Three Types of Wealth: Quality, Time and Pure $$$ with a Table

Level 2 - Value Investor

Welcome Avatar! Got some heated debates on X if $2,000,000 at 23 is a lot of money. It is an outrageously large sum of money. You could be set for life with that single amount at age 23 and disputing this is purely insane (from a financial perspective). The only real argument is that it will be blown. This is true. If you handed us or anyone reading this $2,000,000 at 23 it would definitely be blown on all sorts of horrendous ideas related to ladies, leverage and liquor. No doubt about it.

That said, a lot of people still don’t seem to comprehend time value. Not just compounding but life events. You need a lot less money to be rich at a young age (because you can do a trillion things) and the number of things you can do declines over time. Don’t tell us you’ll be running 49 second 400M, 35” vertical, 4 flat mile at age 65. No chance. Bryan Johnson doesn’t post fitness *results* because it would show he’s inferior in every metric to a standard D3/D2/D1 athlete who stayed in shape. Honestly probably worse than a decent highschool athlete who stayed in shape as well.

Part 1: Quality of Life Wealth

This is really the game. You want to maximize your quality of life over a 40 year period. Sure you can be in great shape at 60+ but you’re still not going to be at the clubs popping bottles on a weekly basis.

Health > Wealth is something we preach that is often forgotten.

Even with $100,000,000 we can assure you that you wouldn’t want that much money if it means you’re wheelchair ridden for life. You also wouldn’t want it if it came with constant sharp back pain or breathing issues. Your quality of life would plummet and money can’t fix *real* health problems. Money certainly helps you get the best resources so being rich matters. However. A health problem that money cannot solve will never be worth $100,000,000. (yes we’d take some boring health problem like light shoulder pain, the point is clear with the meaningless exception to the rule comments)

Here is general performance of Olympians average age is right around Mid 20s.

Since everyone on the internet is an extreme athlete with their 60 second 400M and starting shooting guard role at a private school that “coulda gone pro if he tried”, we can extend this range. Just take it out to around 35.

This means *all* of your peak performance outside of total freaks will be between 20-35. After that you’ll never experience peak performance in physically demanding tasks (if you were training your whole life!).

Moving onto Mental Tasks - Chess as Indicator You get to 20-40.

Add This All Up

Even if you are elite, your performance will peak across all tasks at around 20-40 years old. Add in PEDs, tons of HRT, tons of supplements and you can eek out a few more good years. Keep it simple 25-45 is the peak of everything: physical and mental.

What these means directionally is pretty simple:

Assuming you had a billion dollars, your peak life experience would land in age 25-45

If you had no money in this band, you will not hit peak performance in anything: physical or mental, since resources impact your ceiling

You’re basically a decision maker and unless you plan on all your assets going back to uncle Sam, your priorities typically shift to friends/family by wide margin

The summary is that the $ number to be considered rich is *MUCH* lower in 25 and hits a cliff by around 45. Not going to nail this perfectly but that’s the summary.

Part 2: Time Wealth

Once again, Health > Wealth. Assuming that is solved, the other major constraint is really time. We will go to the grave knowing that 99.99% of people would rather control their schedule and earn 20% less vs. being on the clock in any corporation.

No where do we say any of this stuff is easy. Testing ads (losing money), manufacturing issues, product issues, return issues. None of it is easy. The experience makes it worth it when you can earn more *and* no longer be forced to go to some meaningless Team building event.

Even in high paying positions the time loss is pretty brutal

Losing time on forced meetings. Even ones that are useless and just used for facetime

Losing control of vacation time since you must go when business is slow (August for Wall Street), probably around February if retail. So on and so forth.

In ability to actually click “stop”. Constant email checking even when off the clock

Forced schedule that makes you cram into a crowded gym before or after work hours

Unable to go to your kids events, asking for permission to even see a basic game or recital

All of this adds up and impacts Part 1 (quality) which makes it another facet of time wealth. If you’re born into the Trump family you don’t have to worry about all this but we’re confident the majority are not in a situation where they can simply take control of their time at age 21.

You Can See This Based on Readings of Happiness in Humans Over a Year

While some would argue it’s just due to holiday seasons, this kind of defeats the idea. Holiday season is typically when you’re in 100% control of your time beyond just seeing friends/family. If you can increase time wealth you’ll increase this bar structurally forever. You can decide when to work and when not to work you could see your friends/family when you wanted to by definition

Financial Wealth Makes This Possible: As we’ve said many times. A job is where you are paid based on a time for money exchange. A career is where you are paid based on results delivered for someone else. A business is something that makes money while you sleep.

Outside of a business owner, having a lot of assets would free up your time at certain levels. The $2M debate would free up about $100,000 per year of time. If you can live on $100,000 a year (easy for someone who is 23) this means 100% of your time is free. If you are 35 living in NYC with 2 kids and a wife who doesn’t work, the amount of time it frees up is less than 50% for the vast majority. Not the same.

Part 3: Pure Wealth Incorporating Time and Quality

With that out of the way, we can use pure numbers to try and outline what is wealthy for people. We’ll say two of the same things: 1) *Vast* majority will be set with a *paid off* home and *$3,000,000-$4,000,000* in addition 2) a great financial goal *rough* math is to be worth around $8,000,000 by 40-ish. 38-43 we just use 40 as a round number. Impossible to say either of these two is not rich. There is always going to be someone richer than you unless you’re Elon.

