What’s DAT?

Level 2 - Value Investor

Welcome Avatar! This is entirely a guest post by Vivek Raman with no edits exluding formatting and some spell checks.

Again, entirely a guest post explaining DATs.

On that note handing it over!

Summary

DATs are positive for responsible crypto adoption and are here to stay

DATs are institutional and will be the next-generation asset managers

DATs are not Ponzi schemes and will ultimately consolidate to be stewards for the crypto ecosystem

ETH is the best asset for DATs, combining store of value upside with the most robust economy for yield generation

Who DAT?

The movement started with Strategy (formerly MicroStrategy)—the earliest iteration of the Digital Asset Treasury (DAT). Michael Saylor and the Strategy team opportunistically identified that converting their publicly traded steady-state software company into a Bitcoin holding company would unlock capital markets access, a full brand revamp, and most importantly, tremendous market capitalization upside.

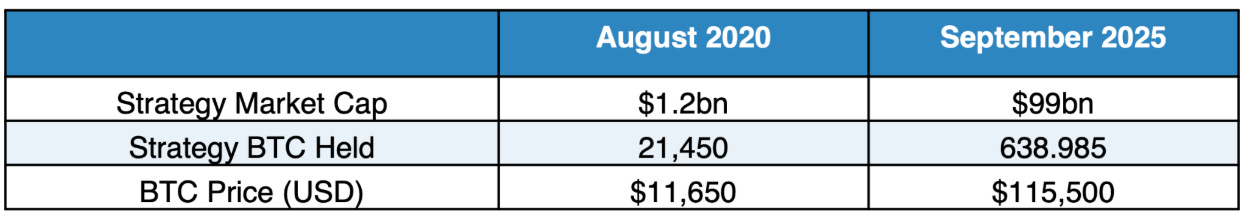

This strategy succeeded beyond anyone’s wildest dreams:

In just five years, Strategy’s market cap increased by ~80x (vs. a ~10x increase in BTC price), and the stock trades at a 1.4x premium over the value of its BTC holdings, creating consistent access to novel forms of capital and growth.

This is capital markets wizardry, and it was unlocked by Strategy (MSTR), a public company, adopting a DAT approach with BTC as its reserve asset.

In retrospect, it was inevitable.

Why’s DAT?

Given the resounding success of Strategy, it should not be surprising that there would be a Cambrian explosion of DATs. The only surprising part is how long it took for this to proliferate and permeate to other digital assets beyond BTC.

Zooming out, the notion of a DAT is not entirely new. As an analogue, there are ~800-1000 publicly traded asset management companies in the U.S. This includes BDCs (which invest in private assets), REITs (which invest in real estate), closed-end funds (which invest across asset classes), and alternative asset managers (PE, hedge funds, and credit funds).

These vehicles all have public market wrappers around their underlying assets, charge management fees, and have a wide range of market capitalizations, capital markets access, and management styles. The reason these asset management companies exist is the same reason DATs exist:

Human nature. In short, people do not want to manage assets themselves!

What’s easier than owning individual rental homes, managing tenants, collecting rent, and doing maintenance? Owning part of a REIT. What’s easier than buying cash flowing companies, adding debt, cutting costs, and flipping them? Owning part of a PE fund.

Similarly, in an ideal world, people would self-custody their crypto assets, navigate yield opportunities across decentralized finance (DeFi), and deploy and rebalance regularly.

Or, they could just own part of a DAT. History tends to rhyme.

Why now? Crypto was not exactly welcomed with open arms in the U.S. until 2025. The U.S.— with the strongest, most robust capital markets in the world—had been effectively closed to public crypto companies. As a cherry on top, most crypto assets (ex-BTC) were in an intentionally-crafted purgatory, living as Schrodinger’s cats oscillating between being securities and commodities.

When the U.S. adopted a more innovation-friendly stance toward digital assets, the DAT movement started in earnest, beginning with a deluge of BTC DATs, then ETH DATs, then altcoin DATs.

How’s DAT?

DATs are elegantly simple. A public company—either an existing company or a SPAC—raises money from investors (typically via a PIPE, a private investment in public equity). The public company then announces its intention to become a treasury vehicle, discloses its choice of crypto treasury asset, outlines its strategy, and goes out and buys large quantities of that crypto asset with the capital raised.

