Want to be the 1%? Get Used to Building Assets

Level 1 - NGMI

Welcome Avatar! Currently, we’ve got a few things working in the background. Another cartoon has successfully started yet another niche E-com biz that is taking off and we’ve got our favorite Cartoon mouse working on a post related to AI tools for E-com/Online biz. We’re not kidding when we say a team of 3-5 could easily scale to $100,000,000 in annual revenue with today’s tech.

If you look at stable coin “companies” they are printing billions with a near zero headcount (essentially banks that pay no interest and don’t have any overhead from real estate/equipment beyond computers).

Which brings us to a classic topic on how getting rich really works and some new information about the dreaded golden handcuffs. Many don’t realize how many Managing Directors are eventually fired and can’t get another seat at a lower tier bank (the industry is in decline as you all know).

This means even if you are a star performer, you’re looking at hitting a ceiling of net-worth (Roughly $3 million) and becoming so jaded that you end up not saving much. The net-worth number looks like end of life care at a hospital. Flat.

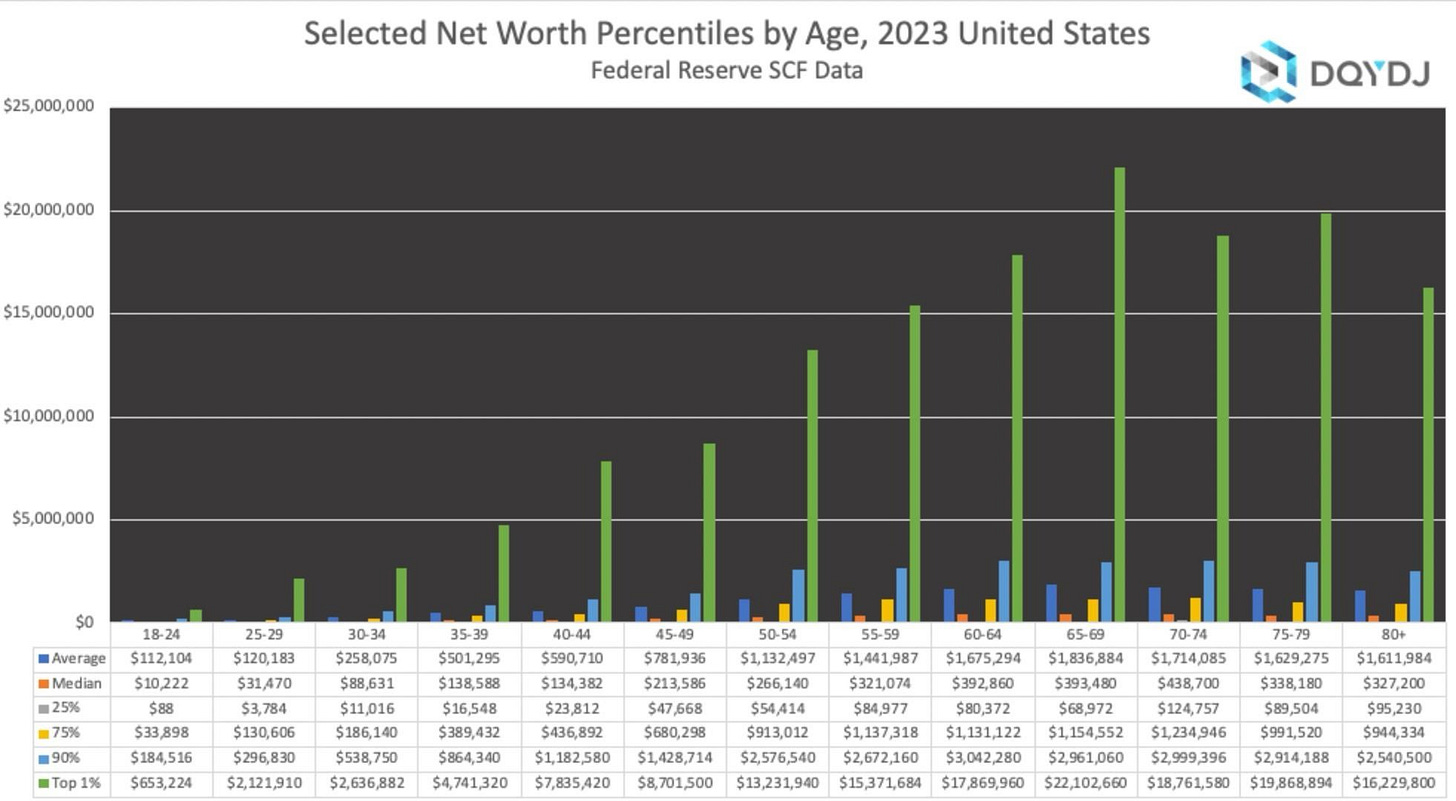

Our Favorite Rough Way to Gauge Net Worth - 2023

Benchmarking: People always ask ways to benchmark and we think this data does a good enough job of sizing up the percentages. We already covered the differences in types of wealth here and how to value them (Source). The key trick here is planning for the 10 year jumps. No one can plan perfectly 10 years in advance instead you essentially need to set it up like this

Early 20s: Ideally get a good career so you will be on track to hit the top 10% in a worst case scenario

Build in Your 20s: Kill yourself and grind as hard as you can while you have unlimited energy to build an asset (e-com biz or any asset) then fail a hundred times. If you are learning it is working. By the time you hit 30s you should have your first exit

30s: If all went well, you’re giving up the W-2 to focus on repeating your success building assets to create a flywheel that generates mid-six figures in annual savings post tax

40s: You’re focusing more on asset allocation and only doing things with high returns since you don’t want to build 3-4 assets if they eat up your time. Low hanging fruit building and focus on asset allocation/preservation

50? Basically everyone chills out on the net worth building game or the compounding does it for you

General Life Notes: Before starting there are few things to remember before trying to compare yourself to this data. The reality is that you can’t choose your initial starting balance. Some people grow up broke, middle and at the top from day one (trust fund kids). This is why the top 1% even at the 24-29 range is at $2 million.

The second thing to note is that there is a “trust fund cliff” at around 35-39. This is the most common age bracket where people receive their big money inheritance. Parents assume the kids will be able to handle the money by then.

