Brief History and the End of the FIRE Trend

Level 2 - Value Investor

Welcome Avatar! Back in the late 2010s we had an aggressive/humorous take on the frugality crowd, calling it a feminine trait. This was a play on the old Wealth Management joke that the most risk averse person in the world is a retired/widowed woman in her 60s (or older).

Now? That trend is on its elevator level decline down. COVID really put the nail in the coffin and the majority of Frugality/FIRE lovers are forced back to work. We’ll try to put a positive spin on it. Just know that living in a 3rd world country like Thailand with $1,000 a month doesn’t really cut it past the age of 30 or so.

Part 1: Brief History of FIRE

Fire stood for “Financial Independence, Retire Early”. It is still around but is largely a shell of its prior movement.

The strategy was basically the following: 1) live like you’re still in a college dorm, 2) same some crazy percent of earnings like 70-80%, 3) after 15 years or so you can quit and 4) you live off the assumed 4% long-term safe withdrawal number

If you run some quick math, since the goal for many in the movement was $1,000,000 they intended to live on about $40,000 a year. This doesn’t really work in the USA anymore, but probably works in a 3rd world country.

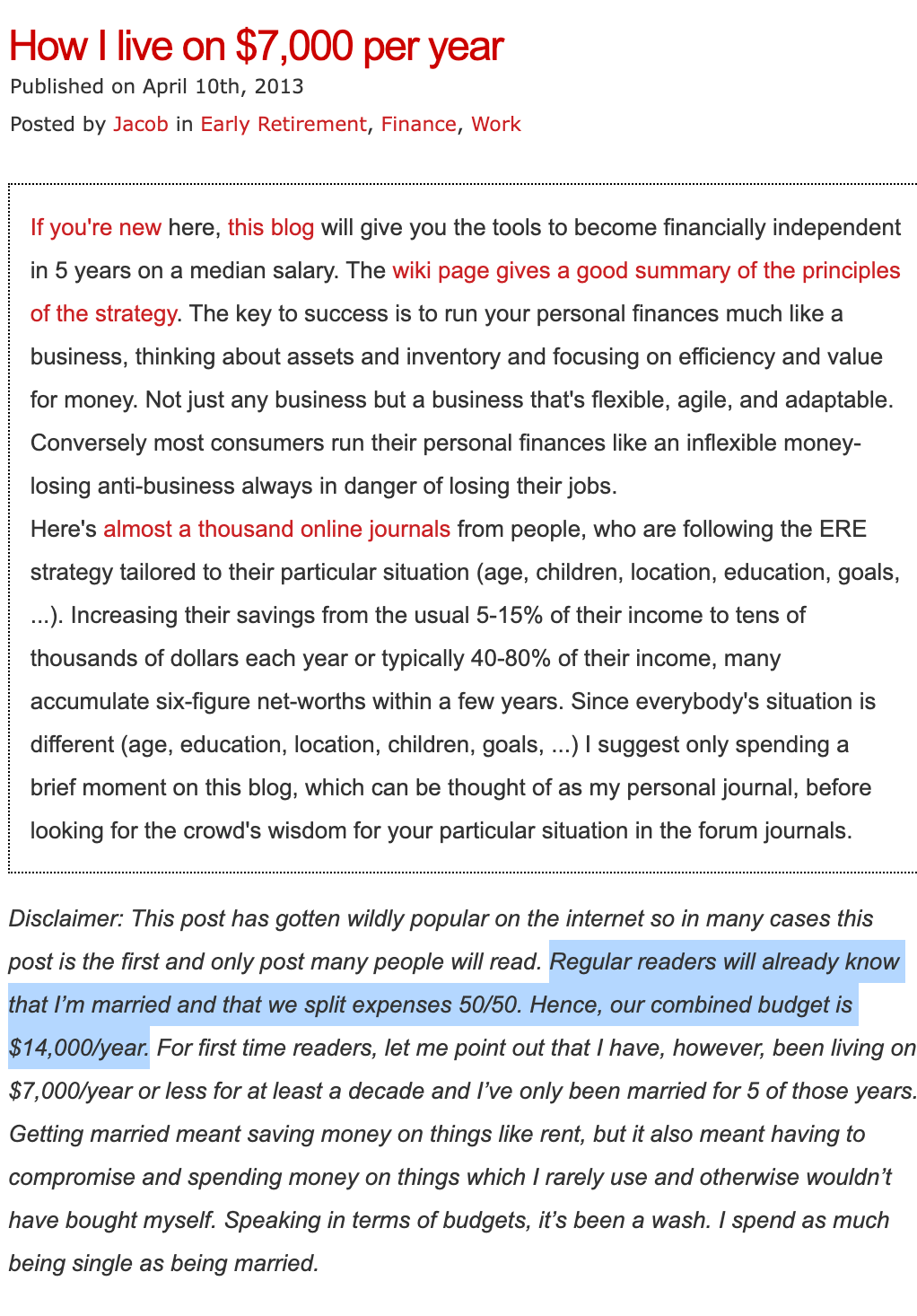

If you think that’s crazy there was an ultra popular extremist who lived on… $14,000 for him and his wife!

While we don’t really care how people live (we’re homeless on a beach after all) the irony is that this person could have been an incredible entrepreneur. The amount of pain tolerance you must have to live off $14,000 a year must be similar to child birth on a daily basis.

