$300,000 a Year is the New $100,000 a Year

Level 1 - NGMI

Welcome Avatar! This is a bit of a throw back to people who remember the 90s. Back then the internet wasn’t prevalent and you had to tell your siblings/mom/dad to get off the phone to use the internet. Yes. Seriously. Back then the same line for the internet was used for the phone.

Life has gotten way easier (information wise) since then but your main form of entertainment in the 90s was riding bikes and “playing outside” until you got guaranteed sunburn.

The *Six-Digit* Dream from the 90s

In the 1990s, earning $100,000 a year was considered a lock for success. It meant homeownership, a bmw, family vacation and enough to save for retirement. You were considered one of life’s winners.

Today? $100,000 barely scratches the surface in the vast majority of major cities. With the cost of housing, education, healthcare, and food/groceries outpacing wage growth, $100,000 is closer to survival mode than luxury living.

Enter $300,000: The New Benchmark

$300,000 has become the new baseline for what $100,000 once represented.

1. Housing Costs

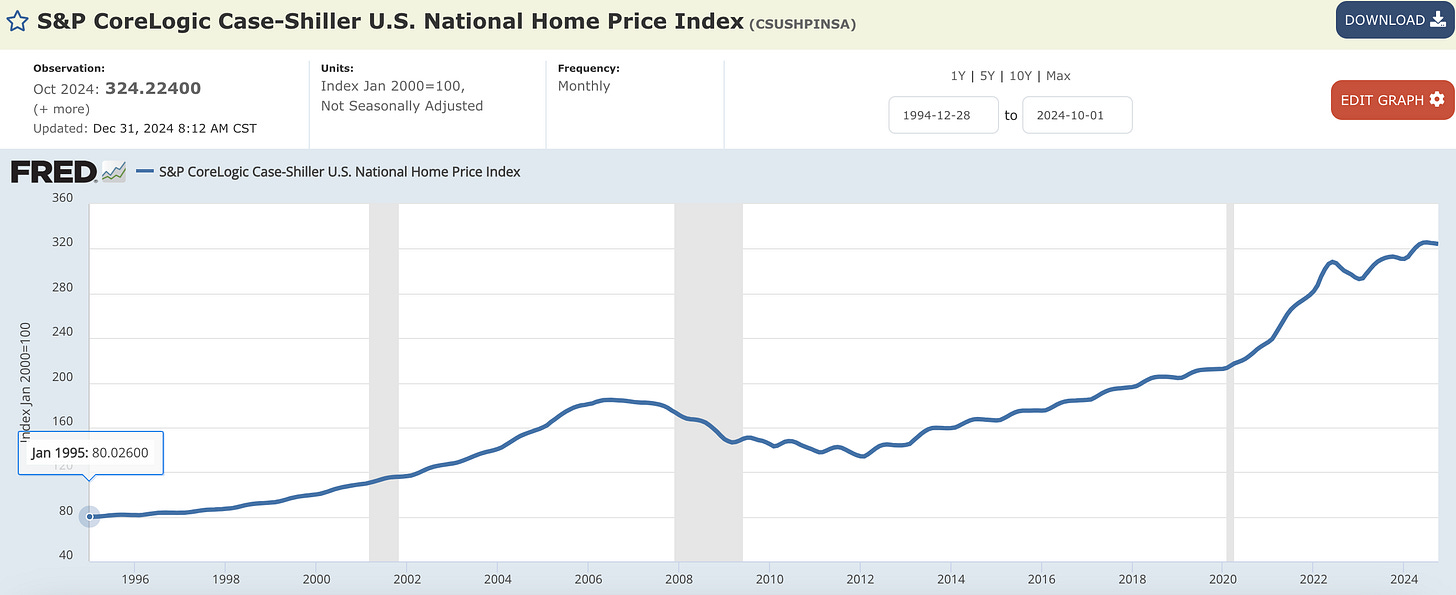

Depending on which metric you use housing prices have gone up about 3-4x. A typical home would be in the $120-140K range and now it’s in the 400K range. If you’re looking at major cities, there is basically no shot at finding anything below $1M and more realistically you need $2-3M to have enough space for a small family.

To keep things simple, if we assume the exact same interest rates it means a mortgage payment + tax + insurance was around $800/month ($9,600 a year) back in the 1990s. Now it would be around $2,500/month ($30,000 a year).

