Talking About True Wealth and Entrenchment

Level 1 - NGMI

Welcome Avatar! We’re going to talk about trends in wealth accumulation, how it will change and proof of a lot of concepts covered here. Before beginning though, the easiest way to good information is still the same. If you’re truly curious about how people get rich/make money, you can call a Wealth Management company and LARP as a wealthy person. Build a quick relationship and simply ask what type of clients they deal with and how the money was accumulated.

Unless you’re calling a company that specifically does wealth management for say Athletes or Actors you’ll find the exact same thing: 1) small business owner, 2) real estate - which is essentially small business and 3) a few rare cases of high-earning professions - Managing Directors at large investment banks for years, extremely high-end lawyers/doctors and other ultra rare professions such as CFO/CEO/Head of Sales at medium to large companies

In the end, the vast majority always focus on #3. The “W-2” which represents practically none of the clientele. 80%+ will skew to small business.

Part 1: Decide on Wealth Level for *You*

Before feeling “behind”, it’s a good time to realize how easy life is in the USA. For those that say add cost of living, we can only laugh. The cost of living is high in the USA because we have a high quality of life. If you have $1M and live in Thailand, yes you can buy more stuff. The question is… What is the tradeoff? We all know the answer there unless you want to have open heart surgery in Bangkok.

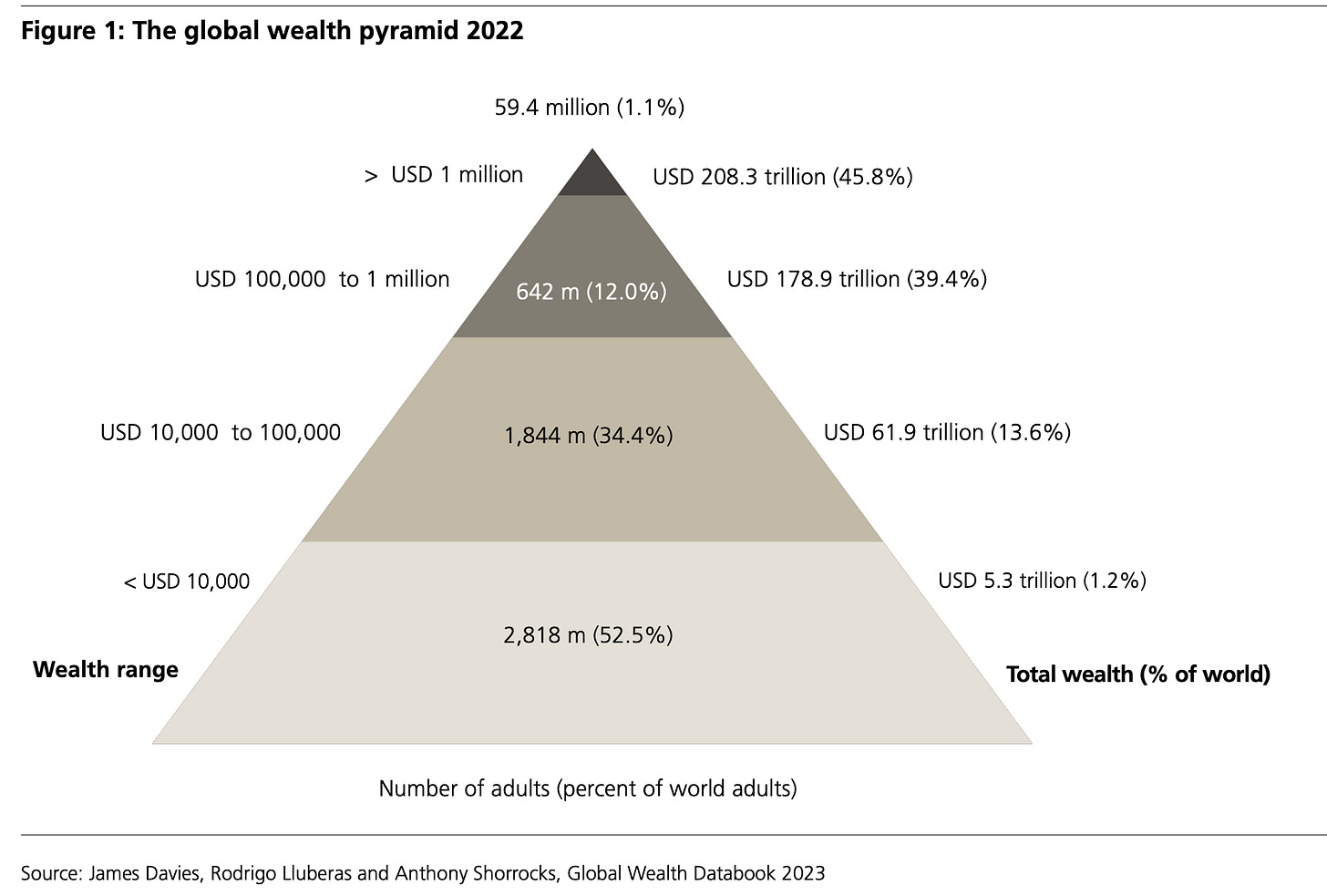

Before moving on, if you are worth over $1M, you are in the top 1.1% of the world. Part of a group that controls 45.8% of the wealth.

That is simply an insane statement. If you’re born in the USA it is time to pour out some liquor for all the people before you that made it possible to live in the land of opportunity.

Time to Make a Decision

It is none of our business. Your life is your life. We try to avoid personality based life decisions since some people do enjoy simplicity. Some people don’t have an interest in becoming wealthy (yes it is true!).

You see a ton of these individuals in the outdoor professions with a wide range of jobs (working with animals, professional sky divers, etc). Next to no shot they care about this side of the web. So. We’re going to assume you’re uninterested in that direction.

How About $1M?

If you’re born in the USA, you can make it to $1M with forced savings. If you make $25/hour and trade your time for money, you could work like a mad man and crank 80 hours per week. It would result in $100,000 a year. This is with pure grunt work, no insane skills, nothing.

Saving $10,000 a year for 30 years gets you there.

Yes, we agree. That won’t buy you much in 2053. And. The math is the math.

The point is the same. Getting to $1M is unlikely a problem for anyone who found this website.

If you’re willing to grind you’re already a future millionaire. How is that for some positive reinforcement! With that we can jump into the wealthy and how their assets give clues about the path to “making it”.

