Understanding the Future of the Consumer and Basic Spending Patterns

Level 2 - Value Investor

Welcome Avatar! The USA is largely a place where money is seen as a God. This is pretty easy to see based on who we glorify and what type of individuals the government wants to elevate. People like the Kardashians have done an incredible job at making middle eastern people sexy in popular culture, glorifying sex work and normalizing botox/fillers/plastic surgery etc at a young age. You can debate this stuff or you can capitalize on it by building a business targeted at these major trends (such as Med Spas!)

Part 1: Instant Results Continuing Trend

It doesn’t matter if your product/service is going to work for years. All that matters is fast results. In fact a rebill/constant need for it is a bonus if your goal is to make money on the future consumer.

Ozempic? This is the latest popular example. While we’ve never suggesting touching it and unlikely will in the near future, it offers a massive quick fix to weight loss. Generally, we’re always skeptical of fast acting products since long-term impacts are unknown.

Generally don’t prefer to touch stuff with visible clues. Once again, never used it so could be FUD but you get the idea.

We could be wrong (which is fine) but that still defeats the point we’re making.

The reason why it crushed is simple: instant gratification

Fast Delivery: Around 230-250 million people use Amazon Prime. That is a massive number to get faster delivery. If you’re trying to improve your profit margins, just charge slightly more for fast shipping. Yes, seriously.

Even if it makes zero sense at all (to you), remember that you’re the builder not the consumer. Consumers have low impulse control and less patience than a 4 year old in an ice cream store.

After Pay and Debt: Despite high interest rates, people will still prioritize getting the shiny object today vs. waiting for a cash payment. If high rates didn’t stop anyone from going further into debt, nothing will.

“Mortgage balances shown on consumer credit reports increased by $190 billion during the first quarter of 2024 and stood at $12.44 trillion at the end of March. Balances on home equity lines of credit (HELOC) increased by $16 billion, the eighth consecutive quarterly increase after 2022Q1, and there is now $376 billion in aggregate outstanding balances, $59 billion above the series low reached in the third quarter of 2021. Credit card balances, which are now at $1.12 trillion outstanding, decreased by $14 billion during the first quarter but remain 13.1% above the level a year ago. Auto loan balances increased by $9 billion, continuing the upward trajectory that has been in place since 2020Q2, and now stand at $1.62 trillion. Other balances, which include retail cards and other consumer loans, decreased by $11 billion. Student loan balances were effectively flat, with a $6 billion decrease, and stand at $1.6 trillion. In total, non-housing balances fell by $22 billion.”

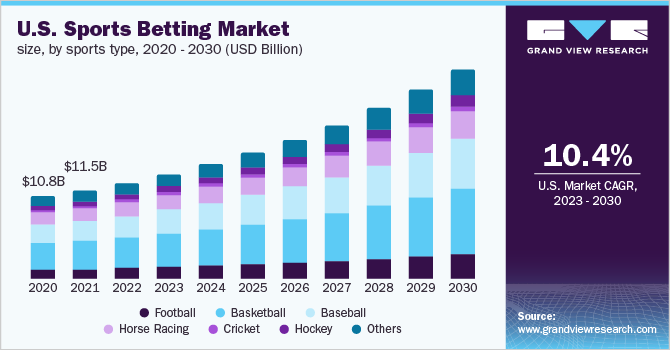

Continued Gambling: If you’ve watched any sports, you now see announcers talk about betting lines during the game on live television. This is pretty crazy and degenerate but it’s the future. The US is now glorifying losing big and betting big in sports. Anyone who has seen small towns crushed by lottery mentality belief systems can attest to how dangerous all of this is.

Will it change? No. It’s all a symptom of the same thing, instant gratification/instant win/loss feedback. In fact, seeing random people go viral like the Hawk Tua girl just drives more gambling and the same instant feedback cycle. All of it is related.

10% Growth!

Part 2: More Purchasing Power to Women

Yes, we’re serious. While the top performing men (guy making millions), will always be at the top of the pecking order due to supply/demand, the actual spending is still going to tilt heavily to women. You will have more sugar babies, more inheritance that has never been earned and for anything sales/customer service based women are better than men. Anyone foolish enough to use a male photo instead of an attractive female photo for their customer service/correspondence is purposely losing money.

Quick Understanding: Despite years of the same thing being written, people still get upset that “commercials are not selling to men”. This is because men don’t buy much.

If you want a simple cultural reference we’re sure you’ve heard the phrase “What is mine is mine and what is his is ours”. Also. If you have ever dealt with real estate before you know that the wife typically decides which house to purchase, not the husband.

Break down the Phrase: Since women are hard wired to look up the socioeconomic ladder we can make a simple example. Say a nurse making $80,000 marries a corporate guy making $120,000. The guy can live with little and the girl can spend her entire income.

