Start a Business — The Only Real Way Out

Level 1 - NGMI

Welcome Avatar! We decided to do some quick research and it looks like MBA and Law School applications are increasing. For those in the know, this is historically a bad sign. When people don’t know what to do, they go out and get more degrees. MBAs are also known for picking the pico top of any industry. It peaked out for Banking, Consulting, product managers and likely some sort of made up AI consulting/innovator role soon enough.

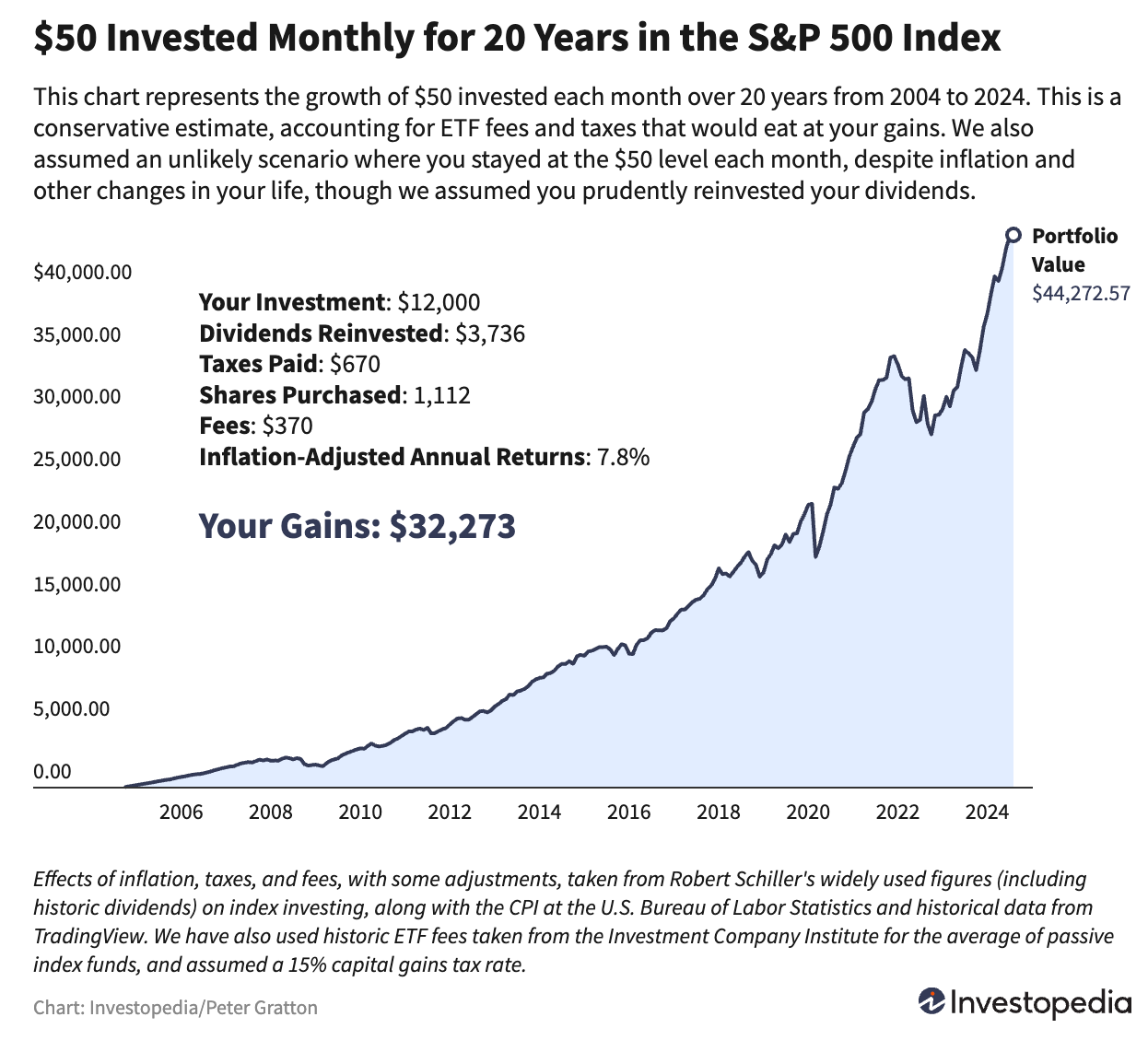

If I Can “Just Invest $10K More”

We know you’re doing this. We did this mental exercise as well. Thinking that the limiting factor was earning slightly more to invest slightly more. Reality is that it just doesn’t work. Rent and bills keep climbing in relation to your total compensation.