Assuming the rest of the company (legacy operations, or lack of operations in the case of a SPAC) is ultimately worth ~$0, the public market capitalization of the DAT then becomes the net asset value (NAV) of the crypto asset.

But then a curious phenomenon occurs, where the DAT market cap tends to diverge from the underlying NAV. Let’s use an example:

An existing company raises $1bn and buys $1bn of ETH. The legacy underlying business is valued at ~$0.

The company’s ETH NAV is $1bn, so the public equity market cap should theoretically be $1bn.

However, the actual market cap on public exchanges ends up being $1.2bn, creating an mNAV (Market Cap to Net Asset Value ratio) of 1.2. This is because investors sometimes pay a premium to own the public company than the underlying ETH asset, explained in the “Why” section earlier.

This mNAV premium can become a discount, and so in the end, all DATs end up playing “the mNAV game.” Using ETH as an example again:

If mNAV is at a premium to NAV (>1), the company sells more shares into the market (using an at-the-money, or ATM, share offering) and uses the proceeds to build a cash balance or to buy more ETH, increasing the concentration of ETH per share.

If mNAV < 1, the company can use cash on hand (or issue debt) to buy back shares, increasing the concentration of ETH per share.

Some companies issue debt (bonds, converts) regardless of mNAV to purchase more ETH, increasing the concentration of ETH per share.

Ultimately, as ETH per share outstanding increases, the DAT becomes a more concentrated, and potentially more efficient, way to increase exposure to the ETH asset. And equally importantly, this can be done via a public market vehicle available in brokerage accounts.

Despite an opportunistic (but temporary) proliferation of DATs, DATs are not Ponzi schemes. There are underlying assets providing a NAV, underlying strategies to manage those assets, and potential to navigate capital markets to maximize shareholder value.

However, not all DATs are the same. Some will have an mNAV persistently above 1, many will trade persistently below 1, and there will be differentiation.

Differentiators

What are some key differentiators separating the premium DATs from the rest? Below is a non-exhaustive list of characteristics to consider:

Strong underlying asset: the underlying treasury asset should have widespread buy-in, across institutions and retail. BTC repricing from $11k to $115k was undoubtedly a large tailwind for Strategy’s growth, and only similar assets with multi-year secular tailwinds will provide long-term value. We believe the two best underlying digital assets for DATs are BTC and ETH, with ETH having an edge for outperformance at this time.

Capital markets sophistication: DATs rely on the mNAV game outlined above. This requires capital markets expertise, relationship building across the sellside and buyside, capital raising and deployment sophistication, and creative financing mentality. This includes risk management strategies, especially when debt is involved. DATs with experienced operators across capital markets are likely to outperform.

Yield generation sophistication: BTC does not have a native yield, and so the asset accumulation potential is limited to selling shares at an mNAV premium or raising debt. However, Proof of Stake crypto assets like ETH have a native staking yield, which allows for passive asset accumulation even when mNAV is 1 or below. Additionally, some ecosystems like Ethereum have robust, battle-tested, institutional-grade yield generation sources beyond staking. Just like capital markets sophistication is a differentiator for offchain operations, onchain yield generation sophistication (with associated risk management strategies) will allow the best operators to command higher mNAVs.

Geographic diversification: While the U.S. has the most robust capital markets ecosystem globally, expansion to other jurisdictions could unlock access to capital and higher potential mNAVs. Metaplanet (a BTC DAT) is an example that built its brand in Japan, where retail demand was high. DATs with multiple geographic focal points could potentially outperform on an mNAV basis.

Size and scale: Larger DATs are likely to have more attention, focus, and access to capital markets than smaller DATs. We have seen this play out for BTC, with MSTR having the highest persistent mNAV due to its size and scale. One note: this could be disproved with enhanced yield generation strategies, where smaller DATs for yielding assets like ETH could trade at higher mNAV multiples by generating outsized yield.

Strong marketing engine: DATs are public markets vehicles that are competing for attention and capital. Having a strong front-facing, well-known figure (e.g. Saylor for BTC or Tom Lee for ETH), as well as a well-oiled marketing engine, is important to drive ongoing interest into each DAT. DATs are all on the same mission—to accumulate and grow their crypto holdings per share—but they are competing for similar pools of capital, and the best marketers will have a premium.