The third and final thing to note is that around age 50, people usually get all of their inheritance. By this time it is likely both your parents have died and all of their assets have been dispersed to the kids. This explains the jump at age 50 for the top 10% getting a sudden jump of $1M and the top 1% getting yet another boost at +$5M.

Age 50 Cliffs

$10M Snowball: If you can get to $10,000,000 the snowball already works in your favor. Even if you end up spending less later or spending the same, the increase in net-worth essentially happens organically. Even some of the richest people can’t spend more than $50,000 a month since you will always be doing something for work to keep your mind sharp. Hard to blow through $10M invested + your own biz income.

The $3M Hurdle: You’ll notice that unless you have a large amount of money, once you get to age 50 and you’re in the top 10%, you simply don’t care about chasing digits on a screen. This is quite common in the real world as well. While most of our readers are 20s/30s and don’t really talk to people 50-60+ in their day to day lives, you should go ahead and look around. When you’re 50, you’re not hitting night clubs and constantly traveling - you’ve gotten tired of it. Therefore, you just spend whatever you got and keep your wealth stable. In the 1% category you do find a lot of sugar daddy types but the trend is still your friend. By around age 50-60 you begin to see less and less value in running up digits.

The $1M Hurdle: Oddly this happens at age 50 for people in the 75th percentile as well! They get their 401K or whatever balances they have to read $1M. They live on the interest/dividends and some hobbies for income. You see that it largely doesn’t move. Stable at $1M.

The message here? For the vast majority (exceptions such as Colonel Sanders starting KFC at age 60 do not disprove the rule - source), your financial set up is largely done by age 50. You simply won’t care as much about running up digits and you likely don’t have massive energy to start new endeavors.

Late 30s to 40

If you force us, we’d say this is the target for the majority of high performers. Yes you can do it earlier. You can be extremely talented and be loaded by age 25. Anything is possible. That said, this is a good age band to no longer care about money. Since most of our readership is crazy intense we’d guess that the majority of our winners make it by age 31-35 (assuming they find this side of the internet around college age, they will likely avoid major mistakes).

Either way, 40 is a good goal for a few reasons. If you can break into the 1% or say top 5% by age 40 it means you were able to do so despite the following: 1) likely a tragic financial event, 2) majority will end up having kids, 3) majority will get fired/fail at multiple businesses at least 1-2 times and 4) you’ve still got more than enough youth to enjoy your success.

Tack onto this. You’ve already seen a market cycle and know that your peak net worth will be quickly taken away from you in Euphoria times. Your lowest point when you feel like quitting the game entirely is the day to load up. This is a way of saying the number you hit at age 40 is unlikely to go lower barring a catastrophic event you can’t control (health related or major natural disaster).