Statistically, the most reliable way (based on probabilities no “guarantee”) is building and owning a business. Not a side hustle that funnels a few extra thousand per month into your brokerage/crypto exchange account. A real asset that pays you, goes up in value if P/E multiples expand, compounds in value based on intelligent operations and gives you pricing power (hint: businesses all pass inflation costs back to the customer assuming their product is not a disaster)

This isn’t a platitude. It is statistics.

Go through Wealth Management companies. Their clients? All small business owners and small real estate entrepreneurs (which is just another business anyway). This trend is structural.

Own the pipeline. Earn money while you’re sleeping. Suddenly inflation works for you… for the first time in your life.

Wages vs. capital - Wages Lose. Rapidly.

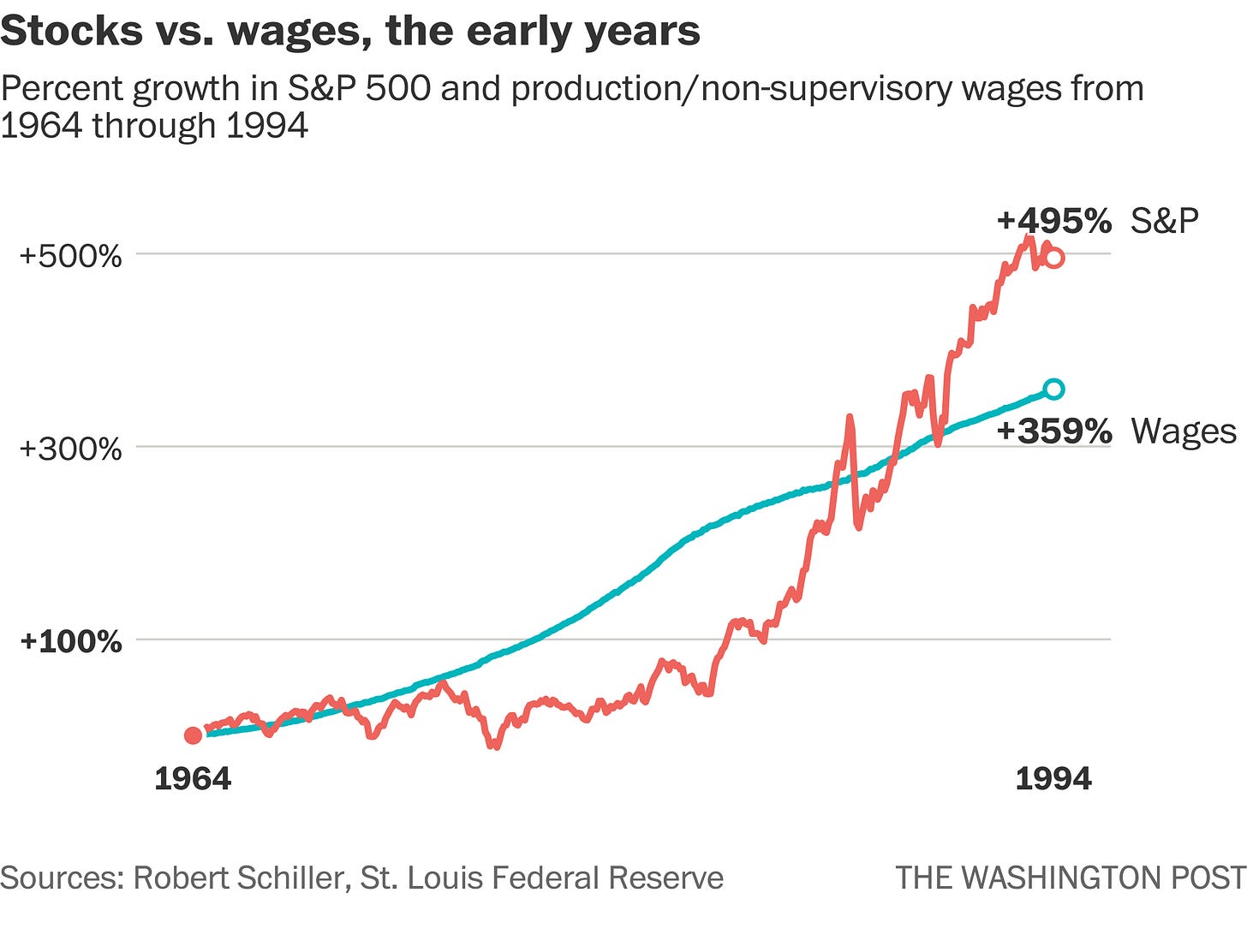

Capital markets and business earnings capture long-term productivity growth and compound those returns. Wages don’t.

In fact, the company has a goal of growing wages *below* revenue growth to increase operating margins!

Over decades, the stock market compounded materially faster than wages. People who own capital get a repeat advantage.

Stock-market-level capital gains and private business equity are the mechanisms that escalate wealth faster than selling hours ever will.

If wages only buy you X and capital compounds at Y, you can either accept a lifetime of trading hours for increments of X… or… build something that owns Y.

