Think Twice After You Make It

Level 1 - NGMI

Welcome Avatar! For some reason the following post has gotten quite a lot of traction.

While it’s true that being rich and bored = you’re a boring person. This does not mean that you end up doing no work. Work is required to remain relevant for the long-term. If someone got rich off of DVDs, they ended up falling far behind the times.

Netflix came along and rendered the entire industry a zero. Now? Have no useful advice/skills to hand down to the next generation.

Also. It’s exciting to learn more about technological advancements.

An older wealthy guy messaged us a few years ago (sorry forgot your name!) and said something along the lines of “I’m interested in crypto because you can’t stop learning even in your 60s”. This is the right attitude to have. Even though he already made it, remaining relevant was a top priority.

He won’t accidentally tell his kids/grand kids to go into Equity Capital Markets.

Part 1: What Happens When You “Make It”

Anyone with above average intelligence and extreme work ethic is going to be a millionaire. Definitely believe this statement. Have never seen a person go all out trying their best for years and fail. Every single person ends up making it there even if it takes longer than they originally expected.

Second, if you’re following the game plan: 1) high paying W-2, 2) WiFi biz and 3) *after* getting good income = invest… you’re likely going to get into the multiple millions. This is where things start to get tricky.

You end up selling your first biz or having a banner year. You’ve got a few million dollars and a paid off home. You’re already invested in crypto, stocks etc.

Whatever floats your boat.

“Now What?”: The majority? Well they don’t experience this level of freedom. They also don’t have the personality to grind and build to make it in the first place. They all say the same thing “Bro I would totally just go to Thailand or live on a small farm in Alabama pursing my passions”.

Reality? No one with this personality will get a dopamine rush from that. You need a specific level of intensity, grind and intelligence to get there in the first place. These types do not click off until they are older (at minimum - if ever. Even Warren Buffet is working)

For those that started on this path already, the dopamine rush from that first E-com sale hits like a metric ton of crack cocaine. You can’t forget it. The day you hit your freedom numbers? 500 tons of crack cocaine.

You end up making the same mistakes (we all do)

You start overspending a bit on things you never really cared about. Could be a watch, could be a car, could be a new wardrobe, could be random collectables… could be anything

You end up traveling and doing other foolish things, burning money at night clubs, bars, high-end hotels etc

A few months pass… None of those things are exciting anymore *relative* to the dopamine rush you got when you “made it”

After going through the standard bender + messed up sleep schedules. Taking naps at 1-4pm, being wide awake at 4am like you’re in college etc… Reality sets in. There really isn’t a feeling of reward. You’re not going to the PGA tour, you’re not going to win the Pulitzer Prize etc.

Drum Roll? You go back to the same video game you played before. Building something with the talent and skills you created in the first place. While you might even dabble in actual video games, anyone who had that initial thrill? Going straight back to chasing the same one again (it’s never as high as the first one!)

Lets Assume You Try to Do Nothing

“Idle Hands Are the Devil's Workshop” - This term is so old that it comes from religious work. If a saying lasts that long… there is at least some truth to it.

People can lose a ton of money... Fast.

You can look up lotto winners and see that the exact same thing happens to them. If you have a bunch of money and time, it can spiral. This is the same reason why many trust fund kids end up as drug addicts

Liquor, Ladies and Leverage. Well known pitfalls first. Spending tons of money partying or with extreme leverage (greed). Ends up exacerbating losses and there is no bottom to all three. Mess around long enough and you’ll be down 50% back to back faster than you can blink

Chasing Businesses With No Background: People go into businesses they have no expertise in. Trying to buy businesses just because they cash flow well. Doesn’t cash flow well when you can’t figure out how the engine runs! Money starts to go from black to neutral to red. Next thing you know that entire “easy money” investment is negative and burning cash flow

Personal Life Blow Ups: Suddenly you have 15 cousins and and 50 best friends. Amazing how you’re the coolest person in the world the day after you make it. One “loan” ends up being lost. Then another… then another… next thing you know you’re the bank for everyone who has your phone number. The sickest part of this downfall is the moment you stop giving them stuff they turn on you as if you’re the “evil rich guy”. Human nature has a strange backstabbing genome in it

Options Trading and Other Degenerate Activities: If you want a good book on this, “Reminiscences of a Stock Operator” is a wild one. If you’re known as the “boy plunger” you can guess how this story ends by the time the book is finished. Never be jealous of the guys who get rich this way, ends up being a curse in more ways than one

Extreme Lifestyle Creep: A rule we have is simple. After you make it or have a huge change in cash flow, take *one* full year and don’t change your spending habits at all. Let the dopamine wear off and then decide what you actually want to upgrade (if anything). On a personal note we’re at a point where we’ve got no interest in moving up market in anything. It’s a pointless game of more costs and more headaches. Leave the absurd mansions for Bezos. For all you know, Tyson may come and wipe out a huge chunk of your savings (health event, catastrophic natural disaster etc.).

