Tax Day is Coming - Crypto Tax Organization

Level 2 - Value Investor

We think Summ is going to work best for our audience which has complicated on chain transactions.

You can access Summ HERE and get 25% off your first year for being a BTB subscriber. Yes this also operates as a ref link. (BTB25)

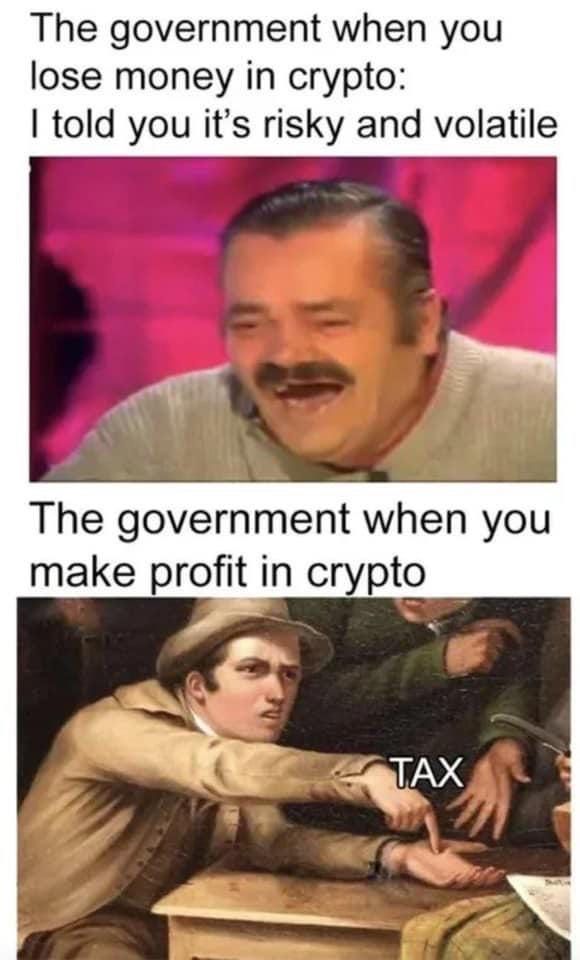

Welcome Avatar! As you know tax season is here and if you’re in crypto you’ve got ~10 days left to get it together (check out part 1 if you are behind)! Here is some alpha for the remainder of the year so you can work on minimizing your tax burden for next year while making the most of the bull run

It’s less than two weeks until the 15th April tax filing deadline for US taxpayers. While taxes are top of mind, we’ve put together this post to outline some strategic tax considerations for this bull run so you can avoid getting rekt by Uncle Sam next year.

If you haven’t sorted out your crypto taxes for this tax season, this is your reminder to do it. Check out our Tax Post from March for the information you need. We’ve gotten you a discount on the best crypto tax software (in our opinion), Summ Calculator. Use Code BTB25 for 25% off all plans for the first year. You’re welcome.

As we’re sure many of you have discovered, crypto taxes are an absolute nightmare. This is especially true if the only time you ever think about your crypto taxes is the week before the deadline.

If you’re planning to “make it” this bull run, part of your planning should include taxes. Not only will future you thank past you immensely when the filing date comes around next year, but you will also avoid a number of gigantic pitfalls that could seriously set you back.

Strategic Considerations

When it comes to crypto and taxes, there are a number of strategic considerations related to tax that you should keep in the back of your mind at all times. It is important to note that these are just considerations; do not let the fear of paying tax hold you back from making money.

Here are some tricks to keep up your sleeve for this bull run.

Timing is Everything

Timing the market is important; that’s why we leave it up to the professionals (AI trading bots).

However, when it comes to taxes, it's easy to be in the driver's seat. Some simple timing strategies can help you keep more hard-earned gains.

For those paying tax in the US (and some other countries), the tax man gives you a discount on capital gains made from assets that you held “long term”. For US taxpayers, this means the asset must be held for over a year, and the rate paid for long-term gains is substantially lower than what you must pay on short-term gains.

While it is not always possible, if you know you are approaching the one-year mark for assets you are thinking about selling, consider whether it would be worth holding out for the one-year mark to get the discount.

Of course, this only applies if:

A) you have made any gains on the asset and

B) you believe the value of your holding won’t fall more than the value of the tax saving before you hit the threshold

In the US, you can also use specific ID inventory methods (if you keep the right records - tax software can help), which allows you to choose which asset lot you want to allocate to a particular disposal event.

For example:

You’ve bought 1 ETH at the market price on the first of every month for the past two years. You decide you want to sell 3 ETH. If you have the correct records, the IRS will allow you to select which 3 ETH you would like to sell.

