Time Based Opportunity Cost

Level 1 - NGMI

Welcome Avatar! As you know we had a recent health scare at the end of the year. Emphasis on scare. For those that really care some skin cancer removal. Easily caught and nipped. The interesting thing is that it quickly reprioritizes your life.

The old “Yin and Yang” statement is true. While it’s never good to hear about a potential real health issue, it does make you reprioritize your life.

What Is Opportunity Cost

Most immediately think of the annoying $100 bill on the floor example. You guys know the tired boring story. A billionaire makes so much money per second that it isn’t worth it to pick up the bill.

“If it was a real $100 bill someone else would have grabbed it.”

This of course doesn’t make any logical sense at all. A billionaire is not trading his time for money. A billionaire is making money while he is doing nothing (sleeping) and while he is working (making decisions) and when he is eating lunch. As he picks up the $100 off the floor he is still making money. Therefore it is actually logical to pick it up. Another failed example of “opportunity cost”

Real Opportunity Cost: Now we’re onto the correct way to think about opportunity cost. It means you *could* have done something else. This is extremely important and distinct. If you make $200,000 a year in your W-2 it doesn’t seem rational to start a small business that makes $1,000 a month the first year. You lost so much time!

Not correct at all. If you were building this income and *could not* earn money, it means the decision was wise. It is even wiser if it eventually makes money while you sleep.

Therefore opportunity cost is dependent on time. This has crystalized why we harp so much on working a W-2 while building on the side. If you build on the side you are basically taking zero risk with infinite upside. If you try to go all in on day one, you’re potentially losing $200,000+ per year in easy to make income (yes working a white collar job is pretty easy vs. building a sustainable business). Either way. The point is the same. The opportunity cost is extremely high during working hours and extremely low off hours.

What is Time Based Opportunity Cost

This really boils down our distain for people who love the frugality movement. Couldn’t put it into words until now.

Time based opportunity cost reflects the loss of experience.

Lose too many of them and you end up like this…

If you decide to work 80 hours a week for life, you end up missing a wide range of life experiences. This is the real cost of the frugality movement.

Should Always Be a Good Day To Die

In an ideal world you should feel like this every year. If you died today, you lived life to the max up until that point.

If you want to maximize that metric it will require you to generally bucket your life into 5 year chunks. What you are doing at 20-25 vs 40-45 should be unrecognizable. For example, if you did the whole party in Thailand thing at 20-25, you are not going to care about it at 40-45 (the bug was already smashed)

Time Based Opportunity Cost Assessment

After a health scare you quickly reorganize your priorities. Specifically, we’re in transition to becoming full time investors vs. builders.

This was the big picture wake up call. Building stuff is fun, however, at a certain point you need to transition into pure capital allocator. The amount of time you have left is declining rapidly and the quality of life is also going to decline (Age 60-80 is worth nothing compared to age 20-40).

The general big transitions look like this: 1) figure out what you’re good at, 2) build sell repeat, 3) build only if ROI is high and 4) focus purely on capital allocation.

As you can see these are high consequence changes. If you don’t make these jumps it makes life harder. Running on fumes in your 60s isn’t really enjoyable (we know there are always some 0.001% freaks out there). Similarly, if you’re stuck in part 1 at all times, you never even get the ball rolling in the first place!

Break It Down In Your Own Life

Go through and see what skills/talents you are developing. Are they going to be relevant for the next stage (go back to the four stages). If not, it needs to be scrapped instantly.

Removing Activities

For example, fighting middle aged men in an MMA competition where injuries are through the roof? The equivalent of drunk driving on a Saturday night. Negative long-term ROI.

Another example. You are already pretty set and decided to learn a brand new business for fun. Ignoring your main skill. This is only going to hurt you since the ROI will be down and you will lose track of investment opportunities. Compounding two problems at the same time. Negative long-term ROI.

Adding Activities

Say you decided you’re going to have a family (again your choice). Well before you do that, probably wise to spend a full 1-2 months seeing some stuff you won’t be able to see. Galapagos, African Safari, Racing a Super Car, Sky Diving… whatever. All of these are actually high ROI things to do now. As long as you’re not throwing away the house money or levering up, the opportunity cost of delaying that is extremely high.

Assume you plan on exiting your company in about a year. Well instead of trying to get an extra 2% on the sales price, you should actually spend a bunch of time figuring out who you will be spending all that free time with. Economically speaking it is rational to get an extra 2% but it is completely irrational when you consider the downside of having a huge account and absolutely nothing to do.

Now Applying this to YOU in 2026

We’re of the belief that the vast majority of you are still on the way to making it. Every year we get dozens of people who make it. This is because there is that standard ~3 year lag for people to get a breakthrough (shout out BowTiedVampDeer!)