Summary

Anyone of above average intelligence with extreme grit is going to make it at some point. Could be 30, could be 45. We have no idea who you are, how hard you’re grinding or how much talent you’ve been gifted by the genetic lottery.

It doesn’t matter.

Unless you have an outrageous $200M+ exit that is world wide news, the void of having nothing to do is painful. Lost purpose = loss of life.

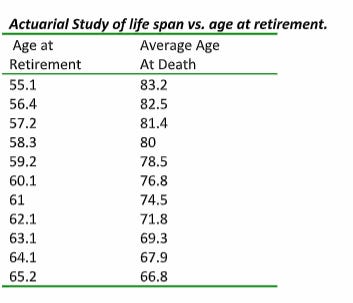

For the True Autists, Around Age 55 is when you can call it quits if you really want to

Statistics are great because they give you a general trend-line. Somewhere in the 50s is where you can truly do nothing from a statistical point of view.

Part 2: Anomalies and a Good General Framework

Since the mid-curve loves to point out exceptions to the rule… if you’re looking at a 9-figure payout? Unlikely worth your time to build much else. It won’t even be fun. If you try to build a mini project that makes $2-3M at exit. That’s only 2-3%. Even if you put all your money into treasuries, you’d do better than that!

Anomalies - MySpace Tom

This guy is probably the ideal person to follow if *you* make it to the crème de la crème of society. He hit a 9-figure sum and went off to do various hobbies (travel, photography etc.). The most important part? He became an investor.

This is a completely different animal. At 9-figures you can take a large chunk (diversify) then take a smaller chunk and invest in various stuff for entertainment. Crypto, Start-ups etc. You simply end up being an advisor here and there.

In short, if you make it ultra big then yes… you can just do passion stuff, take a chunk into low risk then take a *smaller* chunk and become an investor to stay on top of future trends.

Done and done.

For the Remaining 99.9%

Now for the vast vast vast majority. You’re going to have some sort of freedom number. We’ve stated around $3-4M + a paid off home is good enough for practically everyone. In this case you are going to do some sort of work you *enjoy* and you’re going to live your life stress free. Cool set up.

What does this look like?

Step One You Exit: This will be the wildest day of your life in terms of dopamine (under the assumption it is driven by a sale of an asset). You celebrate, pop some champagne. Louis XIII starts flowing etc

Step Two: You take 12 months and don’t change your standard of living (mentioned above), this resets your dopamine. If you “made it” for the first time, we can practically guarantee you’ll ignore this.

Step Three: You make it again (climbing out of the self dug ditch) and follow the correct plan of taking 12 months off with no change to standard of living

Step Four: You now go through a list of actual upgrades you want and triple check that they line up with the standard 4% rule (4% on $1M means you can spend $40,000 a year in near perpetuity)

Step Five: You decide on what you will do for work. This is basically a non-negotiable. You don’t need to make millions anymore but you need to do something to feel useful and productive. Love golf? Go work in that field. Love Martial arts? Repeat the same.

Step Six: After 6-9 months of this you’ll know if you’re “done done”. IE. if you are getting antsy and feel like you’re wasting time, it means you’re not done building. If you feel amazing and have no interest in building again? Congrats you got it solved. Do your hobby work for fun, some health care and some basic socialization

Step Seven: It gets dicey if you realize you are antsy and feel like something is missing. Majority end up realizing they want to build something… That something? It needs to be in the same wheelhouse.

Building in the Same Wheelhouse

Now that you’ve got the general framework, the last part is heavily dependent on how you made your first exit. It makes a lot more sense to try to do something similar in nature. Instead of trying to use money as a crutch (reinvesting all of your proceeds), you can start the process from ground zero again.

This goes back to the same old rule. If you fail at the first business your chances of succeeding in the second one? Much higher. If you succeeded in meaningful way already, the chances of having a complete dud? Pretty low. Not zero but much lower.