For tax purposes, it would likely be smartest to choose ETH purchased over a year ago and/or in a month when ETH was more expensive.

Timing also comes into play on the other side of the coin: income events.

You might recall this from our tax post last month, but the IRS counts many different crypto transactions toward your income, including airdrops, staking rewards, interest, mining, referral rewards, etc.

The point here is that the value of the crypto at the time it is received (into a wallet or account) is what counts as income.

This means you have the opportunity to be strategic about when you trigger income events, such as claiming airdrops, staking and farming rewards, etc.

Keep in mind, the IRS limits the amount of income you can reduce with capital losses to $3,000 each financial year. This means it's in your best interest to minimize your income as much as possible to reduce your “guaranteed” (with a $3,000 variance) income tax obligation.

In practice, this could involve claiming airdrops or rewards from farming/staking/mining/referrals, etc., when you anticipate the price will be lower.

This practice is simpler with things like staking ETH, as you are likely focusing on growing your ETH stack, so holding off to claim on a red day isn’t too risky.

However, it’s also important to ensure you aren’t sacrificing money to lower your tax (remember; if you’re paying tax, you’re making money). For example, farming volatile shitcoins is probably not the time to be considering holding off your claim for a red day. Claim the tokens, set aside enough to cover taxes, and do what you want with the rest.

In general, if you’re earning income in crypto, be sure you set aside enough to cover next year’s tax bill.

Stay on Top of Crypto Income

To really hammer this point home, strategic consideration number two is all about avoiding getting rekt by crypto tax. If you do not stay on top of it, you will likely be in a world of hurt in the future.

Remember, some common crypto transactions that count towards your taxable income include:

Salary paid in crypto

Mining

Staking rewards

Yield farming

Airdrops

Referral rewards

Chain forks

Crypto is a fairly unique asset class because you can earn income entirely disproportionate to your portfolio size and your IRL income. This can create chaos for those who are unprepared.

We mentioned it in part 1 last month, but let’s dig deeper.

Take this (very common) scenario:

Degen Dave, an avid airdrop farming enthusiast, has been spreading his funds far and wide across new tokenless protocols and chains in the hopes of capturing some juicy airdrops. Throughout the tax year, he hits a few home runs in airdrops, landing more than double his year’s salary as a teacher in magic internet coins.

Farming on some protocols also led to some very nice APY returns on his deposits. Throughout the year, the combined fiat value of the airdrops and farming rewards at the time he claims them to his wallet is over $200k. He has changed his life (just not in the way he thinks).

Towards the end of the year, Dave had claimed over 20 different tokens as rewards and airdrops. He bullieves strongly that this is the “supercycle” and crypto will never go down again. He’s going to “make it”. Dave sells no coins and diamond hands like the community discord told him to.

The end of the financial year rolls around, and a catastrophe hits the industry. Markets are in turmoil. The majority of Dave’s bags fall 50-90% by Dec 31st. He panic sells most of his coins at the pico bottom, collecting a meager $45k worth of stablecoins.

The following year, Dave meets with his accountant and gets asked about his crypto investing. He was under the impression that crypto wasn’t taxable but soon learns that the IRS has been cracking down on crypto transactions and works with the centralized crypto exchange which he KYC’d for.

He sheepishly divulges his airdrop and farming from the past year. His accountant crunches the numbers and determines he has a taxable income of 300k from crypto and his teaching salary, giving him a total tax obligation of around $100k.

Dave remembers selling his tokens far below the value he claimed them at and tells his accountant about the ~ $150k capital loss. The accountant marks down the taxable income number to $297k, offsetting the maximum $3k of losses from Dave’s income. His tax obligation is still ~ $100k.

Dave only has $15k in savings from teaching, and the value of his stablecoins and remaining crypto has fallen to a measly $50k. Even after selling his entire crypto portfolio and using all his savings, Dave now owes the IRS $35k, the equivalent of more than two years of savings from his teaching job.

Dave just got rekt by Uncle Sam.

This is strategic consideration No. 2. Stay on top of your crypto income!

Use tax software to track the value of your income throughout the year, and set aside the necessary funds to cover your taxable income. DO NOT reinvest your tax money into worthless shitcoins unless you want to be in the same position as Dave.

Note: you can use Summ to automate the tracking of income events.

Always make sure you are in a position to comfortably cover your tax bill no matter what the state of the market is. You should never put yourself in a position to owe the tax man more than you can afford.

Harvest Your Losses

This one is pretty simple and will be something that is more applicable towards the end of the financial year.

