The Deepening Chasm: Why the Rich-Poor Divide Is Structural

Level 1 - NGMI

Welcome Avatar! For those that have followed us a long time, you know that the W-2 paycheck is the rockhammer they give you to break out of Shawshank. If you don’t use it to claw out of prison, you end up becoming an “institutional man” unable to operate outside the Wage Mentality.

Fortunately for you (and unfortunately for everyone else), there is a way out which is by going all in on WiFi Money, Equity, Crypto, Tech and investing into loneliness/degeneracy.

For those that go down that world view, we are of the belief that you make it. We’ve never seen a decently talented person put in 100% effort for 3-5 years and end up with nothing. We *have* seen people put in 3 months of effort or 6 months of effort and quit. That’s the 99% who will inevitably be on the poor side of the Rich vs. Poor divide.

Civilization Historically Has Elites Then Masses

Was built on a top down structure: elites and masses.

It feels different today because the industrial revolution gave significant wealth to people in the middle. The tech revolution? Massively different. The entire goal of tech is to replace human effort (going directly against the Industrial Age belief of higher head count = better company).

The second reason? The structures in place to entrench the rich are more resilient, more systematic, more self-reinforcing. By way of example, in the 1990s a doctor could buy 3 homes with his Salary. Today? Would be lucky to get one and more likely half of one. That is a huge hit to W-2 type income especially since Doctors are still rich relative to the world of W-2 earnings.

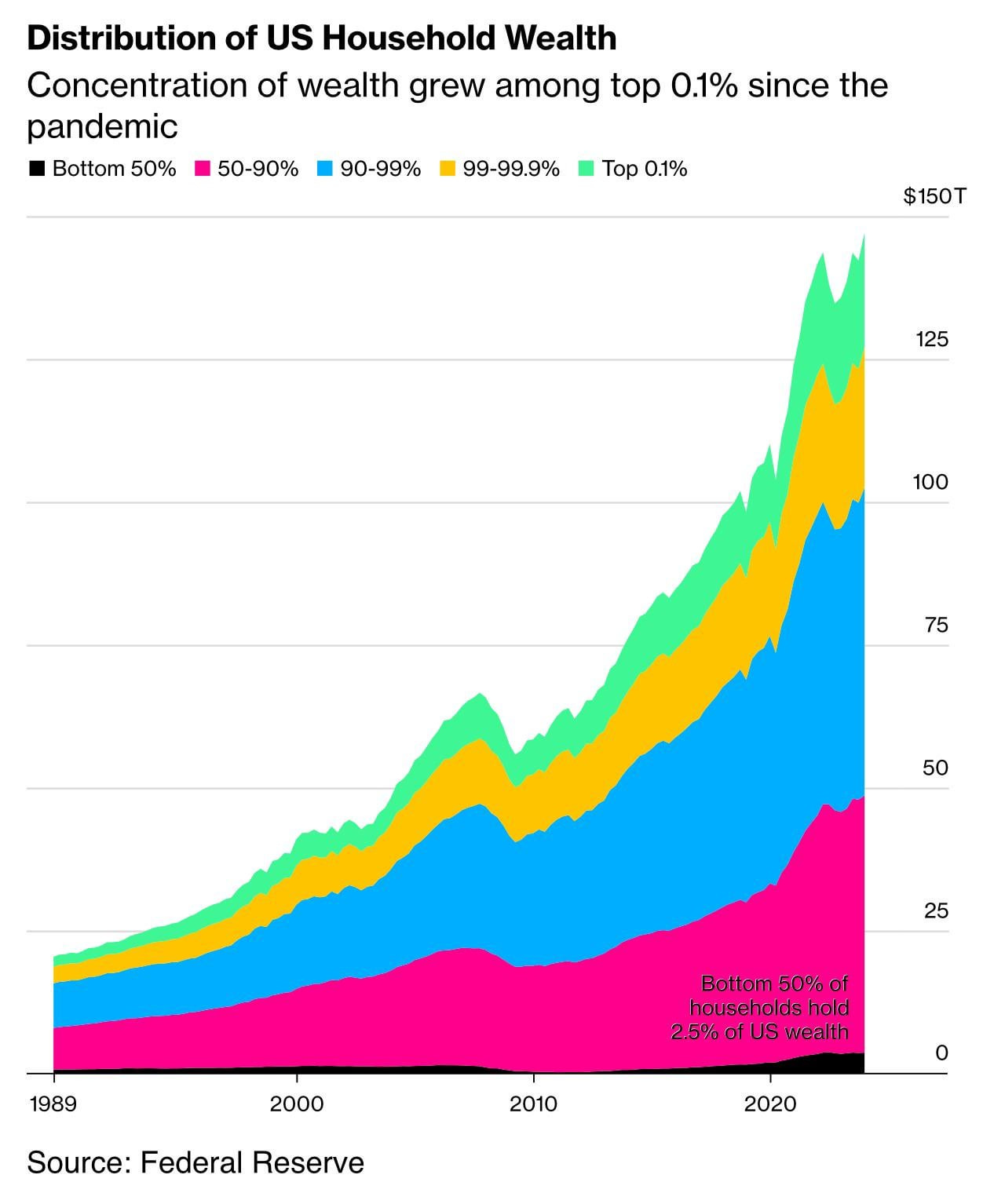

This means that the wealth gap is getting higher by definition. Assets are outpacing all earnings.

