Why Your Parents Have it Wrong - Despite Trying Their Best

Level 2 - Value Investor

Welcome Avatar! Typically people make it after 3 years of eating glass. We have used the phrase “give up three and you’ll be free” mantra for over a decade. Now its possible to do this faster (as many of you have seen with various jungle success stories from Ramp Health to Better Biom etc.).

Instead of harping on that, we’re actually going to outline *why* this constantly happens. Generational wealth is lost, not because of gambling, but because of incorrect information being handed down.

As an example, if you told someone to go become an investment banker in 1990 it was a niche area that only intense people knew about. Fast forward today and its no longer lucrative.

While the headline numbers always sound good, you have to remember that it is still going down. In 2010s the total compensation compared to 2025 is basically flat across all levels (excluding Analyst/Associate since the firms need to pay a lot to recruit the top 10 Universities).

In short, industry is in secular decline and you’re swimming up hill.

This is critical to understand. Someone who is turning 50+ now is likely behind the times. They have teenage kids or kids about to go to college (rough range). They will explain that the best way to make it is by doing the same thing: 1) “Top school", 2) Good job and 3)" “Climb ladder"

If they follow that same map, it’ll be going downhill for them. If they end up having kids then they will legitimately have no idea what to tell them.

Quick History

Every 20-25 years or so there is a major shift in how money is made. Usually via new invention/innovation.

Here are some examples:

Explosion of oil and automobile got rid of the majority of short transportation (horses and even trains). While trains are still used for transporting large materials or for cheap short trips like a subway system, the majority just drive since it is more convenient vs the cost benefit analysis

After this we had the explosion of telecommunications. Before you had these weird circular dial phones: wood wall phones, candlestick phones, 3-slot pay rotary phones, and Art Deco desk rotary phones. This turned into buttons and hand held devices within the home

During this transition period was largely the "industrial age”. People were making tons of money by staying at a single career for decades. This is due to the prior two trends. You needed more people to build all the telephone lines, data centers and operate all of this equipment to farm and pull oil from the ground. Since wages were growing and employment was rising, it led to people having a lot more kids and creating the “boomer generation”

At this point we then got the internet. People would say that ordering items from the internet was dangerous. Getting into cars that were not labeled like taxis/black car services was considered dangerous as well

Fast forward and people realized that the internet was pretty safe, eBay and Craigslist really drove all the retail adoption. Selling stuff, listing apartments for rent and buying hard to find items like collectable cards

Since everyone got comfortable buying on the internet, everything started moving there including stock trading/bond trading etc. You now login to an internet portal and simply click buy/sell. Being on the floor of the NYSE is not even close to the word elite. Can barely make any money since no one is calling to make a trade anymore

Now we’re at today. Go through all your credit cards, debit cards etc. Outside of taxes we’re near certain every single one of you reading this will realize *more* money is spent online than anywhere else. Amazon, paying your utility bills online, reading articles online and more. All of this is Electronic Commerce and it will not change any time soon. Built in foot traffic is a *meme* since you can quite literally target the exact age range, gender and location using META/Instagram/TikTok/etc.

Why is this important? It’s important for two reasons: 1) the emotional reason to not blame your parents for being behind the times. Back when they were growing up it *did* make sense to get that prestigious degree and go build all this infrastructure and 2) you have to predict where the money is going to go. A common saying amongst the wealthy families is “go where the money is flowing”. This has deep meaning. If you know that more people will be using Product A, figure out what they can buy using Product A.

In 2025 product A is pretty clear: smartphone, laptops, desktops and in the future virtual headsets. If your income is *not* tied to people using those products, you will be swimming up stream. It is not easy to fight 3-5% declines in customers no matter what industry you’re in

There is Always, *ALWAYS* a New Opportunity

Right now the big debate is how much AI is going to take in terms of market share. How much can AI do? What will those people end up doing? Will we need UBI? Etc.