The IRS allows you to offset capital gains made in a financial year with losses made in the same year. As we covered above, you can also offset up to $3k of income.

For example, throughout the course of a financial year, you make a killing on the stock market, but your crypto portfolio is lacking. Several of your coins are underwater come December 31st.

The savvy investor would weigh up whether it is worth holding these coins or whether it would be better to sell them, bank the loss, and then use it to offset gains made in stocks. Of course, this is highly dependent on what you’re holding and how big the losses are (ask yourself: is banking the loss going to make a meaningful difference?).

It’s important that you don’t get caught out for wash trading. The IRS has clear rules on this, so don’t sell your underwater positions on Dec 31st and then buy them back on Jan 1st. According to the IRS, you must wait at least 30 days before investing in the same (or substantially similar) asset following the sale, or you’ll risk getting caught for wash trading.

Other Considerations for the Tax Optimisooors

There are many other strategies available to minimize taxes. Each has its own specific rules and limitations, so you should speak to a tax professional before taking action on any of these items willy-nilly. The idea of this list is to arm you with some information to go to your accountant and ask if it could be effective for your personal situation.

Tax-Free Gift Thresholds

The IRS allows you to gift property (including crypto) to a certain value each year tax-free. The threshold changes each year, and you must adhere to several rules to qualify, but it can be a great way to transfer crypto to others in a lower tax bracket. There are special rules for spouses and children which can provide further advantages for families.

We won’t go into the exact details here. Speak to your accountant.

Using DeFi to Your Advantage (Higher Risk)

The IRS has yet to specifically address whether depositing crypto into a smart contract counts as a disposal (thus triggering a capital gains tax event). While there is a strong argument that depositing crypto into a smart contract means giving up beneficial ownership, this is a grey area, meaning there is room for different interpretations.

If you decide to take a more aggressive approach, you could use DeFi to your advantage in some ways, such as taking out loans against your crypto to access liquidity rather than cashing out completely. Of course, this comes with its own set of risks.

It’s important to remember that many smart contracts will also give you a receipt or LP token in return for your deposit. The IRS has clear guidance that crypto-to-crypto trades trigger a capital gains tax (CGT) event, so if you’ve encountered this situation, you may have a tough time adopting a different approach.

If you do decide to adopt a more aggressive stance, you will need to have reasoning to support your claims. It’s worth speaking to a tax professional that specializes in crypto before going down this path but it could be worth the hassle for some of our readers with reasonably sized portfolios.

Note: Summ Calculator lets you toggle between conservative and aggressive tax treatments in settings.

Form an LLC

This one comes up a lot online, so we’ll briefly mention it here. While there are some cases where forming an LLC for your crypto activity can save you on taxes, for the majority of people, it is not a good strategy and can create a number of headaches.

The key point from the IRS’ perspective is that you must be classified as a trader, not an investor, for this to be an option. In general, investors are those who buy and sell periodically, whereas traders rely on crypto as their main source of income and trading very regularly. There aren't hard and fast guidelines available on this, especially regarding crypto, so again, speaking to a tax professional here would be required if you think you could fall into this category.

More Generally

We’re sure most people have heard this before, but more generally, there are two things that will make next tax season a whole lot easier.

Keep Good Records

There is nothing worse than looking back at transactions made over a year ago on a barely legible block explorer trying to figure out what the hell you were doing sending HarryPotterObamaSonic10Inu to an unknown 0x contract. Make use of tax software throughout the year to automate record keeping if you are doing anything beyond simple buys on a centralized exchange.

You should regularly sync your wallets and exchanges to your chosen software, ensuring that it is labeled correctly and that you have left any applicable notes for your accountant or the IRS in case of an audit.

Speak to a Crypto Tax Professional

As we’ve said repeatedly, speaking to a tax pro with crypto experience is a good idea if you have a decent portfolio and plan to do anything out of the ordinary. The sooner you speak to them, the better. Decisions made during the tax year can only really impact the current and future, so if the next time you start thinking about this stuff is in 2025, you’re too late for 2024 (and potentially this bull cycle).

That’s likely the last time we deep dive into taxes this year. Again, if you haven’t sorted your crypto taxes yet, check out our part 1 from March or skip straight to using Summ, which we believe will work best for our readers. Use BTB25 for 25% off.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

Point about airdrops is smart. If you get a high value one like with ENS you can get into trouble. Ordinary income meaning I owed like 3.5k on it, and then the token price dropped in half eventually.

I already filed my extension, lol.

Have not been able to finish my tax filings on time since 2021. Complete nightmare.