If you’re skeptical, that’s good. We’ll go through history and explain how this has evolved and why it is unlikely going to change.

Once again. No one is coming to save you. No one is going to give you a 20% raise (outside those big promotions in your 20s to entrench you in Shawshank). No politician cares about you.

Long View: From Pre-Industrial to Today

Global inequality over centuries: If we go back deep in time to the 1820s, the top 30% has seen gains in purchasing power at 2x the rate vs. those in the bottom 50 %. (Source - World Inequality Report)

Within countries the divide has grown as we produce billionaires, and trillion dollar companies.

US Specific: Since getting off the gold standard, income and wealth inequality have increased within the USA. This wasn’t just a COVID issue. (Source - PEW Research)

The Great Divergence is the phrase used by the New York Times.

So. The long view shows two things: 1) inequality is not new and 2) the durability and distance is rising (concentration).

The Feedback Loops That Lock It In

Once you see this trend you can then move onto incentives. The people in power are already on the rich side of the spectrum. Do you think they want their kids to fall backward? Of course not. Therefore once they gain control over the system, they vote in regulations and tax laws that benefit them.

Much easier to pass down a large estate vs. reduce taxes on a high salary. This is how the system is designed.

Cumulative Advantage

“The rich get richer” is actually based on statistics. This is called the *Matthew Effect* where initial advantages compound over time. (Matthew Effect)

This is the official phrase for a concept that most know: The Snowball effect. After you have a certain amount of assets you accelerate your growth because the investment returns are larger than your take home earnings.

If you have no assets and leave your money in a checking account, not only are you stuck with low returns (potentially interest and penalties as well!). Over decades 3-5% of headwind is millions in opportunity cost.

Policy skew and Winner-Take-All

The wealthy increasingly shape the rules of the game. They all know each other: Lobbying, campaign finance, regulatory capture, think tanks, media narrative control. This results in tax, law, patent policy and regulation to favor capital/assets/equity/ownership over labor. This is a incentive based policy structure. You’re not writing the bills/propositions, someone with 20 houses and 5 entities is.

Once laws are bent to favor of asset owners, it becomes harder for lower income groups to catch up: their tax *rates* are a heavier burden. Long-term cap gains are 15-20% but if you are in the highest income tax bracket it is 37% (nearly double the percent). Also. The person with the cap gains does not even need to sell. They can get big enough and simply borrow against their assets “Buy, Borrow, Die” and legally pay $0 in taxes.