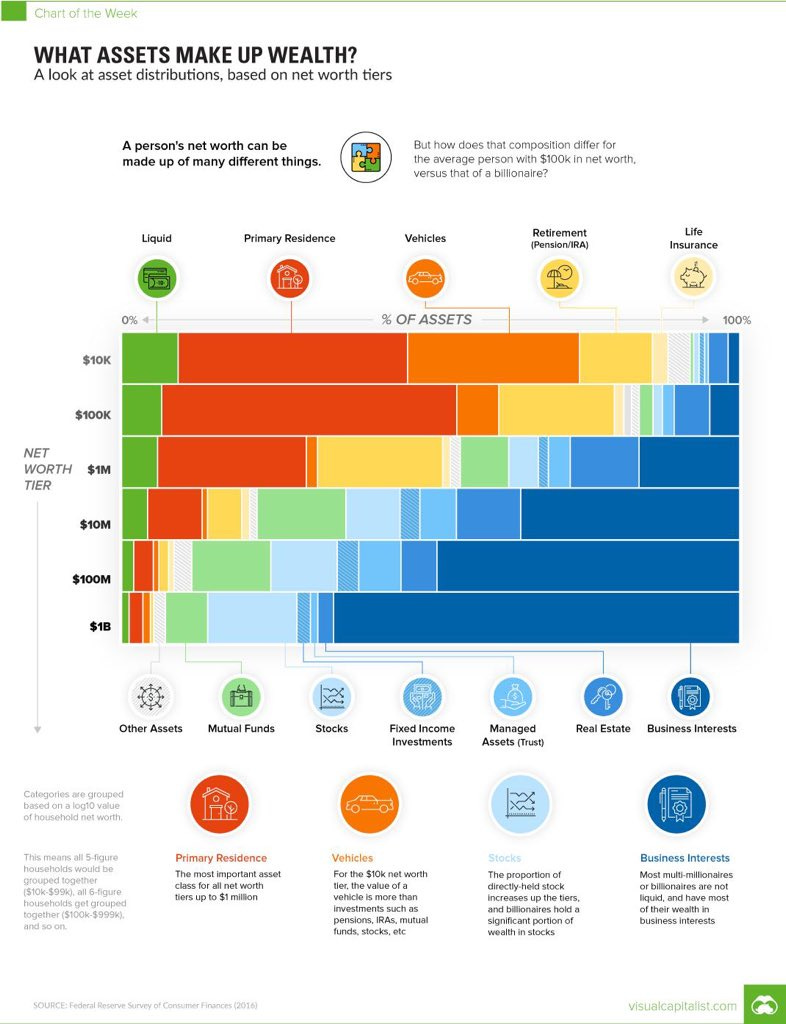

Going by Asset Type Left to Right

Liquid Cash: As your wealth goes up, your liquid cash as a percent of net worth goes down. In fact, this happens every single time you step up the economic ladder from $100K to as high as $1B. This gives out hint #1.

You should only keep liquid emergency money and that is about it. While $10K may be emergency money for someone a couple of years out of the work force, $5M could be emergency money for a billionaire who has to pay for a wide range of potential issues (house repairs, family emergencies, lawyers, etc.).

Primary Residence: While we wouldn’t include primary residence in net worth since you have to live somewhere (buy another one if you sell), we’ll let it slide for illustrative purposes. If you have kids and live in a 4 bedroom with a plan to downsize to a 2 bedroom, then a good chunk of your current home is certainly net worth.

Anyway. If you look at the trends you can see that the majority of people who get to $1M but never much more are *house rich*. Most of their money is tied up in their primary residence.

If things get tough? They use it as a bank account. Utilizing HELOCs and other products to borrow against their equity since there is no other option.

Vehicles: Massive cliff drop in value relative to net worth. If you’re aware of how the rich operate, they simply don’t care all that much about flexing. While there are always exceptions to the rule, the wealthy will drive a car that the upper middle class can afford but always have the latest and greatest model. As an example Porsche/BMW/Lexus/Mercedes are all potential vehicles. If you simply eyeball the vehicle color, you can see at $1M+ it’s around 5% which would be $50K and the sliver comes down to around 1%. This give you a vehicle value range of $50-100K (likely two upper middle class vehicles).

401K/Retirement: Ah ha! Again. We see why people get so upset when you laugh at 401Ks as wealth vehicles (Source). The rich know this and over time it becomes a meaningless percentage of total wealth. While the assets are still visible at the $10M wealth marker, there is a complete cliff drop after that.

This tells you several things. Most people who get to $10M+ *did* work some sort of W-2 at some point. Anyone saying you should “just quit your job and go for it man” is selling a pipe dream most of the time. You have to start at a W-2 and lowly grind your way out. There is no other option. Unless you’re a Trust Fund baby or you are a pro-athlete/celebrity. In that case, you’re already on 3rd base and can start swinging.

The vast majority work and find a way to exit the system via a business.

Life Insurance: Conceptually this is the same as a 401K. You have it there as an emergency. As you get bigger and bigger it just doesn’t matter anymore. If your family is going to get $50M+ there is no real point in purchasing an insurance policy.

