The Point of Each Investment Class and When the Scales Tip

Level 1 - NGMI

Welcome Avatar! This will be rudimentary for anyone who has made it to the mid-seven figure mark. However, for people who compare the S&P to T-bills, you’ve got to learn now before you KO yourself after making your first million.

Part 1: Type of Assets

Most people just think about cash, stocks and real estate. That’s practically the end of it. Within this, the vast majority (around 90%) have nearly their entire net worth in primary residence. This is just how it goes.

Assuming you’re following the plan of high paying W-2 and biz equity, you know the real world is more like this: 1) liquid net worth and 2) illiquid net worth - real estate is in this bucket.

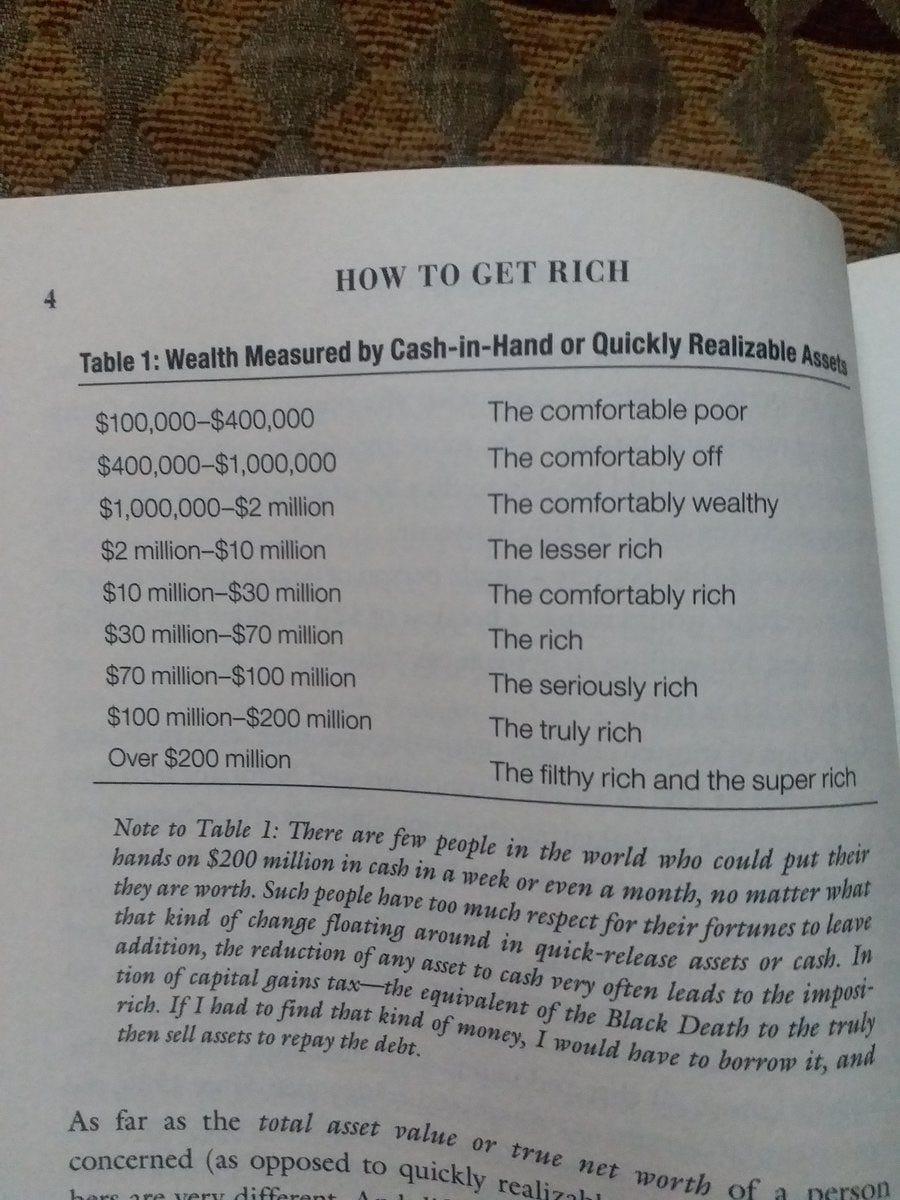

Big Difference: For those that have a copy of Felix Dennis’s book “How to Get Rich”, you will remember the above photo. It says that comfortably rich starts at $10-30M and this compares to the net worth starting point of $80-150M for comfortably rich.