The Two Traps: To do this correctly the two traps are: 1) using money as a crutch and 2) going into something completely different “for fun”.

The first one should be clear. If you reinvest everything you might lose it all. Not a great tradeoff.

The second one is scarily common. Looking to a new love/passion business… with no skills/talent to back it up! If you have the pang/itch to build a bit more to go up the socioeconomic ladder, it means you need to focus on what you’re good at.

We’ve said it 100 times and we’ll say it again. Doing what you love and enjoy is last. Doing what you are good at is primary and most important. You are depriving the world of your talents by ignoring them. The price is mediocrity and disappointment (a fair price to pay for depriving the world of your value).

Summary

If you follow the rough guideline here you’re going to be good. We already know no one will do it. Everyone goes through the bender/terrible decisions phase. That said, save it down for later.

You’ll know if you’re ready to chill and work on that golf course or go back to the video game that set you free in the first place.

None of the other games in life compare to building anyway. Anyone who says it is boring is a liar, they simply never succeeded.

Part 3: Excuses and When to Call it For Good

Excuses

Some will come up with the craziest excuses. They want to see the world (it gets old). They want to play guitar (also gets old). They want to spend 100% of their time with their kids (they need a role model… doing nothing isn’t a good role model). So on and so forth.

While you should 100% dedicate more time to your personal life, the complete drop off to zero is highly unlikely at a young age. It doesn’t make sense from any perspective except for a major health issue or the extreme case of becoming a capital allocator like MySpace Tom. By the way, managing 9 figures is basically running a small hedge fund anyway, it isn’t easy.

When to Call It - Other Circumstances

You can call it when you’re around 50-55 (rough range). You can call it if you have a serious health issue being dissolved by work (the whole point of life is to live not work). You can call it if there is a real extreme personal life situation (typically family emergencies). That’s about it.

Other than that you’re doing one of three things: 1) a fun hobby for some small income, 2) you’re building another small business to keep in touch with new changes and 3) you are large enough to be a pure capital allocator.

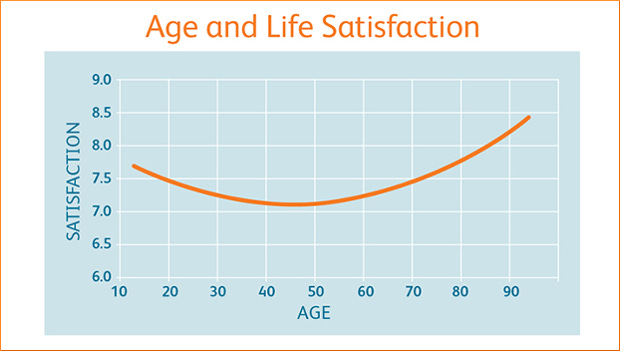

Life Satisfaction Usually Bottoms around Late 40s/Early 50s

By calling it for good around the bottom/turnaround phase, you’re going to accelerate your life satisfaction for the next few decades.

As a side note, by making it earlier (most of you will make it in 30s, early 40s at latest), you will not have that large drop. You will spike back up to baseline (age 10 and scale up from there).

Part 4: Summary and Other Thoughts

Just because you make it doesn’t mean that quitting for good is a logical choice. The vast vast vast majority need to do something. Men (in general) are builders. It is why they always look for new things to do. NPCs and the masses will enjoy being plugged into VR headsets with an IV drip of nutrients. Anyone who is talented and driven will need to work until they are older (at least somewhere in their 50s).

We realize this is just a cartoon internet account. That said, there is enough literature on this for you to spot check it. Don’t listen to anyone who says “i would totally bro”. They haven’t even made it yet so their entire opinion is moot. If you didn’t live it, unlikely you have any relevant things to say.

Call up some wealth management firms ask for their typical client. You will learn largely small business owners and then learn they are all doing something for work

Go join a luxury gym. Go at 11am or so. You will find nothing but winners since none of them are working a W-2. Guess what… Practically everyone is still working

Go do the same at a golf course or tennis club

Now you get the idea. Instead of debating on the internet, arguing with us or coming up with a theory, just find out yourself! This will help you make the right decision when you make it.

Good luck!

Autist Note: for the extremely nit-picky people, around $25 million is video game money where you can largely be an investor. We just used the 9 figure number as a non-debatable extreme wealth metric. Hilariously, tons of you will get to $3-4M and a paid off house. You will be well beyond the $25M mark when you’re in the grave. Cap it!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money