Starting from Zero - Be Adaptable and Some Tax Basics

Level 3 - Value Investor

Welcome Avatar! We’ve noticed a lot more petty misunderstandings and battles over things that don’t matter. In the long-run, this current downturn (and obvious recession) is not going to be the end of the world. Anyone who is willing to recognize that we’re going through a pain period that won’t stop tomorrow (or even in the next 3 months) will be better off by sitting back taking some deep breaths and waiting.

So. In the meantime, we can flush out a lot of wasted time on Disagreements starting with how to succeed in 2022 and beyond

Part 1 - Slight Changes to the Master Plan

For long-term readers back in 2012-2016 or so the plan was this: 1) get into Investment Banking, Tech Sales or a Tech Job, 2) Do the bare minimum to be in-line for promotions - do not be #1 in the firm, 3) spend all your free time working on a WiFi/Side money business, 4) go out Thursday and Saturday night so you don’t end up becoming one of those weird frugal socially strange guys with no personality and 5) do compact workouts 5x a week at minimum.

That was the jist in a paragraph. As usual, the “jist” is easier to say than to do which is why a small number of people actually follow through.

2022 What Changed? In 2022 a few things have changed. We’ve made some significant adjustments. First M&A is no longer the best option. Back in 2010 it was one of the best options since we were coming out of a recession, deal activity was okay and the hours were lower if you did some socializing and figured out how to avoid the sweatshops. At this point the rank order is: 1) Tech, 2) Sales and 3) Investment Banking M&A - ECM and DCM should still be avoided since limited skills are developed.

The second thing that changed is remote work. If you can find a single remote job (even if it only pays $50,000 a year), you can actually slaughter the 10 year plan to a million and do it in 4-7 years with a high probability of success. You simply work that remote job for 1-2 years and use that to fund your WiFi biz. We’ve covered Ad breakdown (link) and the major mistakes most people make here (link)

The third item that changed is actually the website you’re reading. If you’re around 25-30 years old we’re happy to send traffic and get you started on some WiFi money. The problem is you *must* be good. Otherwise it never works as we’ve seen with numerous accounts.

The good ones have done well with limited hand holding just “hey check this one out it’s good” a few times. What do you know, Ox, Octopod, Fawn, Salesguy, Cocoon, Opossum, Tetra, Systems, Owl and Iguana all earn enough to pay their bills online now.

The fourth item that changed? You have to be more patient and careful right now. With debt issues blowing up and deleveraging taking off, you want to make sure you have certainty in your e-com/wifi biz launch. Better to start out slow with some sort of consulting/time for money exchange in year 1-2 because budgets are going to be under strict scrutiny.

The fifth and final item is that you should heavily assume career path money is going to dwindle. This is a major issue for many people reading right now. It’s no longer possible to move up the chain quickly in the vast majority of organizations. Since numbers are down massive, the older people will stick in their seats for as long as possible. No one wants to pay up since revenues are flat or down. This means you have to create the upside in income *yourself*. Your boss doesn’t care about you.

With the small edits out of the way now we can talk about some of the “debates” people have on Twitter that are beyond foolish starting with “choosing” the right people to work with.

Basic Talent Evaluation

Talent is the ability to do *better* than expected. That’s the simple metric. If you see a 10/10 attractive woman and she isn’t married to a rich & decent looking guy… you know she is not a good decision maker in the dating world. It’s unrealistic to assume someone with options would choose to trade down for no reason.

If you see an unattractive guy with a 10/10 girl and he’s not even rich… You should probably ask him how he pulled it off. So on and so forth.

With the dating example aside there are two concepts that do not conflict: 1) EVERYONE is biased to trust someone with a Harvard Degree, 10/10 looks and well spoken and 2) since we know we have these biases, we should look for people who are exceptional *despite* not having those features. If this appears to conflict in any way, sad to tell you that you’re probably not ready for this side of the internet.

Step 1 - Create Biases: The first part is obvious, make any biases work in your favor. You know that people trust in shape people more than out of shape people. You know people trust clean skin, white teeth and well kept hair. You know that symmetry and fitting clothing impact your first impression. Since *you* can bias people in your favor max all of these things out. There is a reason why attractive women should be hired for sales and be used as the default photo for your “virtual assistant”.

Step 2 - Choose Correctly: Do the opposite when choosing *who* to work for. You go into a major company and find out that there are three sales guys all aged 45. All of them make the firm $10-20M a year. You find out: 1) smooth talker and good looking, 2) guy who looks strange but his dad is the CEO of the largest account! and 3) the last guy is out of shape, mediocre looking and was born in some strange backwoods part of the USA with no connections.

