Smile, Nod and Agree - Career Version Don't Work to Death

Level 2 - Value Investor

Welcome Avatar! If you’ve found this side of the web you at least have a punchers chance at financial freedom. Over a decade ago there were several high paying careers that would net you a good life with minimal risk. After all, the vast majority of Wall Street people are risk averse since they grew up in Rich Kid private schools designed to create perfect rule following robots.

For better or worse, those days are now coming to an end.

Careers are Largely Dead

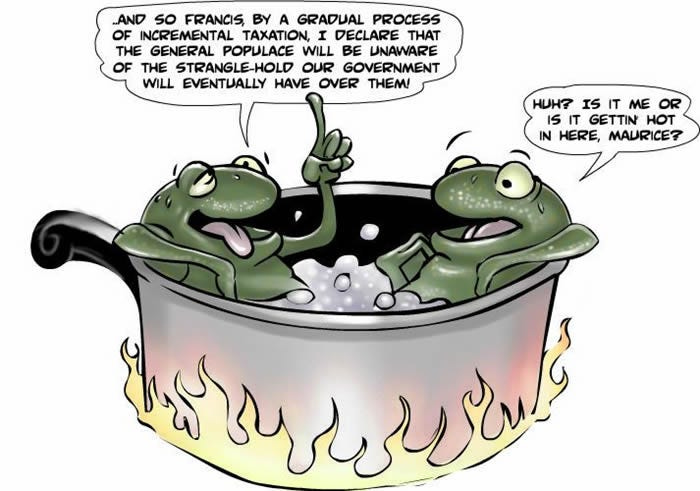

Everyone has heard of the standard boiling frog metaphor. Where you slowly increase the heat and the frogs die. It has been used to explain slow increases in taxation or in context of this post - slow erosion of income through inflation.

The Catch? In the real world, if you were to put frogs in a pot and slowly turn up the heat, they jump out. The boiling frogs metaphor isn’t grounded in reality. The only frogs that wouldn’t jump out are the ones that are either injured or trapped. In the case of the “careerist” they are entirely trapped due to expenses and lifestyle inflation.

People Won’t Jump Because They Are Trapped

People were going to strike on behalf of the BofA employee who recently died due to extreme work conditions: 1) 120 hour weeks for well over a month, 2) consuming tons of energy drinks to function and 3) over-worked causing death.

What actually happened? No one went on strike.

This isn’t surprising if you’ve seen the work culture. Vast majority are operating in a state of complete fear. They have mortgages, kids (they can’t see due to work) and can’t save a penny beyond their bonuses. This means they will never ruffle feathers.

Getting a dreaded “F—- you bonus” of around $10K is possible. In that scenario, they wasted an entire year working 60-80+ hours a week. Better to be complacent.

Imagine being 40 years old and being told “no you can’t go to your kids baseball game, we have to finish this power point presentation that no one will read”

Still Not Convinced?

No problem. We can also provide some hard numbers. The trick to the corporate game is making sure the entry level jobs are attractive. This is usually the bottom two rungs on the ladder (both considered entry since one is post grad the other is undergraduate).

2010: Banking analyst around $140K; Associate around $250K, Managing Director around $1.2-1.5 million (3-year vest on stock portion)

2023/2024: Banking analyst around $200K; Associate around $350K; Managing Director around $850,000 (4-5 year vest on stock portion)

Seeing the Numbers: While entry level positions are up about 40% over the last 10-15 years, the higher paying positions which are supposed to represent “making it” are all down massively. Is it any coincidence that the entry level pay grade is matching inflation nearly perfectly? Nope. Don’t be fooled. It is no coincidence.

Goal of Firm: Companies know that once you’re in the door it is hard to leave. Where else are you going to go and collect $250,000 a year for aligning logos and copy pasting numbers from SEC.gov? No where.

None of your skills are really useful for starting a business or working at a start up to gain ownership/equity. After a few pay raises you’re stuck with a higher cost of living (lifestyle creep) and they don’t need to pay you massive salary bumps anymore (once you’re a VP they push you to buy a house and get debt trapped).

Yes. We’re typing explicitly. No valuable skills are learned as an analyst/associate beyond the ability to type words and numbers onto a screen quickly.

Now that they have their cogs in the machine, what’s the next goal?

Get rid of high paying seats.

This shouldn’t surprise anyone who has been on this side of the web for a long time. As you move up the ladder you are actually targeted more for layoffs. When you make VP they are searching for reasons to fire you (unless you are extremely profitable for the firm).

Quick Math: In an expensive city (where most high paying positions are), making $150K is largely breaking even. This means you’d save $50K pre-tax, essentially max out the 401K and maybe another $10-15K. The problem is that prices of assets are going up much faster than that. Since 2010, even the S&P 500 is up about 5x.

What is the Conclusion?

Earnings and income is no longer sufficient!

Since you know that your income is not going to keep pace with inflation and assets are going up much faster than inflation (500% vs. 43% isn’t even close), the goal is to be an owner of assets.

The most logical way to do that is with an online biz which you can do with a kitchen (source) or you can do the more standard way with AI tools and ads (source).

People Lack Priorities, Not Time

If people are willing to work 120+ hours a week (60-80 is more standard), we can assure you that you will earn more per hour working for yourself. When you math it all out, you are essentially earning overtime hours on minimum wage.

