Are You Beating Inflation?

Level 2 - Value Investor

Welcome Avatar! After President Powell announced that inflation is transitory the masses are coming to grips with what this really means: this is the new normal. With fiscal deficits crossing $35 Trillion and interest rates at ~5%, it means that the only way to keep this ponzi going is by printing more money. While rates could drop to 0% if they decide to go in that direction (or negative like the Europoor region for a period of time), that would just lead to “free money” which in essence is the creation of money with cheap debt.

Part 1: What Inflation to Beat

Now that prices have ratcheted up and wages are not keeping pace, defining returns need to be in inflation adjusted returns. If you invested into a basket of assets and they are up 50% but everything you buy is also up 50%, you’re just keeping pace with inflation. Portfolio theory of 60/40 and quatro strategies are not as relevant anymore. Instead you should take a look at what you want the asset to do. Do you want it to keep up with Food inflation, Home inflation, Energy Inflation etc. This is a much more reasonable way to look at your portfolio in 2024.

Real Wealth: As mentioned many times here, taxing income is a waste of time. While the vast majority would consider someone making $1,000,000 a year on a W-2 as “rich” that’s not really how business owners or politicians think about it.

$1,000,000 is top 1% income, after taxes that’s $500,000 since most of these salaries are in high tax places like NYC or California

“To be in America’s top 1%, the benchmark for entry is considerably higher - puts the average wealth of the top echelon at $33.4 million in 2023.” - Source

Doing the quick math there, the asset owner can borrow say $330,000 to fund their lifestyle and the remaining $33.4M can grow tax free (don’t sell and just die). This creates a spread in the millions. For those unaware of buy-borrow-die (basics here), think about the standard returns instead. If they do 5% returns $1,670,000 is generated. This means they are making more than the “evil” top 1% wage earner by doing absolutely nothing.

In short, top 1% wealth can generate a multiple on top 1% income by doing nothing.

Conclusion Need to Generate Assets to Beat Inflation

If you’re not building a WiFi business and are not invested heavily for long periods of time, there is not much you can do in terms of catching up. You’ll be eaten slowly by inflation (lately? eaten quickly).

