Second Passport and Sovereign Individual Strategies

Level 2 - Value Investor

Welcome Avatar! Some of the stuff we’re working on in the background do not apply to everyone. That said, it may not be of importance to you *today* but that does not suggest it will always be the case.

The general premise of the Sovereign Individual is that countries will compete for talented people over time. Historically, the USA has been the biggest beneficiary of “brain drain” from other countries. We’re not going to drink the Kool-Aid and tell you that is going to happen today or tomorrow. Instead this is going to act as a quick overview of *options*.

If you don’t know what the world looks like in 5-10 years, then the best option is choosing the path with the most doors. (btw: that sentence is great general career advice as well - for those that are young).

Part 1: General Premise Before Starting

The general strategy here has been largely the same for nearly a decade: 1) get the highest paying career you can get that tailors to your specific talents - not love/passion/dreams, 2) have a plan to slowly build out an income stream on the internet - E-com for most, could be SaaS and could even be basic consulting if you’re really out of ideas, 3) the best investment is always in your biz growth until it reaches high cash flow and 4) at that point you’ll have excess money to invest in crypto, tech, real estate, etc. We’re biased to Tech/Crypto but everyone has their reasons/skills/personal background story.

The Idea: Generally speaking, corporate income doesn’t “cut it” anymore. After watching Wall Street total compensation decline (or at best stay flat) for a decade, it’s hard to maintain pace with assets that are now up some 30-50% from pre-COVID levels. We’re not against working (unless born into a wealth family 90%+ will end up in a W-2 to start).

The premise is that this won’t really get you the quality of life you want (and deserve if serious about succeeding).

While you’re doing good enough to be in-line for promotions, you’re not going to be the super star since that doesn’t have a real payoff ($10,000 is not going to change your life).

Why it works: You can sell a company you cannot sell your career/job. You can sell a company you cannot sell your career/job. You can sell a company you cannot sell your career/job.

The corporate world is brutal. You’re just a line-item and no one is going to pay you 4x earnings to quit your position as a VP/Director/MD at the company. The Company is just going to hire someone else and move on. If you’ve worked in Corporate America or Wall Street or even Big Law, you know that when someone quits/leaves no one even remembers them within a month.

If you have an income stream that can be taken over (E-com store, or even highly sought after Brick and Mortar like Med Spa - Source) you can sell it at a multiple. If the Net Income is $250,000 it could sell for a multiple of that. To make it sound fancy say 4x earnings which would be $1,000,000!

The point is that the value of income from a biz is worth more than any career/job because you can sell it later.

Why Online? Our *bias* is always going to be for online income streams because you can move. We saw some crazy stuff happen with COVID and major companies like Tesla are even voting with their feet to leave high-tax states. This is just an example in the clear and growing trend of flexibility.

If you can take your income anywhere, it can: 1) reduce your taxes and 2) help you create a different work schedule. While the taxes can be calculated, the freedom and mobility is really an intangible asset that should be worth something. We’d wager a ton of money that people would rather make 80% of what they currently make if they were allowed to work anywhere in the world.

Why Invest? This is redundant for anyone following this side of the web, but countries will continue to print and print. Even if tech helps create some deflation that has ramifications for job loss, potential UBI/unemployment claims etc.

