Why $1M in 30 Years Will Mean You're Poor

Level 1 - NGMI

Welcome Avatar! As you’ve seen in just the past week, a single change in policy can impact the long-term cost of living tremendously. The only way to combat inflation is by being an asset owner, creating equity with *any* biz at this point and removing inflation as a headwind (neutral or tailwind).

Even if you do something simple like sell T-shirts, you’re better off than a typical W-2 who sees salary/income increases that do not keep pace with inflation.

Part 1: Running the Math

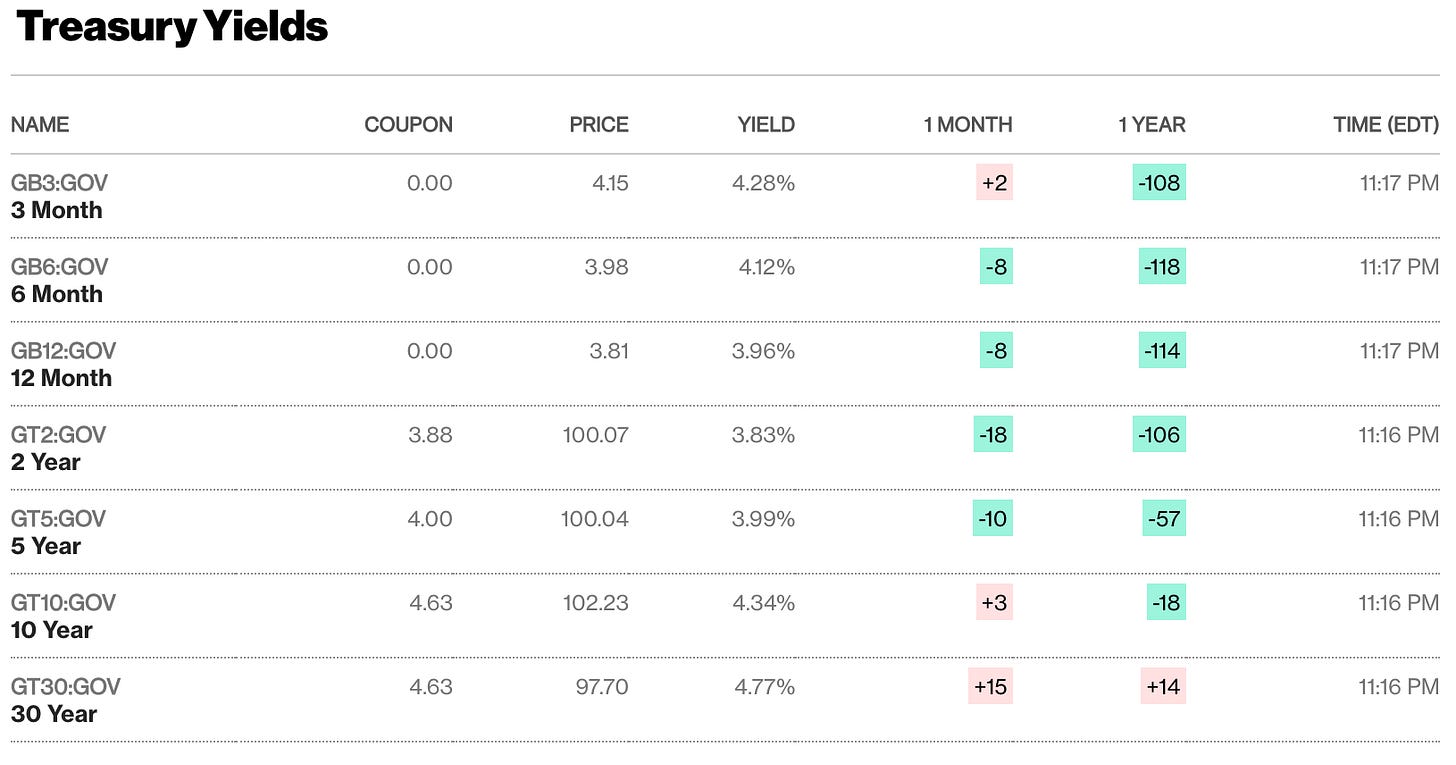

We’re going to make extremely conservative assumptions. If you look at the Risk-Free rate that should be a good enough proxy on what things will cost in 30 years. After the past 5-years we really doubt anyone believes the “government approved” inflation numbers.

Currently, the risk-free rate is 4.77%.

To keep the math simple, we’re just going to use 4.5% over 30 years. This lines up with your classic “401K millionaire calculation” that the HR books hand over to you.

In short, $1M in 2055 is going to feel like $250,000.

Four Major Items to Keep It Simple

The biggest expenses for the typical person are: 1) Home, 2) Food, 3) Utilities and 4) Healthcare. We’ll do a basic outline for a simple family of 4 without a crazy expense structure.

Rent at $3,000/month: Don’t think this is particularly high for a small single family home. You would either be doing this or paying at least $5,000 a month in mortgage, property tax, maintenance etc.

Food - $1,200/month: This is quite low. $300 a month per person. No real going out to eat no real lavish parties/expenses. Even if you actually embrace homeless level qualities of beans/rice and table scraps, it won’t be dropping below $1,000.

Utilities, Water, CellPhone, Internet - $1,000/month: This might seem a smidge high but we’re assuming you wont be breathing air at home and nothing else. Everyone will be forced to spend at least a couple of hundred dollars on some form of basic entertainment expense.

Healthcare - $1,000 a month: This is pretty low as well. It can easily ratchet up to $2,000+. This assumes a $250 per month line item. With a single major health issue, you’re down 6-figures in a single year.

