Trump Initial Change and Why Corporate Life is a Risky Choice in 2025

Level 1 - NGMI

Welcome Avatar! Since Trump is officially the President, we thought it would be a good idea to do a quick summary of what he has already put in place. No there wasn’t an Strategic Bitcoin Reserve on day one, but some of the changes will impact your Career & WiFi earnings (you do have a biz to reinvest to with all your crypto gains don’t you anon?)

Part 1: Executive Orders and Other Future Changes

We doubt anyone cares about anything unrelated to making money so we’ll skip all the J6 pardon stuff and just focus on the recent changes that’ll impact you from an income perspective.

TikTok: This was a hot topic for a few days but it looks like they will settle this within a few months. We’re pretty confident that it’ll be around. The only real lesson here is to diversify all your traffic if you were printing on the platform. Always run at least two traffic sources. If you hit it big on TikTok/META/Other, don’t take a victory lap and find a way to convert similarly on a second platform. Of all of them we still think META is the best place to get started, US based and pretty easy to work with the terms and conditions.

Federal Hiring Freeze: This is good for the US debt issue. Not great for US consumer demand. A ton of jobs created over the past 5 years were just government workers. Without government employment increase, probably looking at higher unemployment numbers in 2025.

Quick math, ~800,000 new jobs were created the last year and a half. That’ll go to zero creation and potentially negative for 2025 if DOGE steps in to cut headcount. Probably want to reduce ad spend in DC & Arlington.

Leaving Climate Change Groups: He’s exiting the Paris Climate agreements. This is probably going to lead to lower energy costs. Unless you’re in the Oil business probably doesn’t pertain to you too much. Gas prices go down a bit and that’s all you will likely see in your personal life (for now).

DEI Slashed: For those still in career mode/looking for W-2 increases, don’t think this will actually change much. If you look at what happened with the rules around college admissions, the Universities didn’t really adjust. While the DEI department is gone, if you’re at a woke company, it’ll stay woke.

On the fringes this is still better than the prior admin pushing harder and harder for the insanity of “multiple genders” and a “diversity quota”. Net positive for the typical American but just know if your company is hard core woke, it probably doesn’t change much.

Future Changes

Based on the comments he made, it seems like Tariffs will be a serious stick used by the admin. Once again. If you have inventory coming from abroad (which should be 99.9% of E-com biz owners), best to just bring that in now. They can’t back date the rules. Put it into basic storage and then see how the pricing shakes out.

Before anyone gets mad, this is just how the business world works. You don’t sit on your hands and take a potential 25% hit. You try to front load inventory now to avoid getting cooked by your competition who are certainly thinking the same thing.

"We are thinking in terms of 25% tariffs on Mexico and Canada; I think we will do it on Feb 1st." - Trump

You have 10 days to get it done but if you have been reading on the paid side you should already be set. If you know pain might come the smart move is to take it all up front, order and wait. Chances of your store being down 50% in a year is unlikely. Just stock up so you can adjust prices later

Summary: Lower job creation in the government, higher import costs and lower oil prices. That appears to be the major three items. The rest is largely riff raff with J6 pardons and the inevitable Ross Ulbricht pardon. While it gets headlines unlikely impacts you at a personal level. Finally, DEI stuff helps on the fringes but woke companies will remain woke since politically the USA is heavily spread/divided. “Us vs. Them” mentality which won’t change overnight.

Part 2: Why Playing It Safe Is the Riskiest Bet of All

While we’re sure everyone is excited about the changes, it’s a good time to step back and look at the mega trends. The mega trends don’t really change and the thesis here is still the same: The most dangerous place you can be is in the middle of the herd.

Playing it safe in a career definitely feels comfortable but the higher ups are already using AI tools/software to get rid of the middle as fast as possible. That’s the vast majority of white collar 6-figure paychecks.

It’s what society has conditioned you to do: “Stick to the plan. Follow the rules. You’ll be rewarded.”

Unfortunately, this no longer works in the 2020s. The boomers who told you to get a stable job for 40 years and retire didn’t adapt to the new economic reality: Equity Owners or nothing.