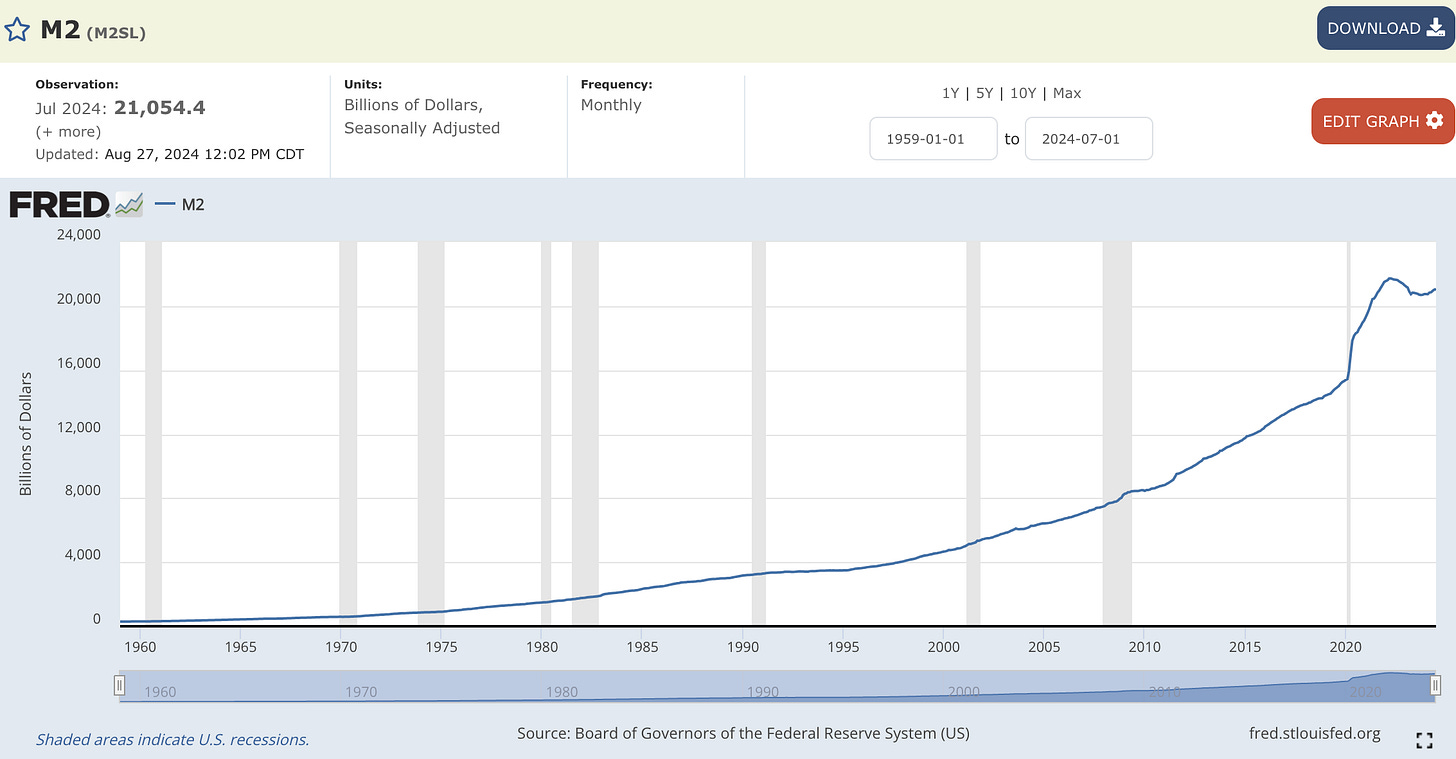

Outside of a few blips in time, over decades, the amount of money being printed has a clear trend.

Summary

The world has changed tremendously over the past 25 years. High paying careers/jobs don’t really offer the stability or *quality of life* that it did years ago. Excel sheets don’t lie and none of this is necessarily bad. If you’re a smart worker, it isn’t too difficult to be well liked and use technology to help you produce better results than your co-workers. The path forward is clear, it just isn’t the same as it was in the late 1990s.

One of the major traps is getting comfortable with any sort of high paying position. If you want to motivate yourself, it’s a good idea to track down the people who are in their late 30s - early 40s. Figure out how many of them really sustained a high paying position for a decade, how many dropped off and look into how steep the decline can be if “called into the conference room with HR” in the middle of a work week.

Before signing off, if you don’t want to do any of the ideas listed in the paid stack, please at least do some consulting online. Yes it is time for money exchange (a blasphemy around here) but after further thought it’ll at least prove that you can earn money online. Nothing hits like that first $100. Once you can pay for your cell phone, you’ll be paying for your monthly food bill, then your rent, then you’ll finally rid yourself of that painful poverty belief of losing even a single penny. (Don’t worry the cold sweats and nightmares waking up thinking you lost it all is a lifetime curse no matter how big you get!)

Hope for the Best, Prepare for the Worst

This is our general life view. Many say ultra cynical. That’s fine. If you put a dog in front of a steak, eventually it will be eaten no matter how well it is trained.