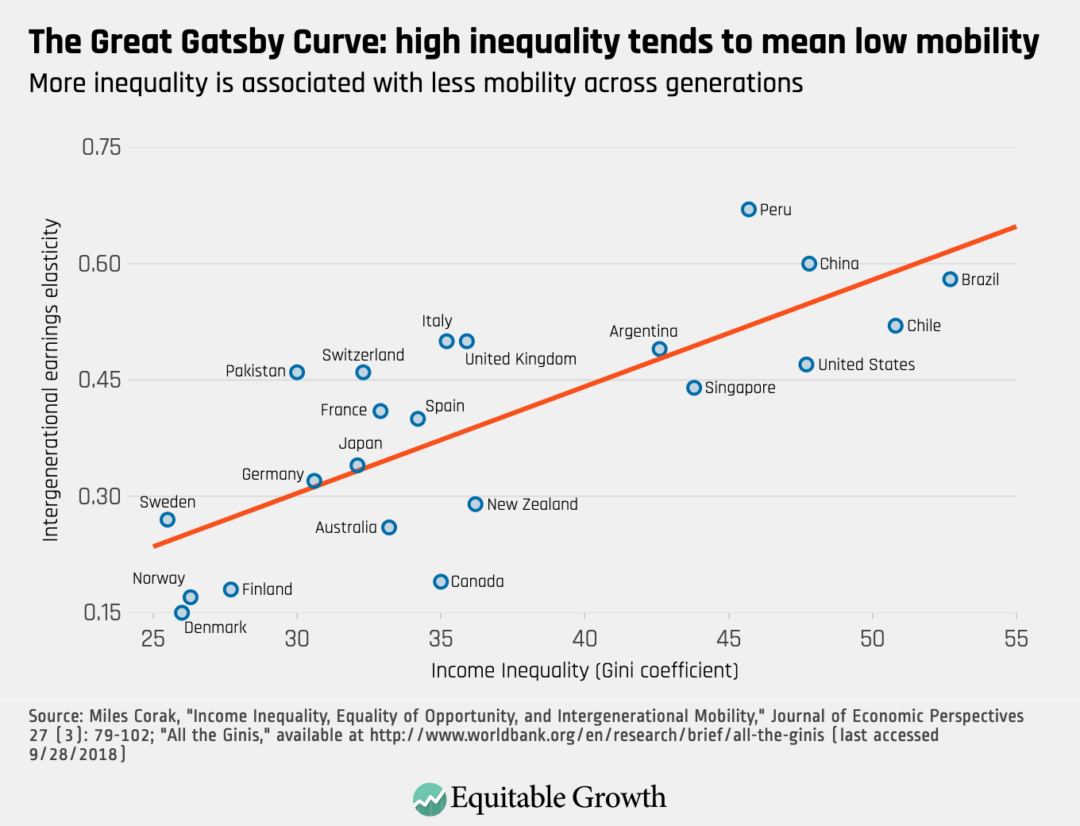

There is a Name for this: The Great Gatsby Curve

For those that have been to Brazil you know how extreme it is. Rich or poor and that’s really it. Be thankful for the internet as your way out (there is no “rich and poor” moniker on the internet).

In short, if you don’t play the same game as the rich, your chances of catching up the NPC way is declining rapidly.

Networks and bifurcation

Once again, thanks to the internet, you can carefully choose your network and social circle. Research models have shown that inequality can be caused by structure of interactions and group separation. Here is the paper on class division. Class Division

Elite circles (financial, social, govt, etc.) become more insular. We’re seeing this now with pockets of wealth (super zip codes) which make it harder to access and touch/feel how these groups think and operate (do everything you can to break into these groups!)

Lower Quality Public Products

As AI/Tech remove people from the work force it’ll put pressure on public goods and calls for UBI. As public systems deteriorate people move towards privatized and gated communities (see prior point of insulation).

You can see the vicious loop here, part of the reason we’re under the working assumption of a wealth tax being proposed in the future (would be due to populist uprising, politicians will never vote to tax themselves).

Warning Signs: Mobility, Legitimacy, Instability

If the divide continues to worsen you’ll see the following logic from people: “Why bother?” Or. “It is rigged against me”. Sounds familiar no?

This leads to what you’re seeing today: political polarization, distrust in institutions, decline in social cohesion and a move to nihilism.

Where we are now?

We’re not at the end state of a total uprising. You can see the writing on the wall though. People are becoming more extreme as it relates to politics. People are starting to realize that the concentration of wealth won’t change soon (Newsflash, the largest companies in the world are all buying 10% of each other publicly… governments are taking positions in public companies… this all suggests the same!)

As power clusters together, the system moves to the perception of rigged architecture vs. the current view of difficult but possible to make it.

Worry when the *majority* have the same beliefs as us. Worry when the typical NPC thinks both the democrats and republicans are in the same party. This means they gave up hope that “their team” will improve their lives.

Economic Signs

From a pure math perspective, worry when labor growth is being outpaced by asset growth *and* the labor leans to credit. You don’t want people borrowing money to pay for necessities like they did for a period of time in COVID.

General Paths From Here

You can fight this, however the logical conclusions lead to the same. Here are some possible solutions.

Wealth taxes

You can try to tax companies but they will fire people and replace with more AI/robots. Your best bet is a wealth redistribution to prevent structural and large amounts of unemployment.

Crypto a natural bull case for it right there.

Robot Taxes

Since unions would just cause companies to fire (again), they have to find a robot tax to fund the employee being replaced. For example if you had 10 people at a manufacturing plant, if you fire 9 of them, the 9 robots need to come with a tax to cover the lost employee for a period of time. Exact mechanism? We don’t know. The idea has legs. We doubt any politician cares about the opinion of an internet cartoon anyway.

Change to Inheritance/Tax Law

As you know we have written simple explainers here. If we’re creating trusts and organizing to pass down wealth, you can imagine that we don’t think this changes any time soon. That said, it is a potential solution. The problem is the execution of it. Another country would jump on the chance to offer better taxes for billionaires.

Political Reform

If the NPCs wake up and view democrats and republicans as the same party, it could lead to political reform. The current system is designed for a world that no longer exists. If tech/robots etc. take huge chunks of the labor market… we should be focusing on quality of life. Not on metrics like GDP

A New Classic

Love this meme. It highlights a lot of our philosophy in terms of investing (not trading). A few times a year there are opportunities to buy/sell. That is about it. In the big picture? Nothing really happens. If you go through history and the list of current items in place (printing money, monopolies investing in each other, top 0.1% getting vastly richer on a proportional basis) you can conclude that “nothing ever happens”

Unless something outrageous happens, assume this is the default.

Choose Which Way *You* Will go

The gap between rich and poor isn’t determined for *you* specifically. That said, you know how the system is designed.

Build. Invest. Teach. Create. The antidote to the despair of “why bother” is ownership and equity. Never trading your time for money.

If you’re reading this, you’re already ahead of 99% of people who’ve stopped paying attention. Use that leverage. Help build real assets: not just financial but intellectual and communal social circles. The more people we push from dependency to self-reliance, the stronger the foundation gets. The BowTiedJungle has proven that with years of growth and *built in public results*

We can’t fix inequality for the masses, but we can fix it at the micro level.

Lady Luck only rewards builders, not beggars. She gets “the ick” from desperation and despair.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

How ETH is Staked: Covered (here)

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money