Small RWA Coin - Narrative Potential

Level 2 - Value Investor

Welcome Avatar! Today we’re doing a post on a small RWA coin. As usual for full disclosure we are owners of ONDO (for those on the paid stack) and own a *small* position in this coin as well (CHEX). The coin is extremely right risk curve type stuff and due to size it will be nearly impossible to do anything in size (you’d be illiquid).

With that disclosure out of the way here is the overview.

Part 1: Quick Overview and Scope

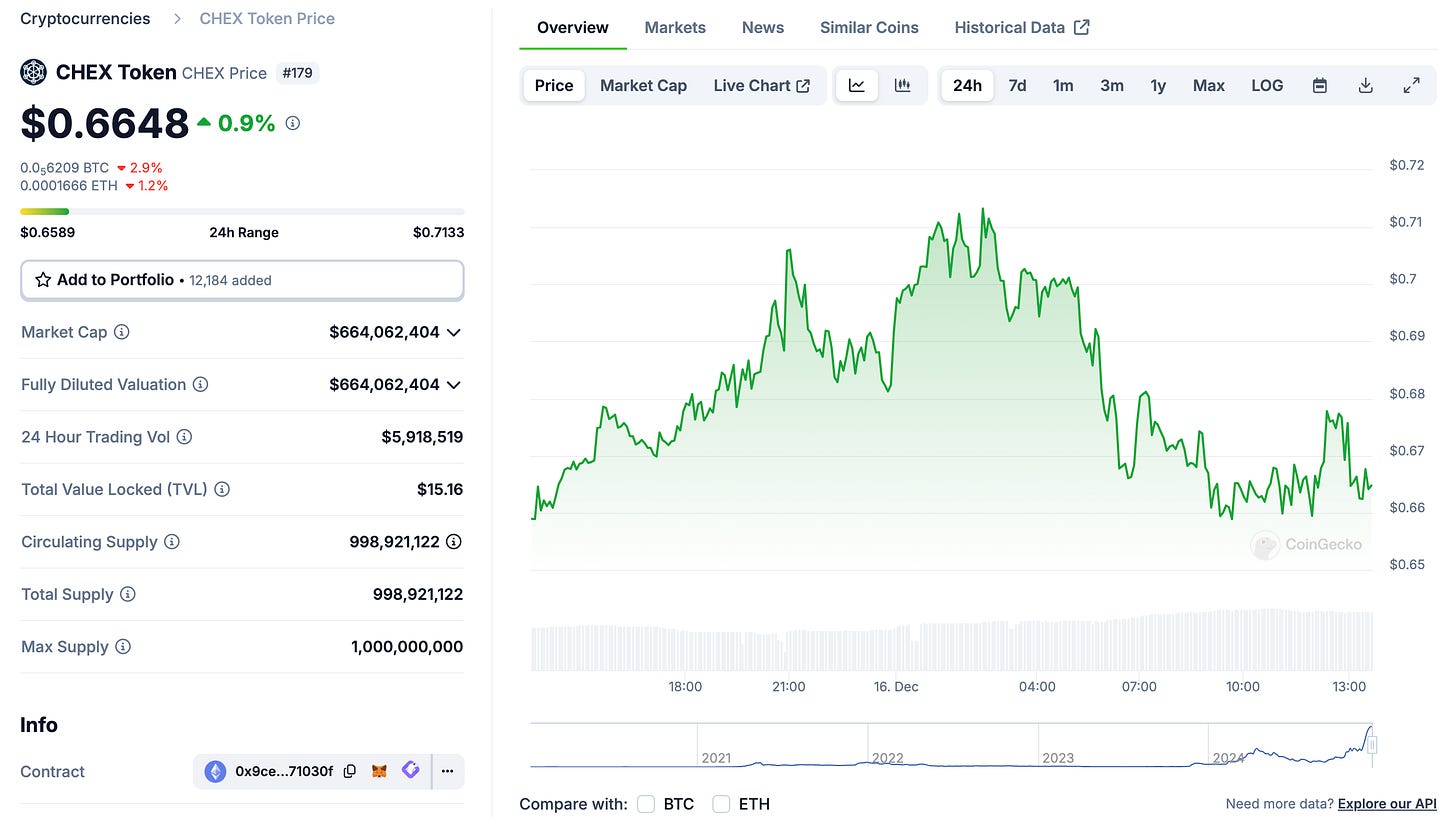

As you can see market cap is under a billion with trading volume at mid 7-figures. Unlike ONDO, it isn’t really possible to build a significant position ($500K+). Instead what you’re looking at is optionality on the RWA narrative spreading to Asia.

For those with severe PTSD you may remember a similar thing happening in 2017. When ETH was flying and ICOs were all the rave a new token called the “Chinese Ethereum” came out called NEO.

The majority of alt-coins go through parabolas and break which is typically why you just want to sell back into BTC/ETH when you think the narrative has hit max mania. CHEX has a similar narrative opportunity to be the “Asian RWA Token”. Since we already have our free-rolled position of ONDO at this point, this might be a derivative/beta play on the same narrative but with Asia at the helm.