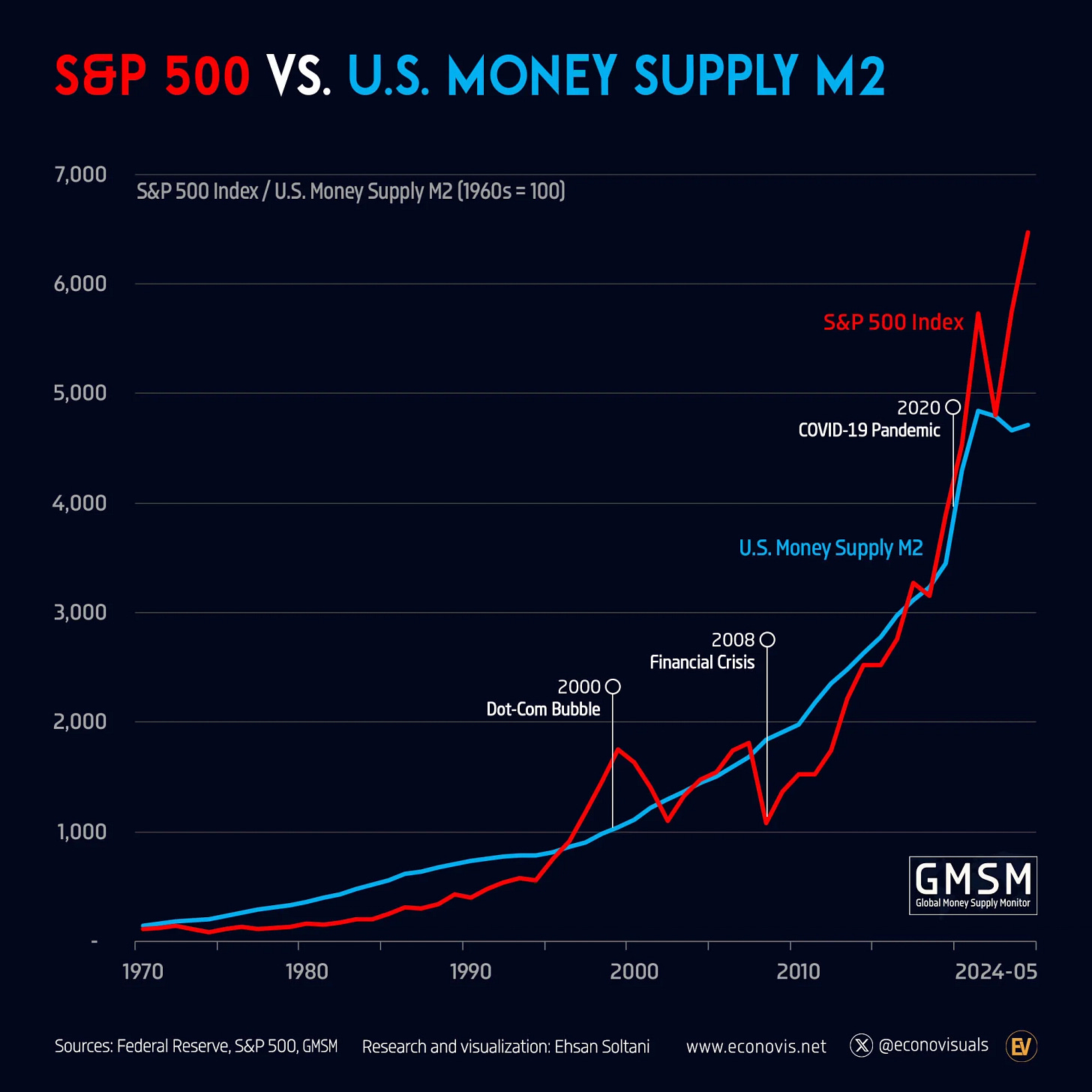

While there are dips above and below the money supply (likely due to global M2), the path is pretty clear from the chart. More money comes out assets go up in price. There is just no way that wages are keeping up with asset inflation (S&P growing double digits while wages rarely grow by that much - except early career where they try to golden handcuff you around mid 30s). The stable comfy check is designed to make it difficult to leave by this time frame (also where major life events occur - families for many)

The middle is where you’re most exposed to group think and stability, a boiling frog as your income eventually can’t keep pace with assets

The Illusion of Safety

Careers/Jobs give you line of sight to slightly higher income which feels *good enough*. Then you’re locked into a house with a 30-year mortgage and a 60/40 portfolio of stocks and bonds (according to mainstream plans). You’re told these choices will lead to long-term security and comfort. But in reality, this path is riddled with hidden dangers:

Asset Price Increases Eat At Your Quality of Life: If you’re not building equity as prices of assets rise, you’re being priced out of the market. While inflation has been the topic for a few years, it’s more than that since asset price appreciation has been well into the double digits pre-COVID

Corporate Layoffs: No job is truly safe. The secure paycheck can disappear overnight when a CEO decides to cut headcount to appease shareholders. We know a ton of people who were in revenue generating roles that get cut and have to take a -50% paycut hit to land in their next position. The top 0.1% of corporate performers are fine but mathematically you should always assume you can be cut at any time

Missed Opportunities: Opportunity cost is massive. By avoiding risk, you’re passing up asymmetric bets—those rare chances where the upside dwarfs the downside.