Also. The guy sold 54,000+ of his extreme frugality book at $10. That means the guy made $500,000+ just on his writing ability. Instead of realizing he could just earn more money and increase his quality of life, he dedicated his entire being to the frugality movement. Once again, his choice, to us it looks crazy from a quality of life and entrepreneurial upside perspective.

Became Mainstream

All of this really started post financial crisis in 2008. Probably because everyone was forced to reduce costs. Back then (if you were around), cities were pretty empty and rents were actually declining (yes seriously!).

Some people had a big awakening moment when they realized their happiness didn’t really change all that much when they downgraded their lifestyles a bit. The tricky part (as you can see from the prior example) is some went full insanity mode on cost cutting.

You knew there was a problem with the strategy because numerous people became mainstream famous from it. Guys who retired with $500,000; people were featured on CNBC money and even put on national television.

Doing a Quick Search it’s still around just not generating as many clicks as before

Post COVID Realization

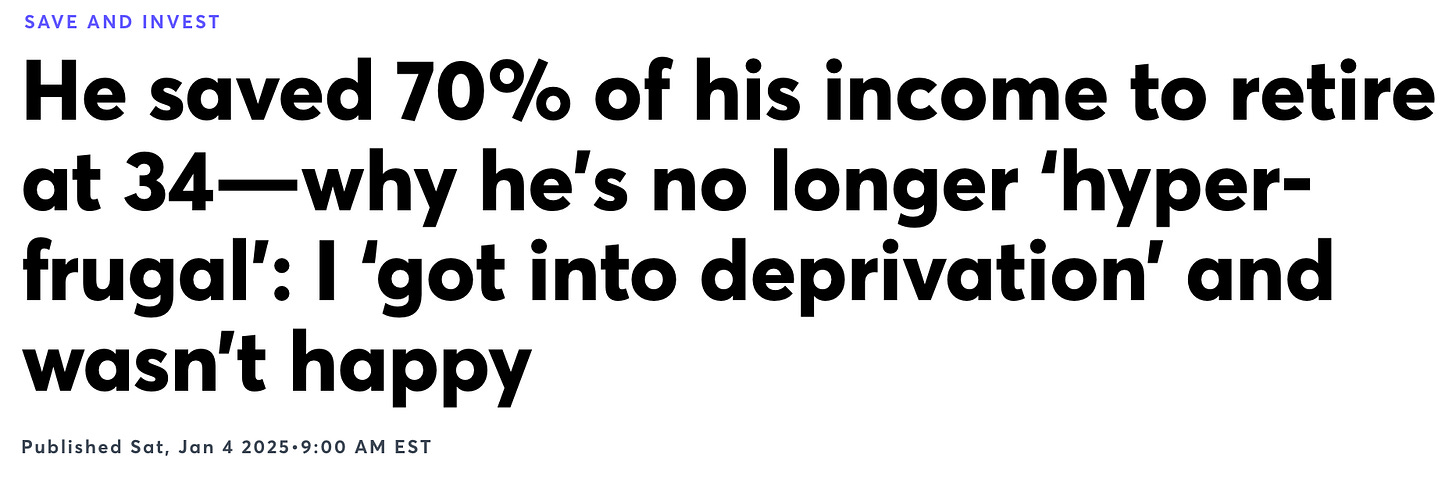

Once the US government printed $10,000,000,000,000 out of thin air, the prices of everything went up. The idea of saving 70% of your income by living in a Van or with 17 roommates didn’t even work anymore. It’ll be years before we get to some sort of normalcy.