If this is you then you should look at 2026 through the lens of opportunity cost as it relates to Time for money

If you’re not financially set, your goal is to earn as much possible without renting out your time. (Job = time for money exchange, career = performance based exchange and business = makes money while you sleep)

In 2026

The leverage menu item list is now enormous. You can scale to a 8-figure business with under a handful of people. Every day you’re seeing small headcount companies sell for 8-figure paychecks. 1) AI tools make it possible to scale without HR, 2) targeted ads removes the need for sales people, 3) recurring revenue models make the pain periods more manageable and 4) extreme use of 1099s reduces your legal risk materially.

The only Question you should be asking: Does this skill allow me to earn without renting my time? If your plan is: 1) new degree/signal, 2) change in title at your W-2 and 3) consistent raises… you’re playing the wrong game entirely. In fact you’re slowly digging your own grave. Just a ticking time bomb.

New Scale Set Up

Before, in the industrial age, success was based on headcount. Since the only input was “pay person A $10,000 and get $2,000 in net profit”. If you hire a thousand people you’re now making $2,000,000 a year as a manager.

Now? Completely different. The game is now: 1) who can attract the most attention - ads, social media stars etc, 2) how can this attention be converted into a product that people need on a recurring basis - could be a SaaS could be dog food. The point is recurring/consumable and 3) how do you take that success and redeploy it into more ownership.

As you an see this means your time is no longer a hinderance on earnings. In fact, they are unrelated.

Get Out of Employee Belief Systems

Since you go to school, write what they tell you and leave… you’re pre-programmed to assume income = show up get paid, leave.

This is an impossible way to get rich since there is a fixed number of hours in a day. You need a continuous loop of “put capital in get more capital out”. If you put $1,000 into an Ad campaign and you generate $500 in pure profit *after the ad cost* you should try to put a trillion dollars through that system (your market will be much smaller than a trillion dollars but you get the point. A business is really just taking money and making it create more money than you started with)

If you’re still forming the $5-10K to get your first ads tested. That’s great. Just don’t fall into the standard trap: 1) hourly billing, 2) one time sales no repeat demand and 3) making it impossible to sell without you there.

Quick Time Evaluation

Now that you’re well on your way, here is a good heuristic to valuing your time. We all instinctively know that a middle aged broke person isn’t a good person to listen to. This is because they had 20+ years to make it. Therefore, the expectation (correctly so) is that someone in middle age shouldn’t be grinding 80 hours a week.

Instead your free time hanging out and having fun should be going up every decade or so.

Variables for Time Value: 1) health - declines over time, 2) options for experiences - declines over time, 3) interest in partying - this also declines over time and 4) the big lever which is your family - if you choose to have one.

20s: Rough framework is that your time is worth 3x more than you think it is. Instead of trying to party as much as possible during your “good years”, you should be partying the minimum amount to feel good. You still need to go out and have fun, just know that you want the minimum dosage.

Think of it as a social gym. The bare minimum to retain social fitness.

Enough social skills to avoid regret, constant building of skills/equity and taking advantage of the ability to eat glass all day.

30s: This is probably the most balanced decade for most. Your time is still worth about 2x more than you think. If you were going out about 2x a week, you’re actually free to ramp this to 3x a week if you like. The tricky part is that we *assume* you have an asset earning money while you sleep.

The right way to play this is by taking a week or two extended vacation. Typically going out 2x a week is more than enough in your city. The difference will be scratching the travel bug so you don’t get that one later

40s: You should be in maximum control. This means you have enough money to say “no” to things you don’t like. You should not be entirely focused on maxing cash flows. Instead you’re doing work to remain sharp and compete at what you’re truly gifted at. Also. This is where you should no longer be refreshing your net worth or having one of those corny spread sheets that tracks every account by the day.

Equal weight of work/personal life.

Intuitive Balance

The posts of “$10M is not enough to retire” are all gone. This is because the entire comment was crazy to begin with. We’ll go ahead and stick with out one house + $3-4M liquid being good enough for 99.9% of people.