Write a Quick List

You’re free to make changes to this list. After all this is just a cartoon account. That said, our list is as follows:

People will have less kids and need less space. This means Real Estate in the middle of nowhere will struggle over the long-term. If someone gets a $1,000,000 inheritance and doesn’t have a large family, they are not going to keep a 3,000 square foot home in Kentucky. Nothing wrong with Kentucky, it’s just human nature/preference. Instead they would downsize and move to a place with: 1) better weather, 2) closer amenities and 3) easier to maintain residence

Examples of good: Townhomes is 9/10 school districts. Gated communities. Places with good weather - Sun Belt. Ideally all of those in one but you get the idea

Examples of Bad: Large residence that is 30+ mins away from commerce. Things like StarLink will improve the ability to be back in the economy (the internet) but it won’t solve the high maintenance of square footage + yard work etc. Another bad one is something in the upper middle, lots of the high-earning white collar professions will

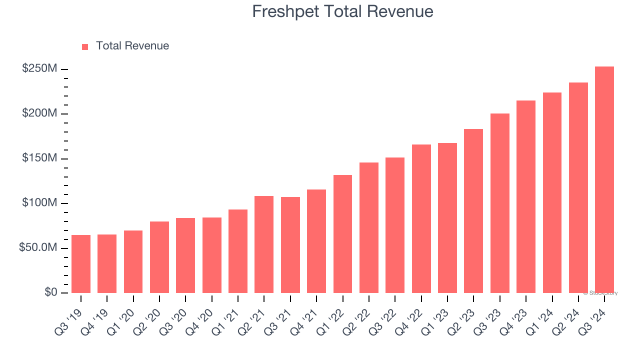

Since they are having less kids and have less space that means the pet market will continue to print. FreshPet is a good example of people treating their pets like humans. It sounds nuts but if you want to think through it even more, pet cemeteries and funerals would be a thing as well.

People will be glued to screens. Right now you’re reading off a screen. You’ll switch to buying something on Amazon on a screen. Or streaming sports/TV etc. Or even plugging into a video game for an hour or two. Required reading is a book called Ready Player One. While fictional, it’s a good depiction of what people will be doing in 20+ years. They won’t be playing outside as much. They will be playing video games and interacting on the internet vs. real life. At this point, if you include zoom, video calls, text messages, iMessages, emails etc. We’d wager that the majority of your communication is now digital as well