The second issue is actually much bigger. By living like this you miss out on the entire purpose of life: adventurous living.

In your 20s, you can do all kinds of stuff. You can sleep in hostels in Europe or South America. You can hit nightclubs on a Tuesday. You can go bear hunting if you’re clinically insane like BowTiedBroke … so on and so forth.

In addition to this, anyone who can take that level of pain and suffering would likely be incredible business owners. The amount of pain and suffering needed to start your own organization is just as high as living on $2,000 a month.

Realization: The rough realization that hit people is as follows: 1) each decade has a general theme to it, 2) you miss out on that decade you can’t really go back since time (and health) are the only two assets more valuable than money and 3) your priorities will change.

As a general framework:

20s: Your biggest value is *energy*. You can easily work on a couple projects and still hit the bars and clubs 2x a week. You can even throw in a 1-2 week bender in some foreign country. Just use some credit card mileage points book economy and suck it up. In this age range you can slam a bunch of tequilla shots with Push Up Bra Susan, wake up the next day hit the gym and feel nothing. Sitting around doing nothing actually costs you *more*. Not just money but in life experience

30s: Around this range you’re pretty much in the best of both worlds. Your income is up pretty significantly but you still have the energy to work out and go socialize a couple times per week.

40s: Most people who “make it” start to lose interest in really running up their accounts. They spend more time with their friends/family and priorities have moved to living in a place they love and raising kids

50s: Pretty similar to 40s unless you’ve hit a string of bad luck (divorce, health issue etc.)

60s+: People finally realize no one actually cared about what they were doing in the first place. No one really cares if you’re a billionaire or worth $100,000. People in this band are incredibly independent and don’t want to be told what to do in any capacity. Also. Risk tolerance plummets to near zero since they know they’ve got about 20-30 years left (statistically)