Look at Dollar Amounts After Age 30: People really mess this up since they have been taught to look at percentages due to their “401K calculators”. You have to look at the dollar increases around this range because it teaches you that a salary isn’t going to cut it anymore.

Sure, it’s good to keep it until WiFi money is 2x your W-2 income but don’t bother putting that 5% raise into the compounding interest calculator. It simply won’t move the needle at all.

30-34: For this 5-year band you’re looking at $100K each year increase in wealth for the top 1% and ~$48K each year for the top 10%

35-39: For this 5-year band you’re looking at *$420K* each year increase in wealth for the top 1% and ~$60K each year for the top 10%

40-44: For this 5-year band you’re looking at **$600K** each year increase in wealth for the top 1% and ~$60K each year for the top 10%

This tells you essentially everything. Ideally you hit your stride by around age 33-36 as a rough range. If you don’t and want to break into the 1% that ship is moving fast in the wrong direction. The top people are putting away $500,000+ a year every single year for a decade straight. To put that in perspective, for a W-2 earner in a high tax state that would be $1,000,000 worth of W-2 income. Every. Single. Year.

The Top 10%? Vast majority are the guys in middle management. Unless you’re a real killer and move up lightning fast the majority get stuck in this $300-400K total compensation range in a high tax state like NY or California. They clear about $17-18K after taxes a month and save about 5-6K a month which lines up practically perfectly with the $60,000 annual moves in the 35-44 bracket.

Ever wonder why your middle manager is always so mad about life? Well now you know. He followed all the rules he was told. Yet he has a zero percent shot at living in the nice areas since the cost of those homes start at $2,000,000+ and he already has the wife and kids. Everything he was taught didn’t work out the way he hoped.

The Outrageous Top 0.1%: Just in case you’re interested in ultra wealth, entry into the top 0.1% is mid-high hundreds of millions and by some metrics a billion depending on which study you look at. That’s how hard it is to get into the top 0.1%.

You’d be forced to flip businesses over and over and over and over again successfully. This means you’re probably exiting your first company in your 20s and found a niche talent that allows you to do this repeatedly (ex. Elon Musk). Being honest here, no one who is truly interested in the top 0.1% would even care about careers at all. They would be starting from zero the day they graduate high school/college and never look back. Since 99% of the population can’t even set up a basic website to make some consulting money online, safe to say the majority won’t even think about this.

Summary: If you plan on being well off, a high paying W-2 could get you into the top 10% pretty comfortably. If you want to be in the top 1% you are only fooling yourself if you think the best path (probability wise) is a career - the math will prove you wrong even without normal life events - kids, layoffs and standard sudden expenses.

Getting Ahead Now

Fortunately for you there are a few things that the boomers and middle managers don’t understand. They don’t understand: 1) AI tools, 2) crypto currencies, 3) video editing, 4) AR/VR use cases and 5) network effects.

If they understood any of these things they wouldn’t have stayed in middle management, they would have built the requisite skills and asset base to leave sooner than later.

All of these skills are easy to learn today with zero need for a a $200,000 degree from some top MBA program with a 20-30% unemployment rate. Just up to you to decide if you’re going to try and get into the top 1%. Or be part of the pod bros with apple vision pro!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce. We’re an advisor for Synapse Protocol 2022-2024E.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money.

The numbers check out almost exactly with my own experience and other guys I've worked with. Mid 30s you've either got a business that's kicking off numbers that almost scare you a bit or you're on the long term 401K ladder.

One warning to the folks who are going to be in the Top 1%: you will not feel like you're "loaded." You will notice friends that have 1/10th your net worth spending more than you and wonder what on earth they are thinking. (And then realized why they have 1/10th your net worth.)

One upside to folks who are not going to be in the Top 1%: best investment you can make is in your family. Good spouse and kids going into old age beats staying at the Four Seasons in Hawaii vs. the Hilton in Florida.

For anyone feeling discouraged maybe this will give you a bump in the right direction… started at $0 net worth age 30… now 37… $600k liquid, 1 six figure w-2 plus four side businesses (close to 2x w-2 combined but now will likely never leave (anytime soon) with health care benefits of w-2… $800k house free and clear not including stock investments and 401k… still have a long way to go but momentum on my side… you *will* have major (1-2 minimum) life setbacks along the way that will destroy momentum, dont let it deter you from starting and know its part of the “life tax”. Keep going. its never too late but you need to start now. GL.