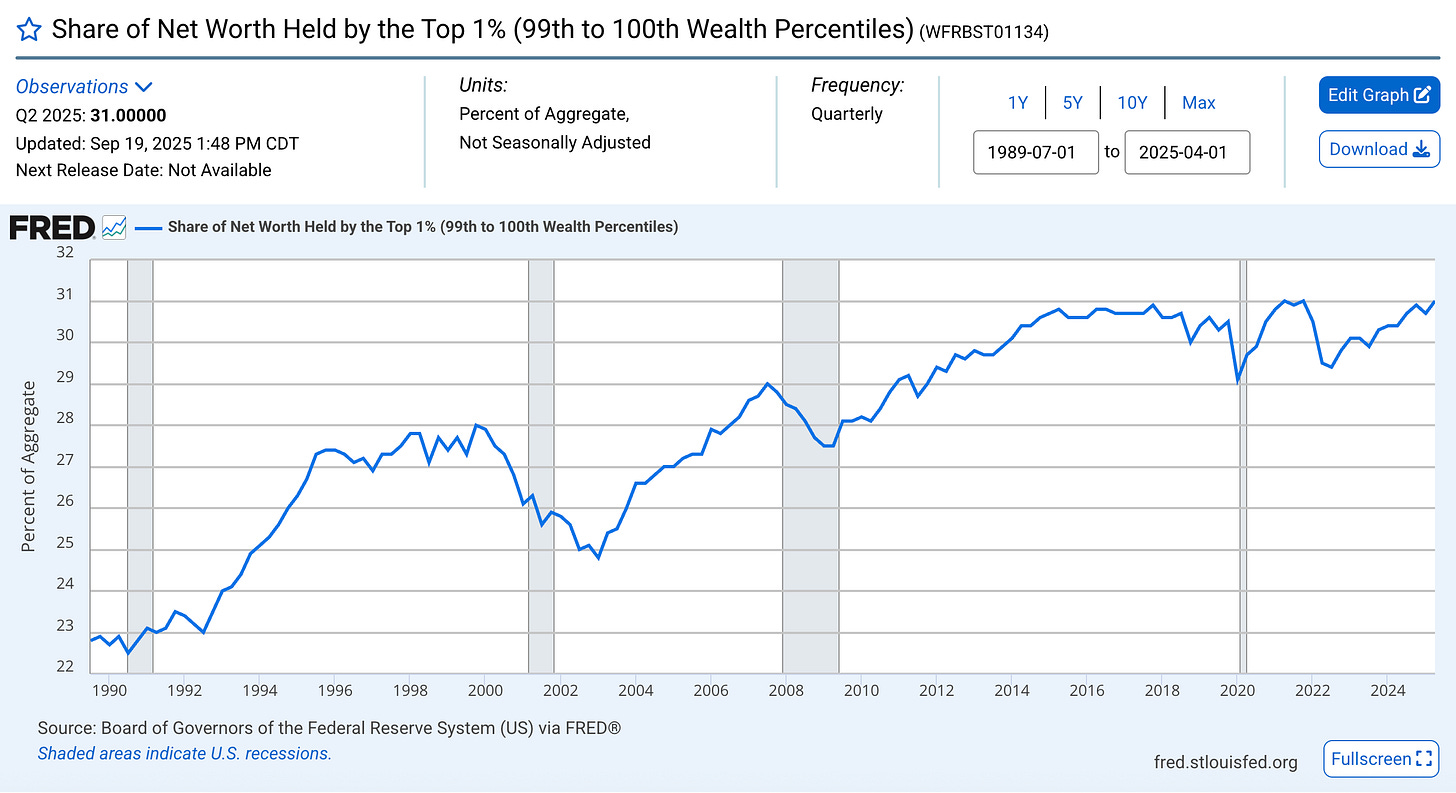

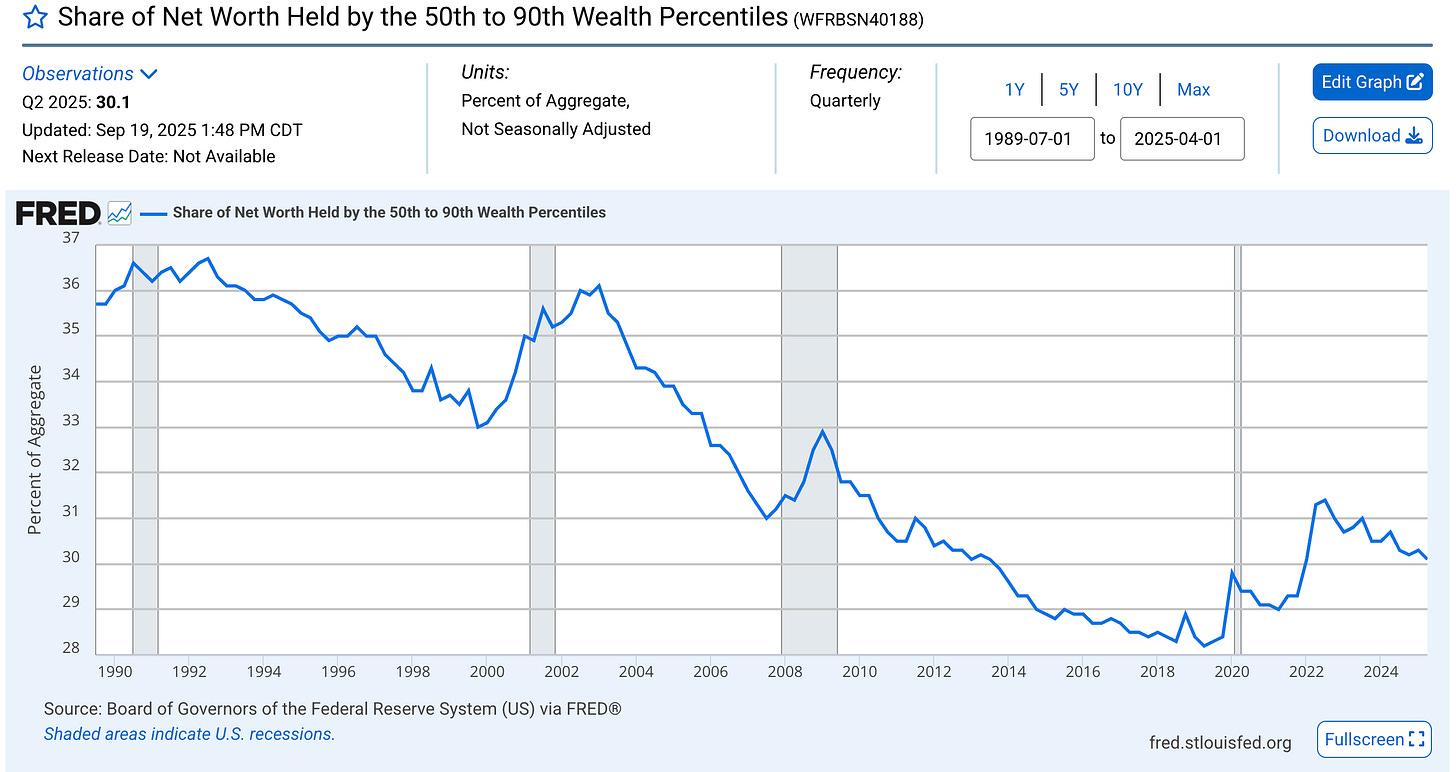

The Rich Make Inflation Work for Them

The top 1% now control a far larger share of net worth than they did 30–40 years ago. That concentration isn’t a talking point to “eat the rich”. It’s proof that the mechanisms of ownership (equity, businesses and outsized capital gains) are what create generational wealth.

The top 1% share of US net worth has climbed consistently. The only reason it goes down during recessions is because the rich simply HODL through downturns. Once the market comes back, they go back to taking more of the pie.

While owning 23% of all wealth to 31% seems trivial (8%) you have to look at it in terms of gains. It would represent a 34.7% relative increase (31/23-1 = 34.7%)