Other: The new rich are going to laugh at this one since the "next generation” of wealth certainly owns a ton of alternative assets such as Crypto. Anyone who has survived more than two cycles? Likely has at least 25%+ of their net worth in crypto. The earlier you were, the larger it is. Since this chart doesn’t really account for alternatives, we’ll simply ignore it.

Mutual Funds: Here? It gets real interesting. The mutual fund game is largely due to 1) taking advantage of uneducated rich people who don’t know anything about stocks. Think any small business owner who didn’t make their money via anything related to financial services, 2) a lot of access/information sharing - investing in particular funds will give you access to special private events. They are “in the know on up and coming investment products”. In fact, some funds won’t even accept new money unless it is significant and locked up for a year or more. This could be a full post in and of itself.

Instead, we’ll simplify this for you. If you’re asking “what mutual fund should I invest in to also get access” the answer is you’re not rich enough to even get access. Simply how it works. When you’re rich, the wealth managers and all different kinds of financial advisors will find you.

Stocks: This is where you can get a bit of an edge strategy wise. You know that mutual funds rarely (perhaps never) outperform the stock market. Therefore, unless you’re plowing money into your business (which includes real estate rentals, since that is a business), ETFs are good enough for your stock exposure (VOO and other indexes with near zero management fees). Just scale up here with all *excess* money. You already know that $30,000-40,000 is enough to start a real biz in 2023.

So, excess money should be significant once you are cash flowing.

Fixed Income: Unsurprisingly, this represents practically nothing. This is because the data is not reflecting the latest massive change in bond yields. Anyone who was putting money into 1-2% bonds for the past 10+ years has been destroyed.

Perhaps you found a diamond in the rough over the past decade but fixed-income vs. stocks over the past 10 years has been a complete disaster. Unsurprisingly, the wealthy already understood this concept and didn’t own much. That is likely changing now as you’ll see in the next section.

Trusts: Just going to skip this one. When you make it (many of you will), you’ll learn about this by default. Many of you will have kids and this creates another deep educational process into inheritance, blind trusts etc. In the future we may do a full post on this topic. In short, you’ll learn about this if you make it and trusts are not really a way to “get rich” so it is not pertinent to this post.

Real Estate: Well well, here is an extremely interesting section. You notice that other real estate has a bit of an upside down V shape to it. Rentals have next to nothing for net worth then peak at the $10M level and then come way back down. Guess why?

The dirty secret is that a heavy cash flow business or W-2 (such as Managing Director at an Investment bank) is funding this Real Estate venture. Don’t believe us? Read the post from Deca-millionaire BowTiedBroke (here)

Most are pestering him about “how to get rich with RE” and yet, they are putting the cart before the horse. How did he start in RE in the first place? Oh that is right. By printing mid-6 figures in an online business which funded the chance to do real estate!

There is no way to short cut the scaling.

Business Interests: The exact opposite of the cash example. Every. Single. Tier. Requires an increase in business interest net worth. Every. Single. One.

While many will laugh at you for your first $10K made online, they will laugh less when your business is worth $100K. They will stop laughing and ask for “help getting started man” when your “little idea” goes from $5-10K a month (example) to a million dollar valuation. (example)

You already know what to do. Smile, nod and tell them “I just got lucky bro, I don’t know what to say”

Quick Summary: 1) the *highest probability* way to make it into the $10M+ camp is by starting a small business, 2) the *highest probability* suggests that if someone is obsessed with their 401K or personal home that they are in the $1M or lower net worth range. They are emotionally attached to those two items due to the weight in their net worth, 3) the *probability* of bonds being this low in the future in terms of asset allocation is low given the rate change from 0% to over 5%+ and 4) stocks or real estate should be your preferred *next* step after your first business.

Read that again if you have to! Until you have a small business (even $20K a year is a fine start), you should not bother with investing. You should be investing in yourself to learn the skills needed to grow your biz.