Therefore compared to *gross* income it lines up pretty well. Would be 10% of $100K and for $30,000 that also lines up with ~10% of total gross income.

2. Education

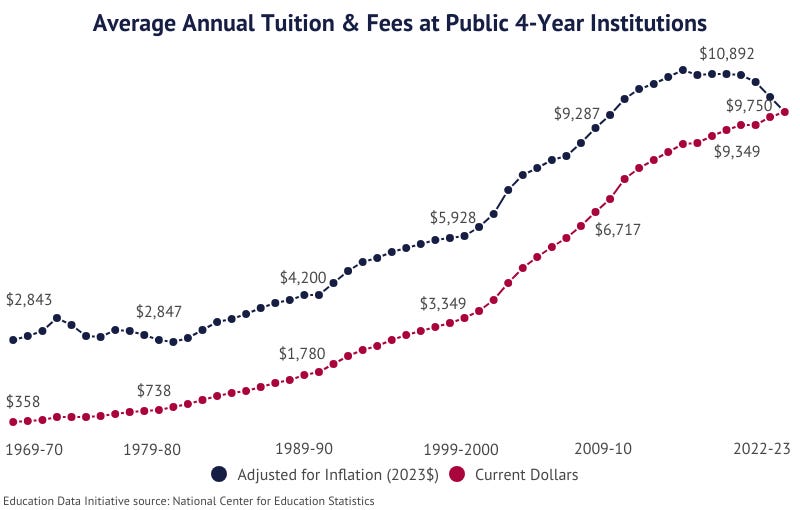

College tuition has been *Up Only*. A rough 5x for quick math. This means it has actually gone up *faster* than the average/median home in the USA. If you were going to shell out about $10,000 back in the 90s for school, it’s looking closer to $50,000 in 2024/2025. This assumes it is a public school, don’t even get us started on the Ivy Leagues which would run into the $200-400K band for 4-years.

Hint: find any talent your kids have, if you intend on sending them to college getting in for free due to a sport or other activity will pay incredible dividends.

3. Healthcare

While the vast majority have W-2s cover healthcare, the expenses have gone up significantly. At minimum you’re looking at $25,000 or so for four people. This is up at least 2x and more likely 3x since the 90s.

Once again you’re looking at a minimum of 3x+ which is in-line with the $100,000 dream being closer to $300,000.