Liquid Net Worth Does Not Include Home Equity

There is always going to be some debate around this and part of the reason for the chart is to illustrate a few things: 1) you’re expected to be broke out of college, some kids get $100,000 from the bank of dad, 2) you have to create a plan that creates wealth acceleration to make it later - around 40-ish and 3) we would 100% choose to be 30 and have $1M vs being current age + wealth.

This is purposely done to create some debate because it is also true we wouldn’t choose to be 21 with $100,000 since a lot of luck, timing and perfect circumstances can prevent you from making it into the $8M+ range.

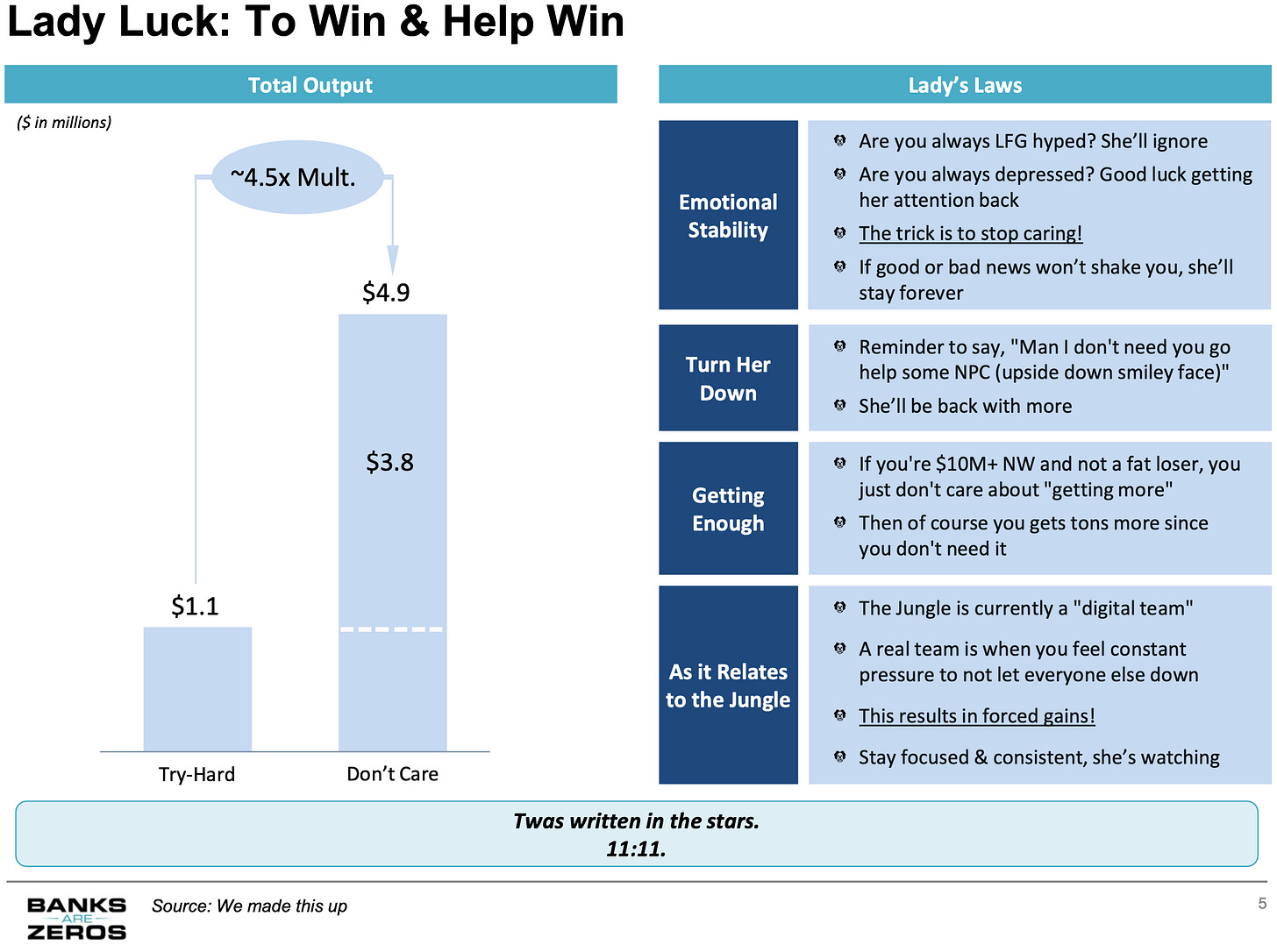

All that said we have *NEVER* seen an extremely high effort person fail. Not one. Even with slightly above average talent we’ve seen everyone we know get into the low 7-figure range. The people who get past that is a combo of talent, luck, right time right place. We’ve got no qualms saying lady luck is involved and are happy she sticks around.

For Fun: If you ask us to go back in time to say age 25, we’d probably give up everything for around $750,000. We would 100% do this for $2,000,000 since you could live it up for a long time (no one with a single brain cell would do nothing, would get bored).

How about you, if you could be 25 again how much would you give up? Guessing everyone who is older will say $1M is more than enough to click the time machine.

Note do not include stuff like your family etc, in those situations you’d never say its worth it! We’re well aware of that exception to the rule.

On that note, back to the tent.

Go get that WiFi money anon. Freedom awaits.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money

https://med.stanford.edu/news/all-news/2024/08/massive-biomolecular-shifts-occur-in-our-40s-and-60s--stanford-m.html

Dropping this here for those who keep debating about aging

Wife and I set up a custodial account for my 17 yr son when he was first born. Just a simple account and seeded with around the annual federal gift tax amount every year for a couple. Auto set it and forget it. A decade in we moved it to something a little more responsibe with better protections. Good kid, he does not know he even has it.