This is a probability based decision. If you have line of sight to going to the MLB, becoming the CEO of a F500 company or you will inherit $10M due to a rich grand parent… This doesn’t apply to you. We’re strictly looking at probabilities for the vast majority (90%+) looking to move up the socioeconomic ladder. (You’d be surprised at the number of investment bankers that can’t do this basic excel math with their $10M+ at age 40 Disney story dreams!)

What Has Changed

Before moving on, if you’re thinking about giving up remember the following:

Crypto now exists which is likely going to become a massive new industry. Interest is at a low not seen since 2019. This is something to monitor.

The internet now allows you to sell practically anything you like online and costs pennies to start versus the past

You don’t need significant capital to start a business anymore

Bonds are now a legitimate option to *protect* your wealth from eroding in your bank account (cash balance)

The USA remains as the greatest country on earth to get ahead by practically every metric. **IF** you’re willing to self inflict massive amounts of pain and suffering while everyone else lazily goes through life doing the minimum since the quality of life is so high

Want to be Mediocre… Better Be Certain!

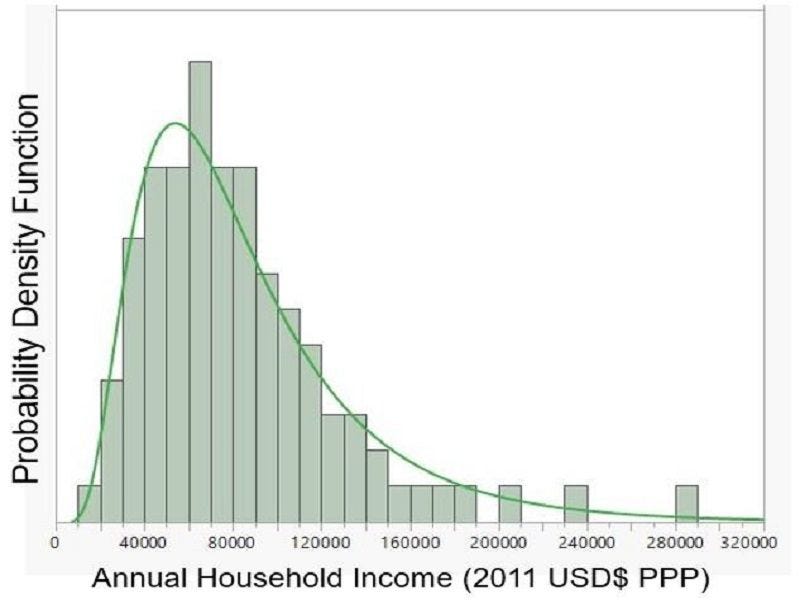

At this point we should think about your decision carefully. The road to wealth is paved in a skewed manner. The median income will always be below the average income. This will only get worse since there is a floor to how low earnings can go (can’t earn negative dollars) and there is no ceiling to earning money. You could earn $100K or $100 billion. The skew will only get worse.

Goal of the Elite: The goal is quite simple for them. The elite know that if you don’t have money to start a business then you can’t create a competitor. So? They focus the narrative on taxing income versus wealth (source)

Imagine having the guts to tell people “we need to raise taxes on wealthy W-2 earners of $1M” who only pay 50%… while the people spouting this idea collect $1,000,000 in dividends that are taxed at only 20%

Uncle Warren Buffet isn’t saying he wants taxes to be raised because he’s a nice guy. He wants taxes to be raised to solidify his standing at the top.

“To prove his point, Buffett has also pointed out that he pays a lower tax rate than his secretary.”

Was he bragging? Probably.

Part 2: Setting Up a Spread

We’ve been harping on rates versus wages for quite some time. Unfortunately, no one cares because they are too busy trying to plan for the next month or week.