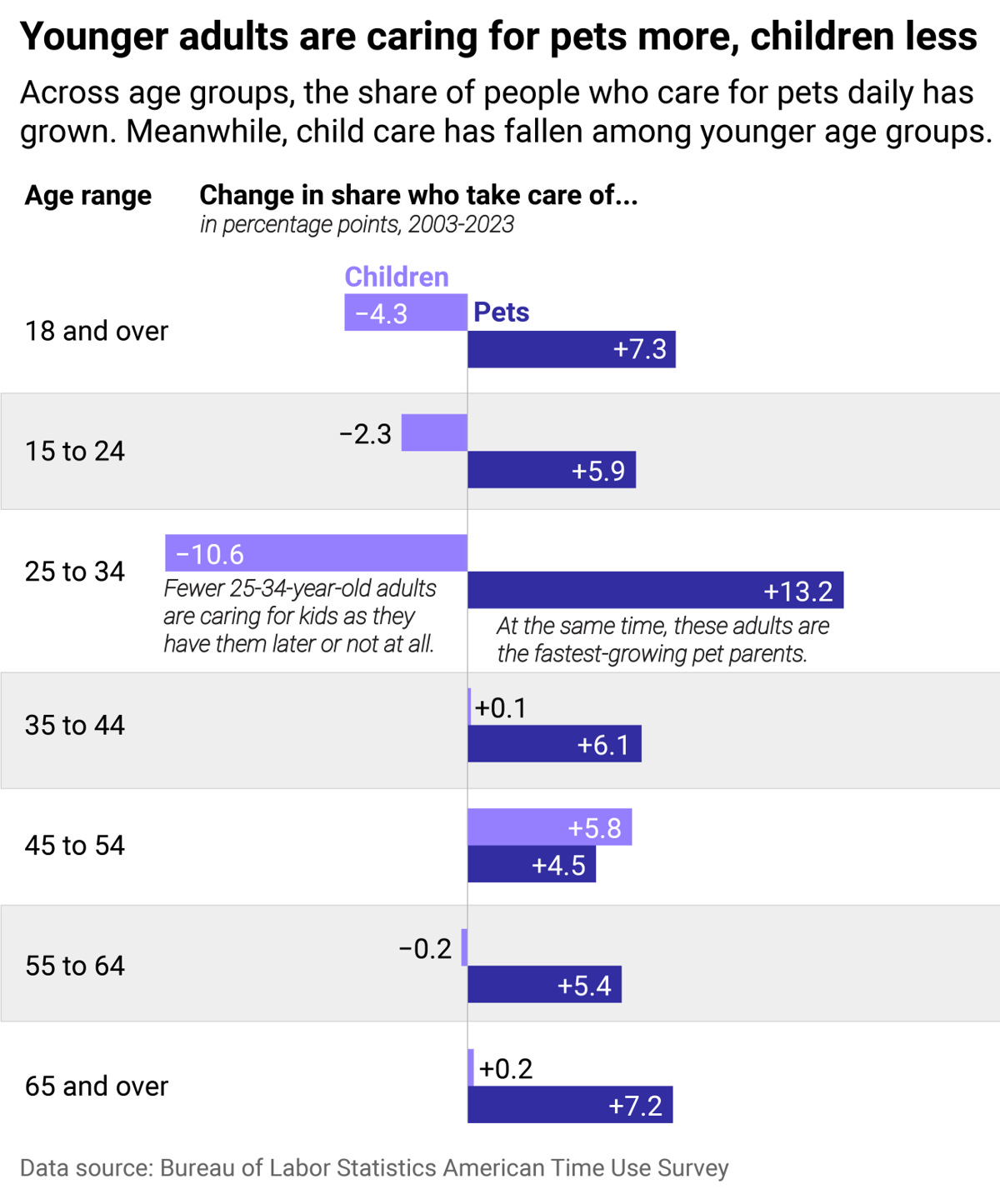

4. Childcare

Raising a child costs significantly more money and all of you know, plants are the new pets and pets are the new kids. Having a lot of kids is a sign of wealth and you can tell that you’re in an extremely rich area if there are a lot of family oriented activities (or extremely broke - bell curve and all!)