ETH DATs

Of the differentiators above, it is worth double-clicking on the “strong underlying asset” criteria. The simplest way to drive attention, capital flows, and mNAV premiums is for the underlying crypto asset to perform very well over a long period.

BTC was $11k when Strategy’s accumulation started and went up ~10x in five years as BTC crossed the chasm of institutional and retail acceptance as “digital gold.” This provided an enormous tailwind for Strategy’s marketing and capital markets engine.

ETH is in the same position BTC was five years ago; ETH’s turn is next.

We believe that ETH DATs may enjoy the best risk-adjusted upside, the strongest capital markets tools (both onchain and offchain), and ultimately the most persistent long-term mNAV premiums of all DATs.

There are a plethora of DATs flooding the market with different underlying crypto assets. Why are BTC and ETH the best underlying assets?

BTC was the first, most battle tested, most widely adopted store of value asset. Others tried to replicate it by being faster or cheaper or more efficient, but reputation and reliability cemented BTC as digital gold.

Similarly, Ethereum is the first, most battle tested, most widely adopted global smart contract platform. Others try to replicate Ethereum by being faster or cheaper, but with significant tradeoffs (more centralization, more counterparty risk, more brittle foundations). As the secular wave of institutional and regulatory adoption accelerates, the more reputable and reliable platform will capture most of the adoption. The network is Ethereum, and the ticker is ETH.

ETH provides the best DAT differentiators outlined above:

ETH is the strongest underlying crypto asset with the highest risk-adjusted upside (ETH could 10x like BTC did).

ETH is the most understood asset by capital markets alongside BTC, meaning access to capital markets for ETH DATs will be easier.

Ethereum has the most robust onchain yield opportunities in the entire crypto space.

The Ethereum network is the most geographically diversified and is the most well-known globally, setting up for global DAT adoption.

ETH DATs have achieved tremendous size and scale, with a growth rate much faster than Strategy (BMNR accumulated almost $10bn of ETH, and ETH DATs collectively own over $17bn of ETH, or 3.21% of the supply)

ETH has vocal marketing engines ranging from Tom Lee to Joe Lubin to Andrew Keys to Etherealize—all educating institutions and retail about the potential of Ethereum

We believe ETH is the best positioned treasury asset for DAT adoption. Our full thesis for ETH is here: Digital Oil

Endgame

What are the benefits of DATs? DATs are positive sum; they provide new audiences access to crypto assets, crypto asset management strategies, and onchain yield. DATs allow crypto assets to have their own “quarterly earnings,” give traditional investors exposure to the underlying asset in a way that’s familiar to them, and educate institutions about crypto while showcasing opportunities across mature financial blockchain ecosystems like Ethereum. DATs will be marketing amplifiers and help onboard the next wave of people into crypto.

What are the risks of DATs? There are operational risks; managing private keys and multisignature wallets, avoiding hacks from insecure protocols or immature ecosystems for newer blockchains, and bad risk management could taint some DATs. Leverage is another risk; companies like Strategy have taken on debt to fuel BTC purchases, and leverage could amplify downside.

We’ve seen a sudden proliferation of new DATs. Are there arguably too many? Potentially. However, as with all new industries and technologies, we’re seeing a wave of excitement and innovation, which is inspiring.

Ultimately, the endgame will likely be consolidation toward a few large DATs that become the bellwether stewards of crypto capital. The largest operators with mNAVs > 1 will likely continue to tap capital markets to access capital; the smaller sub-scale operators with mNAVs < 1 could end up selling to the larger ones.

DATs are here to stay as much as the crypto sector is here to stay. DATs will be stewards of crypto capital similar to how asset managers are stewards of capital across traditional asset classes.

In the end, traditional finance and blockchains will be one and the same, and DATs are one step along the way of merging these two worlds.

We hope DAT was helpful!

Leaving comments open only for anything related to DATs if it deters in any way we’ll shut it down and delete thanks!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money

no mention of hype dats makes this an unserious guest post they objectively make the most sense since the underlying is actually challenging for non crypto natives to buy.

Why invest in a DAT vs buying IBIT or ETHA or another ETF? Is this the difference between buying a in hedge fund vs the S&P500?