The answer is incredibly obvious. You try to work with person number 3 while you copy the style/look of person number 1. Once again if this is confusing this side of the internet really isn’t for everyone. You know that person #3 is just as successful as person #1 but has nothing working for him in terms of positive biases. And. It’s a sales role! He must be lights out when it comes to messaging and catering to the right emotions.

Step 3 - Spot the Good Risk Takers: Once again. You have to look at it from the same angles. If someone already has hundreds of millions, the risk they can take is irrelevant. Once you have $20M+ it means you have a million in income by sitting back and doing nothing. This means you can gamble the other $80M on whatever you like without ever impacting your personal life. Hint: don’t take the same risks as someone who came from money. They can be a lot more careless since the golden parachute is there.

The best person to look at? The guy who makes say $200,000 a year, has a family and suddenly quits to go do something else (start his own company for example). That is conviction. If you surround yourself with people who had to risk something and were right, it means they are extremely good at assessing risk vs. reward. Most people in this situation never have the guts to make a move (too much to lose) and miss out on massive upside.

Sadly, the vast majority of people do the exact opposite. They try to copy trade someone like Jim Cramer (who is already rich and gets paid on eyeballs not returns) or someone like Elon Musk who is rarely 100% serious on Twitter. In short, they try to copy people who already have wealth and that never works since the risk profile is different.

While you’re learning the ropes from person 3 while trying to improve your looks to match person 1, you monitor all of the people who quit. Most will be standard and boring “oh he left for [competitor] firm”. The ones who suddenly quit to do their own thing are the ones to really watch out for.

Short Conclusion

The three items are really this: 1) maximize the biases in your favor, 2) find people who are excelling despite having negative headwinds and 3) do some background research to see if you’re competing with the CEO’s nephew which will never work.

Note: one thing that hasn’t changed is the focus on being as mobile as possible. Liquidity should still come at a premium. If you can create income online (even $2K a month) that is worth at least $4K a month since you can move to another country where $2K a month is a decent amount of money.

Part 2 - Some Tax Loss Harvesting

Since a large chunk of people didn’t bother selling anything during the bull run. Many are sitting on a lot of losses since everything from bonds to crypto to stocks have been down only. Once again, no need to beat yourself up over it. Every single asset was down (except for oil during the boom and other one off items). Generally speaking, all major asset classes have been down only.

Now here are some basics for new people. This should be well known but important to do now.

Tax Loss Harvesting: This is a strategy you should think about now or the next month and a half or so. The rules are pretty simple. If you own a stock or ETF and sell it at a loss, you can’t buy the same asset back for 30 calendar days (not trading days).

Example: You buy the S&P 500, for simplicity call it SPY. You bought this at the end of the year December 31, 2021. Since you don’t want this to go into long-term holding category (different tax rate), you sell it October 1. You have to wait 30 days. Before you can buy ANY S&P 500 type index fund.

Also. You can’t buy 100 shares of SPY today and then sell the other 100 shares you own tomorrow and claim a loss (doesn’t work) since it will be counted as within the 30 days period (it’s 30 days before and after).

ETF Difference Explained: Now that it’s crystal clear. Any stock or ETF you buy you can’t touch for 30 days prior and 30 days after the sale, you want to avoid a “like-kind” transaction. This applies primarily to ETFs and mutual funds (since buying the same sock is certainly a wash sale).