This means liquid net worth gets a 8x value multiple for being “comfortably rich”. $10M vs. $80M.

The reason is simple: the vast majority of wealth creation is done through illiquid gains for long periods of time. Small business owners can’t sell their assets with a click. Similarly, if you own 10 rental properties it really isn’t possible to just click sell over night.

Anything that is illiquid comes with a discount to “paper” net worth.

Therefore when you’re looking at what you own, you should really break it down between liquid and illiquid. Illiquid items should be discounted and *generally* purchased if you have the ability to hold for a decade plus.

Part 2: Liquid Assets

Liquid assets should be split based on what you are going to use them for. This seems to be missed on X App (Twitter) and from what we’ve seen in various Q&As. Comparing the T-bill rate to S&P 500 is laughable at best. One has volatility, the other has none which is immensely different unless you plan on fighting the US military.

Short Term Cash

This is quite literally the same thing as a T-bill. We’re not going to argue about this one to be honest. If you really believe there is a liquidity premium for clicking sell and waiting the 24 hours to transfer to your account, your finances are already a mess.

T-bills especially short term (3 months for example) are 100% liquid since it is a double-digit trillion dollar market place. Again. This market is MASSIVE compared to the entire global stock market. Calling T-bills illiquid is simply mis-informed.

Treasuries: Pay no state tax.

There is no reason to own a CD that pays less than the Treasury rate (same duration)

Checking/Savings/Money Market Account: Largely useless unless the rate is higher than the T-bill rate for the same time frame. Again. Please adjust for taxes on a state level.

That’s really it. This is the only “risk free” asset in the world. While you can lose money temporarily (if you buy a 20-year treasury and rates go up a ton), if you intend on holding for the entire period, you will always get the stated yield. If the US government defaults all of your stocks and other assets are crushed anyway.

Used for What? This should be used only for two things: 1) immediately being exchanged for something such as food and other cost of living items and 2) for extreme asset protection.

The majority will never reach stage two. If you have $1M in net worth, there is practically no reason to ever buy anything beyond the 3-6 month treasury. That’s essentially it. The long-term stuff (30 years) is useless for you since there isn’t enough scale.

Imagine being ultra-wealthy instead. Take it to an extreme of $200 million (Felix Dennis Example). If you spend $500,000 a year on “basic expenses” (in quotes since we realize this is extreme), this means $10M could produce $500,000 for the rest of your life. Now this is a *huge* game changer.

The game changer is not because you’ll collect $500,000 for life, it is because you can invest the remaining $190 million and *NEVER* need to sell.

Selling your company? No thanks no reason can hold forever.

Selling your stocks or computer coins? No thanks no reason can hold forever. So on and so forth.

This type of stability makes risk invisible for the truly rich.

Long-term Purchasing Power Match

Over a long time horizon (20+ years), the goal is to protect your purchasing power. We’re not going to bother with TIPS and other government related products beyond T-bills. No one with an IQ above an 80 is going to believe stated inflation numbers.

If you’re trying to fight inflation you’re really fighting Housing, Food, Medical and Utilities. There is no real basket of goods to track that correctly. Therefore, you’re better off using other instruments to try and keep up while stomaching the volatility.

S&P/QQQ/Medical: Generally speaking, these are the three ways to fight inflation with a *long* time horizon. Most ignore the part in bold. There are multiple time frames where the S&P generates no returns. In some countries, indexes don’t even go up (Europe and Japan being two of the biggest culprits).

Example 15-year Period of Nearly No Returns

The good news is that if you’re long these three categories: 1) S&P, 2) Tech and 3) Medical, you’re going to keep pace over a 20+ time frame. The reasoning is relatively simple. There is no situation in which we return to the past. The future is going to require more and more technology. More and more investment in health. And. The major companies in the S&P will capture all of this (just check the weights of Apple, FAANG etc. within the S&P).