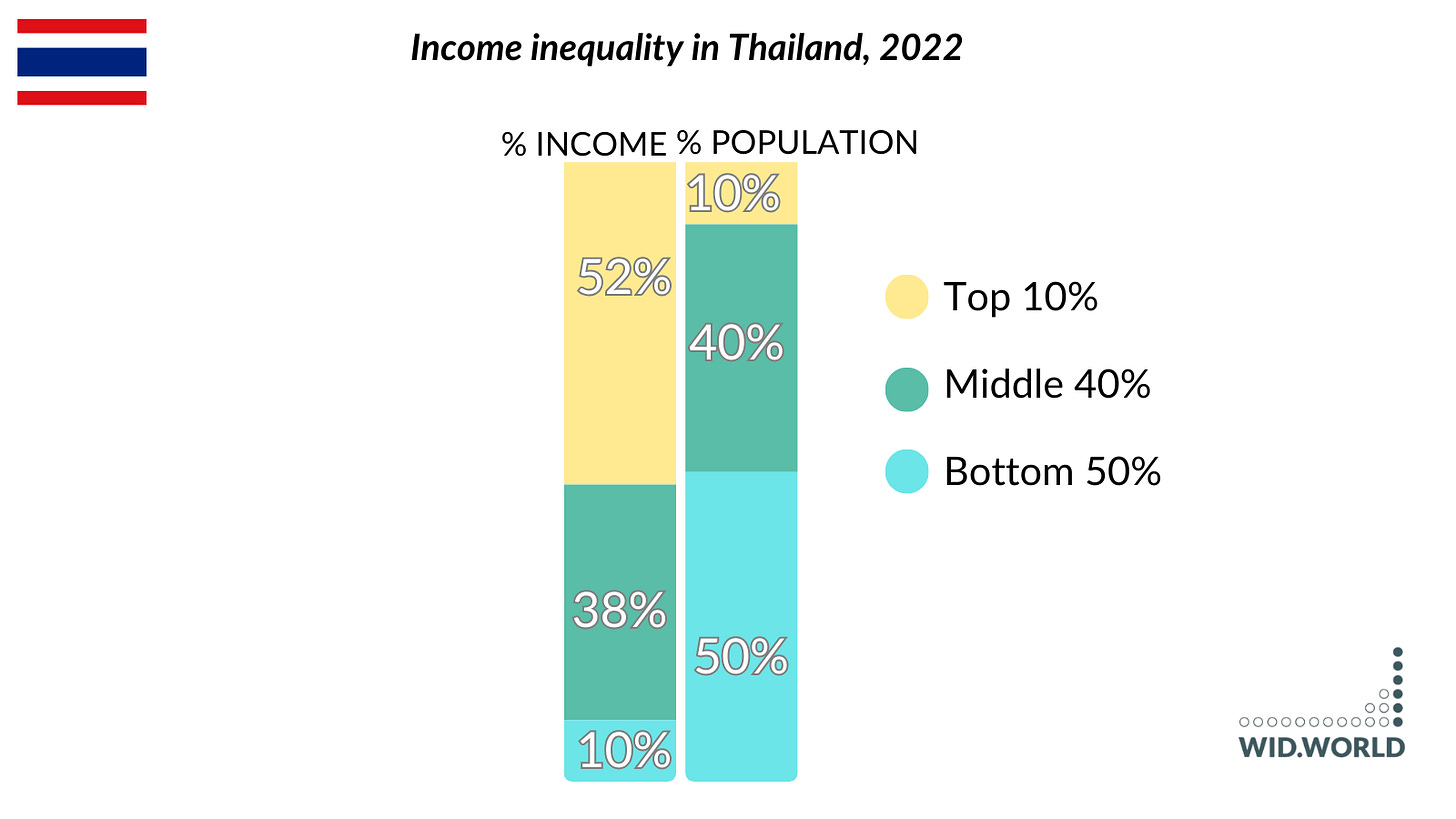

Part 2: The New Reality

The new reality is the United States of Asia. No this has nothing to do with immigration or anything like that. Don’t bother with the whole USA manufacturing because we know for sure you’ve never tried to manufacture in the USA (it simply doesn’t work outside robots). Out in Asia there is a big divide between rich and poor and people who build equity (a biz). The same is coming to the USA.

***Directionally*** it’ll look something like this

Before anyone gets mad we’re not saying it is “easy”. No where are you going to see the phrase easy. Instead it really looks like this in terms of options

Option 1: Work in nothing but a W-2 where the math does *not* work long-term to live a high quality life. $300K is the new $100K (source). Go look up how many positions really pay north of $300,000 and then follow up on how many people really sustain that level of income for 20+ years (no layoffs, no redundancy etc.)

Option 2: Bet on yourself, start building an income stream and develop self belief. It is not fun. Both options are not fun. The difference is that you have a real chance at making it with this strategy. You may not become the next Jeff Bezos but based on the number of Jungle residents making $10K a month, you could certainly work your way to up to buying your own home with *cash*!

Before we get heat for highlighting Moodie we have no idea if he/she hits a home run or is forced to grind another 5-years. What we do know is that we’ve never seen someone really give it their all and fail over a multi-year period.

Most just give up within 1-2 years even though it usually takes around 3-5 years to see significant results. Our 2015 motto of “Give up Three and You’ll be Free” is probably still accurate directionally.

If you’re not the next Jeff Bezos but get a single exit of say $500,000. That’s enough to buy a modest home and be set for life (no financial stress).

The vast majority (95%+) will be happy with this result.

Take Advantage of Tech: There is no way to convince us that this is impossible to do while retaining a W-2. The majority of people are just shopping on Amazon, playing gaming apps on their smartphones and talking about their favorite celebrity (who secretly hates you and enjoys dumping meme coins on your head)

The internet allows you to sell to anyone in the world and allows you to spin up any WiFi company with a few hundred bucks. More realistically you’ll probably spend about $5-8K to make sure you’re testing demand, but you get the idea. A lot better than it used to be (Pre-internet upstart costs of $75-100K in today’s dollars since you were forced to find foot traffic with Brick and Mortar).