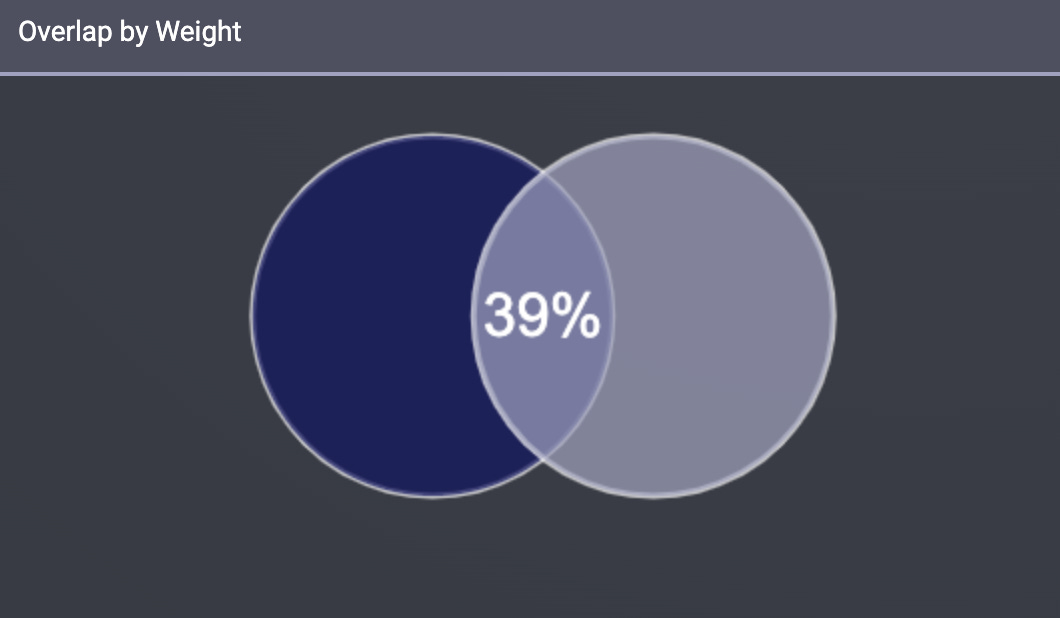

The basic rule is this, it cannot have 70% overlap. If you sell an ETF that tracks the S&P 500 and then buy a similar index fund with only a 3% difference (97% overlap) that is also a wash sale. No tax loss offset.

Checking ETFs Save Link (here): In this link you can compared ETFs easily. As you can see if you sell S&P 500 and buy the tech index QQQ you should be fine (always talk to tax professional).

But if you decide to sell SPY and try to buy VTI. There is an 84% overlap so it would be a wash sale.

How You Can Benefit: Generally, between now and November 30 or so is the best time to consider this strategy. If you sell any tax loss harvesting stocks, you can start January 1 with a clean slate. You can rebuy the asset and claim the loss for 2022 tax returns offsetting any gains you have for 2022 in the process. Note: you can’t sell December 31 and rebuy January 1, this would be a wash sale as well. Just because it is in a different year it doesn’t negate the 30 day rule. Also. If your spouse buys the same stock within 30 days that’s also a wash sale (people try to game the system and it never works!)

Side Note - Max Pain for Some: This is purely a guess as there are no analytics on it. Since 2021 was a lot of greed (people really didn’t sell a dime in many cases because “de-risking is for losers”), we’re betting a ton of tax bills were delayed until October of this year.

When you’re in denial/cope you believe that assets will go back up which is why we saw a lot of people praying for a pivot in June-July. Now we’re at the official “ruh roh” part of the tax cycle. The bill is now due and people will be forced to sell whatever profitable items (and even losers) to get enough money to cover their tax bill. Won’t be pretty!

Short Conclusion

As usual you should see a tax professional if you’re going to attempt to do some tax loss harvesting. The general premise is that you *shouldn’t* do this if you think the stock might recover quickly. A great way to do this is typically with index funds. If you sold a winner for a $50,000 gain this year and have $25,000 in losses if you sold your S&P 500 ETF, then you could reduce your tax liability to $25,000. This is pretty solid since there is a low probability of a sudden 25% improvement in a single month for something as large as the S&P 500. To reiterate, talk to a professional and make sure you’re doing everything correctly if you attempt this.

Bonus - Youth Culture

Now that we’re done with the money stuff, it’s cultural talking point time.

Truly believe this. Now that young people are waking up to the fact that colleges don’t need you to succeed in order for them to bill you $100,000+ for an “education”… They are becoming disgruntled. More scams and “lottery” mentality will brew amongst young people. This is actually quite logical.

You graduate in 2020 can’t get anything due to pandemic craziness. 2021 rolls around you get into something and then 2022 you get cut again because we’re in a recession. Not exactly the best way to start a career! Quite similar to people who graduated college in 2008 only to get offers rescinded and fight off long-term unemployment issues.

Historically, there would be uprisings and things like that. Now? People are just saying “forget it let me find a way to scam the broken system”. You can see this with the wealthy younger generation moving to lower tax areas, leaving the USA and being international for a few years etc. There is no real interest in enacting root cause change probably because the number of people willing to go through that hassle is low (most out of shape, tired all the time and glued to watching videos on a computer screen).

Solution? Not really any that doesn’t involve significant effort. Ideally a group of smart young people really band together and go after a lot of the root issues. No repercussions for Colleges to offer sloppy education with no performance criteria (job placement). No point in raising income taxes since the real issue is wealth disparity (1% income for 20 years won’t even get you close to catching someone in the top 1% of total wealth). So on and so forth. Until then? Strongly recommend only working with written contracts, otherwise you’ll get rugged.

On that note, if you agree with this post you should really consider joining our community of geniuses who are finding ways to escape the matrix one day at a time.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol and on the JPEG team.

2017-2020 Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Security: Our official views on how to store Crypto correctly (Click Here)

Great article. Thanks Bull. BowTied Tax wrote an article a few weeks back on tax loss harvesting strategy focused on crypto, for anyone interested.

https://bowtiedtax.com/2022/09/21/crypto-tax-loss-harvesting-wash-sales/

Both cramer and elon appeal to the masses. By default they have zero alpha in this zero sum game of markets because everyone follows them.

Also conventional wisdom is almost always wrong.

Individuals can search for truth. Big group of people search for consensus.