On top of that, do you really want to sit next to people who were willing to watch a colleague die from long hours? We can assure you that they will throw you under the bus for a 5% raise or additional bonus

As a final note, you’re not really learning any skills anyway. Copy pasting numbers is not a skill and can be done by well trained monkeys.

What to Do? Smile, Nod and Agree: If you are willing to suffer 80+ hour weeks doing meaningless work, we’re pretty sure you can play the good ole’ politics game by being likable for 5-10 hours a week (reducing your work hours by 20/week easily).

Smile, Nod and Agree is the safest and fastest way to become likable.

The overweight MD who played Varsity Baseball. Yes, he could have made the MLB if he had the right coaching. You must believe this and you must sell them that you are being serious. Also. If anyone mentions a stock, you write it down and remind them how right they are about it going up or down. (ignore all their bad calls 80% will be bad)

What is the goal here? The goal is to have the higher ups like you so you don’t get staffed with as much busy work. You want to be likable you don’t want to be seen as the star employee. Star employees just get all the work for 5-10% more. The ideal set up is to be liked “as a person” so you work less but only work on the stuff that generates the firm money.

Bring in the New Computer: Once you’ve established yourself as a likable person, you will bring in a new computer to “take notes”. If you are well liked, no one will really care to be honest. They don’t need to know it is your secret weapon to get out.

Excel Reminder: Assuming your plan is to maximize your quality of life over a long time horizon, this means your goal is to generally get rich by 40ish. You’re going to over-estimate how much you can make in a year and severely underestimate how much you will make in a decade (since that is how all equity building/biz building works).

For that we’ve got a simple snapshot to remind you that the career path won’t get you there. You should be in Sales or Tech (lower hours) and focus on building something instead. We’re going to assume a perfect career and include hard asset appreciation.

Roughly Speaking Assumes 19 Working Years

Example Nice Area on Redfin

Quick Assumptions: 1) assume you are never fired and have a perfect career, 2) comp stays roughly at current levels, 3) assume you can double all your savings and 4) the kicker - prices of assets continue to go up!

While a nice home in a nice area might run $1.5-2.0M today, in 2045 that’s probably 2x at least ($3-4M). We used $4M in the snapshot.

Therefore, assuming you are the golden child, you will be 40 years old and able to own one home in a nice area or you can move into an average American household and retire.

Writing is on the Wall

If the recent events don’t make you want to throw in the towel, not sure what will. You watched as someone died and yet the corporate zombies didn’t even do anything. It got swept under the rug quickly.

This should also serve as yet another reminder. Your co-workers are never your friends. If they’ll turn a blind eye to white collar slavery (worked to death), they will happily turn you in for some meaningless HR issue to get a 5% bonus increase.

Brutal Truth Summary

A guy was worked to death and people didn’t revolt, it didn’t make headlines and the co-workers feigned being upset but when push came to shove they didn’t do anything

The mid-wit argument is that there are millions lining up for the job. Which means the majority are rule following monkeys who won’t survive in good industries - Tech and Sales with tracked KPIs vs. “hours worked”

Majority in this industry (now) are rule following robots groomed to do as they are told - sacrificing health, skill development and personal life

Mathematically, it is not even a great career. Ask Silicon Valley Bank Managing Directors how their years of deferred stock worked out.

Not all is lost of course. For anyone paying attention the future is pretty simple. Tech and Sales will always be around. People will be glued to screens for more of the day than they are spending in the physical realm. Easy bets are: 1) loneliness, 2) insecurity - Looks Maxxing for both men and women, 3) online status games, 4) gambling and 5) drugs/p*rn.

People will be spending more and more time living at home and translating all of their value and status online.

Fade crypto, tech, loneliness and degeneracy at your own risk. All will print many millionaires in the coming years.

If you’re interested in investing in tech/crypto and building a business online to escape the rat race, we suggest subscribing. If not… well enjoy the

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

Started reading your substack 18 months ago. I was in real estate for 8 years, made above average money for my age (20's) but considering the weeks were 60+ hours and I missed most weekends the extra dollars never made up for the lost time.

Last August I started a nicotine pouch wholesale business in Australia. By January this year I was supplying over 100 tobacco shops across the country and the brand was a well known name in the industry. I did $550k in sales for Q1 this year and would've increased those figures substantially if the Australian government didn't come in and ban nicotine pouches from sale/import here.

I've finished up that chapter and am now working on my next project which will launch in about 1 month. I will never work a 9-5 ever again knowing what I now know. Most will consider dumping tens of thousands of dollars into a venture with no guaranteed return extremely risky, but the real risk is working your whole life for someone else who would advertise a vacant position in their company a week after your funeral.

Your work is greatly appreciated and I will be a reader for life.

Very true.

Went down the "perfect wall street career" route. Even ending up moving to Asia to minimize taxes - ended up doing better than most. Ended up in a very senior role, and can admit - company (and industry) is a joke. Hiring practices are redacted. The best of the best are no longer going into finance - just a lot of sheep that can't think for themselves.

Sitting in the management seat:

"Yes, I know people are overworked and people are leaving/dying, but we can't lower the bar, so just tell everyone to work harder. Everyone wants to work for us because of our reputation and it'll launch your career. It's a great place to work and you'll have tons of opportunities to grow your career and take more responsibility and be rewarded for it"

Also me:

"Fuck this place and everyone in it. The second I hit my number, I'm GTFOing"

Spent college making fun of those "tech dreamers" and their failing startups. They tried, tried again.

13 years later, I'm doing fine. They're going public.