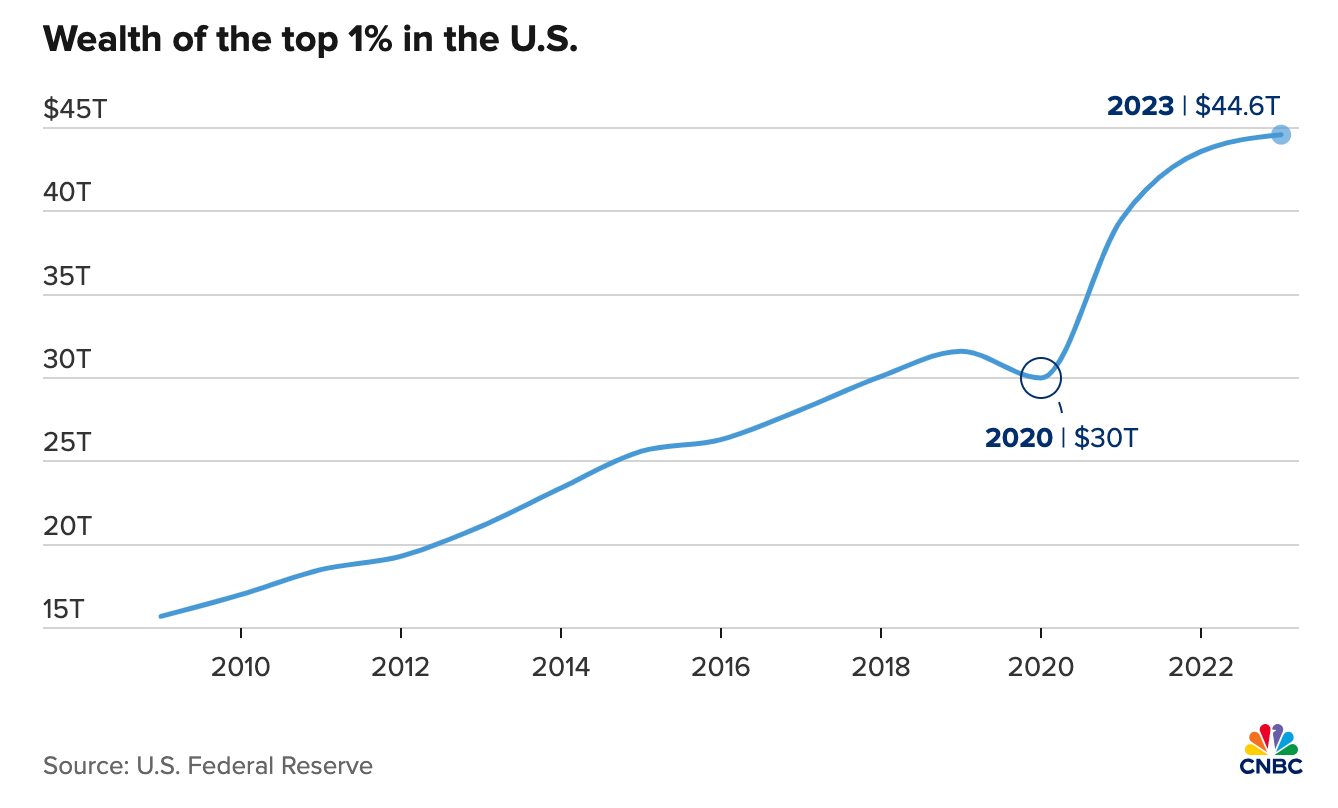

If you think about incentives and general society trends it’s not too difficult to predict out a few years. We’re of the belief people have less kids, more screen time, problems with gambling/degeneracy and loneliness. This is all a by product of wealth/success division.

While it isn’t statistically possible for everyone to make it into the top 1%, it’s pretty reasonable to be one of the mortgage free home owners with some online income and a W-2. The majority would probably be ecstatic to be in this position and there is only so much that money can buy before your priorities switch to life events: family, friends and your health.

On that note, if you’re one of the extreme builders you’re eventually going to hit full disaster prevention mode: multiple passports!

Part 2: Getting a Second Passport

We would not bet against America. America is home to practically every single innovation. Europe is largely just a museum outside of Airbus and ASML. Latin America is improving but outside of Mercado Libre haven’t seen a major innovation. Asia is on the come up with things like TSMC and Alibaba but in the end it pales in comparison to everything in the USA (Mag 7 and a litany of successful entrepreneurs)

A second passport is largely an insurance policy for a high net worth individual or family. If there is a world changing event (war, another pandemic, or sudden governmental changes - tax, regulation, etc).

Definitely Don’t Ditch the USA for No Reason: As a point of emphasis, there is no reason to simply give up your USA passport/citizenship. We’re aware that the USA has problems (like every country in the world), the better move is to be *set up*

This is quite different from YOLO’ing it and pulling the rip cord too early. If you’re in the camp of leaving entirely, the decision is massive and needs to have personal ties that are likely outside the scope of any internet search.

By getting a second passport, you’re in a better position to change gears in a dooms day type situation while everyone else is playing catch up. Even if we ignore COVID, we saw what happened to the Ukraine and Russia. If someone was living in either country, it would have been a lot easier if they already had a secondary passport to escape the devastation.