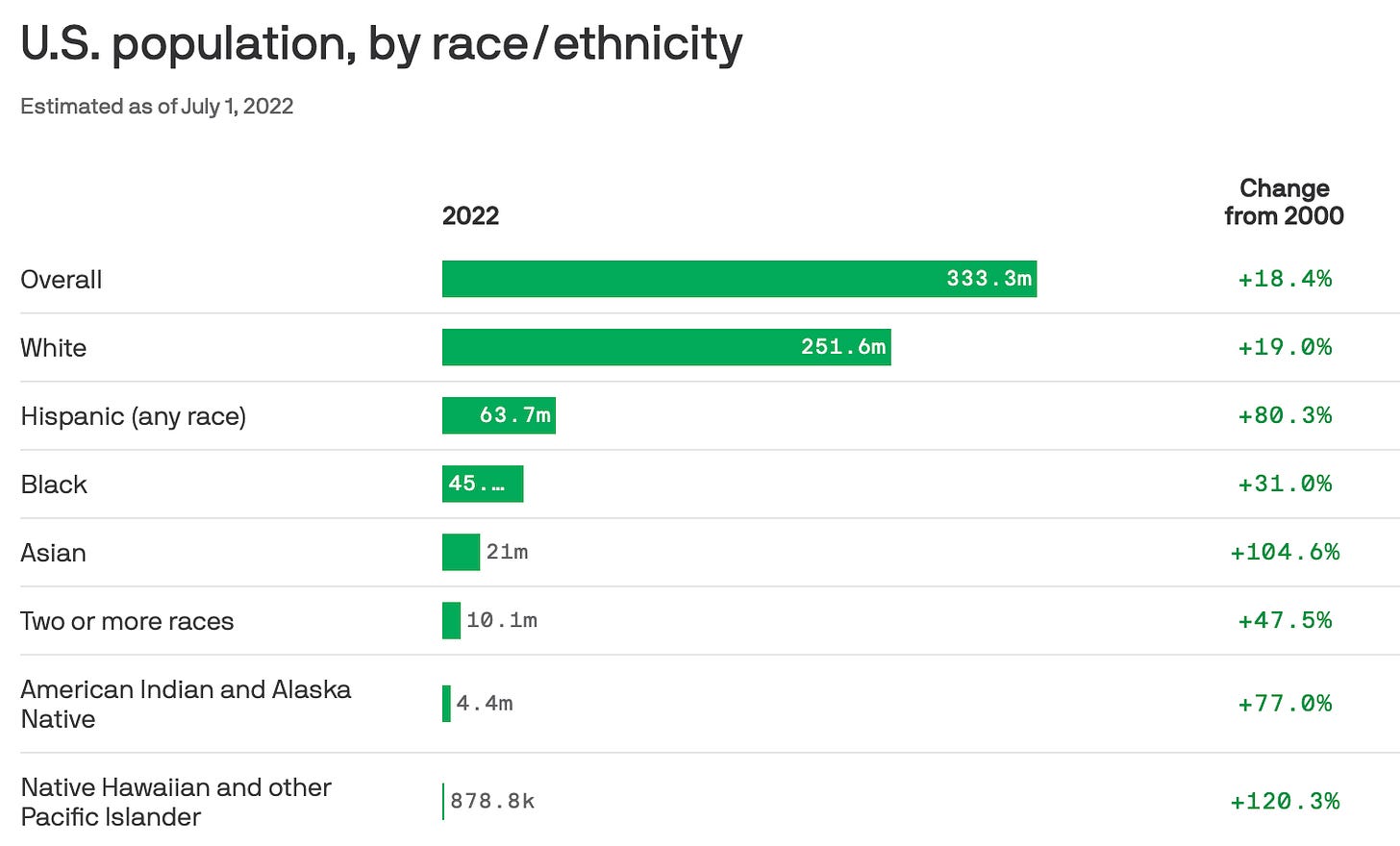

Getting more granular you can then figure out which items will work well in the digital economy by figuring out which population will be growing the fastest. Considering the scale based on the below you’d want to focus on white/hispanic groups. They are the largest percentage and then the hispanic section is growing the fastest by far.

Majority of good business ideas are just copying ones that work somewhere else and bringing it state side. Find a product popular in Latin America (colognes, perfumes, food etc) then target cities with a fast growing hispanic population. Yes we’re being serious

