Crypto For Newbies Welcome New Readers

Level 1 - NGMI

Welcome Avatar! Since it has been an insane month our long-term readers deserve a break. Also. If you guys are getting a bunch of newbies coming in, just send them this post so you don’t have to waste your time. We’ll go through the basics (again) which really hasn’t changed in over a decade at this point.

First is basic crypto security and what a cryptocurrency actually is.

Part 1: What is a Crypto Currency and How to Keep it Secure

The long story short is that you will need a Trezor. The link here will explain what it is in more detail along with options depending on what you intend to store.

In short, a Trezor is a hardware wallet that allows you to generate your own private keys and crypto wallet addresses. It will hold the vast majority of coins you have including BTC/ETH/SOL and even the NFTs.

If It can Be Shut It Is Not a Crypto Currency

We’ll keep it simple with that definition. If you hold USDT which is a stable coin, we can make an easy argument that you own no crypto currency. While it might be useful to help you convert to cash temporarily, remember that USDT can be frozen at any time..

What is currently a cryptocurrency? Essentially holding BTC or ETH on the L1. This means you have a bitcoin address or a 0x address with BTC or ETH on it. That simple.

If you want to include SOL that would be “99.9%” decentralized. The reason we say 99.9% and the reason it isn’t 100% is because of the distribution to insiders + foundation. They can essentially override any changes since they control so much of the supply.

Since everyone wants to buy and sell the latest meme coin, before anyone gets mad, we have a heavy bag of it (relative to market cap) and have nothing bad to say about it beyond that point. It is definitely much more centralized than BTC or ETH.

If You Own an ETF You Own Zero Crypto

The entire point of crypto is to take control of your own assets. This means that if you own IBIT or MSTR or COIN stock, you may see the value rise in US Tokens but you own zero crypto currency. Zero.

We’re not here to tell you to never buy those stocks. In fact, if you own them in a 401K or something where you have no choice we say “Go for it”. The point is still the same though.

If you’re buying crypto it is because you want control over your own finances and you don’t want anyone (a bank, North Korea, PayPal, etc.) to suddenly wake up and freeze your funds one day. Crypto solves this.

If you ever forget the concept, just remember this classic phrase and write it down somewhere “Not your keys, not your coins”

Hold Keys, Never Digital

When you get your wallet, you will *never* put the pass phrase onto anything digital. You do not take a picture of it. You do not type it into a word document. You do not type it into notes on Apple. You have to write it down on a physical piece of paper, or you have to engrave it on metal (by yourself). The vast majority will be best off with writing it on physical paper and having them stored somewhere safe.

If you understand this you will not do anything foolish like “store the keys in a lock box at a bank”. If your plan is to use a safe deposit at a bank, you may as well just buy the ETFs.

Part 2: Big Picture What is This Worth

Big picture the “simple” belief is that crypto will easily surpass the entire market cap of gold $18T. If you want to get fancy we could probably include Silver as well and just say $20T.

We’ll use that number since it is easier to remember.

Currently, the market cap of all crypto currencies is $3.7T. This means that the industry will go up another 5.4x in the future. How long does this take? No one has a crystal ball that is 100% perfect.

Instead, just keep the math simple and say BTC typically doubles every 4 years. As the market cap gets bigger it is harder and harder to grow on large numbers.

We went from $1K to $20K to $69K and now (????) we will see by the peak which likely occurs in 2025 before another inevitable correction.

Since we’re at $2T for BTC, you could do a simple $8T by 2033 which would be ~$400,000 per coin. Assuming the alt-coin market is 50% of the value at that point it means that by 2033 peak you’re looking at around $16T.

Once again, this is not a guarantee or some firm stamp. It is just to highlight a point. If returns are lower it might take longer 2035, 2040 (etc.). The simple message is crypto will eventually pass Gold.

We’re Pretty Sure Millenials Won’t Buy Gold vs. Bitcoin With Their Inheritance As Well.

Part 3: Bitcoin is the Gateway Coin

For the majority of new people here, you’re probably just looking at BTC. This happens every single cycle. In 2017 it started with BTC. In 2021 it started with BTC. And. In 2025 it will be starting with??? Looks like BTC.