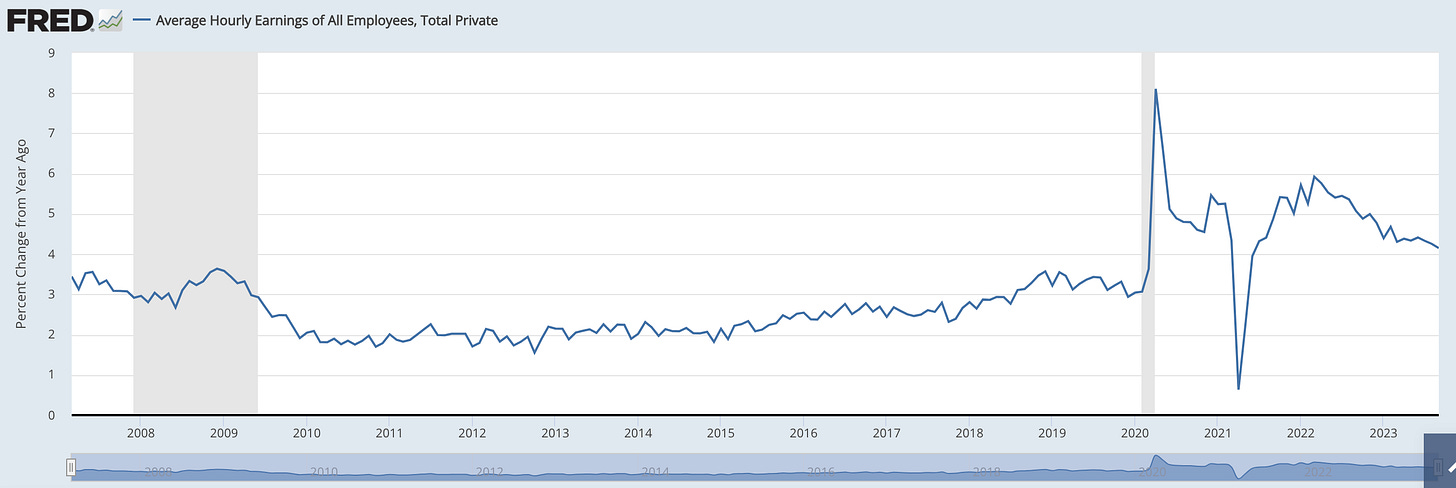

Check the chart out. There is no need to calculate the exact number. If you look at it, there is one anomaly up and one anomaly down. Go ahead and average them out, what do you see? You see average earnings going up y/y by about 3% on average.

Stop and Think: Right now the long-duration bonds are yielding about 4.75-4.90%. They spiked over 5% for a bit. To keep the math simple and easy to follow:

You can lock up cash for a 5% return

Wages do not go up by more than 3% on average even during a full decade of money printing and ZIRP

