and big pay raises (laughably wrong): Being easily employable makes you *feel* safe. Liquid wealth reduces anxiety a bit “I could survive X years”. However. Ownership is true wealth and freedom. Earning while you sleep. No alarm clock.

The end state? You want to create the product/asset. Then you want to own the production line if you can. Then you want to acquire as many assets as possible Then your assets make enough for you to do whatever you like with your time.

Owners Capital Is Step 1

Everyone loves to skip step 1 because it is the hardest. Building up your first small business while everyone laughs and says “how is your little project going”. Takes a couple failures and practically no one has the guts to eat glass for 3 years.

A lean service business, an agency with trackable KPIs, a SaaS, a niche e-com brand, a data product, an education product. Your goal is profitability with high LTV of customer. This allows your ad spend to decline (word of mouth does the heavy lifting) and you become even more profitable (you can see how this cycle works in your favor if you think long term)

Stick with: 1) High contribution margins, gives you room for error. 2) Repeat purchases, 3) Low working capital and sales cycle - allows for fast cash flow and 4) consistent demand - no fad products

No Concentration No Wealth

Most NPCs just think about going all in on one stock. That’s how they think of investing. Just a lotto ticket where they dump everything into one company/coin and make it. There is an ocean full of failures with that strategy and a handful of people who get to the top with limited skills/effort.

You already know that you can’t outrun inflation with wage growth from your employer. Therefore? You need to own a large chunk of your entity. No VCs taking huge chunks, no fund raising. You will eat the $5,000 in ad costs yourself to test demand and figure it out until you’re in the green. There is no need to go on Shark Tank.

As your business grows, your net worth gets concentrated into an asset you control. Go look at the Forbes rich list. All of them are business owners from, you guessed it, concentration of wealth because their companies grew and grew.

Build a Money Printer

The Fed has a money printer. Guess what a profitable ad is? A money printer.

If an ad costs $10 to run but makes you over $20… how much advertising should you run? The answer is Billions if possible. You’re doubling your money in this machine. You put in a $10 bill it give you back a $20 bill.

The great irony of eating glass for 3 years to make it? You learn that working harder doesn’t even make you more money! The only reason you’re making money in the first place is because you’ve created a repeatable system: standard operating procedures (SOP), automation, contractor list, dashboards and cash/inventory management.

You learn that if you must be involved to generate revenue at all times, you just created another job. If you are making money without being there, that is a business. A system that generates money.

Why You Can Bet on More Money Printing - Inflation

Politicians know the tax code better than anyone. They created this massive clown car system in the first place. They play all the games the rich people do. They own houses. They depreciate the asset, they use 1031 exchanges, they borrow against assets to avoid capital gains taxes… so on and so forth. They don’t want prices to go down over the long-term because that would make them poorer and closer to *gasps* being one of the masses they control.