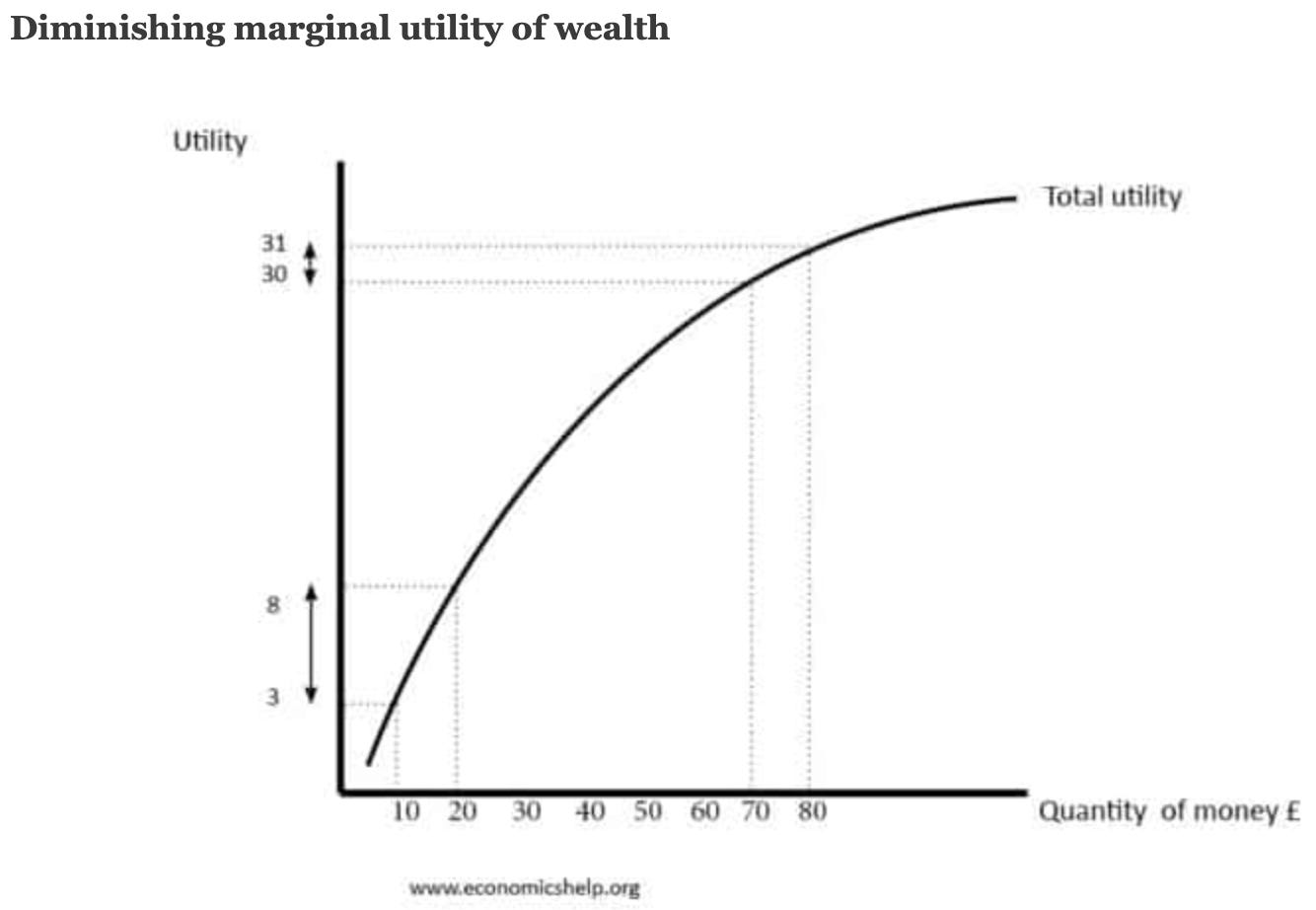

You can run simple math on this and figure out why it lines up.

Take the $4M at 4% that’s $160K. You can pretty much live where you like and do what you like if a house is paid off. If you spend a bit more than that, just go work a little (see the entire section on age 30s/40s).

Now if you were to cut that in half… now you’re down to $80,000. This isn’t even remotely close to the same lifestyle. Spending wise if you try to burn through $6,666 vs. $13,333… it’s a crazy spread. Crazy.

This would line up with (80,31) marker on the chart below vs. being at (40,15.5).

Main Message

The main thing we want to drill here is that you should be actively fighting the time for money machine. It doesn’t need to be your life. We get that your parents and teachers will disagree. That’s exactly why they are teachers.

The majority of your time is spent turning the table around. It takes a few years but it is worth it. Once the numbers flip in your direction you’ll be making more while you sleep then while you are “actively” working.

The step after that? Getting your capital to make more than when you work.

Once you’re at this step, the idea of getting more digits for the sake of digits declines.

Also. We don’t think the idea of becoming a capital allocator is “becoming soft”. If you look at the majority of the wealthiest people in the world, they end up becoming pure allocators later in life. Even Bezos has become an allocator.

Doesn’t matter where you’re starting at just remember the rough four quarters of life and make sure you’re on track to make it to the next part of the game:

1) figure out what you’re good at

2) build sell repeat

3) build only if ROI is high

4) focus purely on capital allocation

On that note, Stay Toon’d!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

How ETH is Staked: Covered (here)

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money