The largest companies in the world have enormous amounts of cash

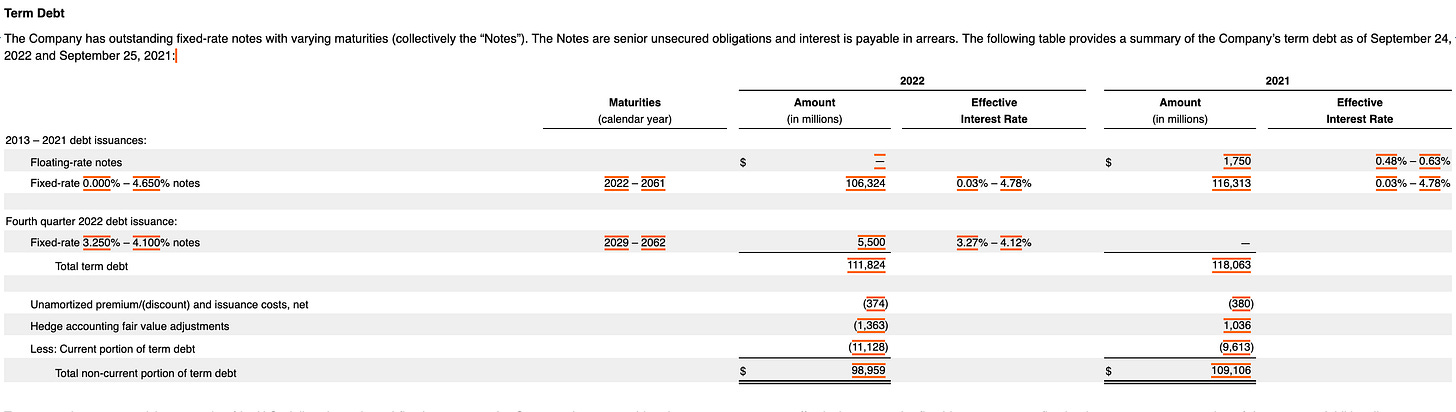

It gets a bit worse. The mega firms (at least the smart ones), issued debt when interest rates were near zero at rates well below 5%. Feel free to look it up! Apple issued notes that pay a whopping 2.2% coupon (source)

For the Finance People that Want a Quick Snapshot

Source: Apple 10-K

What Does This All Mean

The big run in the largest companies is reflecting this financial entrenchment (for the most part). With higher rates for the wealthy, the risk profile for anyone in the UHNW arena is declining rapidly. We’re simply using public markets to showcase it.

Four of the top 7 cash balances are the “magnificent 7” holding up the S&P 500

What About the Deficit! While true, if you’ve been involved in finance for a long time, do you really want to purchase 2.75% German bonds instead? How about 3.9% in Spain, 1.05% for Switzerland or 0.75% for Japan?

Once you look at it from this lens you realize that we’ve got a long ways to go before the wealthy need to worry about a sudden default.

Solution Time!

Solutions for you are clear: 1) starting a business to get out of diluted purchasing power every year - your income won’t go up by more than inflation after the initial few years on the job, 2) position yourself assuming that a wealth tax may become inevitable - scattered accounts, crypto, limit easy target items such as a Mega home - see the Mansion tax in California and 3) this won’t happen but if you want to see real change in society start try to bring up wealth dynamics *not* income into the equation.

For #3 to spell it out, The Fed cannot change the supply side for a house. They cannot change the amount of oil or cars being made. All they can do is print money (increase wealth inequality since the wealthy own assets) or decrease demand. The only way to decrease inequality is to change tax circumstances on assets.

Before anyone calls a bunch of ultra competitive capitalisms “commies” for suggesting such a thing, this is really the only solution. Will it happen? No.

Therefore, adapt or die anon.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

Love to see I'm not alone in calling out the Buffet "tax the rich" switcheroo

If you need another topic for 'the uber wealthy tricking the masses', would be great to see you call out the 'give it all away to charity' trick where you

1) Set up a charity for tax benefits

2) Appoint your kids to be on the board of it for big salaries

3) Get other uber rich to donate to the charity

4) Charity never accomplishes any tasks

5) Get glowing write ups in news about how your are 'giving away all your wealth'

“3) a few rare cases of high-earning professions - Managing Directors at large investment banks for years, extremely high-end lawyers/doctors and other ultra rare professions such as CFO/CEO/Head of Sales at medium to large companies”

Emphasis should be on “few rare cases”. This does not mean most MDs, lawyers, doctors, CFO, head of sales, other c-suite make it to the highest levels of wealth (let’s say $10M+ net worth to be nice but really $25M+). I see a lot of these get stuck and cap out at $5M which incidentally is great for those who employ them. $10M is achievable but usually not till older in their 50s. It’s also fairly common to see “rich” c-level execs leave companies and not even be able to afford to exercise their vested stock. If you’re truly rich you never have to leave upside on the table.

Finally, it’s lost on many that none of the categories from the beginning of the post are mutually exclusive. You can and indeed should be trying to get rich so you fall into more than one of these - 1) biz owner; 2) real estate investor; and 3) top 0.5 percent W2 earner (forget titles; just get paid in large cash comps or large equity grants).