Second Passport Benefits: The initial simple benefit is travel. If you have a second passport/citizenship you could leave to another country that may be restricted at that point in time. It will allow you to open a different bank account, buy/rent property and stay in a new region if your current country is hot for one reason or another.

First In Steps

Lawyers Win Again! While crypto is notorious for simply shifting value to lawyers since every single project gets sued, the lawyers will print once again if a higher number of people want to get second passports.

You’ll need to retain a lawyer to submit all the documents needed for your second passport. The most common way to do this is to pay 50% of all the fees at the beginning and the remaining 50% once completed (sometimes at/near completion). In general you’re looking at low to mid 5-figures to do all of this depending on if it’s just you, you and family along with how difficult the process is. We’ll just say $30,000-40,000 to give a range and you’re free to debate this exact figure (as of 2024)

Lots of Paperwork: Now that you’ve paid half your fee, you get to enjoy mountains of paperwork and box checking: birth certificate, all residency info, criminal background checks etc. Depending on where you’re applying there will also be a wide range of rules around what you must do: buy a property, donate/give money etc.

All of this is to prove you are not going to be a drain on the country. If you have meaningless things like parking tickets or a couple speeding tickets there is nothing to worry about. If you’re D.B. Cooper, then you got problems.

Background Check: At this point you’re about a month or two in and you’ll be asked a range of questions about your life, income and history. Countries do not want to get blacklisted for being a crime hub or added to various grey lists.

Panama as an example, recently getting removed last year

Depending on how complicated your situation is, you’re probably looking at a couple of more months for this whole background process.

Get Accepted: Assuming all is good and you’re not doing anything illegal, you’ll be accepted and asked to do the aforementioned donation/real estate investment etc. As always, each country is different so there is no way for us to tell you exactly what each country requests. If you want a complete ball park estimate, probably a $200,000-$300,000 total commitment (excluding lawyer fees)

Note: if you are married to a foreigner that’s also an option for a second passport but we’re just going to assume you are American and simply looking to have a second citizenship.

Most Common Countries

We’re sure this will be outdated in a few years and the cost will change but generally speaking:

St Kitts: This is one of the most famous ones due to low cost which *was* $150,000 and is now upped to $250,000. A small carribean island

Grenada: This is becoming more popular because it can be as low as $200,000-$235,000 with an E-2 visa that allows you to go back into the USA for a period of time if you renounce in the future.

Dominica: Another island country with $200,000 donation to the state fund. As a quick check this is the cheapest we’ve seen but don’t see why it would be chosen since it has a lot more limited benefits when compared to Grenada (no E-2 Visa here)

St Lucia: Yet another island country, $240,000 in total cost. Good for asset protection but not as good for travel as compared to St Kitts or Grenada.

From the extremely short description you can already surmise that you’re really looking at St Kitts, Grenada and St Lucia. The cost is a lot lower and we’ve left out the real estate option for the countries since it’s going to cost you even more ($300,000+) and doesn’t include more fees/upkeep and potential scams with the property being over priced, in bad shape, unsellable and potential risk for changes in property taxes etc.

Less Common Expensive Ones

For those trying to avoid the island options, there is also:

Turkey: Likely to set you back around $500,000 all in since you have to buy property or make a $500,000 contribution. Unless you have a strong reason/tie to be there it doesn’t seem to be logical. ***updated old comment of $1M was not right, commenter was correct looks to be $400,000 RE investment OR $500K, not both***

Malta: This is a common one discussed for europeans, it has a lot of history to it (not a good thing) and requires somewhere around $660,000 to get in. You’d have to stay there for at least 3 years otherwise the cost is even higher (closer to $800,000+)

Montenegro: They’ve changed a lot of their rules recently but appears the push is really to investing in developmental projects 450,000 Euros or around $500,000 USD. It says you can do a lower amount of 250,000 Euros but that is for developmental projects even further out. Generally, anything developmental or approved by government is likely overpriced or some sort of negative catch to it (dealing with government programs after all)

Part 3: Assessing the Risk and Reasoning

For the vast majority, there really isn’t an immense amount of researched needed to make a decision. For those with international ties already, you might already have access to a separate passport. That said, here are some things to consider if you go down this path:

War/Global Change: This is largely a near zero percentage chance. While we’re aware all the political stuff in the globe doesn’t look great, entering into a draft or massive war is unlikely. Instead just think about it in an inverted way. “What country is least likely to be involved”

Using this as a proxy it makes the decision making a lot easier. We already mentioned we wouldn’t touch Turkey because look at the location of the country. Being right next to Iran and Syria doesn’t sound appealing considering the constant warfare in the general vicinity.