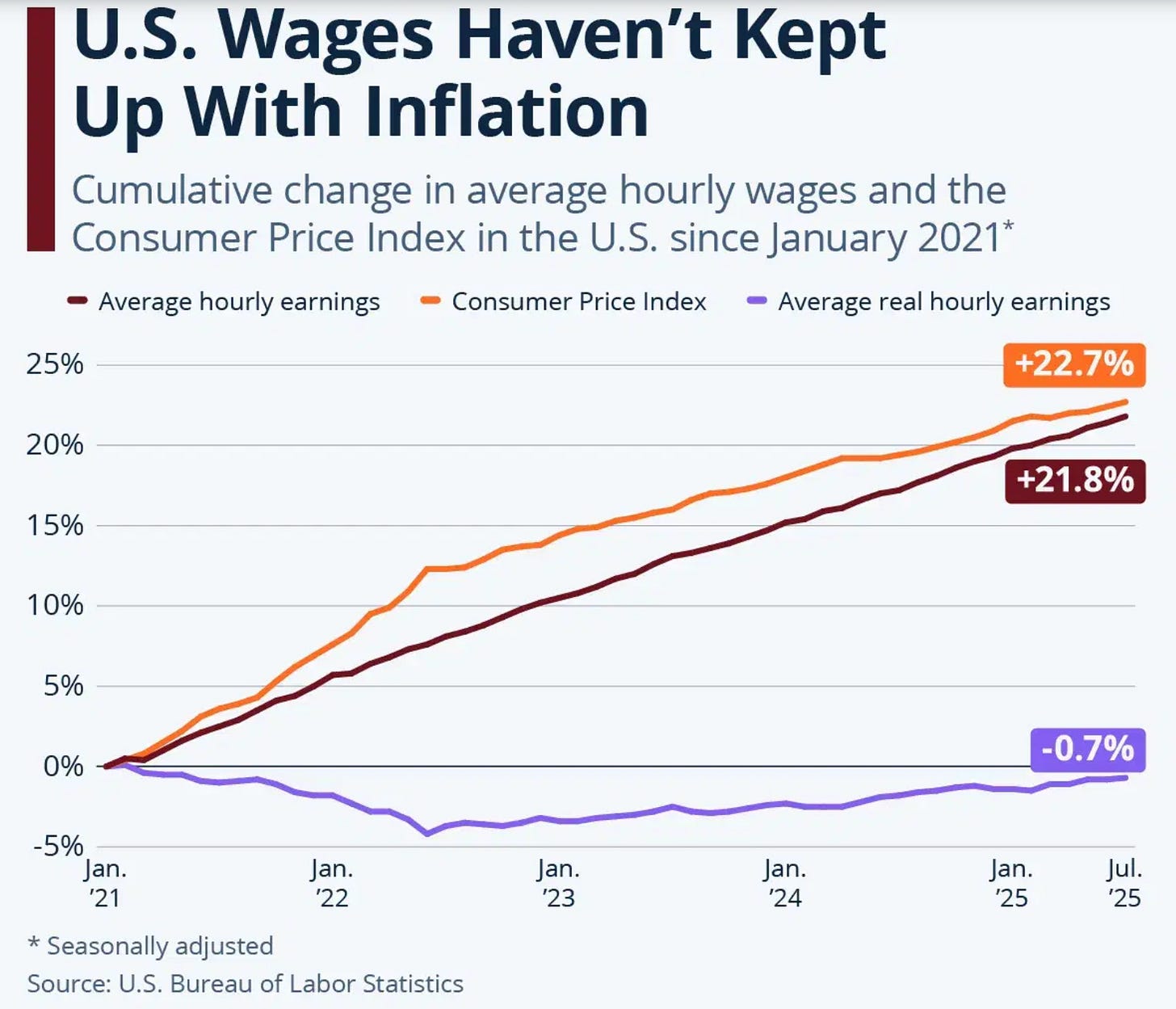

Inflation Taxes Wages, Biz Owners Pass it Down

When input costs rise, the employee’s lever is a raise. The owner’s lever is price.

Businesses with genuine pricing power can pass costs to customers, protect margins, and even grow profits in inflationary climates (you watched this happen post COVID). Workers, in contrast, usually have to negotiate raises that lag the pace of price increases (once again you watched this unfold the past 4 years).