The best example of asymmetic upside is in the multiple your small business generates. Your friends will all say the same thing “good luck with that cute project” “you still doing that idea of yours” so on and so forth.

You can sell a company you can’t sell your career.

If you earn $100,000 net income from a business it is worth a multiple 3, 4, 5 times earnings. It could be even higher than that in the right industry. If your W-2 income goes up by $50,000 you just get $50,000. If your biz income goes up $50,000 you are likely up $200,000. Not even close to the same.

The Herd is by Definition the Middle

If everyone is doing it, there is no real upside. No different from investing in something that everyone already knows about. While investing in something like the S&P likely goes up long-term, it’s not going to result in exiting the middle.

People will congratulate you on the small promotions at work but it’s just another step towards being stuck. When everyone is doing the same thing, the returns shrink, the competition intensifies, and the risks multiply.

With globalization, automation, and cost-cutting, wages have stagnated while housing, healthcare, and education costs have skyrocketed. Playing it safe in this environment is like staying in a boat that’s slowly sinking.

As you can see, if wages average around 5% to keep it simple, this is significantly lower than the rate of change for assets. Using a simple calculator we can compare 8% compounded over 25 years (career) vs. 5%

8% over 25 years = 6.85x compared to 3.38x

Quick math is you’re *half* of where you would be as a biz owner. This is why standard of living has been on the decline and won’t be changing any time soon. Robots/Globalization will continue. We know that’s not popular but it’s still going to happen. Slowing the trend is just a bandaid, get the trend to work in your favor.

Asymmetric Bets: The Antidote to Playing It Safe

The alternative is to embrace asymmetric bets: options where the potential upside far outweighs the downside. These bets *feel* risky to most people, but they’re where true wealth and freedom are created.

Investing in Yourself: The ROI on learning a high-value skill or starting your own business is often infinite. A small SaaS company, E-com company or real estate flip might have low returns at first... But you’re learning a new skill and they don’t include that in your return because you “could have made 8% in the S&P, your first idea was only 12% and required time!”

Betting on Innovation: Early investors in companies like Tesla, Crypto or Amazon didn’t play it safe. They saw the potential for outsized returns and made a calculated bet. The smart ones did this with… You guessed it, excess money from the small “hobby” business they built.

The asymmetric moves are still the same. Innovative tech and forced returns with your biz idea.

Treat the W-2 as You Being Paid to Escape

The best part about this is you don’t need to be reckless at all. The paycheck you’re getting is just a rockhammer given to you at shawshank when you enter into your first W-2. Everyone has to pay the *life tax* of learning through trial and error

Losing small is fine if you can win big. We’re more than happy to say the first 3-5 ideas we tried failed entirely. Thousands lost but information gained is worth 10,000x anything from aligning logos on power point or updating a spread sheet that no one will look at.

Reframe Risk: Risk is a tool. The real danger isn’t taking a big swing and missing—it’s standing still while the world changes. Boiling frog.

Start Small: Test your risk appetite with small asymmetric bets. Invest in a side hustle and invest in innovation. Each step will build your confidence.

Embrace Uncertainty: Uncertainty is where growth happens. The more you’re willing to venture into the unknown, the more opportunities you’ll discover. If someone gives you a chance to learn anything related to building equity, you sprint towards it

If you read the history of many successful companies Warby Parker is a good example, the founders didn’t even quit their jobs initially. They quit after it was clear the plan would work.

The rough math around these parts is 2x net income from your idea (E-com, RE, SaaS, etc) is the hurdle. If you’re making $50,000 post tax at work and start generating $100,000 post tax from your scalable biz, time to exit!

For the majority, this process takes about three years. It can take longer. The majority just quit but psychologically the earlier you start the better. The first $10K you make will mean a lot more if you’re young vs. mid career (feels pointless).

Closing Thoughts

Playing it safe is comfortable, but comfort rarely leads to escaping the middle.

The middle of the herd is the last place you want to be when the stampede begins.

Instead, seek out asymmetric bets. Find the edges of the map. That’s where the outsized rewards—financial, personal, and otherwise—are waiting. Because at the end of the day, the riskiest thing you can do is to let life pass you by while you’re stuck in neutral.

You’re not here to play it safe. You’re here to win. Good luck, the divide will accelerate for those embracing all the new tech and those hoping we return to the past.

Note: avoid all people who long for the past, it means they didn’t adapt to the future. Otherwise they wouldn’t want to go back in time.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money