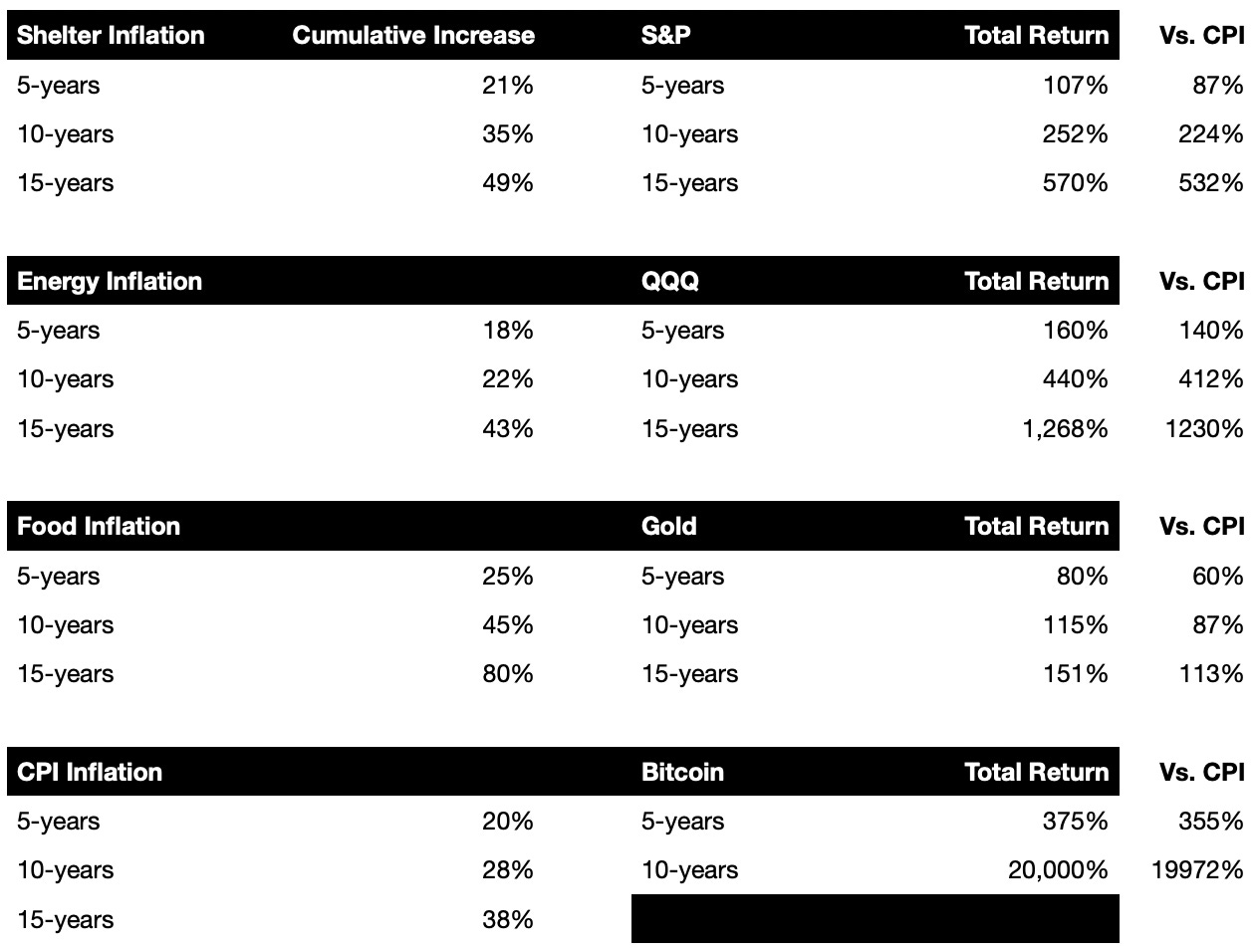

Use 10-years: This is probably a better proxy for the real inflation numbers. It does capture the crazy printing in 2021 but it doesn’t include the 0% rate environment and mark everything at the near bottom (2009).

This would mean that Shelter costs are up 35%, Energy up 22%, Food up 45% and CPI is up about 28%.

Keeping Pace: With the 10-year bond at about 4.27% this means you could get a ~50% return over 10-years. With a catch. That return is going to be taxed at regular rates meaning that your post tax number is 33.7%. Remember. All of the CPI data does not account for taxes or anything like that, the CPI number is the amount that you pay at the store (which is post tax money)

Reconstruct What You’re Doing

Knowing this you can come up with a proxy for the future. If you own some bonds that pay 5%, that’s fine, just don’t expect it to keep pace with the majority of items. Luxury homes are increasing in value ~2x vs. the average home and we all know things like medical and colleges are going up much more than 5% per year.

This means you should look at it like this: 1) what money do i need in an emergency, 2) what money am i putting away to cover energy/utilities and baseline CPI and 3) any addition cash needed to fund your business/ventures.

Beyond that? Basically meaningless.

Tech Is Killing: Looking over the past 5, 10 and 15 years you can see that betting against innovation is a fools errand. Hope is not a strategy. By investing in tech you will have a lot more volatility in your portfolio due to all the hyper around every earnings call. That said, we’re not going to live in a future with less computing. Eventually people will be glued to VR/AR machines with AR/VR boyfriends/girlfriends. This future is coming along with a self driving car and robot maid that’ll do all your basic tasks for you.

Therefore, tech exposure is practically a “must have” vs a nice to have in the 2020s.

S&P 500: If you want to beat inflation over the long-term but can’t sustain a 20% drawdown or mega crash, you’re better off here. S&P is going to benefit from tech but will also get you exposure to all those CPI items (food, energy, shelter etc.). Since it’s a composite it’ll slowly but surely grind up over the long-term with some baked in inflation beat (if you refuse to sell and simply diamond hand).