Just throw away taxes and you can break this comment down “what is mine is mine and what is his is ours” = 100% and 50%. This gets you to $80,000+$60,000 in spending power or $140,000 vs. the total of $200,000. 70% is the resulting number.

We’re well aware that doesn’t get to 80% but 70% is a close enough proxy to understand why women will drive spending for the next several years. Throw in some basic stuff like never paying for dates, drinks, dinners etc. and you can figure out how the number would be 80%.

Cultural Impact

The only problem here is that a lot of men are no longer earning big money. You’ve seen the headlines of a complete gutting of middle management in Tech and Wall Street. In fact, we’ve said publicly many times on X that the difference between now and 30 years ago is “no such thing as a rich employee”

Back in the 1990s Lawyers/Doctors/Bankers *were* rich. While they were making $400,000 or so in many cases, the cost of a home was only $250,000. You can move this around a bit to adjust for cost of living but anyone in these “high powered” careers could easily buy a house within a couple years. No crippling debt, no issues with massive inflation at the time.

Now? If you have someone making $500,000, the cost of a home is closer to $400,000. Layer on much more student debt and higher other costs and you’re looking at essentially a 1:1 ratio (Pre-tax income to total home price) for the top paying jobs in the country (ignore the top 5-10 stocks that go up 100%+ since that’s about as rare as working in professional sports).

The Impact: Women who grow up in wealthier households no longer view money as a status item. In their eyes a hot husband becomes the status good since their Trust Fund is going to earn more than any Doctor’s efforts. Note: this could also be a entrepreneur woman - point is the same.

This creates a new relationship that is becoming more common in the USA. Older women dating younger guys and a type of Boy Toy set up. You’ll also notice the women are a bit smarter, never really allowing for finances to be intertwined as much (just go check out Miami to see this trend growing!).

Likely Trend: Since high inflation and high risk taking leads itself to a higher spread between haves and have nots, you’ll see a lot more relationships where it is clear that one party is the bread winner. The chances of having both parties as bread winners (example both make $1M) is slim. Since their options (rich man/rich woman) are too high, it’ll lead itself to one sided bread winner situations.

A 50% spike in wealth for the top 1% plays out exactly as you would expect. Huge expansion of options for those at the top of the pyramid.

Part 3: Concentration by Geography

This is one we’ve been suggesting for about 2 years and the trend is continuing. Catering to the middle is unlikely a good idea from a real estate/land/population perspective. While someone like BowTiedBroke has a lot more to say about this, if you think about it logically, it lines up.

If you’re a rich person, you’re optimizing for a few things depending on exactly how wealthy/old you are: 1) taxes, 2) weather, 3) healthcare and 4) people/culture.

Every situation is different but you’ll see places like Bal Harbour in Florida do well, Malibu in Los Angeles, Central Park in New York etc. attract and keep the wealthy people. You’ll also see the tax havens do the same for obvious reasons (Singapore, Puerto Rico, Dubai etc.)

Parking Money: If the goal is to simply protect/park money, high-end real estate isn’t going to change much since the truly rich never go broke. Sure you might have to wait a bit longer to sell the asset but there is no situation in which people wake up and say “No i don’t want to live in a place with perfect weather and high-quality health care”. As you get older the place you live becomes more important and traveling around quickly becomes less important.

Making Money: This would suggest that the alternative move is to try and find cities/locations where jobs will be plentiful. Instead of trying to find low cost suburban homes (remember people can’t afford kids, pets are the new kids and plants are the new pets), search for any positive cash flow location that has a large and stable industry (thinking out loud Nevada might be good given high degeneracy/gambling etc).

We’ll stop at that point since we’re unlikely going to go down this path but figured it is worth a mention. You have to either target people who don’t care about money (the rich) or you have to target the bare minimum (need a place to live).

Part 4: Summary

The quick summary of all this if you’re planning on building something long-term that doesn’t go down in flames after a short burst of sales (see thousands of businesses in 2021) is as follows:

Sell to Women, selling to men is a fools game

Try to find something that causes instant results and is hard to return. You can’t return botox but you can easily return a sky blue shirt that wasn’t light enough

Majority of people will not have any savings, this means debt based purchases have to be encouraged

You can charge more for speed since people are impatient. Could be shipping could be digital entertainment

Anything lottery/quick high “could change your life or go to zero” is going to sell extremely well

If you’re looking for more stable income focus on targeting the wealthy, if you’re looking for more cash flow based items, look at bare necessities for the low-end. Don’t buy middle class suburban homes!

All of this leads to the same general direction. Staying at home, glued to screens and lower population growth due to high vice/addiction and belief that the only way to make it is via overnight success.

Good luck and we’d strongly recommend against fading these trends!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

"Sell to Women, selling to men is a fools game"

- this is so true. My gf views racking up cash back on Rakuten as a "side hustle"

“What is mine is mine and what is his is ours” v2 is:

“What is mine is mine and our debt is his”