Token Unlocked: Lots of alt-coins have unlocks but CHEX is already unlocked. This is good because its suggesting price appreciation is not being done to drop a massive amount of coins in one go (ONDO and SOL both have unlocks in Q1).

They have a standard buyback/burn model with 5% of the revs and already have the regulatory approval items (similar to how STX got regulatory approval before launching - just in this case in Singapore).

Marketing Now? According to older articles they are setting a goal to try and press on the TVI now. Specifically “Chintai estimates $150 to $300 million in Total Value Issued (TVI) on-chain by the end of Q4, 2024, and $2 billion TVI by the end of Q1, 2025”. This seems a bit lofty to us in terms of a spike but if they raise significant money then that typically means coin price goes up.

Summary

As a quick high overview, it’s essentially the Asia version of ONDO. That naturally comes with a lot more risk and it’s a much smaller token. If narrative takes off it has a real chance at operating as a Beta play to the RWA narrative.

All that said, it isn’t really possible to put in real size, for that reason on the free side of the stack.

Part 2: Trimbot Original Messenger - Contact

We got sent this coin a while ago and then again a second time. This is entirely written by Trimbot although we have reorganized it a bit and removed some of the moonboy comments.

I’ve written a high-level summary of Chintai and their CHEX token. This is not your ordinary altcoin—this is a blue-chip token with institutional-grade tokenomics and demand that is poised to establish itself as one of the majors alongside Bitcoin, Ethereum, and Solana by the end of this cycle. I encourage you and your readers to not just take my word for it but to also do your own research in addition to reviewing the below.

To save you some time, here's a TL;DR:

TradFi is rapidly adopting tokenization

Chintai is the Shopify of RWAs, offering a white-label tech stack for TradFi to launch custom-branded tokenization platforms

The CHEX token is directly tied to Chintai’s success, with a deflationary model and institutional-grade tokenomics

CHEX is poised to reach multiple billions in market cap if things go well

Background on Tokenization

Every major bank, financial institution, and government is saying the same thing: tokenization is the future of finance. Nearly every financial asset will be tokenized and brought on-chain, and financial institutions will need their own tokenization platforms—just like they all have apps or websites.

The challenge? Building a tokenization platform is resource-intensive, costing millions of dollars and taking years to develop the necessary automated compliance rules and tech stack. Financial institutions have no choice but to embrace tokenization, or they’ll risk being left behind.

The Chintai Solution

Chintai is a licensed and regulated tokenization platform for financial institutions, holding both RMO and CMS licenses from Singapore's MAS—widely considered the gold standard. Chintai provides TradFi with a fully customizable white-label tech stack for launching tokenization platforms, which is why they are often called “The Shopify of RWA Tokenization.”

Just as Shopify powered the e-commerce revolution, Chintai is positioned to drive the tokenization shift. Chintai manages the backend technology, allowing financial institutions to launch under their own branding. End-users never need to ask, “Who’s powering this in the background?”. Building such a sophisticated platform isn’t an overnight task. Chintai has been developing its tech stack since 2019, meticulously optimizing it for institutional adoption.

Every entity that white-labels this technology deploys its tokenization platform on the same shared Layer-1 blockchain, creating unparalleled network effects. Imagine dozens of institutional clients, each launching their own platforms on the same L1. This setup could realistically lead to billions of value on the platform in the coming years.

Chintai already has a strong network of partners, with 50+ new clients launching in Q1 and expectations to surpass $10B in TVL by year-end. However, Chintai isn’t an Ethereum competitor—it complements Ethereum. Issuances occur on Chintai’s permissioned blockchain, but the idea is for these tokenized assets to interface seamlessly with DeFi protocols in a compliant manner.

The CHEX Token

CHEX is the native utility token that powers the Chintai network. It was designed with institutional-grade tokenomics to ensure long-term sustainability—not just as a single-cycle performer. Fair-launched in 2019 under MAS requirements to secure licensing, CHEX has been in full circulation ever since.

Despite launching in 2019, Chintai held back on actively promoting the token until now, aligning with product-market fit and network utility activation. This is the perfect time to front-run financial institutions that will soon need to acquire CHEX.

TradFi institutions are required to purchase CHEX to access the platform’s resources. Payments made in fiat are converted into tokens by Chintai, directly linking the token’s value to the platform’s success. CHEX is also deflationary, making it an increasingly scarce asset. Unlike many tokens, there are no insider unlocks to flood the market…Plus, holders can stake for yield. Essentially, CHEX functions like an RWA ETF that pays dividends.

It’s already one of the top-performing non-meme coins of 2024, with even greater growth expected in 2025. The main drawback is limited liquidity due to its lack of major CEX listings, but this is likely to change soon. For context, the last coin listed on Binance saw its trading volume jump from $2.5M to $500M overnight. Tier 1 exchange listings for CHEX is a call option on the token.

Final Thoughts

The U.S. government, Larry Fink, and every major bank are rallying behind tokenization, this is potentially the Shopify of RWA built in Singapore.

Once again, second section entirely written by TrimBot with removal of some of the extreme price targets since he’s positive on it. You can reach him here and will likely be writing about RWA coins in 2025.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money