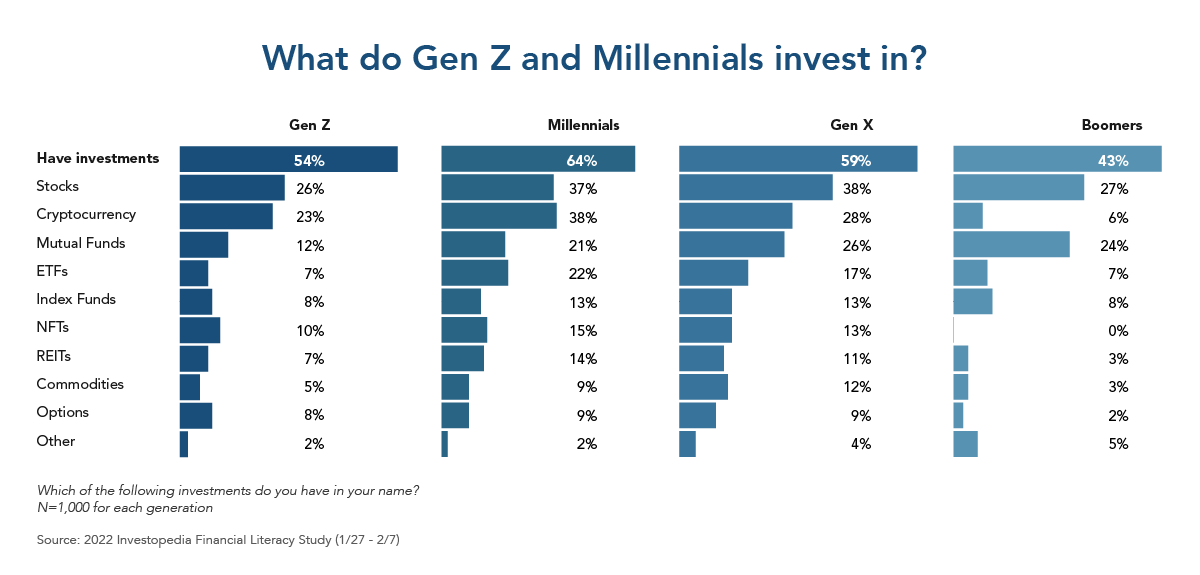

Gold Bugs: The old version of Bitcoin is still going up in price it just doesn’t have the same returns as it once did. The main problem is that the new generation is interested in digital gold, not the yellow rock.

As the boomers hand down their wealth via inheritance a large chunk of it will be reallocated to crypto. If this is any guide you’re looking at a 4-5x increase in the allocation to crypto once they have their standard house set up.

Speaking of Digital Gold: Despite being up 20,000% over the past 10 years, crypto is still quite nascent. You can get this feeling because of the market cap. Total Market cap is only $2.44 Trillion and the market cap of gold is $18.5T. Until these are at parity we’d say this is an insane disconnect. You can build next generation financial services, remittance, store value and even create your own market places (or straight up casinos with things like Predict It and Polymarket).