Something like St Kitts is unlikely going to be a target of large scale military action. It’s more likely that customs asks “what is this country” instead. This means it would be a better solution if this is your main concern

Taxes/Asset Confiscation: International trusts and taxes are a concern if you’re worried about asset seizure/wealth confiscation. We know that Malta is part of the European Union and that region has a wide range of fiscal issues as well. In fact they have a new minimum tax rate of 15% (no this isn’t a large amount it’s just to prove a point with the EU being able to change laws)

From there you’d want to look at the likelihood of wealth confiscation, a complete change to business taxes or personal income taxes. You’d unlikely want a second passport in Malta and as a simple secondary example, try to use debt/GDP as a guideline.

Before anyone says its contradictory to not give up US citizenship because it is on the list, need to remember the USA is still the global super power. Part of the draw is that the USA has more tools to export inflation to other countries given reserve currency status (a long and of course debatable topic for another day).

Access to Social Services: So far this has largely favored the various island countries, but another thing to consider is long-term social services. If you’re not particularly worried about assets or war, another thing to consider is the general quality of life in the country.

If you are forced to leave to the second country, you want it to be livable. Don’t think a large number of people would enjoy living in St Kitts outside of a huge global war. Another strategy could simply relate to a politically neutral country with a decent quality of life. Something like residency in Latin America or Asia may suffice until you can eventually qualify for citizenship (typically requires several years of residency then application).

Part 4: Residency and Wait Strategy

To put a last ditch option in, you can also have a strategy to avoid this entire process. Instead you can take some risk that things will never deteriorate that rapidly and instead have money “ready to go” and purchase real estate in a country that offers citizenship over a long-time horizon or long-term visa stays.

As an example, Malaysia has a “My Second Home” program where they allow you to live for up to 10 years in the country. Currently the tax structure is set up for *no* taxation on income earned outside of Malaysia (great for anyone with online businesses).

Another example is Panama, buy real estate in Panama and wait for 5 years. Not sure who wants to live in Panama (we’re biased since we hated it) but it’s another example of a buy real estate, wait 5 years and get the passport.

Easier example, perhaps Argentina now that it has gone through large structural changes to increase investment in the country. You could buy a smaller unit in the $200,000 range stay for a couple of years and likely get through the second passport process.

At this point, we’re just burning time though. There will be 50+ countries that will offer a residency + long-term visa stay + eventual path to citizenship if you look hard enough. The trade off is that you’re banking on being able to leave and predict that the country will be in good shape for your longer stay.

Otherwise, have to bite the bullet and set up the second passport ahead of the rush!

Conclusion

Hopefully some of this was informative at least and provides some insights into optionality. It’s unlikely going to be an issue (well below 1% chance) but a good thing to think about as your paranoia ramps up as those Internet Dollars stack up in your various bank accounts and computer coin wallets.

Assess the risk/opportunities and live with the results

On that note, back to the tent

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money

Adding a bit of info here, mainly for the European readers (but also for the US folks, albeit with a little longer horizon):

Monaco is still the tax haven to be in. Mainly because it has a history of not charging any taxes for centuries, but also because it is one of the few countries that doesn't really run a deficit, so no need to imply taxes soon (Monaco, while surrounded by EU countries and using the Euro, is not part of the EU).

What you need to get a residency permit: 500k€ per adult on a Monaco bank account (on average per year, but it is not a donation, those funds still belong to you) OR found a new company in Monaco with at least 10 employees.

In addition, you need either real estate or at least a 1 year rental contract for a place in Monaco.

In order to maintain the residency, you need to be in Monaco for at least 60 days per year (which is way lower than the 186 other countries demand) and the Côte d'Azur is not the worst place to be. Residency allows you to travel to the Schengen states without any visa.

After ten years of residency, you can apply for citizenship, provided you have an empty criminal record.

Hey BTB. Just wanted to say props / thanks for the insane level of consistency on your Substack post schedule over the past couple of years. Literally everyone else I've followed on Substack, no matter what they originally promised, has inevitably let the posting schedule slide, and content usually degrading with it. Hard to remember since you're anon and never talk about personal life, but I know there's a human behind this account somewhere, and the commitment to consistency you've had here is really amazing. Which probably explains why you're homeless in the first place.