5. General Lifestyle Inflation

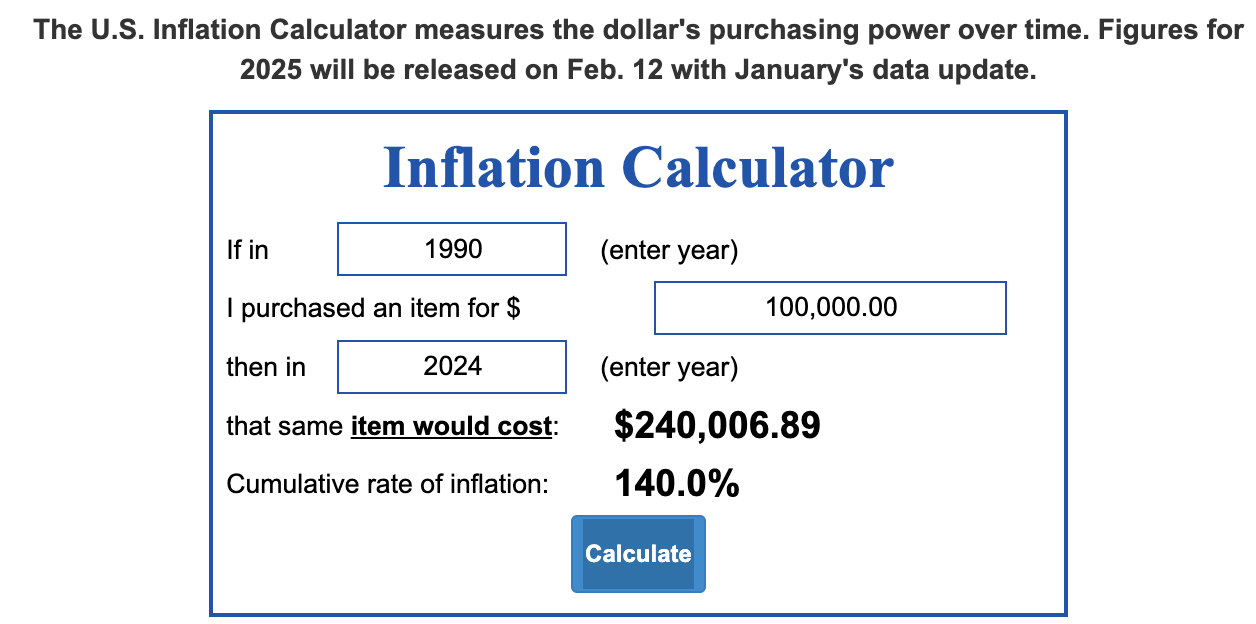

While the 2020-2025 inflation numbers were nuts, we’d say the rest of the items generally kept up with basic inflation. A BMW costs about 2x as much as it did in the 90s and food/others were up 2x as well. This is because the cost of TVs/entertainment went down - at home entertainment specifically.

Therefore just use the standard 2.0-2.5x inflation number for all the “Nice to Haves” vs. “Need to haves” which are up 3.0-4.0x

What Does $300,000 Get You Today?

Here’s a realistic breakdown of a $300,000 annual income:

Taxes: Federal, state, and payroll taxes can easily consume 33%, leaving $200,000 or so. This is simple rough math.

Housing: A $1M home is not a mansion anymore, at 7% rates that would run you $6,000 or so per month. Around $72,000 for a year.

Healthcare: Insurance premiums, deductibles, and out-of-pocket costs can total $20,000/year.

At this point you’re at $108,000 without paying for any expenses at all.

Estimate $40,000 for food/car/internet/cell phones all of that into one bucket for four people. Now you’re at $68,000.

A couple of vacations to enjoy life and you’re looking at $20,000. Left with $48,000

Now add in the classic, $18,000 of random emergencies (something always happens). Christmas gifts, you need to paint the house, someone breaks a leg skiing etc.

Now you’ve got about 10% left for savings.

When you look at those numbers it looks like the “American Dream” from the 1990s. We’re pretty sure it’s a good comparable to 35 years ago.

Problem with this Set Up?

The problem is that earning $300,000 creates a “how do we fire this guy” vibe in the office. From our post last week (Corporate is now risky) unless you are in sales or tech with proven revenue, it is hard to remain as a high cost employee with new AI tools consistently going after your position. (Middle management is cooked).

How to Escape

Luckily, you’re already using the device needed to escape. Back in 2010 it would cost around $40,000 to $50,000 to come up with a product to sell online and test demand. We’ve stated that we think the right number is around $25,000. Ultra aggressive entrepreneurs like CryptoMouse will tell you don’t even go over $20,000!

The trend is pretty clear. People will spend more of their time on computer screens, buying from the internet and brick and mortar will lose business to online sales (can’t compete with the massive reduction in overhead by having zero lease expenses).

Not only that, but you can even use AI tools to create small income streams. Yes. Automated income (a topic on the paid stack for next month).

How to Hit The Gas Pedal

Once you have created some form of income/equity building yourself you can now go from playing defense to playing offense. The two major culprits to wealth generation are 1) housing and 2) taxes.

Lower Housing: If you earn money online, you can relocate to lower tax states and reduce housing costs. NYC is a lot worse than Dallas in terms of quality of life at this point anyway

Reduce Tax: You might be able to move to a Tax Haven (always see your accountant) based on your income (source) or based on your business (PR, Singapore etc.)

Kill the House Bill Entirely: Once you’ve paid the “life tax” of suffering for about 3 full years or sewage sandwiches, you will probably have enough to buy a basic luxury condo (for your area). Your housing cost gets cut from 33% of income to 10% or less. Game changer.

Build Passive Income: Once you build one successful business, you can build other small ones. The typical millionaire has around 5-7 income streams. The mainstream loves to psyop you into believing that 90% of businesses fail. Even if true, they don’t teach you that you’ve developed valuable scalable and irreplaceable skills. Once you’ve developed a skill for earning, it’ll translate quickly if you start a new idea or if you buy a company that you *know* is run incorrectly.

In the end, life is just a game of probabilities. We try to look for the highest probability answer at all times. Notice. That does not say a “guarantee”. It says probability. If you’re making the right probability based decisions, eventually lady luck shows up and hands you the gold at the end of the rainbow.

Then Mike Tyson shows up once you’ve celebrated, but that’s a story for another day.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money