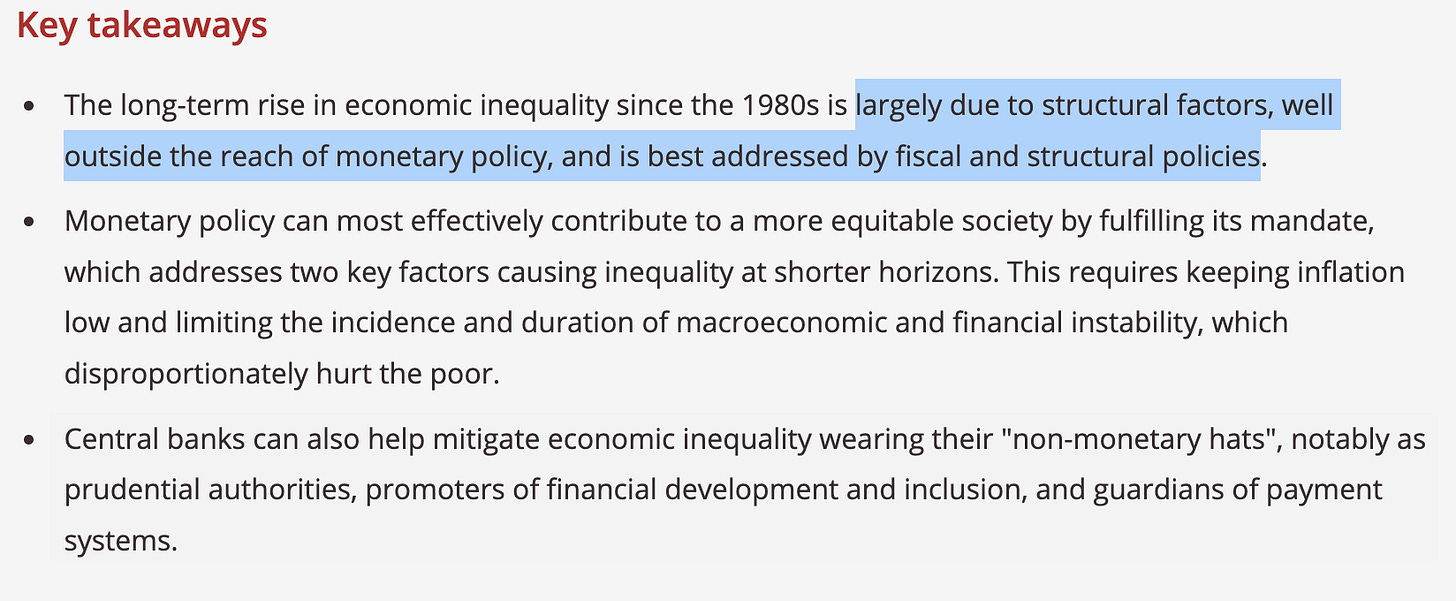

Inflation disproportionately impacts lower income people. If someone is living paycheck to paycheck, prices going up = credit card debt. If someone is rich? Prices going up means they got richer. All their assets went up so it doesn’t matter to them.

In 2021… They actually said the quiet part out loud. The BIS actually came out and recognized that inflation benefits asset holders and people with access to cheap debt (again asset holders would have access to cheap debt since they would get lower rates based on their large assets)

Tech Creates Much of the Same: As AI makes the divide bigger, populism will rise. Socialism is becoming more popular as well (look at NYC). To fight this off, they will print money and simply give people enough money to live (robot tax, wealth tax, anything to transfer money to the bottom 50%). The government is not foolish enough to let the median person starve while the top 0.1% lives on a yacht with 700 condos in NYC.

Over the past 3-4 years or so wages are also lagging consumer prices. This is causing real change to purchasing power for the consumer (substitute goods on the rise!)

Major Key Point: If acquire the things inflation lifts (stocks, real estate, productive businesses), you can ride the wave. If you sell your time, you’re buying those assets later at higher prices with diluted purchasing power.

30-Day Plan

Week 1: Pick your sector (SaaS, E-com etc.) and define a Single Offer (one problem, one solution). Open a separate business account.

Week 2: Start selling immediately. No friends. No Family. Test those ads, bang on those doors, whatever it takes based on your industry.

Week 3-4: Over-deliver and document. Follow up with every single sale and make sure your product is above and beyond. Get feedback to improve it and if possible look for new markets (new problem, new solution)

Repeat Week 2-4 over and over again.

You’ll be surprised at how fast two things happen: 1) you learn the idea wasn’t that great and time to go to the next and 2) how fast things come in if you’ve hit the right product and niche. You’ll find that your real issue is filling demand vs. getting it.

Goal is to Change the Way You Think

You will chase simplicity. Multi-tasking just means lack of priorities. You need a simple system to repeat over and over again.

You learn that the system is what needs to run smoothly. More hours in means you are *losing* money because you don’t have time to improve the system.

Don’t waste time asking “if the demand is there”. It only costs a few thousand to find out. In the bigger picture it won’t negatively impact your life.

Once you see that it is possible (the first sale is the biggest dopamine hit you will ever have), you’ll instantly realize that being an owner is the only viable lever in 2025 and beyond.

No one is coming to save you. No boss. No politician. No billionaire philanthropist.

The good news? By utilizing technology and understanding where we’re heading, you can own the engine, the assets and become time rich (control of your time).

Within ~3 years you’ll be making more than enough to ignore macro talking points.

On that note, on Wednesday for Paid Subs we will be going over the substitute market in 2025 and beyond.

The consumer is largely tapped and we’ve given out the luxury/upper middle to target on the paid side already. Will be going downstream and highlighting where consumers likely take their dollars.

Lets be honest, they won’t be reading this or spinning up a WiFi biz any time soon. They’ll waste their next paycheck on some sports parlay where the player throws the game and they lose.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

How ETH is Staked: Covered (here)

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money