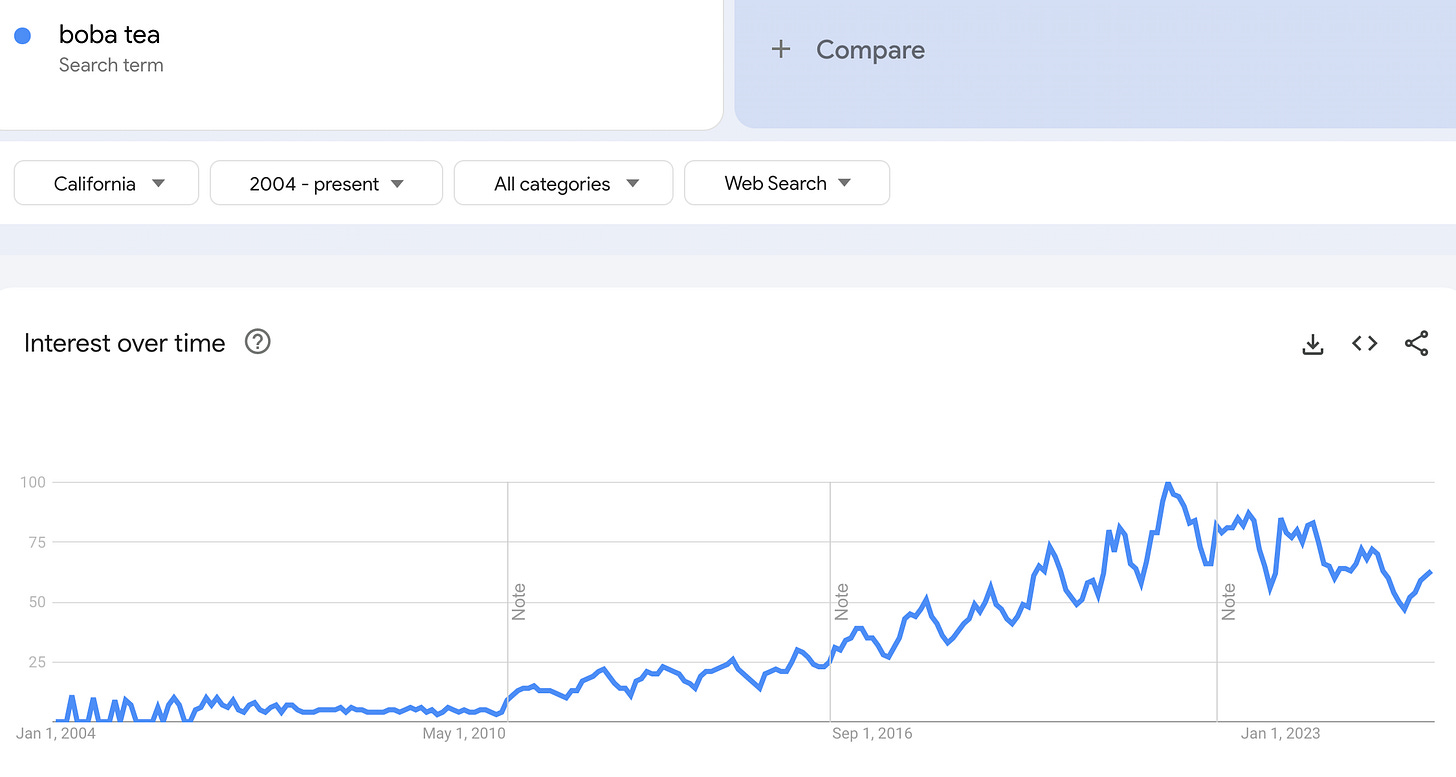

If you want another specific example not related to that group, go look up something called Boba Tea and overlay that with heavy growth Asian Population (California/New York) and you’ll find some extremely fast growing companies. Essentially you can now target cities/states based on which population is anticipated to increase in the future. Invaluable tools are available online at this point

Since a lot of people will not be having kids that means there will be two distinct markets for families, high-end and low-end. If you look at the high-end it will be obvious since they *will* have kids. It also means a lot of high-end neighborhoods will have a lot of ultra wealthy foreign money coming in. The people who buy Trump’s Gold Card (whenever that is off to the races) will be moving to the luxury areas

Lots of lonely people. You see it a bit on X. Even men are complaining about being single past mid-30s or so. They didn’t make a lot of good long-term decisions and are now getting further and further from their prime (peak for guys around 32-33, most don’t realize this though). This means you’ll see a lot of people living alone for long-periods of time

General 35+ Wine/champagne/alcohol venues. Even retro video game type places

Many will go deep into some strange hobbies like collectables, cars, boats etc

Mental health issues will be even bigger in the future, the SSRI issues combined with loneliness for both men/women is pretty much set to make this a money printer. High anxiety is something that will become common place - there is a product angle here for sure

Loneliness and degeneracy go hand in hand. We’re sure you saw the Sweeney Bathwater soap. Won’t get any better. Will be a lot of drug, gambling, alcohol, sex addition type stuff. For the high-end likely sex and gambling since they got rich and need thrill. For the low end more likely drug/alcohol. We learned via X that people take EBT credits to pour out water, recycle the product and get cash for drugs/alcohol (absurd dedication to an addiction)

Drill Down

Now that you have a rough list its important to write down the venues available to you. No one can do it all for you. The best you can get is a blueprint. No one can execute the blueprint for you.

Go through those trends and decide what fits you best. If you’re extremely good with your hands? Rehabbing lower end homes might be the move. If you’re extremely good at making ads? E-com. If you’re able to deal with high emotions? Create an online betting/casino type platform. If you have granular info on population changes in a state, probably best to find the products the future inhabitants will purchase. Take advantage of the niche knowledge.