Corporate Bond Portfolio: Back when we were going nuts about 20-year bonds on the paid stack in October, we mentioned corporate bonds as well. This is still an option but we really doubt anyone here wants to go through the sewer to find good notes. Instead, you can keep it simple and say “anything with a 7% coupon”. This is really the line in the sand. If you find a company that will be around for 5-10 years (extreme confidence) it’s a great play to protect your principal purchasing power.

Currently, the low end of Investment Grade is where a lot of interesting notes reside. If you’re looking to simply protect your purchasing power you can take a look at the 2-5 year range if you’re looking to get your feet wet and learn how to judge how risky a bond is.

Liquid Long-term Purchasing Power Gains

This is effectively single stocks and large cap crypto. Crypto is pretty much the only category that is both liquid and illiquid. If you own a bunch of coins with trading volume of $20K/day, you shouldn’t be counting your $10M as “liquid”. By selling you’ve move the price dramatically, likely forced to over-the-counter at a discount.

$200M Daily Volume: This is a good rough number to think about. Remove all the crazy crypto up and down days. Just look at the general volume trend over 180 days. If you look at this and get to a 9-figure daily volume - you’re liquid. Pretty hard to argue this unless you own 9-figures of the coin. As a rule of thumb, anything trading in the top 20 coins or so is *typically* liquid. Just don’t get scammed by something like ICP (previously in the top 3 due to VC hype and limited liquidity).

Single Stock: Outside of recent IPOs, you can assume that anything with a $1B market cap is liquid. We’re not going to go through every single deal, however, most IPOs have a lock-up period for a few months (90-180 days). They start to trade and part of the reason why the price goes up is because there is no supply. Outside of this window, even a small cap stock is going to be extremely liquid.

Now the Rub: The problem here should be clear. You must outperform the S&P 500 with a single security holding. If you do the same or worse it is a failed investment. If you purchase any stock or computer coin and the returns are not significantly above the S&P 500 (stock comparison) or Bitcoin (crypto comparison)… it *didn’t* work.

Liquid Asset Summary

While people love to say “Bill Gates would be richer without diversification” - hindsight is always 20/20. They also ignore the massive down days. Volatility is removed through diversification. Using the same logic it means that you should compare your entire portfolio return to Apple or Bitcoin over the past ~15 years (of course this is nonsense).

Short Term Cash: Wealthy people use T-bills to take more risk. Read that again and again. Rich people don’t operate like the middle class. If you have serious amounts of money, you can take *more* risk if you’ve already locked in your living expenses for life.

Index Stuff: This is largely your 401K (worst case scenario money)

Single Investments: What you’re forced to learn if you’re trying to make purchasing power gains.

All of this should seem reasonable now that it’s written out like this. No one is going to get rich with S&P 500 since everyone is buying it and there are billionaires who own hundreds of millions of it. Similarly, everyone buys it in their 401Ks.

Your only way to get ahead (investing wise) is to be early or correct on a trend.

If you’re ultra rich, you can invest in every single trend since any investment you make will never change your quality of life.

Part 3: Illiquid Assets

The right way to do the illiquid game is already well known for readers on this side: start a biz. If your biz typically sells at say 4x earnings, you can generate $100,000 of value by simply making $25,000 more for the entity. If you find a way to generate $250,000 it’s worth a million (Example case study in just 2 years)

The catch of course is that you need to have patience to find the right buyer/suitor. Also, the first 5-10 years of pain and suffering is unmatched. Sure beats 40 years of guaranteed servitude in a cubicle though!

Real Estate: There is a reason why everyone loves real estate. It’s because they have a huge chunk of their net worth tied up in it! Funny how that works.

Saying people should rent versus buy at any time period is dangerous in the presence of the masses. They view their homes as bank accounts (drawing down on home equity lines for cash) and if the price ever goes down they are cooked

The good news is that it is a stable long-term investment (9/10 times), a lot of people need this forced savings vehicle. The majority of people struggle to save 10-15% of their after tax earnings. By having a mortgage they are creating forced savings through the slow build of equity.

Well, this was before mortgage rates went to 7%+

After 5 years of paying a 30-year mortgages you’re looking at a whopping $17,100 in extra equity (5% of loan balance paid or a whopping 1% a year on average). $320,000 loan balance example.

Private Stock and Venture: This is how a lot of small money investments turn into riches. You’re taking a shotgun approach to kids in garages hoping to find the next 100x. Being the first check to PayPal or AirBnB for example.