Part 3: Some Positive Spin on the FIRE Trend

Since we just spent the entire post dunking on this idea and then outlined why it unlikely works in the future, here are some good things that came from it.

It Takes Little to Survive: If you’re worried about spending that $10K to start something, just look at how these guys lived. They really did nothing. Cooking 100% of meals at home. Going on walks and doing pull-ups on trees for exercise. So on and so forth.

If you’re worried that you could have “compounded that $10K at 7% a year for 20 years”… you can go ahead and toss that idea into the gutter. It is a meaningless rounding error in the grand scheme of things.

If things really go bad, you can always do a massive cost cutting initiative to survive the pain period. Or. Copy them and live cheap for 6 months and save the money that way! Just don’t catch this frugality mental state of mind

FIRE People Still Working: Another important thing to note is that they are all still working! If you’re attracted to this deep frugal way of life it probably means you’re not particularly adventurous. This isn’t meant to be a dunk at all. In fact it is a bigger tell.

Frugal people are not exciting and don’t really take a lot of risk. Despite having plain personalities… drum roll… they still decide to work!

Guess what that means. Even after you make it you’ll learn that building something and having some sort of work purpose is a must. There is a reason why people are serial entrepreneurs and it’s not because they are greedy (as normies would make you believe) it’s because they need something to do and *gasp* enjoy it.

We’ll go to our graves knowing that most people don’t hate work. They just hate taking orders from someone else. 99.99% of the population would be extremely satisfied making the exact same amount of money *if* they were their own bosses. Once you’ve tasted this freedom, you’re effectively unemployable.

Note: before you quit your day job (to the numerous jungle people making $10K a month now), we still suggest waiting till 2x W-2 post tax income. Lady luck punishes hubris and you will have bad years. We’ve had several bad years, several failed ideas and several horrible quarters. That’s the reason why you want to be certain when you make the jump. Once you jump it’s mentally (nearly) impossible to ever go back.

Missing on Experience is Worse than a Material: This is another good thing that came out of this dreaded penny pinching movement. The majority that regret living frugally say that they missed out on a ton of experiences.

This is a self aware and correct statement.

In your 20s you can go to Nice and party until 3am. Maybe wake up on the beach with a few hundred Euros in your pocket and a throbbing headache. Sprinting back to the hotel since the sun is rising (oddly specific example).

Can’t really do that when you’re 40. It was already embarrassing and hilarious in your 20s, but would just be plain sad in your 40s.

Aforementioned Oddly Specific Example Location

The fancy car/watch/designer sunglasses? You can buy them at age 20 or at age 50. Always going to be there.

The time is not going to be there though. Being able to watch Lebron (live and in person) win game 7 of the NBA finals against the 73-9 Warriors is also not going to happen again (another oddly specific example).

So on and so forth.

Point is, they correctly recognized that certain experiences in life are fleeting.

Part 4: Build More

The general phrase being floated by the youth “just make more money”.

The smart people in the new generation have the direction correct. They know there is a floor to spending. To live a life that is not regrettable, you can’t really live on $1,000 a month.

The only adjustment we’d make to this statement? “Just build more”

If you make an extra $50,000 a year by consulting, that is a great start. Just know that it is a time for money exchange.

Eventually you have to make an extra $50,000 by building something that can be sold. If you build a company that sells at say 4x net income, that means your $50,000 is really $200,000. If you build it up a bit, eventually you hit $100,000+ and that’s nearly $400,000 = enough for a roof over your head for 30+ years.

Start ASAP! If you’re going to start by offering a consulting service go for it. If you’ve done that already and are on the fence about a small e-com/SaaS idea? Just go for it.

The $10,000 it costs to test demand and set everything up won’t mean anything to you in 30 years.

The earlier you start the less painful it feels. If you’re already earning $200,000 or $500,000 or more… It makes the initial $1,000 you make feel like a waste of time. Also. If you succeed at building something, there is a strange flywheel as well. You naturally see new opportunities and meet other people who are steering the boat in the same direction. Winners find winners. Just how lady luck works.

On that note, we can all say goodbye to the FIRE movement. It’s the cartoon network from here on out. Clicking buttons, editing ads, editing copy, investing in tech and watching the world become more clown by the day.

Stay Toon’d!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money