Assuming you plan to do practically nothing in retirement this means you will be spending $250,000+ per year in 2055. This has no vacations, no mistakes, no one time events (Mike Tyson is waiting at least 5 times in your life!) and no real life experiences beyond breathing air and going to public parks.

But Wait It Gets Worse…

People forget that the $1M might be taxable! If you rely entirely on a 401K that can easily leave you with a hole. Yes we’re aware of the ROTH IRA options and other things that will be rounding errors for *you* if you decide to bet on yourself by scaling a business.

Quick math on the tax impact is a simple 20%. This would mean that entire 401K is worth $800,000.

Drum roll… This means a million dollars would give you enough to survive 2.87-3.59 years. That is all.

What You Really Need In 2055?

The rule of thumb is you will want about 25x your annual spending invested. The same 4.5% return is quite easy (although you would pay federal and state taxes if done with bonds).

25 times $278,652 = $6,966,300 = Approximately $7,000,000 to be safe.

In Today’s dollars? You need $1,857,680 = Approximately $2,000,000 to make it easy to remember

Part 2: Action Over Everything

Now that you see the numbers in front of you it seems unattainable. Until you realize that making money is just a massively rigged game. The whole game is to sell products (they go up in-line with inflation) and all of your earnings get a multiple (2x, 3x, 4x, 5x… etc). This means a dollar earned is not a dollar earned.

A dollar earned by something you can sell later is worth at least 3, 4 or 5 times.

Anything Online: There is no excuse here anymore. We’ve seen hundreds of people make money on the internet at this point. You can do these while at work sitting in your cubicle. All you need is a wifi connection and to purchase the exact same model as your company computer. Connect to monitor and you are good.

If you’re too afraid to bring a computer to work you’re basically admitting that you’re a slave. If you’re performing well enough to get promoted (by playing politics and being nice to be around) absolutely no one will care or say a thing. If you want to be entirely buttoned up about it, even Coinbase was created in off-work hours (while the founder was employed). No excuse here.

Instead of Skipping Coffee, Try to Create One of These. Or even better. Find poorly run ones and just print off that (we’ve published examples and at this point think people will be giving up post Tariff impact). Many of them can be improved 10x with basic effort

As you can see, even with a ~$3,000 a month hobby business that your friends and colleagues will make fun of. It would represent a $100,000+ payout. Ten of these and you’re looking at $1,000,000 already. Sure beats going to unhappy hour schmoozing for that 4% raise and nose bleeds tickets to the local sports team.

Rinse and Repeat: Guess what they don’t teach you in school. Once you learn to do it once, you can do it again. And. Do it better. There is a reason why people are serial entrepreneurs. You become unemployable

If you develop a system that is repeatable you’re never going to say “oh i should go back to the cubicles”

Anything Forced Returns: We’re doing some flips in Real Estate and unsurprisingly… it is the exact same thing. You create a repeatable process and suddenly you don’t need as much money to make money.

The phrase “it takes money to make money” is an excuse made by normies to justify their fear of building and taking risk. Outside of a small amount of initial capital, the entire game is

Say you have accumulated around $500,000 with a couple of small wins/exits. Maybe you worked in banking, tech or sales. You can still work on another small win but why not use the same amount to compound faster by doing a flip. Even a low risk one you can clear 30%+. This would be $150,000 + your $100,000 on yet another boring business that “no one cares about”. Now you’ve turned your money over 50%. This is going to dismantle anyone trying to skip coffee to get 10% returns in a stock/bond portfolio.

Play Asymmetic Items: Crypto is asymmetric, Tech is asymmetric, BioTech is asymmetric. We don’t really care which industry you choose (we’ve been in crypto/tech for well over a decade). The game is simply this: what will people need *more of* in the future.

The *more of* is often ignored by people. If there is no significant growth the returns will never be significant. Tech, Healthcare? Pretty confident people will always need more of that. Every year more and more people will spend more time staring at screens than walking around in every day life.

The hard part here is the holding period. Most say they can survive a 50-80% drawdown. The reality is that 99% of people cannot. Why? Go back to steps 1 and 2. They never created any system to earn money. They lose their job during a downturn and they are forced to sell their assets at a loss. You’re watching this live as people panic about the stock market, crypto market etc. Despite having the data to look back 10 years and realize this happens frequently, the emotional pull is too high.

The System Works For You If Played Correctly: It’s painfully obvious once you start with your first boring business. Even if you only make $1,000 a month we’re promising you that you’ll be thrilled. You’ll realize the following happens:

Inflation goes Up? Doesn’t matter that much, if everyone raises prices by 5% so do you. If the entire industry does this you will lose no market share

Taxes? You can now deduct expenses before you pay your tax. A W-2 gets their money shaken out on day one, you get paid then pay your taxes *after* expense. Deduct cell phone, office space etc. A chunk of all your expenses just became *pre-tax* expenses

Multiple? If you grow your income by 5% you didn’t get a 5% raise. You got a 10% or 15% raise. There is a multiple not a “we’ll get you next year buddy”

Part 3: Plug It Into Excel

If you’re still not convinced, we hope you take the time to plug it into excel yourself. Take your total earnings today as a W-2 and go find the *average* person who is 15-20 years older. This does not mean the one rock star person. This means the average of the guys who fail + the guys who make it. This number is the most likely outcome.

We already know what it says, unlikely to get to $2-3M by age 50 even if you don’t get laid off (let alone the $7,000,000 minimum we just outlined here).

Work Backwards. In 2055, being a millionaire will be the equivalent to having about $250,000 in today’s dollars. Is that going to last 20+ years (average retirement length)?

Definitely won’t.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money