Recent data through 2024–2025 shows episodes where CPI rises outpaced real wage gains.

Build a business where you can raise price without losing the customer. That’s where owners win in inflationary cycles.

As a simple example, if the price of rice goes up by 10 cents, the chances of people switching? Near zero. The producer simply passes that cost down and people are forced to eat the increase.

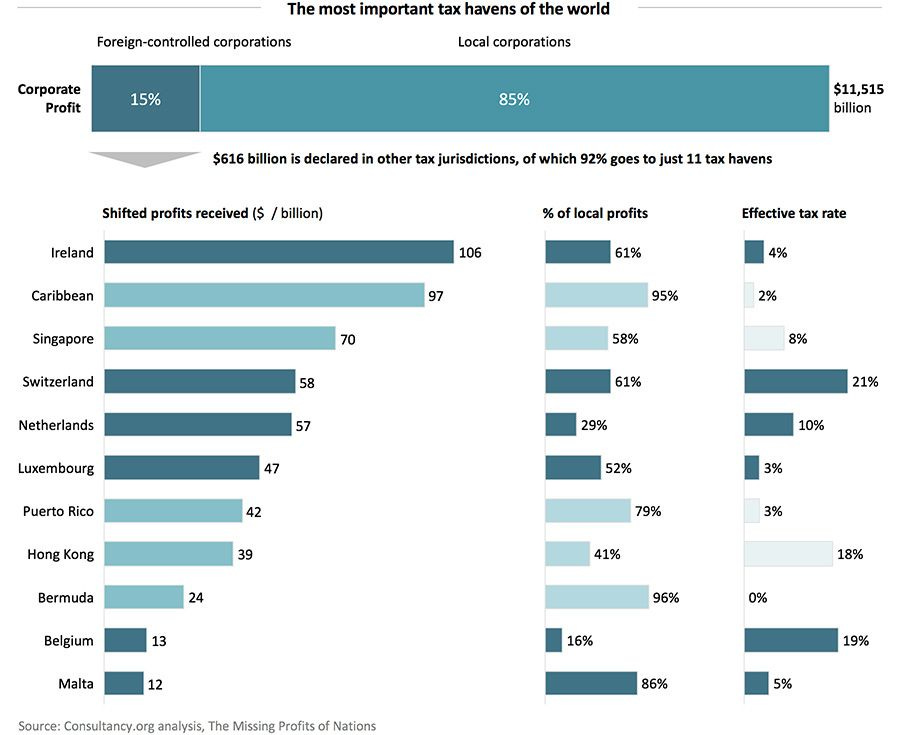

Taxes: Legal Ways to Compound

The tax code is tilted toward risk-takers and business owners (structurally).