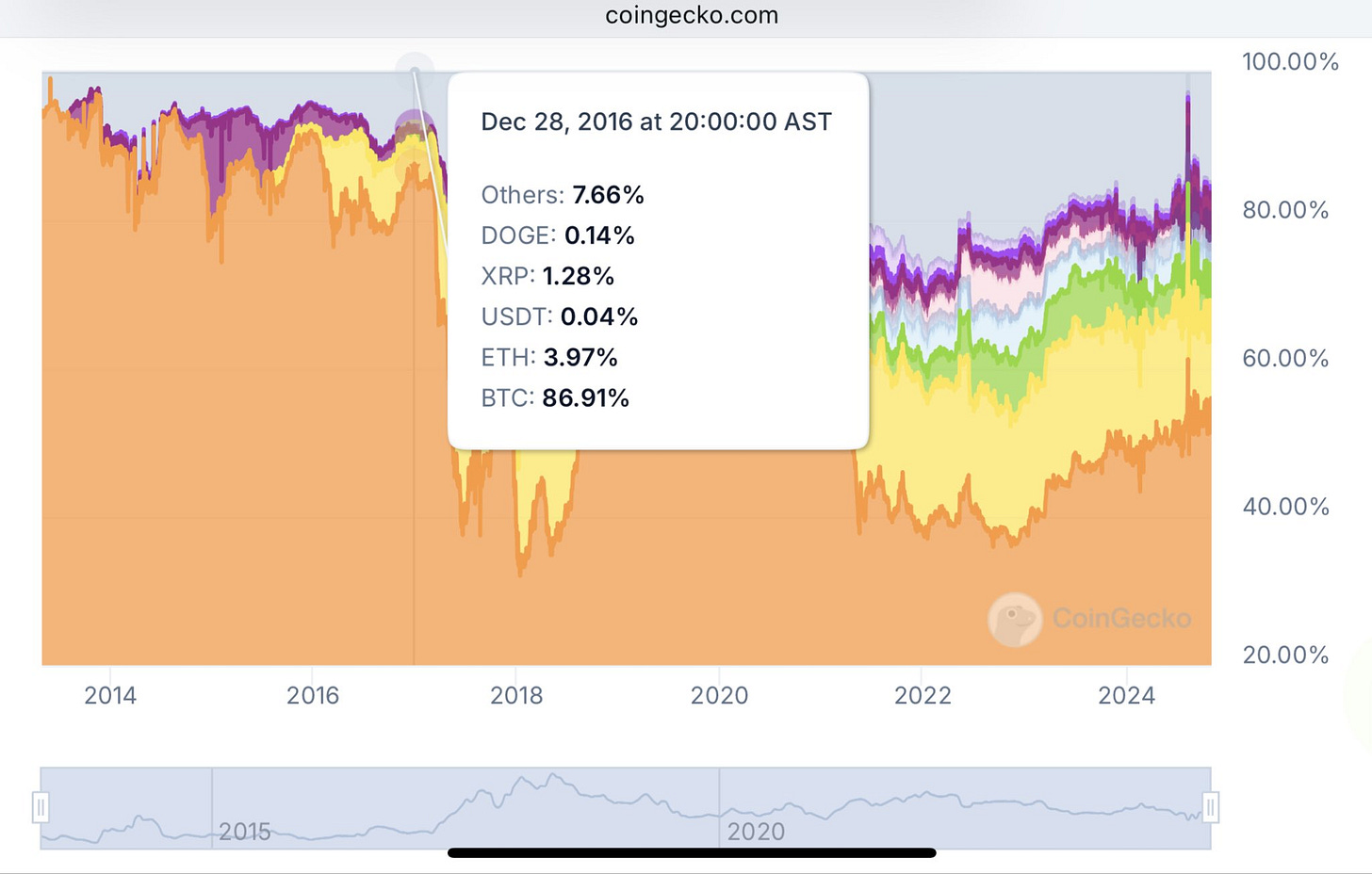

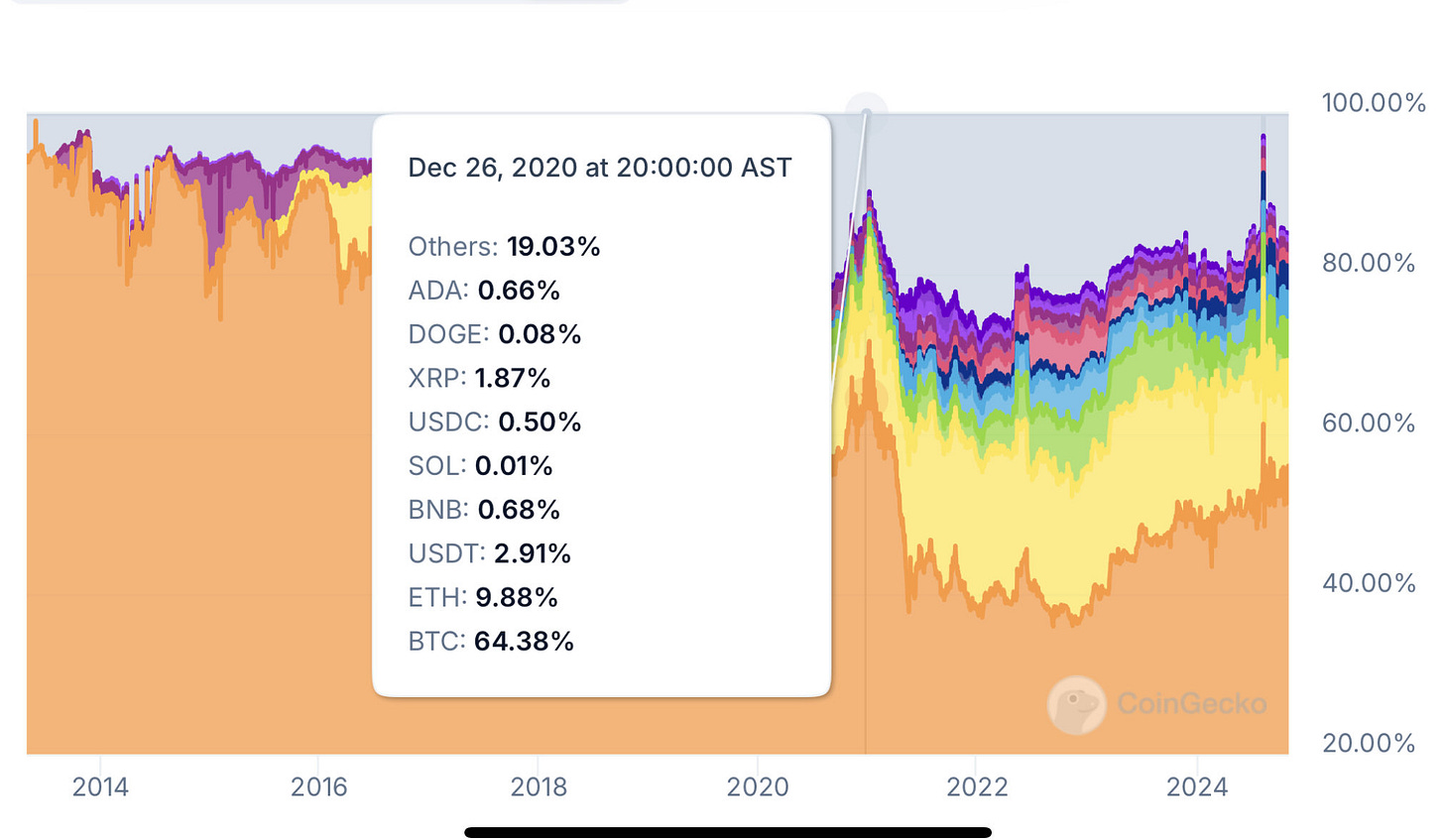

All of this will be built while BTC continues to take share as the digital store of value.

Standard Cycle: Unlike other industries since the emissions for BTC are on a standard 4 year halving, the supply demand imbalance flows through every 240 days or so. Exact day metrics are largely meaningless but you can see from the above that the 3rd year post halving is typically when we see BTC dominance spike. After that new products and innovation are funded (alt coins, smart contracts etc.) and we get into mania season.

Hope you’re all prepared!

Same Strat Different Day

If you’re building equity in a company, you are destroying inflation if net income goes up. Unlike a job that pays $100,000 a year, you can sell a company.

$100,000 net income goes to $200,000 and that’s all you get

$100,000 net income goes to $200,000 that you can sell for 4x earnings means that you’ve hit $800,000

Once this is drilled into your brain you’ll never take those 3-5% annual wage increases seriously ever again.

You’re beating inflation with your effort (forced equity appreciation), you’re beating inflation with your investing (largely tech/crypto and some stocks/bonds to dampen volaitlity).

Then you’re off to one large race to $4,000,000-$5,000,000 in today’s prices and a paid off house. Then. Poof. Disappear.

Good Luck Anon, for all of you that are still here? You’re going to make it. For the rest? Well there is always the afterlife.

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money

Wanted to share some of the biggest mistakes I made in investing. I’ve learned you can be right on a trend, but wrong on the profits. Example: cannabis stocks. I thought, legalization is a no brainer, get in early on a budding (pun intended) industry. Wrong. My stocks got demolished. Even worse I didn’t have stop losses which dented my portfolio. Example: Bitcoin miners. Bought at the top to give my portfolio more exposure to BTC. Cratered 80% or more. I would have been better off just owning NASDAQ or S&P ETFs.

Interesting movie clip. Spot on.