In that situation you can negotiate for significant equity and even create a structure so you can’t get diluted. The downside is that the majority go to zero (well over 90%).

Assume Worth Nothing: Until you have an actual take-out value (purchase offer) or the company is going public… it is best to assume the equity is worth next to nothing. If you want the latest and greatest example of this, look no further than OpenAI. After Sam was fired, the share value is stuck in the middle of a Tornado.

Illiquid Coins: This is basically the same thing as Private stock and Venture. The difference is that it is a public market. If you wanted to describe crypto to someone new (in normie friendly words) you’re investing in companies like a VC. The difference is that there is practically no regulation and no oversight. If the same venture check/private stock (prior paragraph) had tickers on them, you’d get the same madness you see in crypto.

Exit Liquidity: This is a term used to describe the standard hype phase founders use to create liquidity in their token. Tons of “announcements” that mean nothing and upside potential just to create trading volume. This is so they can sell or do the standard SAFT agreement at a later date (more info here)

Illiquid Asset Summary

For real estate you can go ahead and assume a -25% for a fire sale price. This is the rough proxy that Felix Dennis used to explain the concept. If you have a home worth $500,000 based on the latest comparable sale, go ahead and say it is worth $375,000 if you wanted to fire sale it quickly and get cash out ASAP. Yes, this assume you can’t borrow against it, but the point is the same. With transaction fees and desperation to sell quickly, a -25% is a good starting point.

Private Businesses: Go ahead and assume worth nothing. Except the cash flows. This is just the reality of the situation unless you see similar companies selling quickly. If you see a similar company sell for 4x earnings you could go ahead and assume a 2.5-3.0x multiple as the liquid fire sale value. If there is no comparison, just assume it isn’t net worth until you get an offer.

Secondary Stock: This is in-between private and venture. If you own a private company but have an *offer* in hand from a place like second market (source), then you can use this as the valuation for the window period. Emphasis. During the window period. As soon as that window closes go ahead and assume it is back to worth nothing on the liquid side. If you want proof of this we recommend asking Clubhouse investors about their $4 billion valuation today… (source)

Illiquid Coins: This one is a bit easier, if you don’t own a significant amount of the supply you can assume a simple 10-15% discount. This is our best guess on the slippage on some small tokens that trade with minimal volume. The bigger you are, the more you have to discount. Especially if you can completely destroy the project (any time a founder sells all of his shares/coins you know it is a zero).

Part 4: When the Scale Tips

From the first section there is a massive range between someone worth $1M and someone worth $200M. They live on completely different planets from a practical point of view.

The area in which we’d estimate that the scales tip is probably $7-8M.

From what we’ve seen, when people get to around this level they are practically forced to buy a 7-figure home and diversify (yes they do both). Have yet to see an exception to this rule except for sudden wealth (lotto winners, inheritance, price of a venture investment or high-risk coin going up in a short time span).

Now that you have a good feel for this, you understand why people don’t see any value in the long-term bonds back in October. They’ve given you enough information with that alone.

On that note, back to the tent.

If you have an illiquid investment that you think has a fire sale price just drop it in the comments and we’ll take a look! For those wondering, collectables that fit in a suitcase are typically just used by wealthy people for paranoia reasons. If you have a couple of expensive watches or a set of gold coins, it isn’t for investment it is for worst case scenario sprinting for the door situations. -20% on stated value if you catch yourself in a bad situation!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

My autism would like for you to refer only to Treasury maturities of less than 1 year as Tbills and anything longer as either 'Treasury Notes' (typically used for 2-5y maturities) or 'Treasury Bonds' (typically used for 10-30y maturities). Thank you

A lot of people like to talk shit on investing in Bitcoin when they know nothing about it. They instead think it's prudent to invest in the S&P, make their 7% gains, just like everyone else.

It seems to me that the vast majority of people are just straight up pussies with next to zero level of risk tolerance. But what they don't seem to understand is that 7% is not going to cut it. Inflation is increasingly getting out of control and the percentages on the most essential things like housing and food is going to continue to outpace 7%

Personally, I think it's crazy to not be taking higher risk investments. You're going to need to be getting returns of >15% if you ever want to get ahead.