Pass-through deductions, retirement vehicles for business owners (SEP, Solo 401K), deductible business expenses, and capital-gains treatment on exits are real significant advantages. Owners can engineer when and how they realize income. 10%, 20% or even 30% differences repeated over decades is significant.

Use the tax code like a tool, not a crutch.

Example: If you think this isn’t a meaningful amount it is. Take someone who sells an asset for $4M. We’ll keep it simple and use a 20% tax rate.

Okay, many thing $3.2M and $4M is not a lot. Well the problem is that it is a TON of money in future value.

If the person moved to a tax haven before clicking sell? Would save $800,000. This would result in significant compounding. $800K compounded for 20 years is $3.1M at a 7% rate.

You Only Need One: The government calls a small business anything from $1-40M (depending on industry). Read that again. You don’t need to create the next META or Apple.

If you had a single event of $800K, remember that you can compound that money for 20, 30, 40 years. In simple terms, one win and you’re practically set for life. You will always work and do something else. If you don’t touch the money from your first exit, you’re a mid-7 figure millionaire by sitting on your hands.

Asymmetric payoff of ownership

Want to live a mediocre life? Guess what that means. You will actually see declines over the coming decades. Looking for someone else to give you a golden ticket is long gone (outside pro sports stars and other “gotcha” nit pickers).

It isn’t fun. No sugarcoating. Entrepreneurship is messy.

It will test your relationships, patience and ego. But it rewards agency. Owners decide strategy, culture, pricing and who keeps what piece of the upside. Psychological freedom is real and matters for long-term decision-making. Owners live with consequence and with optionality; employees live with perceived safety and ceilings. If you want uncapped upside and a hedge vs. wage-squeezing inflation, ownership is the structural route

Business Can Be Boring, Even Markets Get Boring: For long-term readers you already know how this goes. There are periods even in *stock markets* that are painful. In fact, we’ve lived through this the past couple months. Nothing particularly interesting has happened since the rate cut in September. The difference? The people who stick around and keep paying attention are always the ones who make it. First to know about new trends and not playing catch up when the tides shift.

Business is no different. The people who bet on themselves and grind when it seems like nothing is happening = get the payout. Takes about 3 years. It sucks. It isn’t exciting. You won’t be on national television. In fact, you’ll see your digits on a screen net worth pass that $1M mark and go “uhh that’s it?”. That’s how it actually works.

Basic playbook

For those that are still skeptical, this has actually happened since the 1960s. While everyone is nodding saying “alright see what you mean about COVID but that is a one time pandemic!”… Think again.

Pretty wild to see the ownership of equities (just the S&P) actually outpaced wages during the industrial revolution. A time when people actually had significant negotiation power!

Stick to the Plan Instead of Falling into the Middle…

Start while employed: Validate demand before you buy inventory

Sell outcomes not hours: Productize services, sell retainers and pivot to recurring revenue only

Recurring Revenue valuation multiple. Recurring = less fragile cashflow

Entity and bookkeeping day one: A clean LLC/S-corp and separated bank accounts keep options open for tax strategy and a future sale

Build pricing power: Niche tightly. Win by being irreplaceable. The ability to raise prices saves your margins during high-cost periods

Hire Computers First: Yep. The days of needing a large headcount is dead. You can get to 8-figures in revenue with software tools and a laptop.

Design for Sell-ability: Even if you never intend on selling, standardize the processes and automate yourself in every way possible. No need to be jealous of random influencers making good money. Their face isn’t sell-able. They have created a high paying job in 99.9% of cases.

This simple step by step makes you move from trading time for money to increasing the value of a sellable asset

Conclusion

If you want a real way out, not just a better salary to “invest $10K more per year”, build something that creates recurring cashflow and a real equity stake.

Control pricing, systematize the business, and let compounding do the rest. The risk is real; the upside is structural — and the difference between owner and worker is not moral. It’s permanent.

The same politicians claiming to be for the people, are playing this same game. Year after year after year. The figure head changes, the incentives don’t.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

How ETH is Staked: Covered (here)

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money