On this side of the web, generally speaking the majority are best in E-com or affiliate (in terms of internet based items). Most just start with some sort of consulting online - they need to prove to themselves it is possible - and within a year or two they are full on E-com or Affiliate.

Drilling Down to Mega Trends: The mega trend that ties this all together is really everyone using a computer or phone or future VR headset. People sleep for 8 hours and are awake for 16 hours. In our opinion, the amount of time spent in front of screens might get all the way up to 12-13 hours. Yes. Seriously. Outside of a single workout and going out to dinner/lunch, the vast majority will be consumed by a tablet, computer, phone, etc.

The following industries benefit from that:

Anything needed for constant computer part changes. Chips, screens, LED lighting, video game chairs etc.

It means that E-sports continues to encroach on regular sports over the long-term. Shooting games, fighting games etc. Now professionalized and there was a lull post COVID, but the long-term is the same. Glued to screens

Crypto. Some of the youth already went full crypto. We went to some nerdy type schools recently and they quite literally only have a crypto wallet. No bank account, no nothing. The ones that do have the bank account have some fake number in there just to have it open. The meme of having $50K in crypto and $50 in a bank account is true for a large chunk of the youth

Online profile more important than in person. While people might not vibe with you in your hometown, you will find that you are much more valuable on the internet. On the internet anyone can find you and they will naturally find talented people. This is how it works. Get your product/info out there and you’ll be found over the long-term. We can’t even begin to tell you the number of strange people we’ve connected with due to the internet. Nearly 100% hit rate on value being delivered for both parties

Assume You’re Broke and In a Major City

Here is a good way to build up some money, then slowly escape Shawshank.

What you’re going to do is get any white collar profession. While everyone knows that we recommend sales and tech the most (with Wall St a distant third), it can be *any* white collar seat. That even includes accounting or something basic like that.

After this you go and learn how to fix iPhone screens. Yes seriously. You can charge $20 each and there will be no shortage of demand. This is practically as common as an oil change at this point. If you want to nit pick then just have a machine to install those screen protectors.

Now you’re going to have two income streams within a few months. Impossible to not save $25K.

Then you go into ad research/trend research. Choosing a niche - Source; Breakdown the ad Source; Rip Ads that work - Source

Ta Da you have your first attempt at building your own equity/business. Will it work on the first try? Nope. Probably not. Majority quit after one try since they think they will be the Lord’s gift to money. More likely you hit a few snags, learn the mistakes and by attempt 2-3 you’re off to the races.

Guy on Attempt #1-2 below simply quitting

Put All This Together

Historically had an extremely bad relationship with the Boomer generation. Still believe they are selfish people due to the debt/low interest rate scam they ran for a decade (plus bailing out banks)

However we’ve given up on saying they did all this by *choice*. The reality is that your parents are likely middle of the road types, therefore they were giving you information that *did* work. It just doesn’t work anymore. This is severely different from purposely telling you the wrong thing

Instead, just thank them for giving you life and ignore all of their old beliefs. Smile and nod through their “value investing” ideas when the company is in secular decline. IE. Banks will always be trading at attractive valuations because they are declining in future value.

Come Up with Your Own Forecast

We gave you ours. Depending on where you live, it will change without a doubt. You’re not going to sell Boba Tea in New Mexico. You’re not going to sell sub-woofers and loud base music in Beverly Hills. So on and so forth.

Look at the mega trends. That is the first sales filter. Then get your initial starting capital and start the ad research. With software tools you can quite literally test demand on any product and even find the ads that are doing well. Under 30 mins.

After that? You will be using VAs, Software and 1099 forms to scale up. The Sovereign individual is already here and before you know it a one man shop will be running 8-9 figure businesses.

Make sure you’re on the right side of history on that one. Otherwise, AI will be eating your value add.

Good luck!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post. Crypto Tax Calculator (same as always). You can access CTC HERE and get 25% off your first year for being a BTB subscriber. Yes, this also operates as a ref link. (BTB25) the discount is at no cost to you.

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money