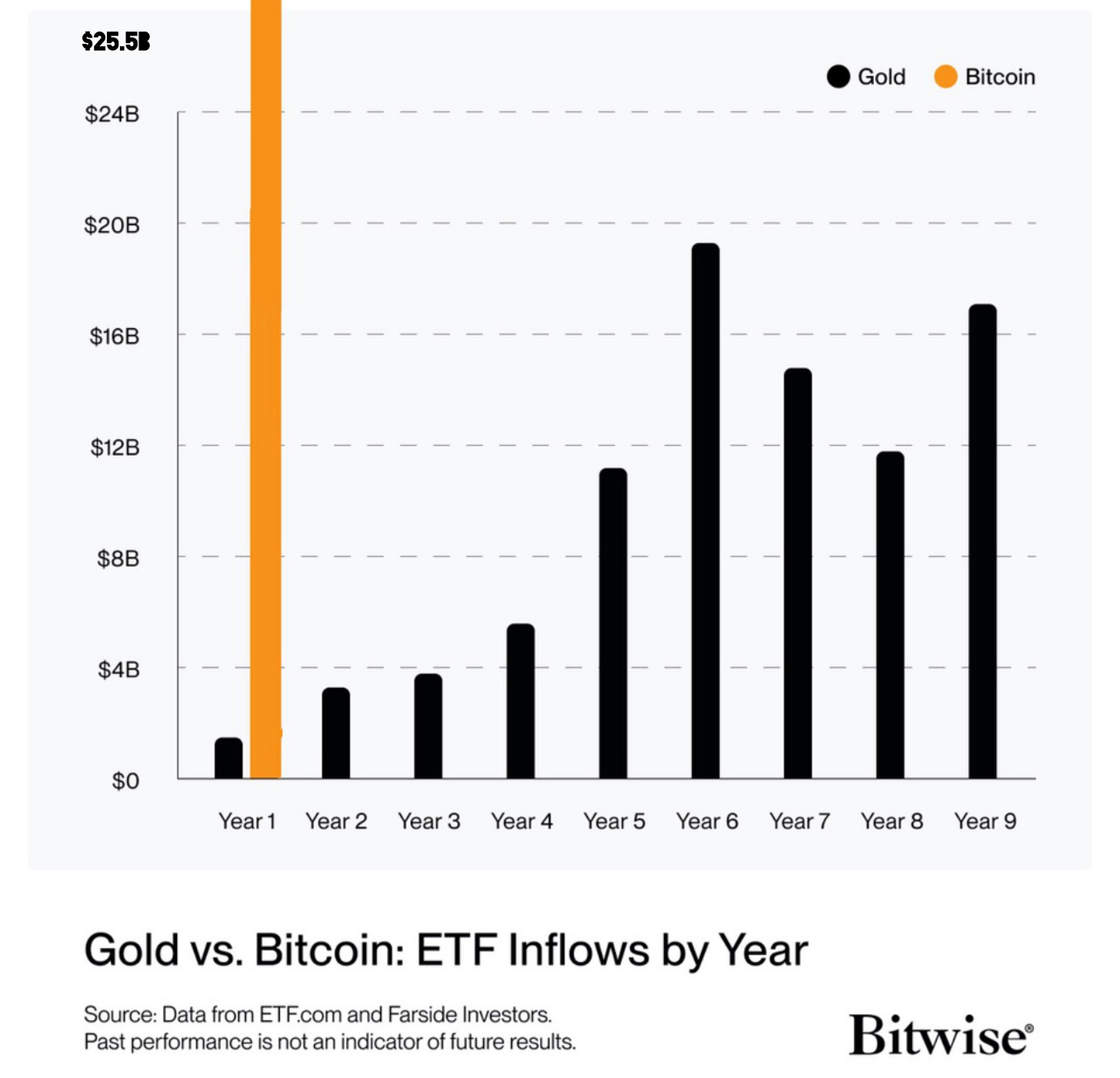

The irony of course, is that when the mainstream media starts talking about BTC that’s usually closer to the end of the cycle *for BTC* than it is to the start. The time to buy BTC was really 2023 and early 2024 before the ETFs started gobbling up the coins.

This Chart is useful - No we’re not saying to buy or sell your house for alts it is just a good and humorous tracker for when alt season usually starts.

Typical Rabbit Hole process

Newbies buy BTC then watch price as the asset sits on a ledger

They learn about what other crypto currencies are doing with the same tech (building applications like lending and betting platforms such as polymarket)

They realize that even though BTC has won the store of value game and will likely pass gold, there are trillions of other applications to be built since middle men add little value (why pay middle men fees when you can just use software code)

They go down the rabbit hole and end up using a lot of applications on ETH, Solana, AVAX, FTM, Base etc

Vitalik Explains it Well in this Classic Video from 10 years ago

Part 4: Fast Forward to Today

Now that you’ve got the basics we already have various applications today: 1) decentralized finance where you can lend out your BTC/ETH etc., 2) you can earn yield on your stable coins like interest at a bank, 3) you can bet on sports or politics with crypto removing the middle man and 4) new games and AI bots are also using crypto now operate the system.

2025? For the majority, if your entire goal is increasing US Token value, then you probably want to look in this direction..

For people with low capital base, it’s going to be a grind of testing new products on chain (this is what airdrops really are - rewards for testing) and finding other exciting projects that may reward its community (Miladys one we picked up a couple years ago recently dropped $10,000 to each owner of their NFT).

Completely New?

If you’re serious about being involved with crypto, then we assume that you understand all the basic concepts. Our Substack assumes you know the basics so we don’t have to explain how to do an LP position, how to bridge or how to earn points for the latest farm.

The DeFi team has a product that will get any newbie up to speed: (Click Here)

If you’re up to speed, we do monthly Q&As and market updates every Wednesday and Sunday. Should be a fun ride and hope everyone reading this makes it.

On that note, stay toon’d!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of Ex-Wall Street Tech Bankers and software engineers who moved into affiliate marketing and e-commerce.

Old Books: Are available by clicking here for paid subs. Don’t support scammers selling our old stuff

Crypto: The DeFi Team built a full course on crypto that will get you up to speed (Click Here)

Crypto Taxes: We have a suggested Tax Partner and 25% discount code, for information see this post

Security: Our official views on how to store Crypto correctly (Click Here)

Social Media: Check out our Instagram in case we get banned for lifestyle type stuff. Twitter will be for money